Are We Running Out Of Gold?

Image Source: Pixabay

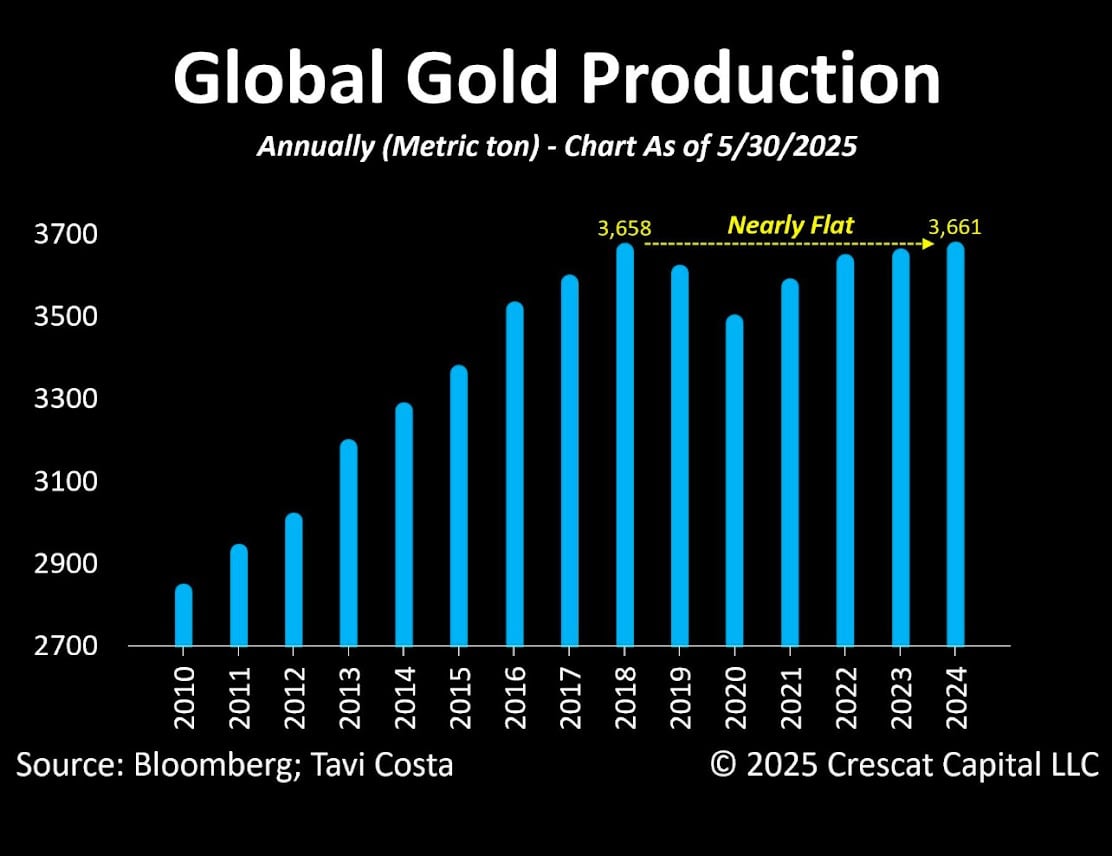

After increasing annually for nearly 50 years, gold mine output has plateaued. Some analysts believe this signals we are close to "peak gold", the point at which mine output will begin to decrease annually.

In this episode of the Money Metals Midweek Memo podcast, host Mike Maharrey looks at the historical and current gold supply dynamics and presents the case for "peak gold." He also highlights one big bank's bullish forecast for both gold and silver.

Mike opens the show reminiscing about his dad's metal detector hobby, noting that he never found much more than spare change and old cans.

"It turns out metal detecting isn’t necessarily a waste of time. Some people actually find stuff! In 1979, a couple using a metal detector in the Kalgoorlie Goldfields of Western Australia located a massive gold nugget. Known today as the "Golden Beauty," the nugget weighs in at nearly 10 pounds. Can you imagine stumbling on such a find? I can’t either. My imagination can’t get past my dad digging up pop tops."

Mike points out just how rare it is to make such a find.

"Mining experts say a 1-ounce nugget is harder to locate than a 5-carat diamond."

Gold's scarcity is one of the key reasons gold is so valuable. It's also one of the characteristics that makes it excellent money. Mike highlights just how little gold has been mined.

"According to the World Gold Council, the best estimates are that around 216,265 tonnes of gold have been mined throughout history. About two-thirds of this gold has been extracted since 1950. This massive increase in production has been due to advancements in mining technology and the discovery of new gold deposits. That sounds like a pretty big number, but it’s not as much as you might think. If we could gather all of this gold into a single cube, it would measure approximately 22 meters on each side. Consider that an Olympic-sized pool is 50 meters long."

Mike points out that there is an interesting dynamic on gold's supply side, and it raises an important question.

"Gold mine output has been basically flat since 2018. Could this signal that we are at or near 'peak gold?'"

Peak gold is the point at which the amount of gold dug from the earth begins to shrink every year.

Mike highlights a number of experts and analysts in the mining industry who have speculated that we are at or near peak gold.

One of the biggest problems for miners is the fact that most of the easy-to-reach gold has been dug out of the ground. The gold that remains is more difficult and expensive to mine. There has also been a significant decrease in the number of new gold deposits.

Mike concedes that the news isn't all negative. Some factors could increase production.

"Technology advances could help mining companies identify new deposits and reach the more difficult-to-mine gold. The rising gold price could also boost exploration activity, leading to new discoveries."

Mike concludes that whether or not we've reached peak gold is debatable.

"It’s clear that production has plateaued at least in the short term. Reversing the trend will require a significant industry focus on finding new deposits or developing methods to extract difficult-to-reach ore from the ground in a cost-effective manner. The fact that gold has risen to over $3,300 an ounce should help the mining industry, but it's like a big ship. It doesn’t turn quickly. So, I wouldn’t expect to see any big jumps in mine output in the next six months or anything."

Meanwhile, gold demand continues to increase, and despite the recent consolidation in the gold price, there is still plenty of bullishness out there.

"In fact, Bank of America is eyeballing $4,000 gold and $40 silver by the end of the year or early 2026."

Mike provides an overview of the reasons for BoA's bullishness and takes issue with one of the bank's analysts' takes on the silver market.

This leads to a call to action. Given the continued bullishness surrounding gold, the supply and demand dynamics, and the underlying problems in the economy (particularly the debt driven by central bank monetary malfeasance), it's still a good time to buy gold and silver before the next leg up.

"Now is the time to call 800-800-1865 and talk with a Money Metals' precious metals specialist."

Articles Mentioned in the Show

More By This Author:

Central Banks Added More Gold In April Despite Record PricesPeak Gold? Gold Mine Production Has Plateaued In Recent Years

Just How Bad Is Uncle Sam's Interest Problem?