AgMaster Report - Wednesday, Dec. 11

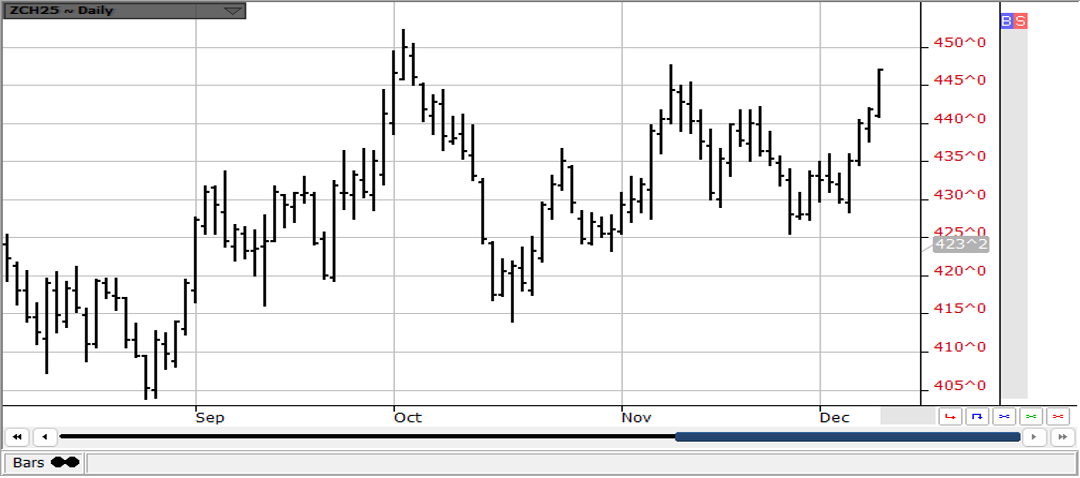

MAR CORN

(Click on image to enlarge)

The USDA issued its December WASDE report & carry-out was reduced 200 million bushel from November – due to robust export demand & ethanol usage! The mkt which had rallied in anticipation of a bullish report – furthered the gains by 5-6 cents -possibly challenging the 3-month high just over 450! Whereas the mkt has already rallied 40 cents from its harvest lows, its still just off 4 year-lows &relatively cheap! Should the S/A Crops not come in as big as expected, Corn Futures have solid rally potential – given the excellent foreign & domestic demand it has garnered!

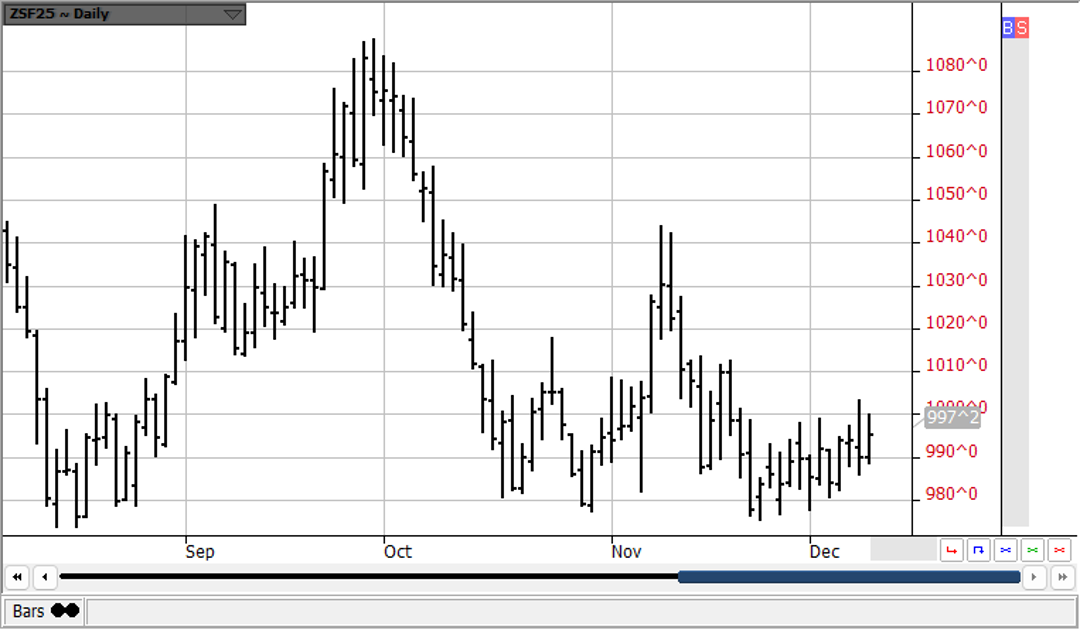

JAN BEANS

(Click on image to enlarge)

Jan Beans have been the “weak sister” at the CBOT due to the looming record crop from South America & the threat of Trump Tariffs once he is inaugurated! However, the “record S/A crop” has been bandied about for some time – has been pretty well priced in & may not be as big as predicted – depending on the climes down there between now & their harvest! Also, the tariffs may be just a bargaining chip Trump is using to pressure the border countries to tighten up their immigration policies! And with the mkt still hovering around 4 yr lows, there appears to be more upside than downside from current levels!

