Cabin Crew, Prepare For Landing: Gold Miners Plane Is Going Down

Once again, practically everything that I wrote in Monday’s analysis, Tuesday’s analysis, and yesterday's analysis remains up-to-date.

In yesterday’s analysis, I wrote the following about the stock market:

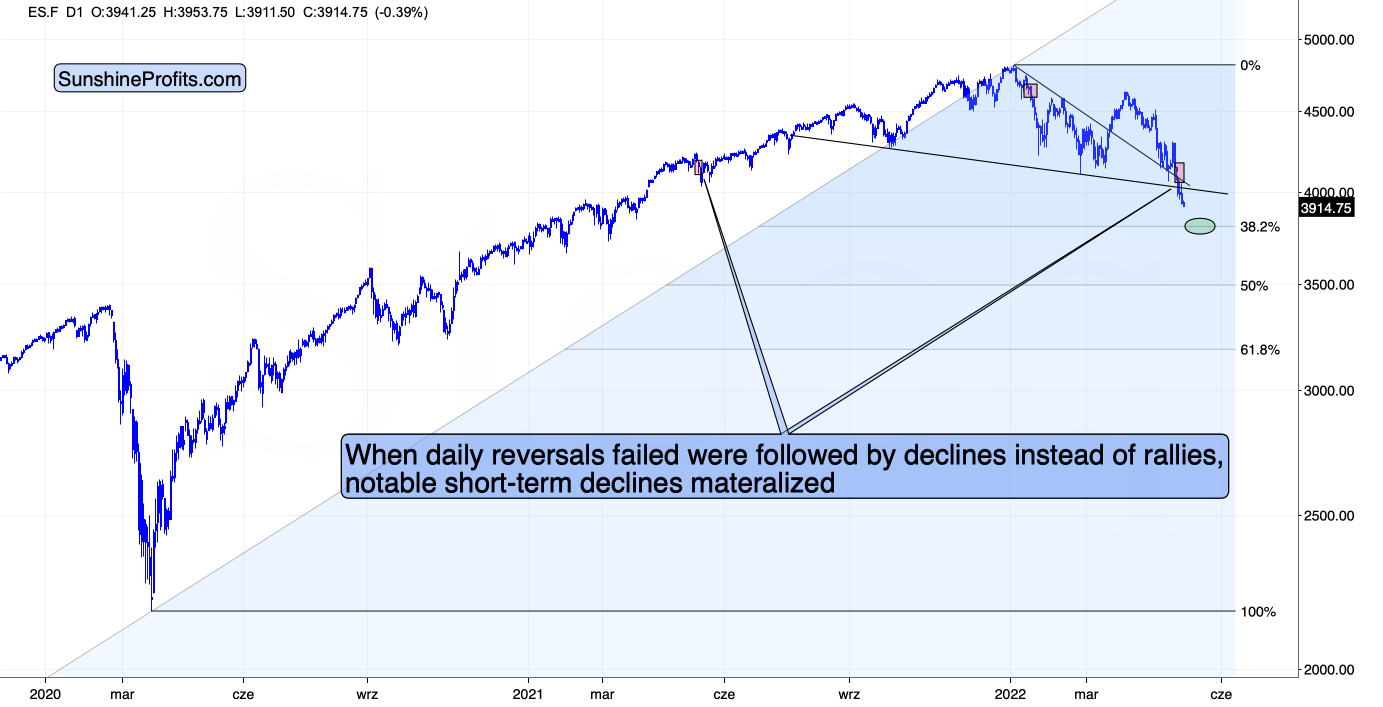

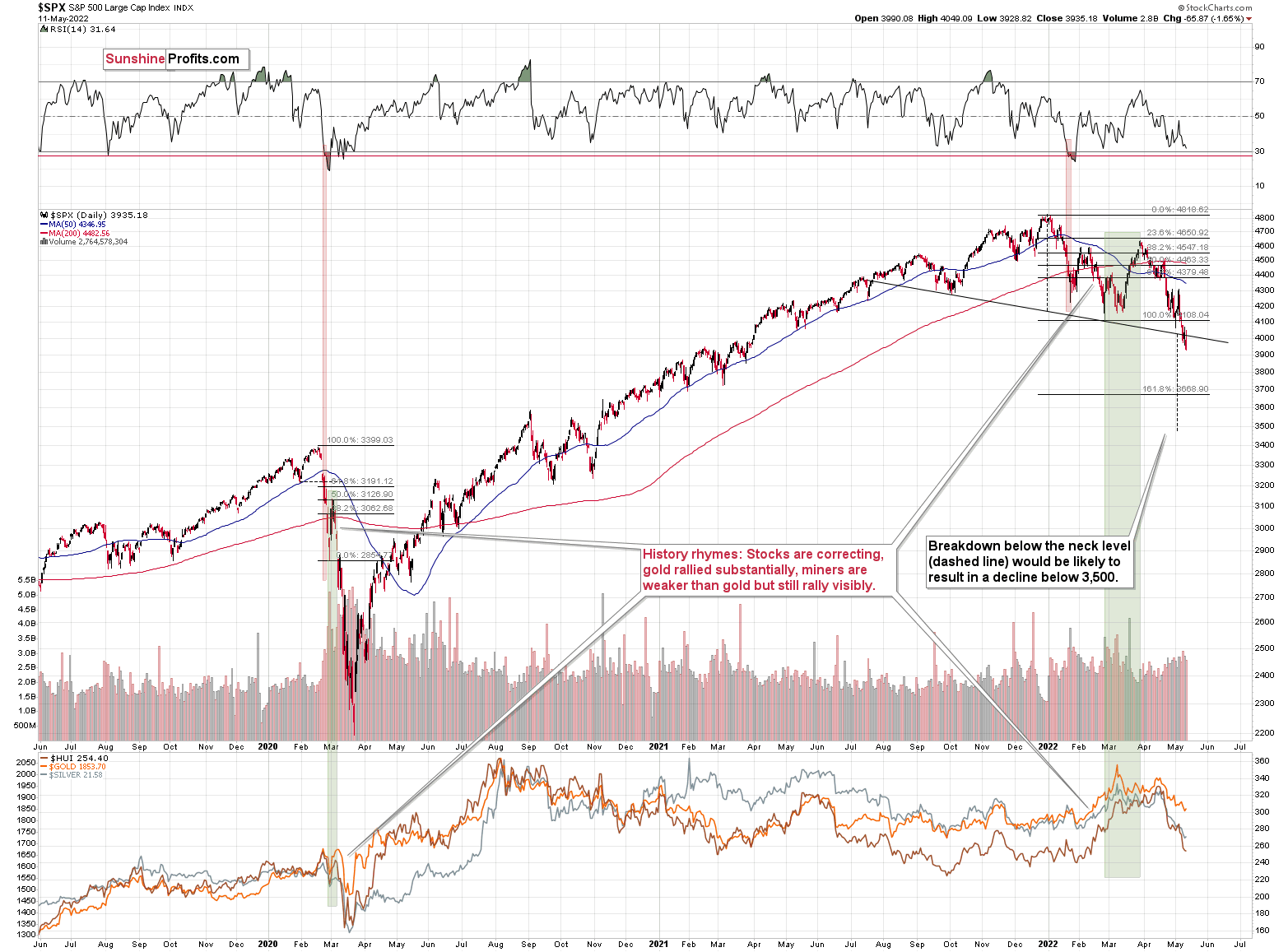

Speaking of the general stock market, it moved slightly higher yesterday (in terms of closing prices), but the move was not significant enough to invalidate the breakdown below the neck level of the head-and-shoulders formation. Therefore, the breakdown is now almost confirmed, and the situation is already more bearish than it was yesterday.

At the moment of writing these words, stocks are once again trying to rally, but so far the rally is not as big as yesterday’s pre-market rally that was just erased. Thus, I doubt that stocks will be able to avoid falling in the near term.

The S&P 500 is currently confirming a breakdown below its head and shoulders pattern. Once confirmed (just one more close below the neck level is required), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

Despite yesterday’s attempt to move higher, stocks closed the day below the neck level of the head and shoulders pattern for the third consecutive day. The bearish H&S pattern was confirmed, just as I expected.

