Jerome Powell Telegraphs That The Fed's 2% Inflation Target Is About To Get Raised

Thursday brought another active day in the gold and silver markets, with both metals rallying, especially off of the lows from early this morning around 2:00 A.M.

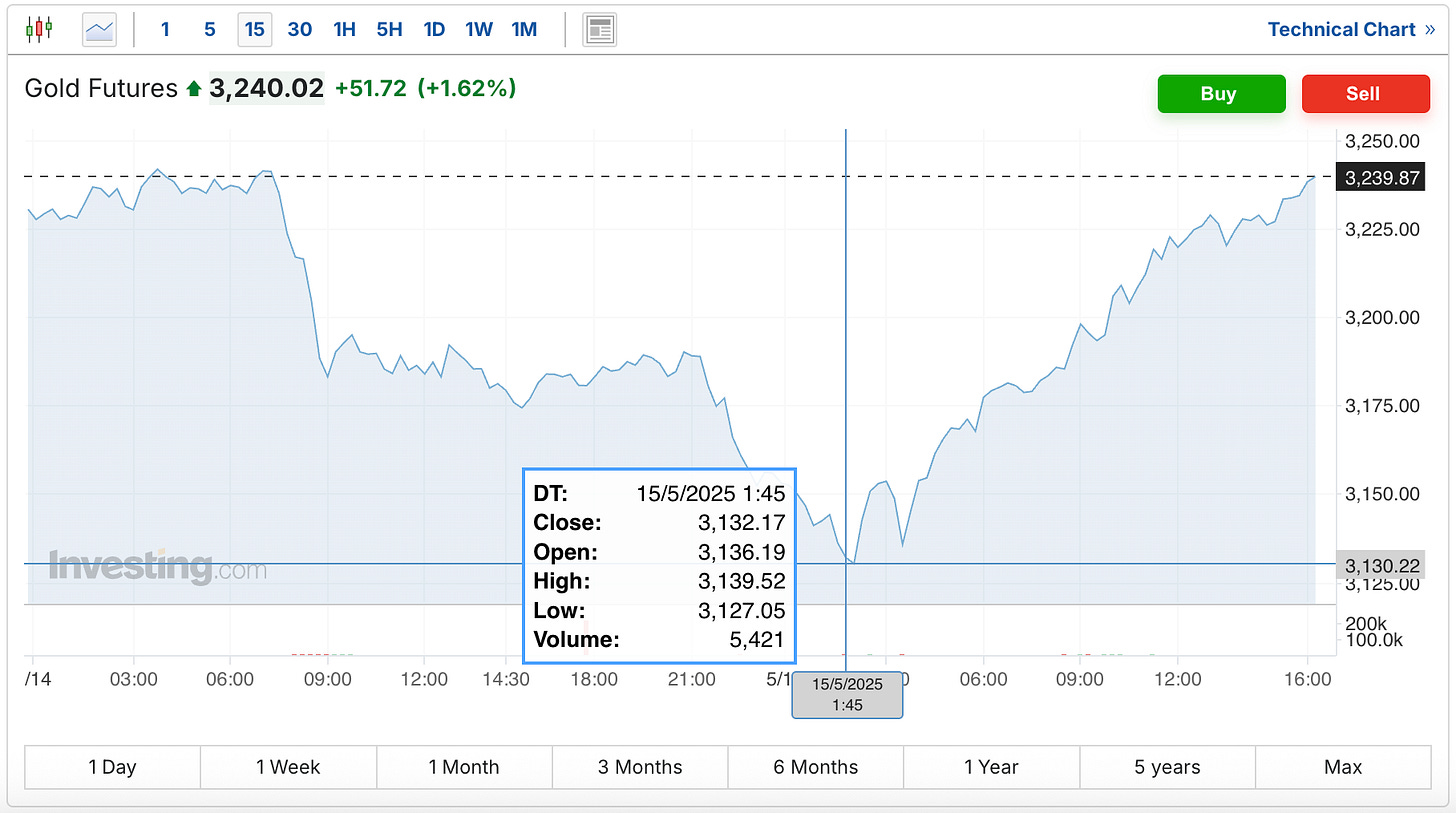

The gold futures were up over $50 today, although as you can see in the chart below, they’re now up over $100 off of the low mark.

