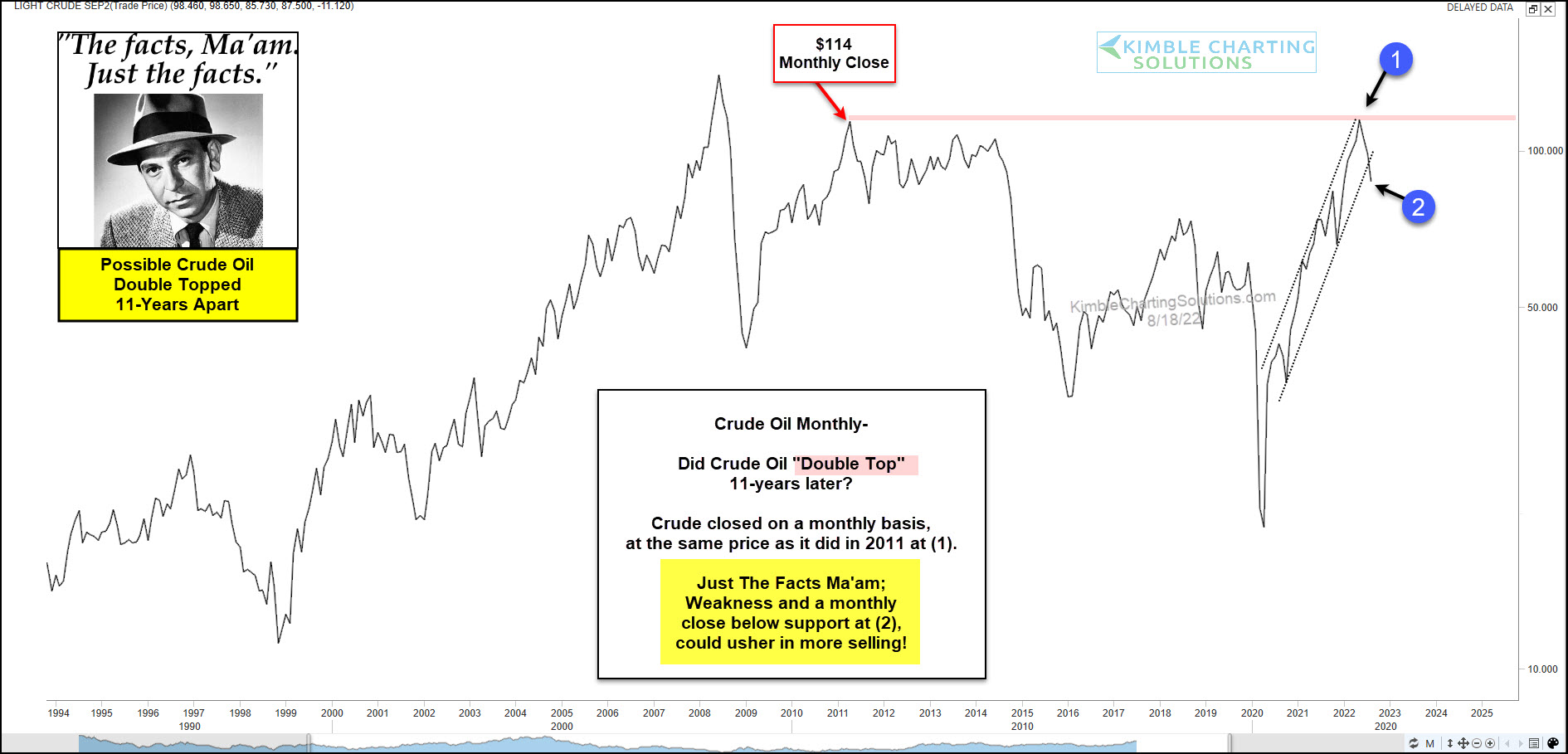

Are Crude Oil Prices Creating A Double Top Price Peak?

(Click on image to enlarge)

Consumers have taken notice of falling gas prices… and they like it.

But will gas prices continue to fall? For that to happen, consumers (and investors) will need to pay close attention to crude oil prices (which have been falling lately)… And they should be aware of a very bearish potential chart pattern…

Let’s turn to Joe Friday for “The facts, Ma’am. Just the Facts.”

Below is a long-term “monthly” line chart of crude oil that highlights the prospects of a potential double-top pattern at point (1). As you can see, crude oil closed on a monthly basis at the same price it did 11 years ago (red arrow and line). And now it is reversing lower.

This move lower has also taken the price of crude oil below its uptrend support line at (2). If it closes the month below this trend line, it would be concerning.

This brings an interesting (and important) question to light: Did the most important commodity on the planet double top 11 years later?

More By This Author:

Semiconductors ETF (SMH) Trading Near Fibonacci Inflection Point

Is the CRB Commodity Index Peaking And Reversing Lower?

U.S. Stock Market Set To Receive Key Message From Fibonacci Level

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.