Asset Prices Are Up, Up And Away. Where Are The Value Buying Opportunities?

If you’ve ever wondered what trillions of dollars in monetary and fiscal stimulus looks like, it appears you got your answer. Everything is up right now.

Stocks are up. Earnings are up. Consumer spending is up. Commodities are up. Food prices are up. Home prices are up. Car prices are up. Cryptos are up.

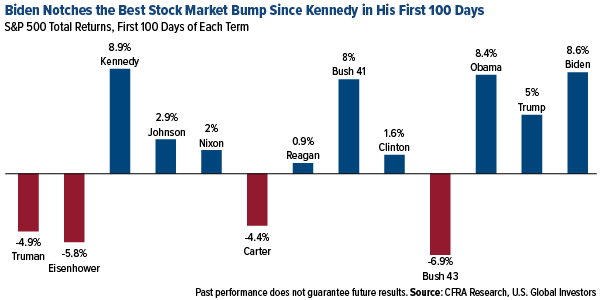

Last week marked President Joe Biden’s 100th day in office. Since Inauguration Day, the S&P 500 has increased an impressive 8.6%. Those are the best returns for the start of a presidential term since Kennedy in 1961. All those stimmy checks have to go somewhere.

With the Federal Reserve signaling it will keep accommodative measures in place for some time longer, and Biden making the case for trillions more in government spending, is this what we can expect going forward?

And with everything up, where are the value buying opportunities?

Pain at the Car Lot and Grocery Store

Before I get into that, it’s important I point out that not every example of price appreciation is being driven strictly by stimulus checks and money-printing. Pandemic lockdowns are still having a massive effect on the global supply of everything from building materials to semiconductor chips, which is driving up production costs that are being passed on to consumers.

Take lumber. Because sawmills have had trouble ramping up production to meet demand, the price of framing lumber has skyrocketed 250% over the past 12 months to around $1,200 per thousand board feet. This has added close to $36,000 to the price of a new home, according to the National Association of Home Builders (NAHB).

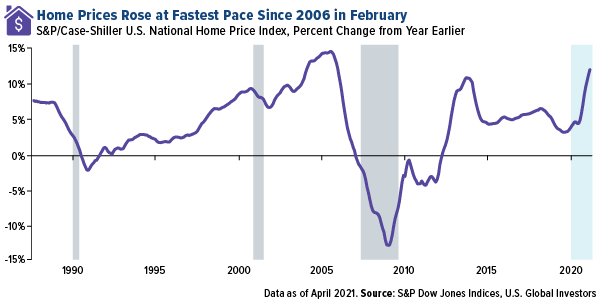

Indeed, home prices surged 12% in February compared to the same month last year, S&P Dow Jones Indices reported last week. That’s the fastest annual pace since 2006, soon before the housing bubble burst.

Or take the ongoing chip shortage, which has been exacerbated in recent months by the winter freeze in Texas and a fire at Japan’s Renesas Semiconductor Manufacturing plant. According to Goldman Sachs, the shortage has impacted a whopping 169 industries, most notably carmakers. Last week General Motors President Mark Reuss told Fox Business that the crisis “is probably the worst crisis I’ve seen in the auto industry, at least in my career, in terms of supply chain.”

As a result, the price of used vehicles, as measured by the Manheim Used Vehicle Value Index, has increased 52% over the past year. Preowned pickups have jumped an unbelievable 75%.

And then there’s food and consumer staples such as diapers and toilet paper. Recently I shared with you that corn prices have almost doubled over the past year, and last week Bloomberg reported that corn has gotten so pricey that some farmers are feeding their livestock wheat intended for human consumption. A host of consumer goods giants, from Procter & Gamble to Kimberly-Clark, have all announced they’ll be raising their prices in the coming months as commodity prices continue to soar.

Copper Near Record Highs

Iron ore and copper are both near record highs on tight supply and strong demand from China. Copper traded above $10,000 per tonne last week, its highest level in 10 years, as investors anticipate further supply constraints on global efforts to decarbonize and electrify everything.

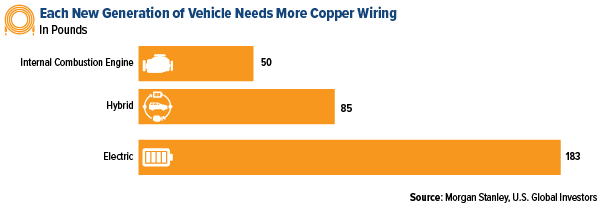

To give you some idea of what I’m talking about, the NAHB last week recommended to homebuilders that they should start pre-wiring new houses for electric vehicle (EV) charging. That calls for more copper wiring in the home as well as the vehicle.

Several car manufacturers have already announced they’ll be phasing out internal combustion engine (ICE) vehicles in favor of EVs between 2025 and 2040. As I’ve mentioned before, EVs require three to four times as much copper wiring as a traditional vehicle. Morgan Stanley reports that ICE vehicles use around 50 pounds of copper on average, compared to 85 pounds for a hybrid and as much as 183 pounds for an EV.

Ivanhoe Mines (IVPAF) remains our favorite way to play the copper rally. The company, which reported phenomenal production results in early April at its Kamoa-Kakula project, has yet to report first-quarter earnings. However, other copper companies have, and results so far have been amazing. Brazil’s Vale, for instance, reported incredible net income of $5.6 billion, well above Wall Street estimates.

Gold Miners Should HODL

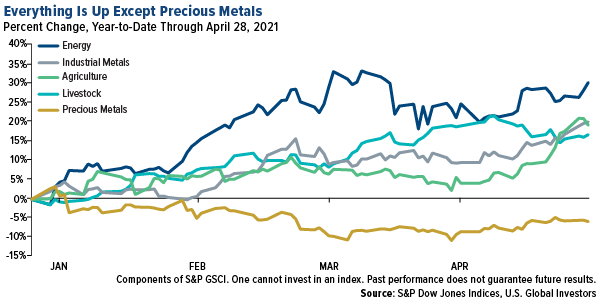

The chart below says it all. Every commodity subindustry of the S&P GSCI is up double digits for the year, with the one exception of precious metals.

That’s where I see the opportunity right now. Not only is gold on sale, but so are the gold and precious metal miners, particularly the royalty and streaming companies. Whereas the NYSE Arca Gold Miners Index is down close to 5% for the year, the big three royalty and streaming companies have performed relatively well, with Franco-Nevada up 12%, Royal Gold up 6% and Wheaton Precious Metals essentially flat.

As for the producers, I would like to see them “HODL” gold as we wait for higher metal prices on unprecedented money-printing and fiscal stimulus. (HODL, in case you’re not aware, is crypto-trading lingo to describe a buy and hold strategy.)

Between the U.S., Europe and China and others, we’ve spent a collective $17 trillion (and counting) to combat the coronavirus and the economic havoc it’s wreaked. Gold has historically tracked the growth in money supply, and in March, the amount of money circulating the global economy expanded more than 17% in March compared to last year, according to Haver Analytics.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to ...

more