The implications are bearish, and while the target based on this formation is slightly below 3,500, it wouldn’t surprise me to see a rebound from about 3,800 – that’s where the 38.2% Fibonacci retracement is located. I previously wrote about it in the following way:

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above and in the previous days / weeks.

It would trigger another immediate-term decline in silver and mining stocks in the near term, wchich would be followed by a (quite likely tradable) rebound.

So, it seems that the general stock market is quite close to its near-term target area but not yet at it – another move lower appears likely.

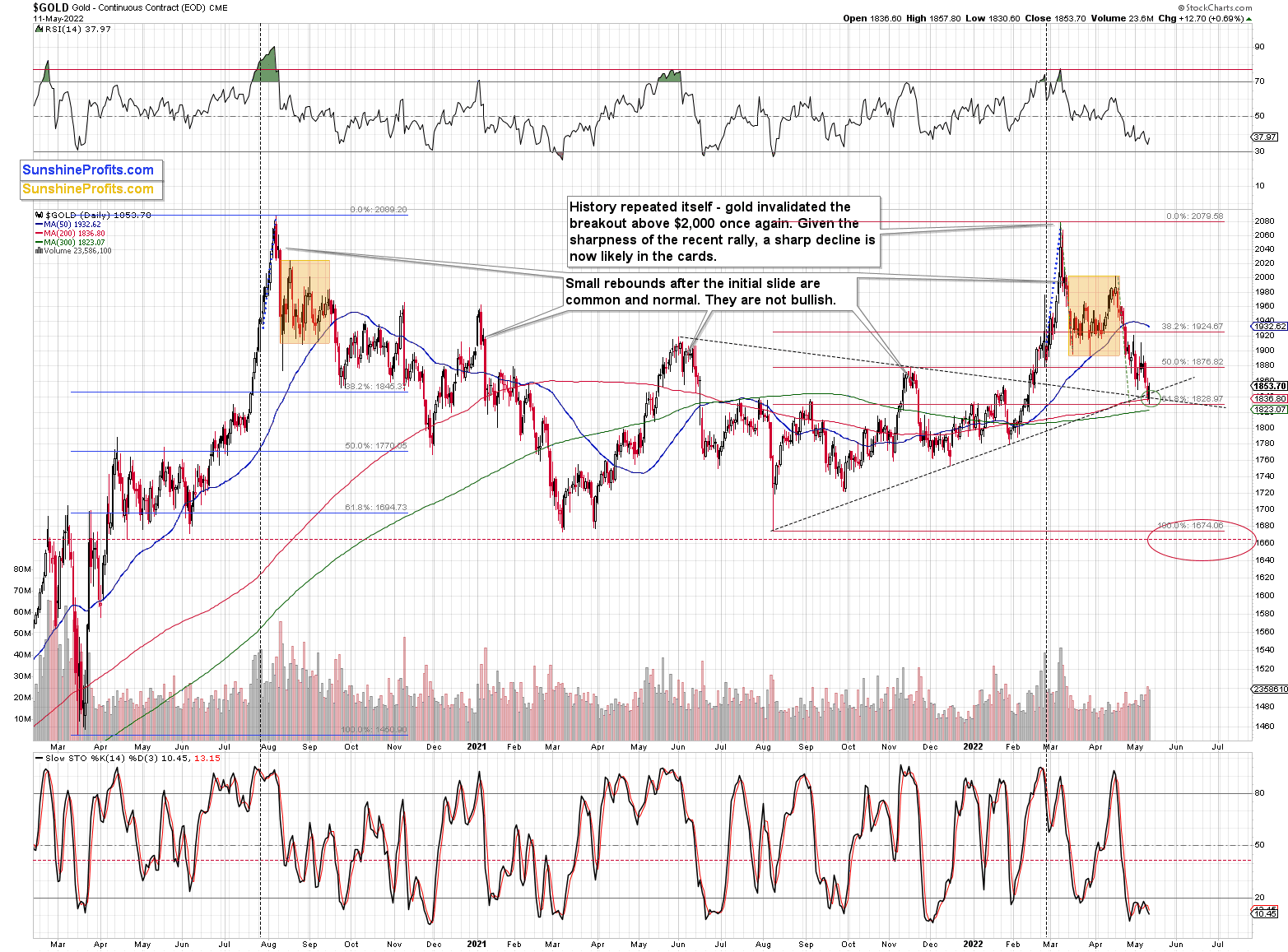

Having said that, let’s take a look at the other (usually main) determinant of the driver of junior mining stock prices – gold.

