China Gold Mania Surged In April, And Now We Have The Data

Gold and silver were both down to close out the week on Friday. Although with gold only down $35, and silver only down 28 cents, relative to the recent volatility, it seemed like somewhat of a tepid day.

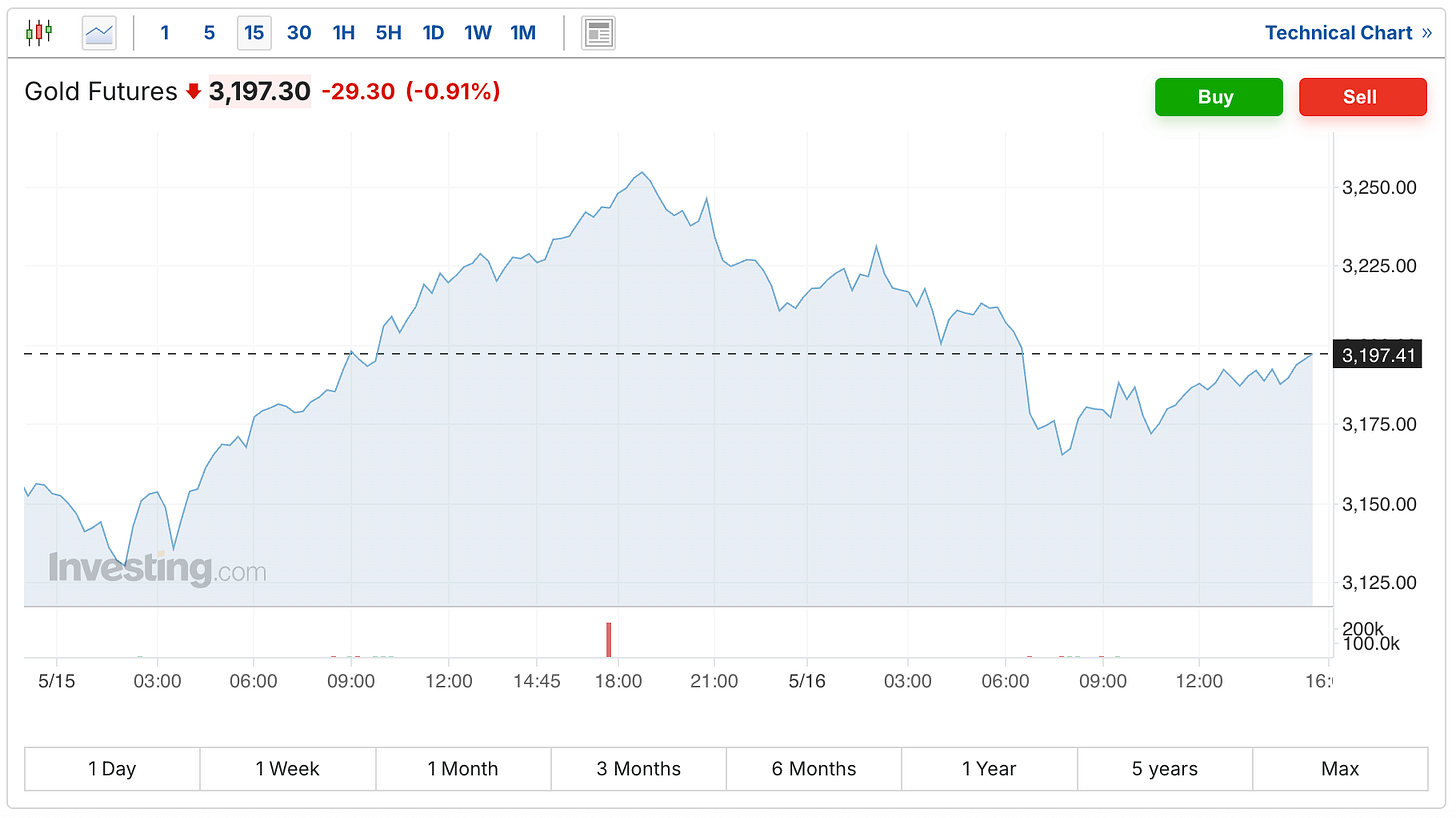

Here's a look at today's gold chart.

