Asset Prices Erupted Prior To Independence Day

The GDXJ ETF was underwater once again, as the junior miners materially underperformed the S&P 500. The former declined by 3.77% on Jun. 28, while the latter declined by 2.01%.

Furthermore, gold declined by 0.20%, silver by 1.71%, and the USD Index rallied by 0.56%. As a result, the PMs continue to perform as expected.

Fireworks Came Early

While it seemed logical that a sense of calm would dominate the financial markets until after the Jul. 4 holiday, asset prices erupted on Jun. 28. Moreover, with the abnormal bouts of volatility highlighting investors’ anxiety, their short-term psyches can’t seem to shake the medium-term fundamentals.

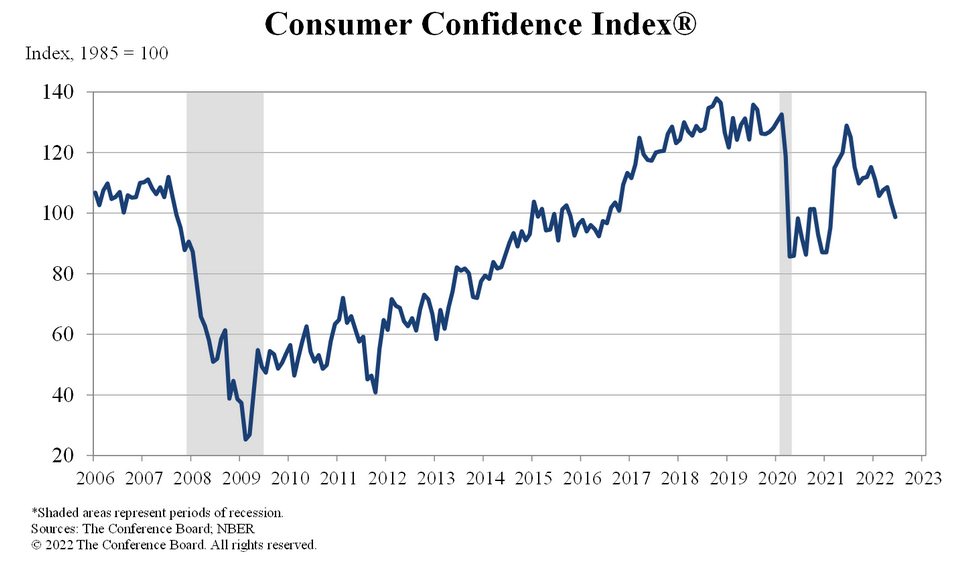

For example, The Conference Board released its Consumer Confidence Index on Jun. 28. The index declined from 103.2 in May to 98.7 in June, reaching its lowest level since February 2021. However, the report was profoundly hawkish for Fed policy. An excerpt read:

“51.3% of consumers said jobs were ‘plentiful,’ down from 51.9%. Conversely, 11.6% of consumers said jobs were ‘hard to get,’ down from 12.4%.”

Therefore, with Americans’ employment prospects holding up much better than their overall sentiment, the data adds fuel to the hawkish fire.

Please see below:

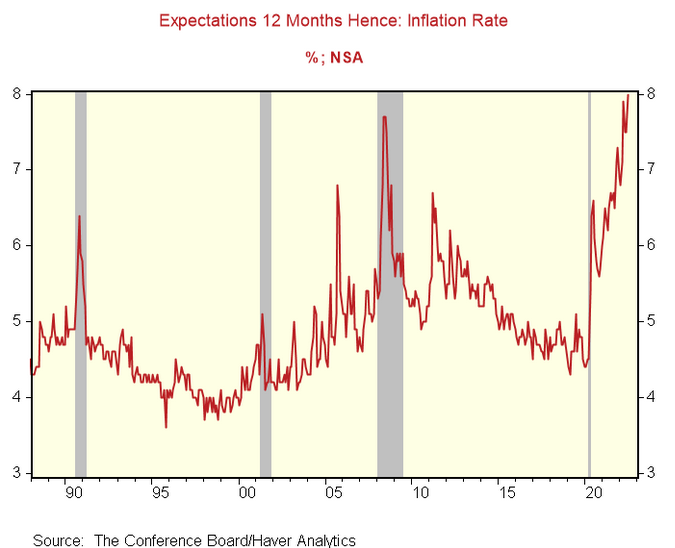

To that point, the report also showed Americans’12-month expected inflation rate hit an all-time high of 8%.

