AgMaster Report - Wednesday, Jan. 31

MAR BEAN

(Click on image to enlarge)

Apparently, enough is enough! After getting blistered on Monday due to Argentine rain & perceived Chinese economic weakness, Mar Beans have rallied interday 25 cents & are currently higher on the week in a classic TURN-AROUND TUESDAY! After dropping almost $2.50 off the 2023 summer highs, Beans are historically cheap! And the total S/A production is still in question in both Arg & Brazil! Ag Resource pegged the Brazil production at 145mmt! Red Sea shipping disruptions continue to threaten exports & China’s fresh stimulus plans could augment their grain imports! As well, grain seasonals are up in Feb! Finally, macros favor all mkts with coming IR cuts upping the DJI to a record!

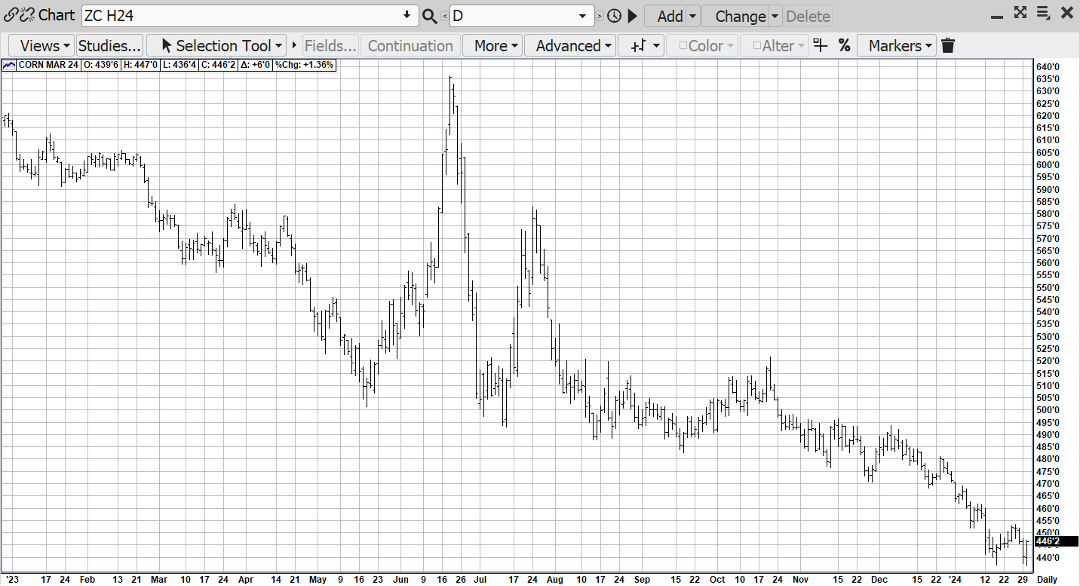

MAR CORN

(Click on image to enlarge)

Much like Mar Beans, Mar Corn is deriving strength from questionable S/A crops, recent economic stimuli in China & a positive Macro environment with the DJI on record highs over 38000 – primed by the likelihood of multiple IR cuts by the Fed this year! As well, US Corn is the cheapest anywhere – which should prompt an influx of much-needed exports this Spring finally, the big intangible is the record short OI in corn (over 260,000) which would be quite vulnerable to massive short covering on any kind of “bullish spark”! The above chart highlights the cheapness of Mar Corn – almost $2.00 off its Summer highs – just like the Mar Beans!

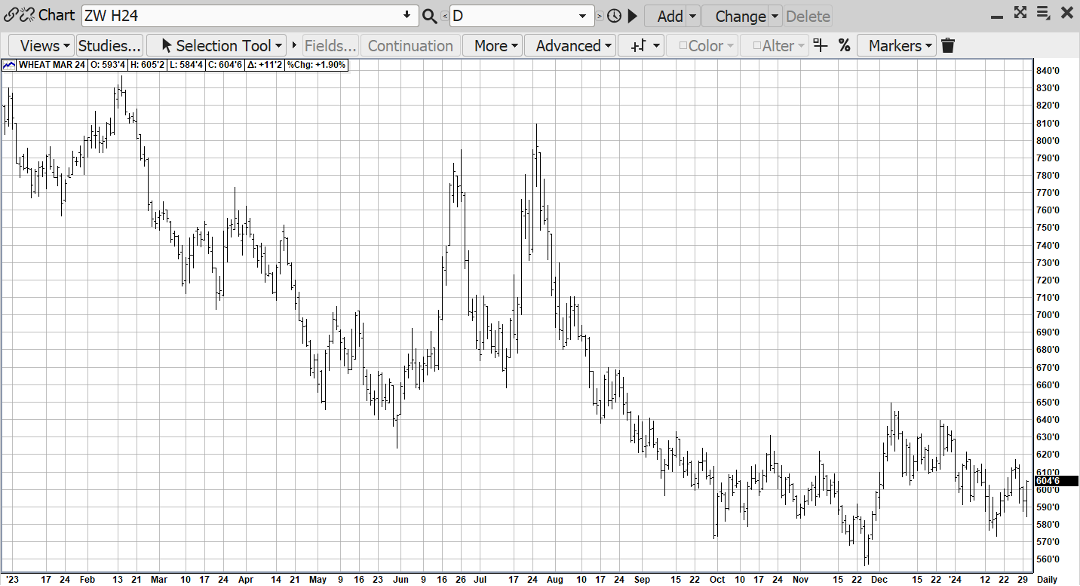

MAR WHT

(Click on image to enlarge)

Mar Wht also got pummeled on Monday due to “rains in the plain” which improved the Kansas good-to-excellent to 54% (43) – as well as from spill-over pressure from its sister mkts Corn & Beans! The Ruskies cheap wheat continues to keep a lid on US Wht with Mon’s inspections only 264,000! But todays Turn-Around-Tues has rallied wht as well – with hopes of better exports showing up soon!

FEB CAT

(Click on image to enlarge)

The last $5 of Feb Cats $16 up-move (163-179) was certainly energized by the Polar Vortex – causing more death loss & less weight gain – as well as improving exports & strong cash! But with the weather turning much milder, the mkt has stalled out – currently consolidating its gains – as it awaits the Annual Cattle Inventory Report due out Wed at 2pm! Better demand & less quarterly production favor a resumption of the up post-report!

FEB HOGS

(Click on image to enlarge)

Since the 1st trading day of 2024, Feb Hogs have been on a nice “bullish run”– fueled by strong cash & demand – and the ravages of the recent cold snap – which reduced average weights & production! The $11 rally (65-76) was especially impressive in light of China’s recent mass liquidation of it hog herd – but lately, their cash has been stronger – helping to fortify the US mkt! Demand looks to pick up into the Spring! As well, China’s recent economic stimuli may even bring them back into our export mkt!

More By This Author:

AgMaster Report - Wednesday, Jan. 17

AgMaster Report - Wednesday, Jan. 3

AgMaster Report - Thursday, Dec. 28