(Click on image to enlarge)

And you see a similar pattern on the silver chart today as well.

(Click on image to enlarge)

There was also some new gold data out from the World Gold Council in their regular monthly China update. That put some numbers behind the Chinese gold mania we've been hearing about, and I pulled out a few highlights that help to put it all in context.

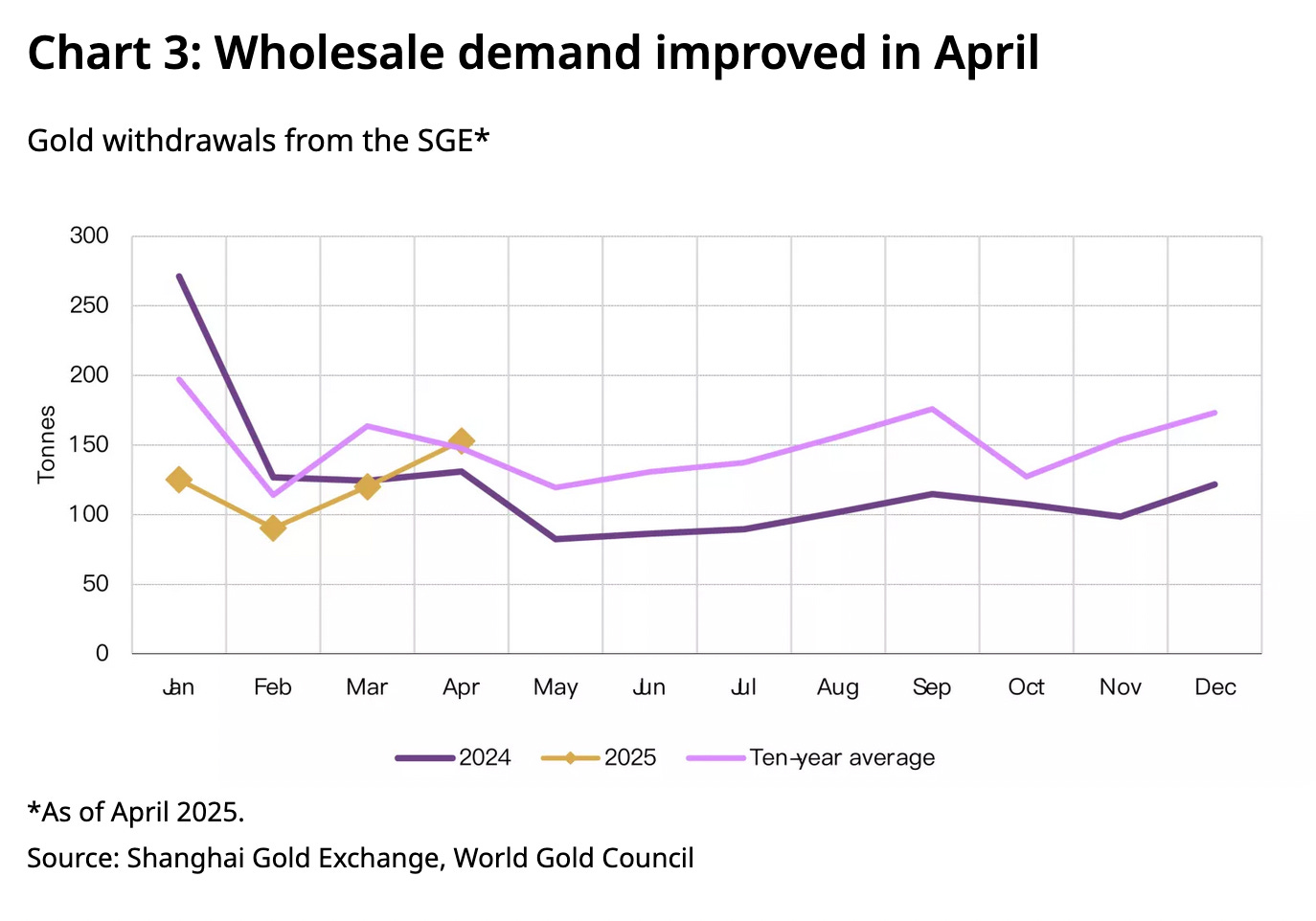

Wholesale demand continued to rebound

The industry withdrew 153t gold from the SGE, a rise of 27% m/m and 17% y/y (Chart 3). The improving wholesale gold demand is also reflected in the rising local gold price premium, which averaged US$37/oz in April, significantly higher than March’s US$2/oz.

We believe the following factors underpinned the April strength:

Continued robustness in bar and coin sales amid strong investor buying: gold remains a top-performing asset in China as US-China trade tensions intensified

Jewelers re-stocking for the early May Labour Day Holiday following Q1 withdrawals that were lower than usual.

As we’ll see in the next note, there was also a surge in ETF gold demand in China in April.