Please see below:

To explain, the red line above tracks The Conference Board’s inflation survey results. If you analyze the right side of the chart, you can see that the metric hit a new record high. As a result, Americans’ inflation expectations fall materially outside of the Fed’s expected range.

Furthermore, I’ve noted on numerous occasions that unanchored inflation is the perfect ingredient for U.S. recessions, and the data from The Conference Board was another stark reminder. For example, Lynn Franco, Senior Director of Economic Indicators at The Conference Board, said:

“While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory – falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as a growing risk of recession by year-end.”

Please see below:

To explain, the blue line above subtracts The Confidence Board’s Present Situation Index from its Expectations Index. In a nutshell: when the blue line is falling, Americans expect the future to be worse than the present.

If you analyze the right side of the chart, you can see that the blue line has fallen off a cliff. Moreover, the vertical red bars highlight how sharp declines in the spread often occur before U.S. recessions. As a result, with inflation preventing the Fed from easing to support the U.S. economy, it’s likely only a matter of time before a recession is confirmed.

Likewise, since the pricing pressures are unlikely to abate without more rate hikes, it may be an extended wait before the Fed turns dovish.

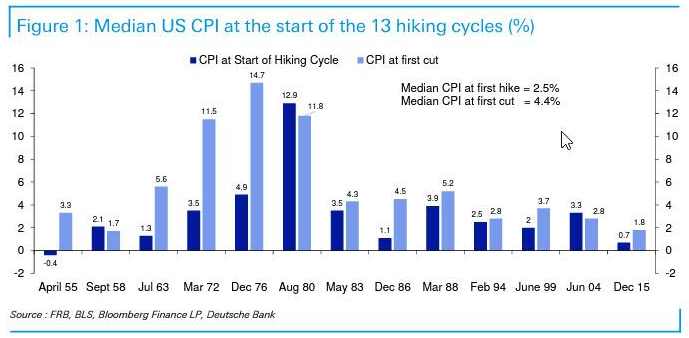

Please see below:

To explain, the dark blue bars above depict the year-over-year (YoY) percentage changes in the headline Consumer Price Index (CPI) when the Fed began its historical rate hike cycles, while the light blue bars above depict the CPI levels when the Fed finally cut rates.

The data shows that the median rate hike occurred with the headline CPI at 2.5% YoY. Therefore, the Fed normally tightens before inflation gets out of control. However, while I warned throughout 2021 that the Fed was materially behind the inflation curve, that ship has already sailed.

More importantly, history shows that the median rate cut occurred with the headline CPI at 4.4% YoY. Furthermore, anything higher than 5% is a material outlier. Therefore, with the headline CPI currently at 8.5% YoY, we’re far from levels where the Fed can run to the rescue. As a result, my comments from Apr. 6 still hold. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