(Click on image to enlarge)

The silver chart has a similar pattern today, and it’s up over a dollar off of its lows.

(Click on image to enlarge)

Now clearly these moves began early before business opened in the US.

Although likely contributing to the extension of the rally was Jerome Powell basically telegraphing that he’s about to lay a reason on you why it actually turns out it’s ok to run the inflation mandate even higher than 2%.

(Click on image to enlarge)

U.S. Federal Reserve officials feel they need to reconsider the key elements around both jobs and inflation in their current approach to monetary policy, given the inflation experience of the last few years and the possibility that supply shocks and the associated price increases may become more frequent in the years ahead, Fed chair Jerome Powell said Thursday.

"We may be entering a period of more frequent, and potentially more persistent, supply shocks—a difficult challenge for the economy and for central banks," Powell said in opening remarks at a two-day conference reconsidering the Fed's current approach to monetary policy, adopted in 2020 as the economy was still scarred by the pandemic.

At the same time, policymakers have since the start of the year been debating how to change their overarching approach to monetary policy, contained in a document that establishes things like the 2% inflation target and discusses how to achieve that and its other mandate of maximum employment.

Hopefully they’ll also review this Federal Reserve history about where that alleged ‘2% mandate’ came from. And maybe even consider what Paul Volcker said about how his own mother would have seen through ‘the obvious scam’ of a ‘low inflation’ policy.

(What are the chances someone will ask Powell about that during the Fed’s next press conference?:)

The article also mentions that Powell spoke about ‘the possibility that supply shocks and the associated price increases may become more frequent in the years ahead.’

Now you can say it’s Trump’s fault. Or that it’s Powell’s fault. Or that it’s Nixon’s fault. Or any other government or central banking official who was part of the decades-long effort to get us to this point.

Yet we’ve been warning here for weeks that the longer the tariff war with China continues, the greater your odds of seeing a significant supply chain disruption. And that if that happened, you would be seeing more price increases (then followed by more inflation of the dollar by the Fed’s response).

Now Powell is confirming as much. And as you’re about to find out, he also lays out how the Fed is going to respond when it happens.

Five years ago the Fed recast its approach to allow more room for lower unemployment rates and pledged to use periods of high inflation to offset years in which inflation was weak, a common occurrence from 2010 to 2019.

The inflation that took off after that, and the emerging state of the global economy, means that approach may need a rethink, Powell said.

"In our discussions so far, participants have indicated that they thought it would be appropriate to reconsider the language around shortfalls" of employment, a change adopted so the Fed would not consider a low unemployment rate in itself a sign of inflation risk, Powell said.

I know they’re always focused on ‘the language.’ Although I’m less concerned about the language, and more alarmed by what they actually do.

Which in this case, if you translate all of that Fed speak, means get ready for some explanation in the next few months of either why inflation is higher, or how the 2% mandate is no longer sufficient.

"At our meeting last week, we had a similar take on average inflation targeting. We will ensure that our new consensus statement is robust to a wide range of economic environments and developments."

His comments point to possibly extensive revisions to a strategy that had been viewed at its inception as a major shift for the Fed, with a willingness to take more risks in favor of a stronger job market and a willingness to tolerate higher inflation after periods of weakness.

A wide range of economic environments and developments?!

Does that include finding out that our supply chains are actually not resilient enough to survive a trade war with China?

The article also mentioned ‘a willingness to tolerate higher inflation after periods of weakness.’

So the same Federal Reserve Chairman who last year told you that the economy was in great shape, while simultaneously cutting interest rates by 50 basis points despite inflation being above the Fed’s mandate for the past 3 years by that point, is now saying that he might be willing to tolerate higher inflation after ‘a period of weakness.’

Which he also just told you was coming (at least in his own ‘Fedspeak’). Although even aside from him warning about it, we’ve all already been seeing it coming.

So just remember the next time gold’s down over $100, that now even the chairman of the Fed is saying to watch out for supply shocks. And that if the economy weakens after one occurs, that his response will be to just raise the inflation target.

More By This Author:

Trump Advisor: ‘Persistent Dollar Overvaluation' Is Root Of Economic Imbalances

JPMorgan: ‘Gold Could Hit $6,000 By End Of Trump Term’

Precious Metals Finish Higher To End The Week, & Indian Silver Market Update