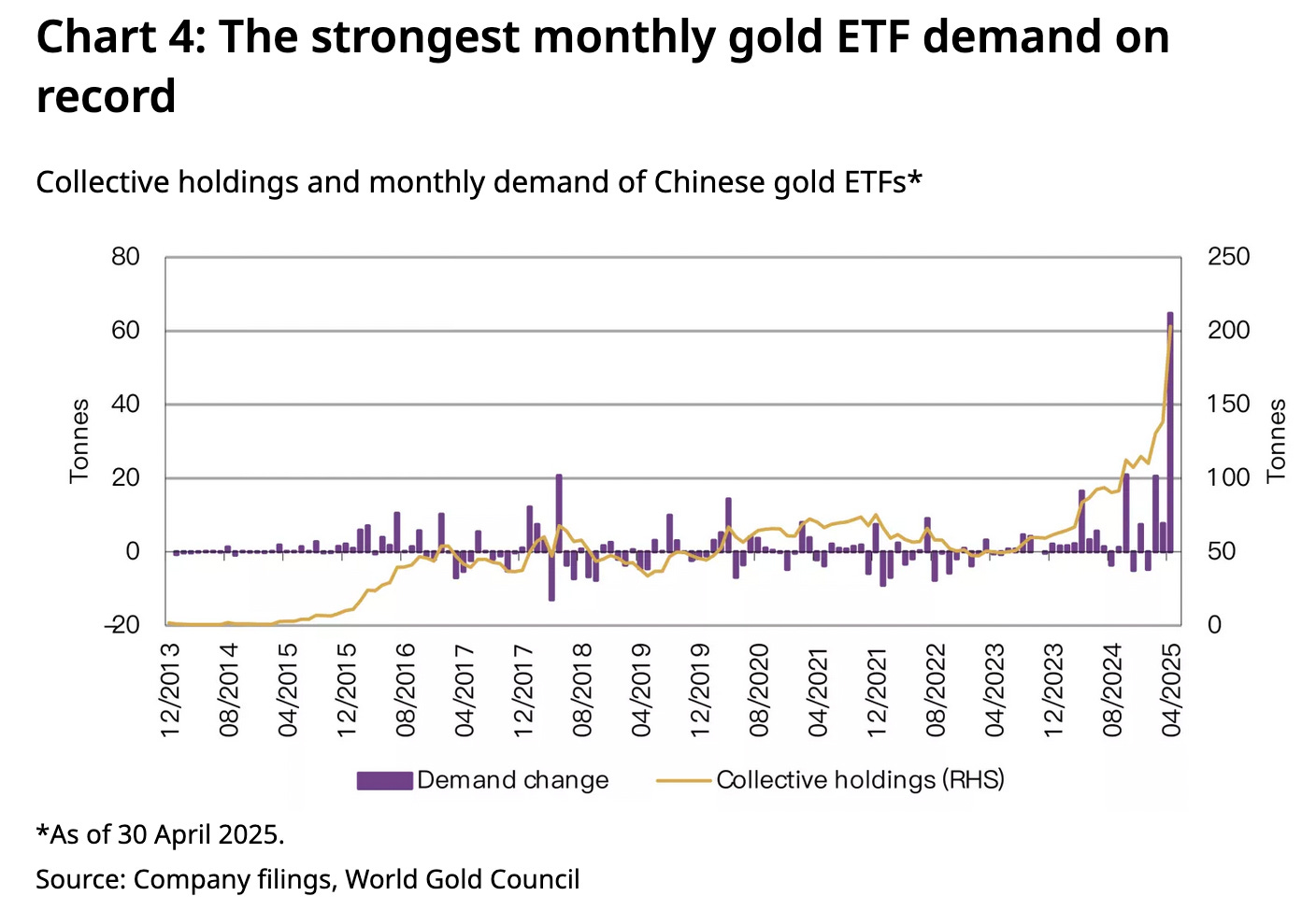

Surging gold ETF demand in April

Chinese gold ETFs recorded their strongest month on record, adding RMB 49bn (US$6.8bn). The third consecutive monthly inflow and the continued surge in the gold price lifted their total AUM to RMB158bn (US$22bn); a rise of 57% in April and the highest month-end value ever. Meanwhile, holdings surged by 65t to 203t, also a record high.

During the first four months of 2025 Chinese gold ETFs’ total AUM and holdings have jumped by 125% and 77%, respectively.

