AgMaster Report - Thursday, July 4

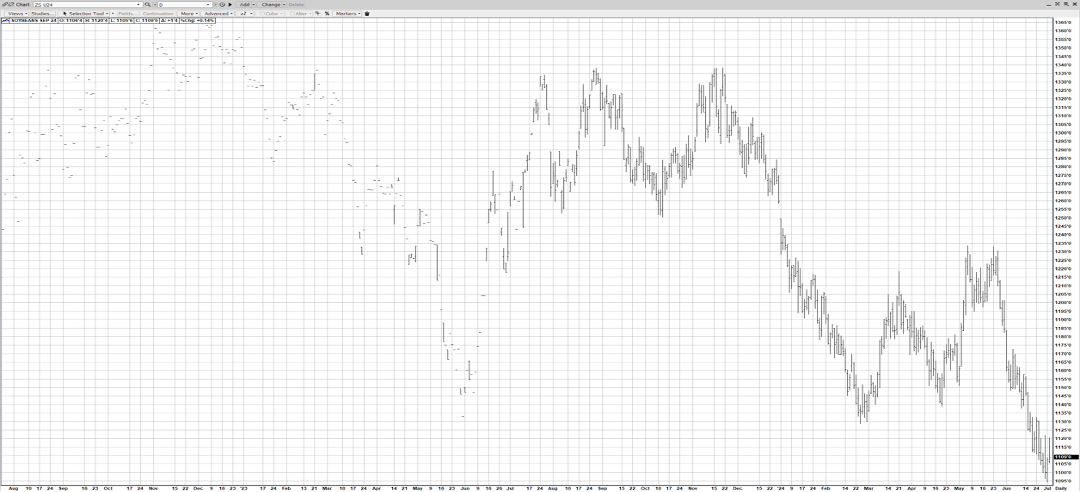

SEPT BEANS

(Click on image to enlarge)

The USDA Report issued last Friday at 11 am came in 700 acres under the estimate & only 2.5 MA over 2023! The Qtly Stocks were 970 mb (est – 957)! The mkt had already plummeted $1.35 since late May & was heavily oversold into the report! Crop ratings stayed at 67% gd-ex! Some pundits feel seasonal lows were scored already – with the mkt $2.50 off last season’s highs & a full growing season ahead in August! As well, global production is on the wane due to drought, frost & flooding & farmer-holding is the highest in 30 years! From current low levels, exports should increase!

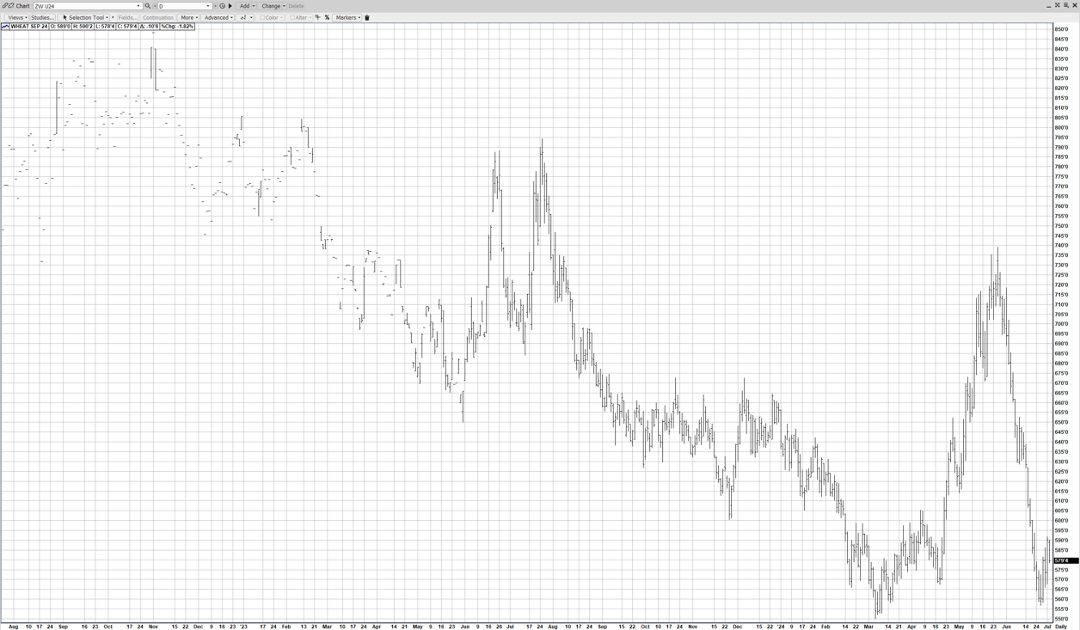

SEPT WHT

(Click on image to enlarge)

The USDA estimated the total wht acreage at 47.2 MA (est-47.5) – well under 2023’s 49.5 MA!Qtly Stks were 702 mb (est-682)! Exports have increased markedly in the past 2 2-3 weeks & with WW harvest at 54% done, the harvest pressure is waning! Sept Wht held its lows thru the USDA Report & had a strong close yesterday! Black Sea weather woes continue to afflict the Russian Wheat Crop – underpinning the contract on any breaks!