Take Shelter

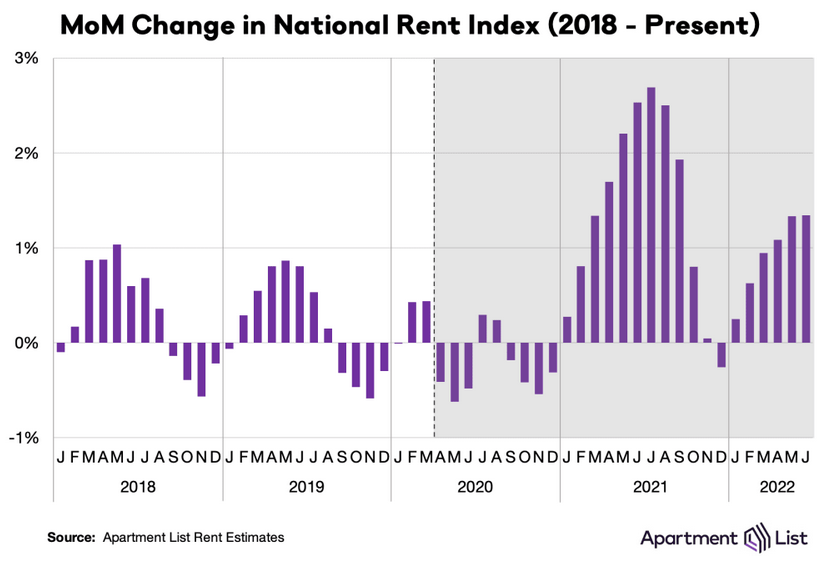

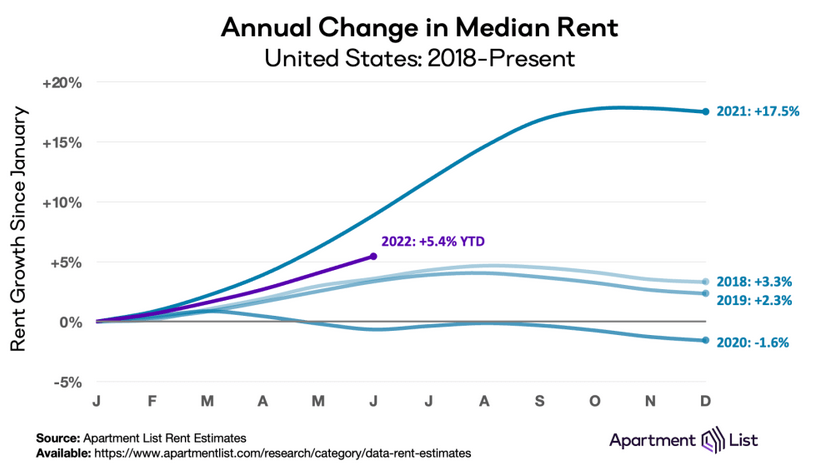

While investors focus much of their attention on food and energy prices, rent inflation is material. For example, the Shelter CPI accounts for more than 30% of the headline CPI’s movement. Moreover, Apartment List released its National Rent Report on Jun. 28. An excerpt read:

“Our national rent index increased by 1.3 percent month-over-month in June, consistent with last month’s increase. In June 2021, our national rent index jumped by 2.5 percent month-over-month, nearly doubling this month’s increase. In contrast, from 2017 to 2019, month-over-month growth in June averaged 0.7 percent, just over half of this month’s increase.”

Please see below:

In addition:

“In the first half of this year, our national rent index has increased by 5.4 percent, well below last year’s 8.8 percent increase over the same months. However, this year’s pace is also still notably faster than that of the years prior to 2021. For comparison, rent growth from January to June totalled 3.1 percent in 2017, 3.6 percent in 2018, 3.4 percent in 2019, and -0.7 percent in 2020.”

Please see below:

Thus, while 2022 rent inflation lags 2021, the important point is that the six-month percentage change has already eclipsed the annual figures from 2018 and 2019. As a result, more hawkish policy should dominate the headlines in the coming months, and a realization is profoundly bearish for the S&P 500 and the PMs.

A Real Conundrum

I’ve long warned about the impact of U.S. real yields on the PMs. However, plenty of liquidity beneficiaries suffer when the Fed tightens monetary policy. To explain, I wrote on Jan. 12:

[Like] hyper-growth NASDAQ stocks and speculative assets like cryptocurrencies, the PMs, suffer from a similar fundamental affliction. For context, the PMs are less volatile than speculative assets. However, it's important to remember that gold, silver, and mining stocks peaked amid the liquidity-fueled surge in the summer of 2020. Likewise, their uprisings coincided with real interest rates that were at all-time lows at the time.