In yesterday’s analysis, I commented on the gold chart in the following way:

As gold moved right to the middle of my target area, it seems that it might not want to move much lower before correcting. However, it’s still possible that the bottom would form over several days, and if the stock market declines during that time, junior miners could decline despite the lack of declines in gold.

If the above is the case, then once the stock market moves back up, juniors will likely soar back with vengeance, like a coiled spring that’s finally able to expand. For now, it seems that the general stock market will take juniors lower (in the very near term, that is).

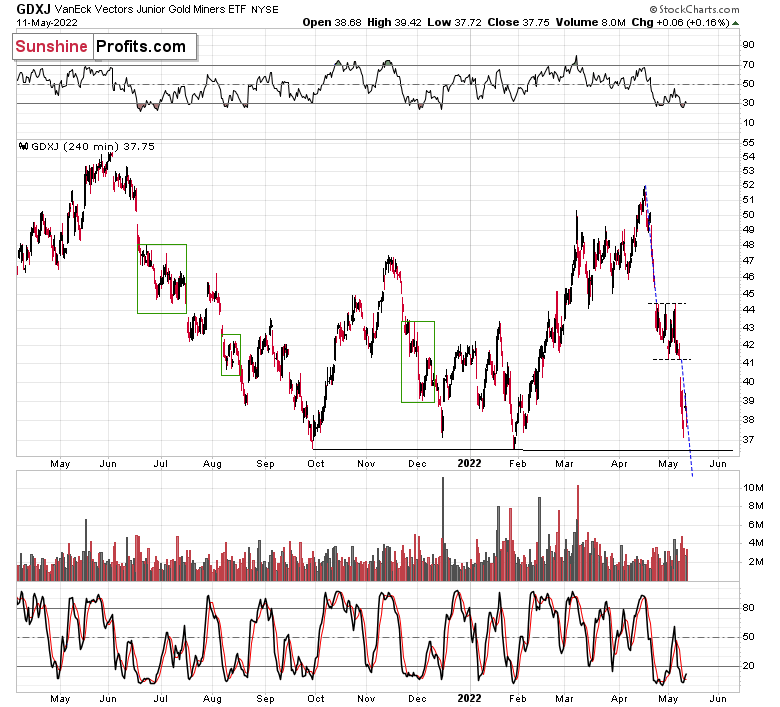

Please take one more look at the part that I put in bold. The stock market declined yesterday, while gold moved higher. What did the mining stocks do? The GDX ETF was slightly lower and the GDXJ ETF was slightly higher, but overall they didn’t do anything despite the intraday attempt to rally.

The above is in perfect tune with the current situation in gold and stocks. As gold rallied yesterday, and it moved a bit lower once again in today’s pre-market trading (~$7 at the moment of writing these words), it’s likely forming a broader bottom here. Since stocks (S&P 500 futures) are trading lower (they are down by 0.5%) in today’s pre-market trading, it seems that junior miners are about to get another bearish push.

As stocks are likely to move a bit lower before correcting, so are junior miners. This means that practically everything that I wrote about their performance and outlook remains up-to-date – the market simply agreed:

In short, just like in the case of silver, I decided to move our exit prices lower – a bit below the previous lows.