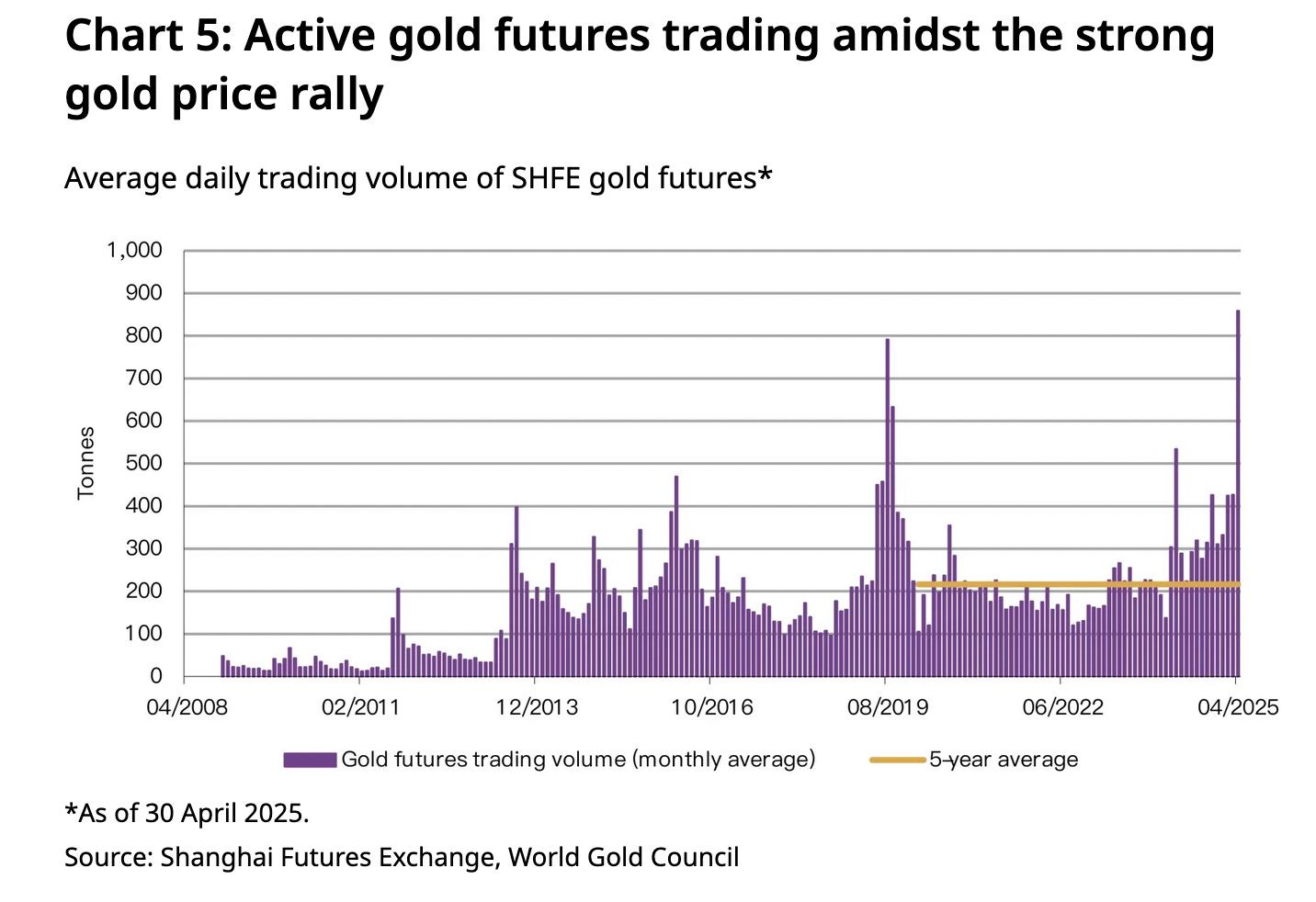

The WGC council also notes a surge in Chinese gold futures trading in April.

Chinese investor interest in gold futures also reached unseen levels in April (Chart 5). The average daily trading volume of SHFE’s gold futures doubled m/m to reach a record 859t.

Although gold futures trading activities cooled mildly in early May, the average volume during the first five trading days remained near the record high at 756t/day.

(Click on image to enlarge)