Conversely, with the Fed's liquidity drain already unfolding and real interest rates poised to rise in the coming months, the PMs should suffer from the likely re-pricings.

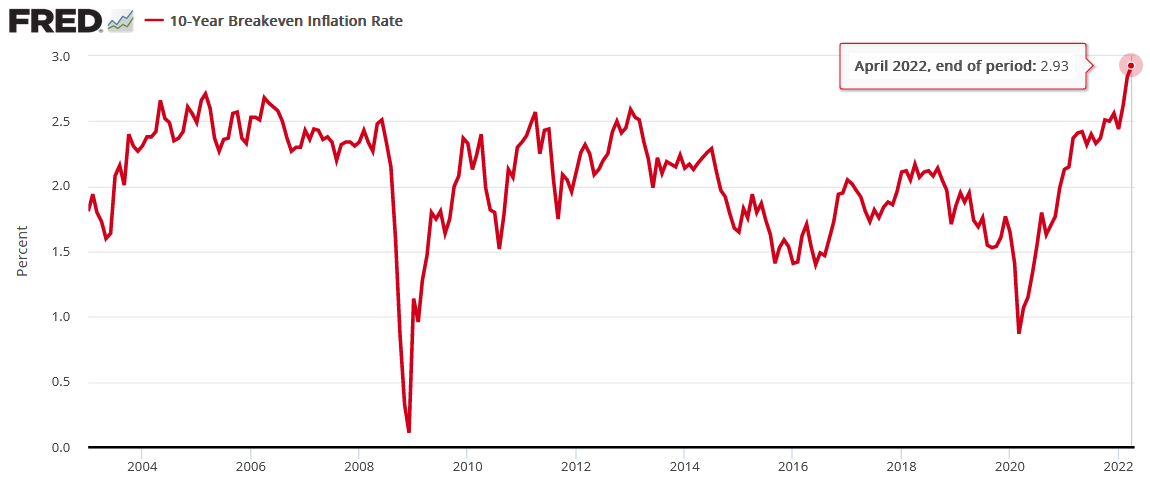

Thus, while gold has remained relatively uplifted, silver and the GDXJ ETF have lost material ground in 2022. Likewise, while Americans’ inflation expectations have become unanchored, bond investors understand the implications of the Fed’s rate hike cycle. As a result, the U.S. 10-Year breakeven inflation rate has performed as expected. For context, I wrote on Apr. 20:

The next leg higher for the U.S. 10-Year real yield may occur for the opposite reasons. For example, I noted above that we don’t need nominal yields to rise for real yields to rise. Moreover, while the U.S. 10-Year Treasury yield was undervalued in 2021 and was poised to move higher, the U.S. 10-Year breakeven inflation rate is overvalued in 2022 and is poised to move lower.

Please see below:

To explain, the U.S. 10-Year breakeven inflation rate ended the Apr. 19 session at 2.93%, only slightly below the all-time high of 2.95% set in March. However, like the PMs, investors’ long-term inflation expectations remain in la-la land.

With the Fed on a hawkish crusade to stifle demand and reduce inflation, the central bank can achieve this goal. The only question is how much economic pain officials are willing to tolerate to get the job done.