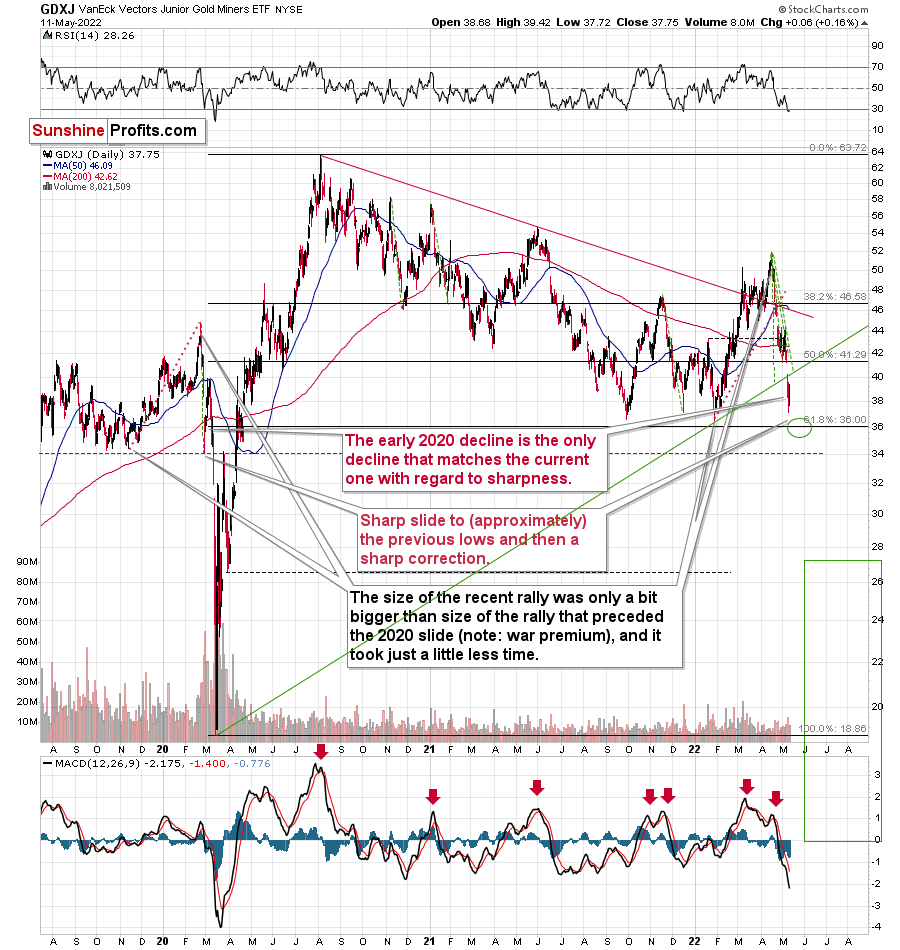

Why? Because that’s where there’s the next really strong support – provided by the 61.8% Fibonacci retracement and because it seems that the general stock market will decline a bit more before correcting.

I mean, I expected juniors to decline along with the general stock market, but the huge size of juniors’ decline was more than I had expected to happen during just one session compared to what happened in the S&P 500.

If stocks have more to fall (much more than just a repeat of yesterday’s decline) and gold could repeat its yesterday’s decline, it seems that junior miners could more than repeat their slide. Since they fell by over $3 yesterday, juniors can now decline by at least another $3. This would bring them below their previous lows and below the previous target of about $37.

In fact, given the strength of the momentum, I wouldn’t even rule out the scenario in which miners slide to ~$34. Then again, let’s not forget that miners tend to show some kind of strength before rallying, so the pace of their decline would be likely to diminish before the turnaround. Therefore, expecting the sharpness of the decline to continue all the way down is not realistic. Consequently, ~$36 seems more realistic as a short-term downside target than $34 is.

Besides, the GDXJ’s 4-hour chart also suggests a move to this area.

Consolidations tend to be followed by price moves that are similar to the moves that preceded them. Applying this to the letter provides us with a target that’s slightly below $36.

To summarize the technical part of today’s analysis, it seems that junior miners will move to their short-term target soon, which will enable us to exit the current short positions in them and (if one wants to do so, that is) to enter temporary long positions to benefit from the likely rebound.

As soon as the target levels are reached in the case of the GDXJ, I think that exiting short and entering long positions will be justified from the risk to reward point of view (regardless of whether you get a confirmation from me). Please note that the move to ~$36 could be sharp, and it could be reversed on an intraday basis.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more