Bullion Bulls Hold Above $2k For Now

In what’s set to be the US dollar index’s best week since February, bullion bulls were discouraged from drawing further conviction from the softer-than-expected CPI and PPI prints.

Gold’s upside may have also been capped by the still-hawkish rhetoric out of this week’s Fed speak.

Yet spot prices remain supported above the psychologically-important $2,000 level by persistent anxiety over ongoing US debt-ceiling talks as well as hopes that the Fed is done with its rate hikes.

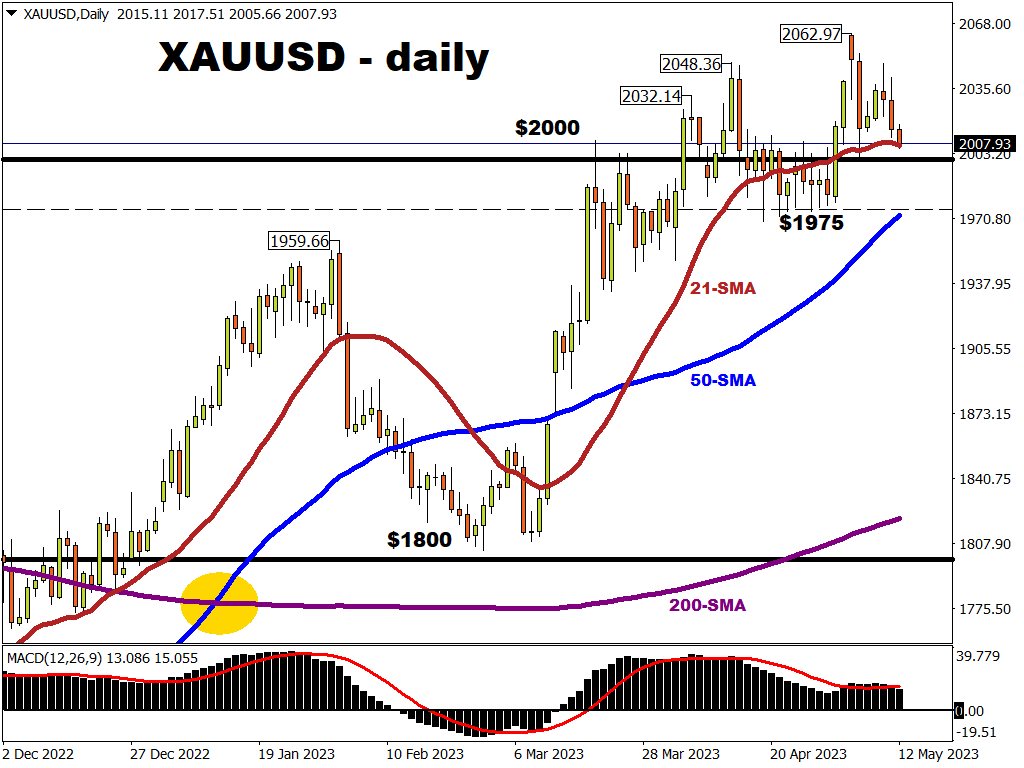

Unable to replicate its recent high above $2060, the precious metal is instead testing its 21-day simple moving average (SMA) for immediate support at the time of writing.

The longer that spot gold can keep its head above $2k amid sustained inflows into bullion-backed ETFs, the greater the chances of the precious metal revisiting its all-time high.

More By This Author:

Disney+ Woes Send Stock Stumbling

Markets Await Crucial US Inflation Data

This Week: GBPUSD Awaits US CPI And Bank of England Clues

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more