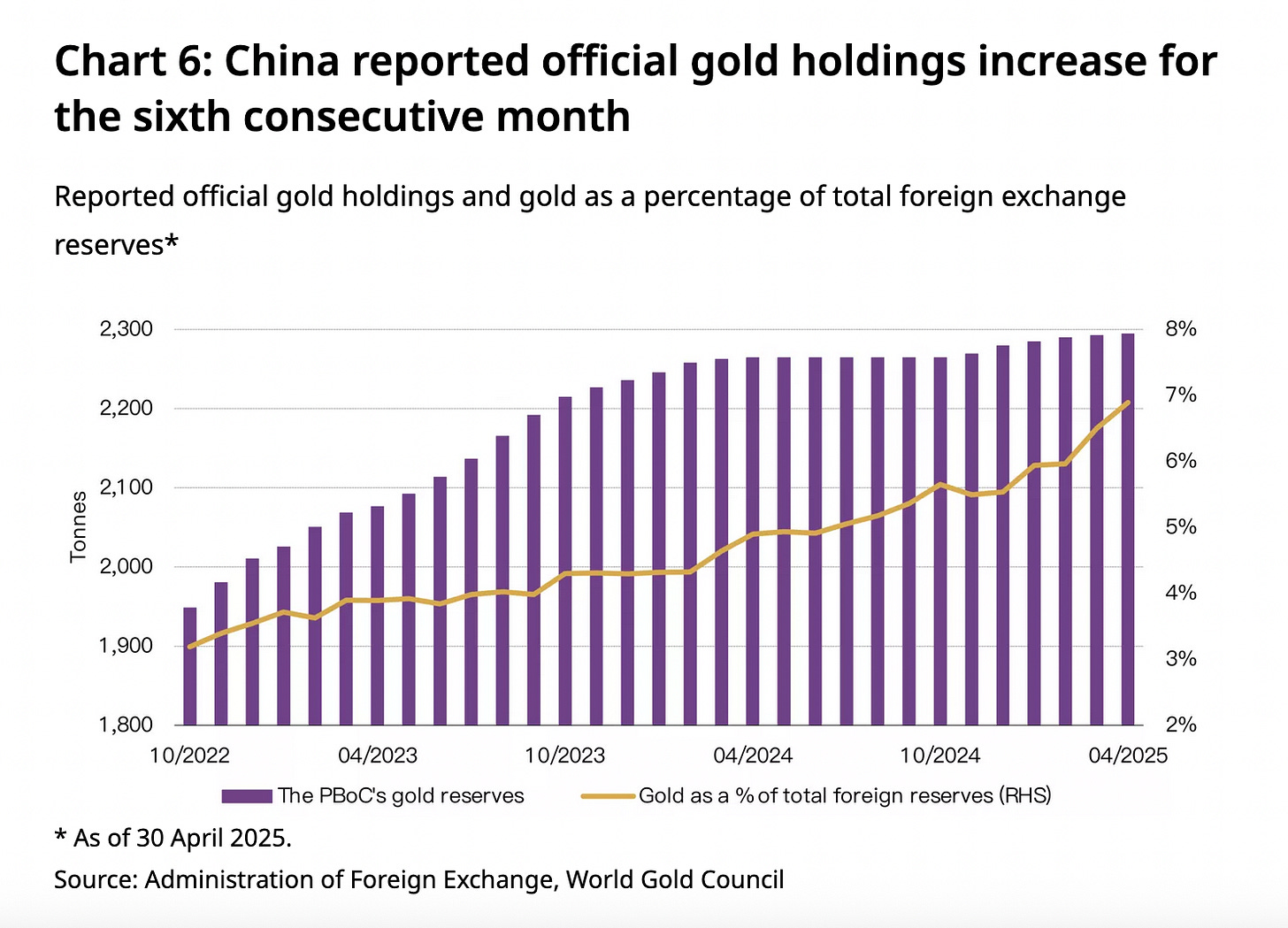

The report also noted the continued accumulation of gold by the People’s Bank of China in April.

The PBoC reported another gold purchase in April

The PBoC’s gold purchasing streak has now extended to six months. Reported gold reserves in China rose 2.2t in April, lifting the total to 2,295t, or 6.8% of overall reserve assets (Chart 6). In value terms, China’s gold reserves rose to US$243.6bn, 6% higher m/m.

So far in 2025 China has announced an increase of 14.9t in its official gold holdings.