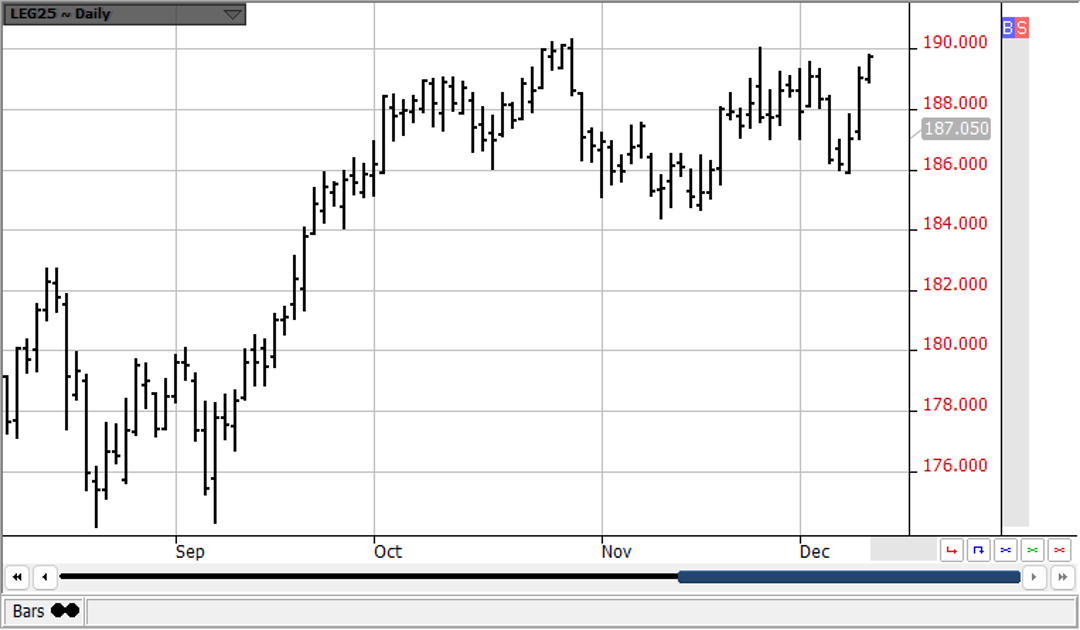

MAR WHT

(Click on image to enlarge)

Mar Wht has been the beneficiary of bullish news out of Russia – both stricter export quotas & lower production due to unfavorable weather! That coupled with bullish ending stock #’s for corn on today’s DEC WASDE have lifted the contract into positive territory today! Previously, the escalating Russia-Ukraine War had added war premium to Wheat prices but now, it looks like that conflict is winding down as soon as Trump is inaugurated – so that premium has dissipated! But we feel, exports will pick up the slack – as wht – just like corn & beans – is coming off 4 year lows!

FEB CAT

(Click on image to enlarge)

Feb Cat has been the beneficiary of several positive fundamentals as the contract prepares to challenge the contract highs just over 190! These include a robust 191 cash mkt, the US-Mexico border closure – precluding imports, improved exports, interest rate decreases & a commanding Trump win in November – which has rallied the DJI 3000 points & promises much-Improved beef demand in 2025!

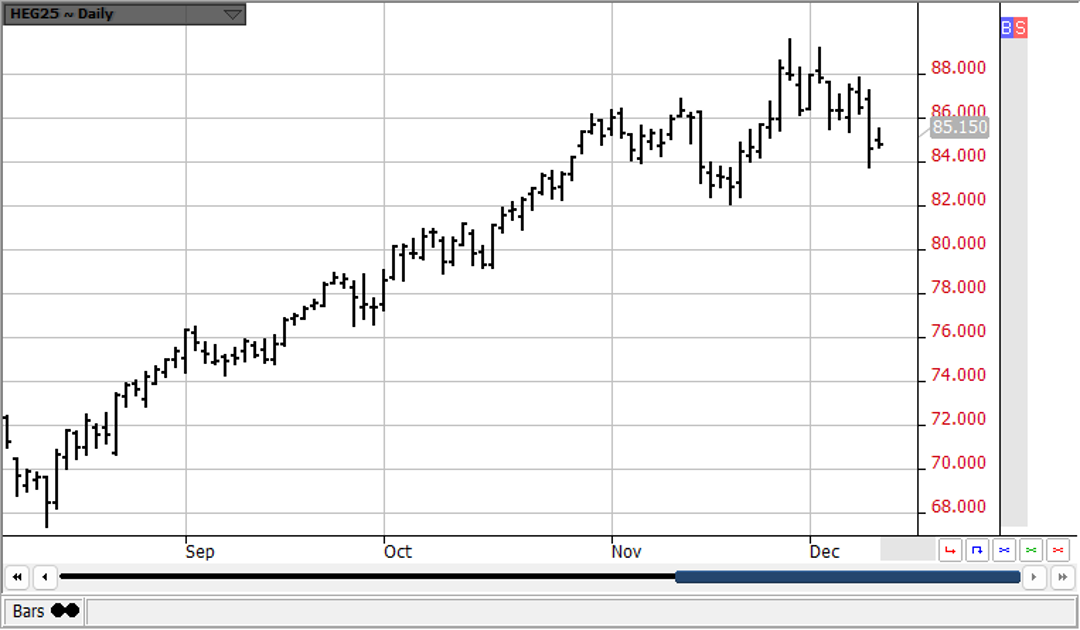

FEB HOGS

(Click on image to enlarge)

Feb Hogs were victimized yesterday by record open interest & record long funds which caused mass liquidation yesterday as futures dropped over $2.00! However, so far the prices are not following thru down today! Higher production & slaughter have also weighed on the mkt as of late! We feel demand will rescue this mkt from current levels as cattle strength, recent interest cuts, pork’s inherent price advantage & Trumps dominant win in Nov will all combine to push prices higher into 2025!

More By This Author:

AgMaster Report - Monday, Dec. 2

AgMaster Report - Tuesday, Nov. 19

AgMaster Report - Wednesday, Nov. 6