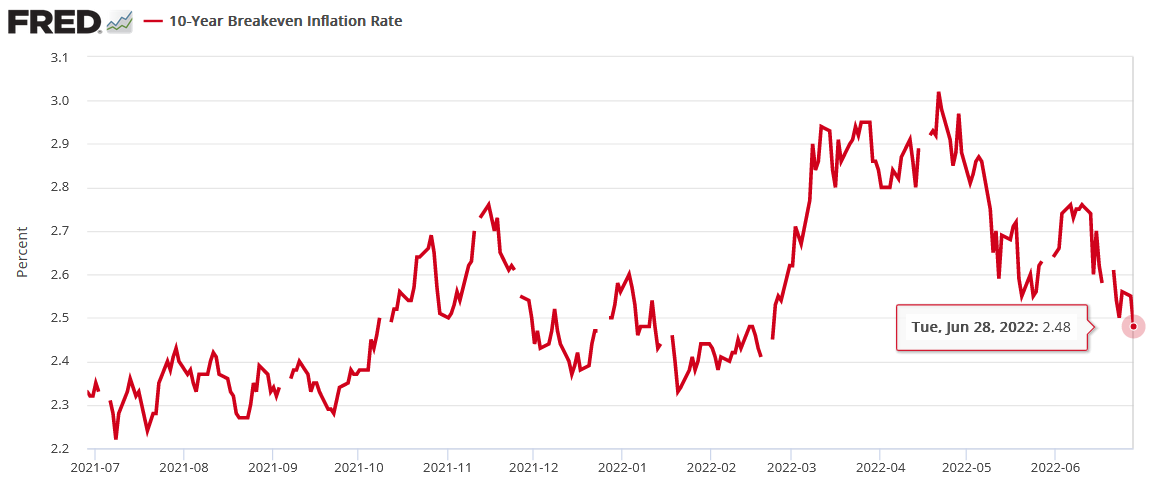

Furthermore, with the metric declining on cue, the U.S. 10-Year breakeven inflation rate ended the Jun. 28 session at 2.48%.

Therefore, with the U.S. 10-Year Treasury yield ending the day at 3.20%, the U.S. 10-Year real yield remains elevated at 0.72%. However, the Fed needs to push the metric higher to curb inflation, and a realization should profoundly impact the NASDAQ 100, the S&P 500, and the GDXJ ETF.

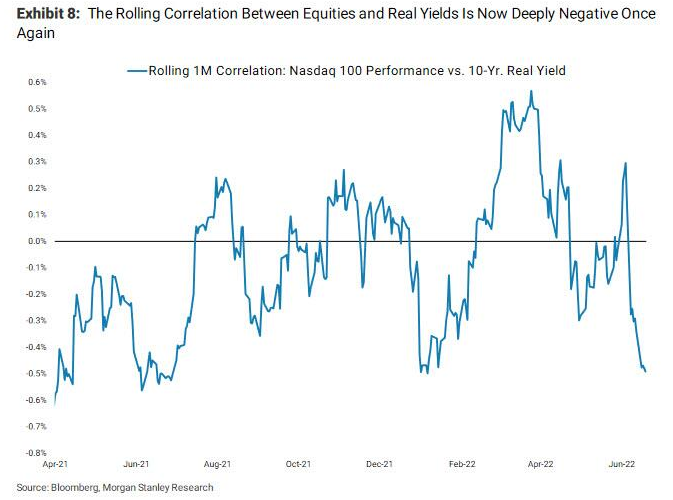

Please see below:

To explain, the blue line above tracks the rolling one-month correlation between the NASDAQ 100 and the U.S. 10-Year real yield. If you analyze the right side of the chart, you can see that the blue line has fallen sharply, indicating that a higher U.S. 10-Year real yield has sent the NASDAQ 100 running in the opposite direction. Likewise, with the GDXJ ETF a liquidity beneficiary that’s more correlated with the general stock market, a continuation of the theme should result in lower lows over the medium term.

The Bottom Line

Stocks sold off on Jun. 28, as asset prices continued to whipsaw violently in both directions. However, the GDXJ ETF has fallen more on down days and risen less on up days than the S&P 500. As a result, the underperformance is profoundly bearish, and the dynamic should continue in the months ahead.

In conclusion, the PMs declined on Jun. 28, as pessimism reigned. Moreover, with the USD Index rallying, the PMs’ medium-term fundamentals continue to worsen. Therefore, a final flush should occur before long-term buying opportunities emerge.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more