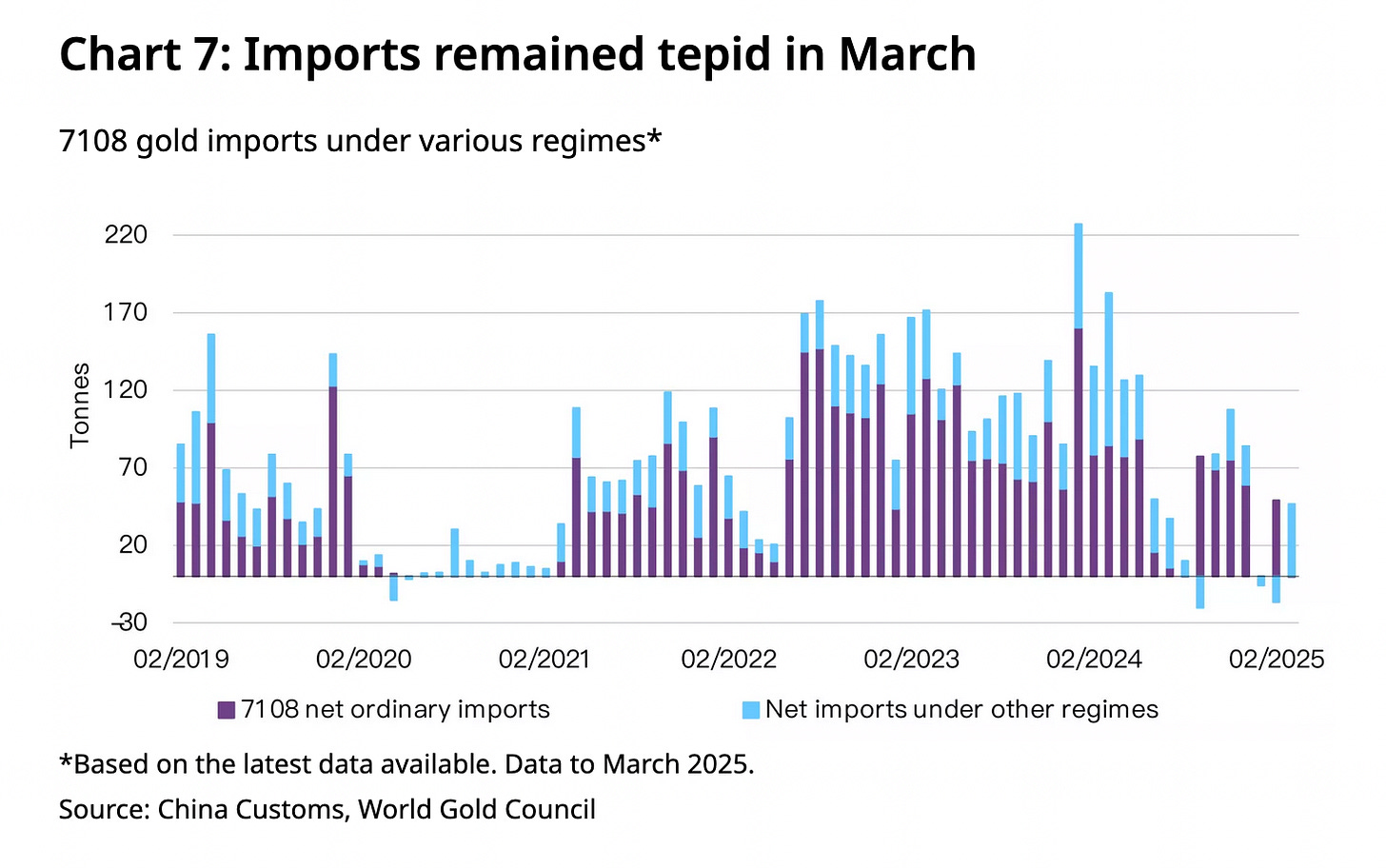

However World Gold Council did report that import demand remains on the low side so far in 2025.

Imports remained tepid at the start of 2025

According to the latest data, China imported 46t of gold on a net basis in March (Chart 7). Despite a 14t m/m rebound, this was well below last March’s 183t. And Q1 total imports amounted to 73t, the lowest since 2021 when COVID-related restrictions limited imports, and far below the 545t level in Q1 2024.

Weaker gold jewelry demand during the quarter was a key reason for the slowdown as it helped squeeze the local gold price premium, at times pushing it to a discount, which further discouraged gold importers.

So hopefully that gives you a good feel for the degree and extent of China’s gold buying so far this year. And again thank you to the World Gold Council for making these reports available (you can sign up for their free updates if you scroll to the bottom of this link).

While the report did mention some signs of a slowdown in May so far, China did relax the gold import quotas last week in order to prevent the Yuan from continuing to rise.

The sources said the PBOC raised such quotas for gold imports last month and has now also allowed the banks to buy the dollars to fund these gold imports.

The move comes on the heels of a raft of stimulus measures announced by Chinese authorities on Wednesday, including interest rate cuts and a major liquidity injection, as Beijing steps up efforts to soften the economic damage caused by the trade war with the United States.

