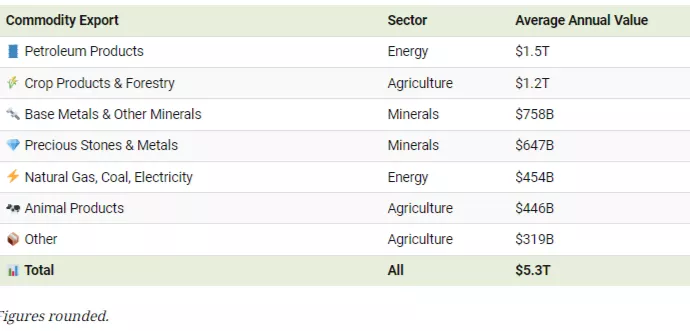

Charted: $5 Trillion In Global Commodity Exports, By Sector

(Click on image to enlarge)

This chart categorizes over $5 trillion in global commodity exports by sector and the value of material exported.

Data was averaged between 2019–2021 to represent an annual estimate. Source figures can be found at The State of Commodity Dependence 2023 published by UN Trade & Development.

Commodity Exports with the Highest Value

Oil and its products account for 30% of global commodity exports on average, valued at $1.5 trillion annually.

When including natural gas, electricity, and coal exports, the energy sector contributes 40% to the value of global commodity export per year ($2 trillion). Agricultural exports ($1.9 trillion) rank second and are higher in value than mineral exports ($1.4 trillion).

Within agriculture, crops and forestry has the lion’s share of value at $1.2 trillion. This category includes everything from wheat to wood exports.

Meanwhile, the minerals sector is more equally divided between base metal exports (like copper, iron, and aluminum) and precious metals and stones (gold, silver, diamonds).

Not pictured in this graphic is how international the commodity trade tends to concentrate in just a few countries on the exports side. For example, one-fourth of all copper produced in 2023 came from Chile.

The flip side of this means some of these major resource exporters have a significant amount of commodity dependence. And relatedly, many of them are low or middle-income countries. When international prices for the commodity exported decline, the likelihood of financial crises and reduced public spending increases, further entrenching economic challenges in these regions.

More By This Author:

Visualizing The World’s Top 25 Companies By Market Cap

Ranked: The Countries That Added The Most Gold Reserves (2013-2023)

Mapped: Electric Vehicle Adoption By State

Disclosure: None