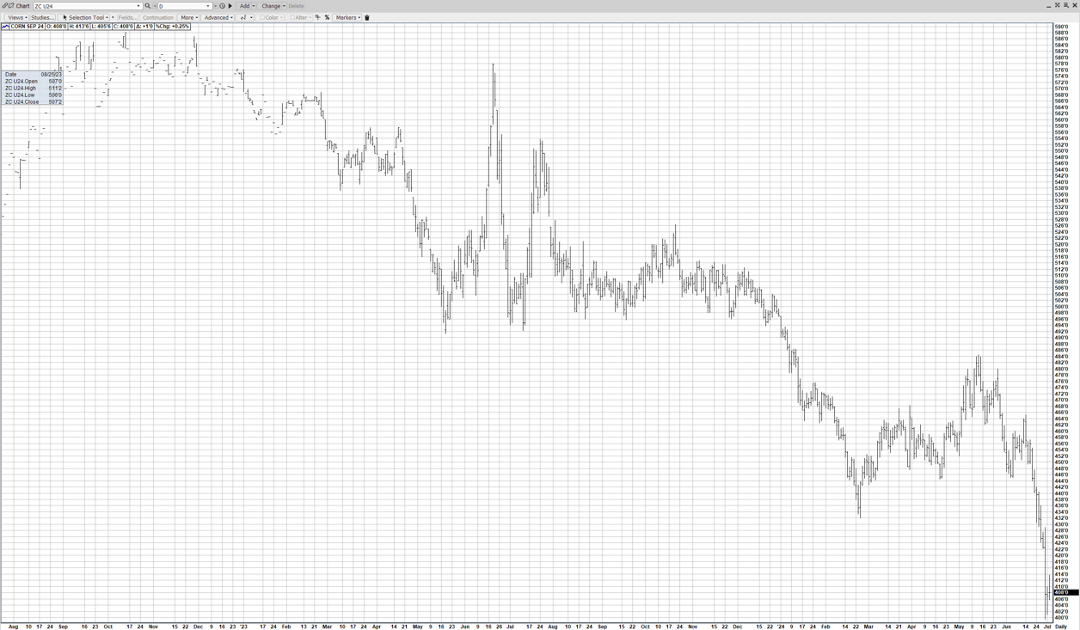

SEPT CORN

(Click on image to enlarge)

A bearish surprise from the USDA greeted corn producers & traders Friday morning as Corn Acres were projected at 91.4MA (exp-90.2) – albeit still 3.2MA under 2023! The mkt closed sharply lower Friday – as expected – but seems to have stabilized the last few days! There are several mitigating factors to weigh – the growing season is fully ahead of us, exports have been up 30% over last year, global production has been slipping – mostly due to drought issues in Brazil, Argentina, the Black Sea & Mexico! Farmers seem to be holding tight at these low prices – reducing available supplies to the mkt place! As we all know, corn is made in July – so record yield estimates may not hold up – & acres are down over 3 million over 2023 so big production is solely predicated on big yields!

AUG CAT

(Click on image to enlarge)

June Cat expired at record high levels late last week – creating an overbought situation – which the mkt has partially rectified this week with a $4.00 correction! But still the uptrend seems to be intact – with lower production, higher exports & exceptional demand! A strong cash mkt has led the way higher & we continue to see this pattern into the Labor Day Holiday W/E! The Grilling Season – beef’s best demand period of the year – continues to support the contract on breaks!

AUG HOGS

(Click on image to enlarge)

Aug hogs have been flirting with a low for several weeks now! Several $5 moves down then up – then down & up again – gives the appearance of a mkt trying to establish a low – with wild mkt swings – a telltale sign of a mkt pivot! A plus $20 plummet in a short time has created a wide disparity between pork & beef prices in the supermarket – not lost on consumers & is providing the genesis of the “mkt turn-around”! As well, exports have turned up in recent weeks!

More By This Author:

AgMaster Report - Tuesday, June 25

AgMaster Report - Tuesday, June 18

AgMaster Report - Wednesday, June 12