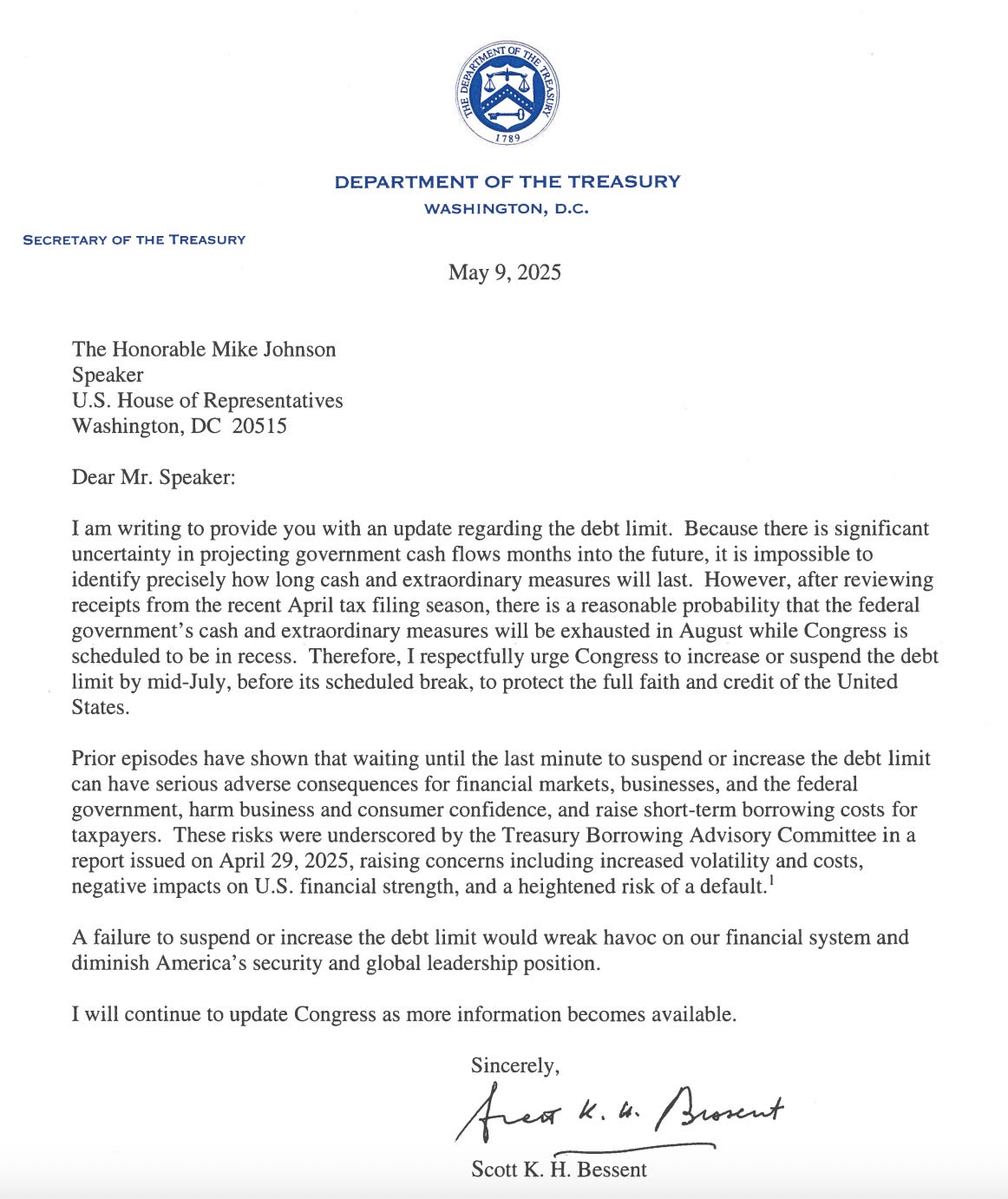

And just in case you were wondering, we are now starting to hear some activity about the upcoming debt ceiling limit, which has been suspended for the last year and a half.

Thanks to Rafi Farber for pointing this out, and here’s what Treasury Secretary Scott Bessent had to say.

In case you missed it, I did highlight a significant development yesterday about how the Fed is starting to telegraph that they’re going to be raising that inflation mandate. And if you haven’t seen it, I would recommend taking a look.

But hopefully all of that leaves you set for a wonderful and relaxing weekend after another week of trading. And I’ll look forward to picking up our conversation on Monday.

More By This Author:

Jerome Powell Telegraphs That The Fed's 2% Inflation Target Is About To Get RaisedTrump Advisor: ‘Persistent Dollar Overvaluation' Is Root Of Economic Imbalances

JPMorgan: ‘Gold Could Hit $6,000 By End Of Trump Term’