Bad Gas

If you think the clobbering of growth stocks in 2022 was harsh, check out the performance of natural gas. Towards the end of last summer when there were real worries that many Europeans were going to freeze to death in the winter cold without gas to heat their homes, the price of natural gas in the US traded to the highest levels in over a decade and approached double-digits. As steep as the runup last year was, the downfall has been even steeper. Suffice it to say, the price of the front month futures contract is nowhere near $10 anymore, and just this week dropped below $3 to its lowest level in more than a year. More recently, the slide has been pretty relentless with 14 declines over the last 20 trading days.

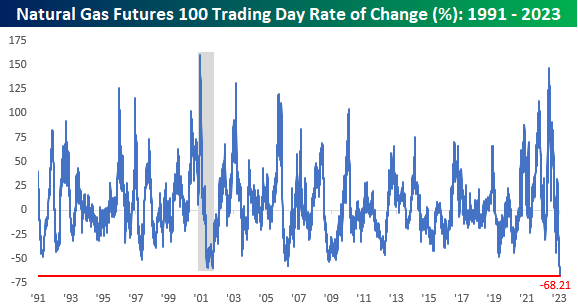

The chart below shows the 100-trading day rate of change in natural gas futures going back to 1991. Through Thursday’s close, the price of the front month contract was down by more than two-thirds (68.21%), which, believe it or not, is the steepest drop over a 100-trading day period in the history of the futures contract (since 1991). It’s interesting to note that the current decline comes just eight months after what was the second-strongest 100-trading day rally in the history of the futures contract (+147%). The strongest 100-day rally was all the way back in December 2000 when prices surged 160%. Like the rally last May, that strong rally was followed eight months later by what is now the second-largest 100-day decline in natural gas prices.

The lesson here may be that if natural gas rallies 100% in 100 days, you probably want to avoid it. In the eight prior periods when the commodity rallied 100% in 100 days, its median performance over the following year was a decline of 30.1% with declines 75% of the time. Conversely, the performance of natural gas following 50%+ declines in 100 days hasn’t been as consistent. In the five prior periods that fit that criteria, natural gas was up by a median of just 1.4% with gains three out of five times.

More By This Author:

Earnings Onslaught On The Way

Bulls And Bears Almost Evenly Split

Claims Peak Early

Click here to learn more about Bespoke’s premium stock market research ...

more