A Hedged Bet On Even Higher Natural Gas Prices

Eric Bakker/Port of Rotterdam

Zoltan Poszar's Predicted Commodities Disruptions

One of the points Credit Suisse strategist Zoltan Poszar made in his "Breton Woods III" note last month was that in the wake of the war in Ukraine and the Western sanctions on Russia in response to it, commodities markets were becoming disrupted. Russia is the nearest supplier of natural gas, oil, and other commodities to much of Europe, and to the extent that Europe eschews Russian supplies, Europe would have to get its supplies from further afield. Similarly, Russia would have to ship its oil further away (to Asia), and much of the infrastructure required to completely rearrange pre-war trading patterns simply don't exist yet.

That's slowly starting to change, as this week's news of a new liquified natural gas export terminal to be built in Louisiana suggests.

Natural-gas exporter Venture Global LNG said it would build a new liquefied natural-gas export facility in Louisiana, as demand for U.S. gas exports surges in Europe following Russia’s invasion of Ukraine https://t.co/Fd77E2iQ7s via @WSJ

— Charles Roth (@CharlesRoth1) May 25, 2022

But as ZeroHedge noted, European demand for American LNG is leading to convergence with European gas prices, which are significantly higher.

US NatGas Prices Top $9, Hit 2008 Highs As EU 'Convergence' Accelerates https://t.co/qWdTwcUqtM

— zerohedge (@zerohedge) May 25, 2022

The likely impact of that is natural gas prices in the U.S. going even higher.

A Leveraged Bet On U.S. Natural Gas

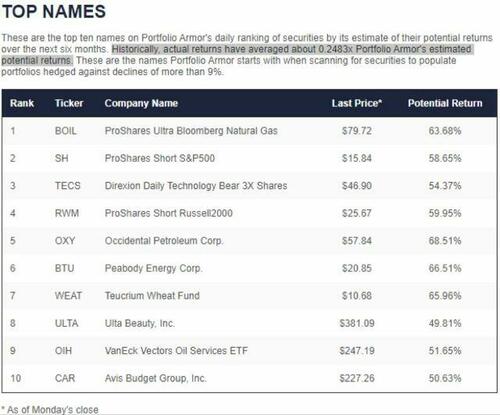

The ProShares Ultra Bloomberg Natural Gas ETF (BOIL), a 3x leveraged bet on American natural gas, has been a recent top name in our system, including on May 9th, as we mentioned in a recent post ("The Fed Is Not Your Friend").

The NY Fed wunderkind-turned-Credit Suisse strategist on why the Fed's helicopters are dropping "financial napalm" this time. $SH $WEAT $TECS $BOIL https://t.co/hKLjrgLKse

— Portfolio Armor (@PortfolioArmor) May 17, 2022

BOIL was part of a top ten names cohort that was heavy on commodities.

Screen capture via Portfolio Armor on 5/9/2022.

Since then, BOIL was up about 56% as of Wednesday's close.

A Hedged Bet On Natural Gas Prices Going Even Higher

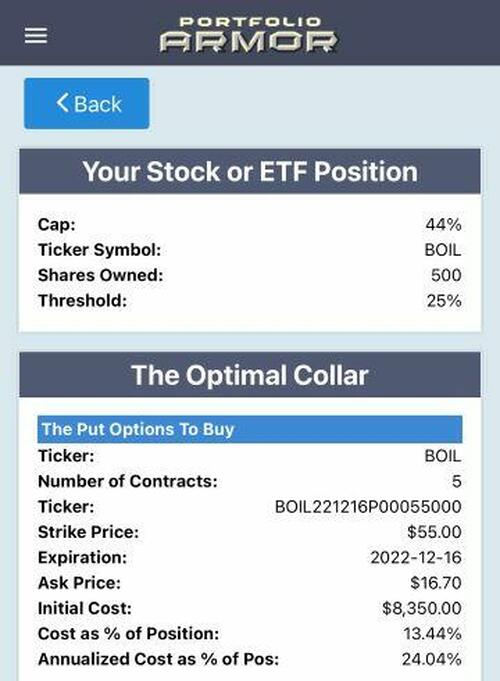

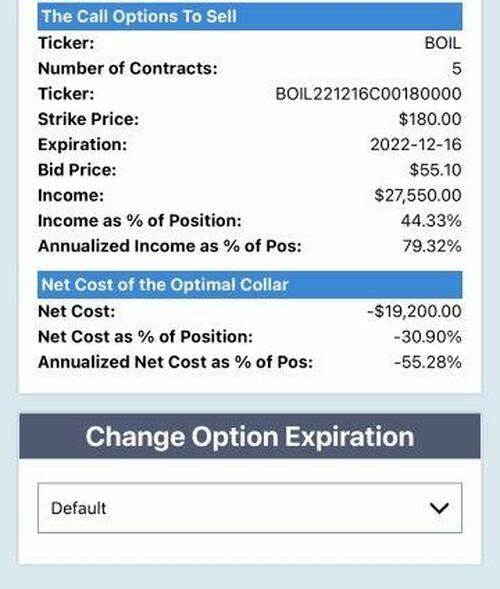

Triple-leveraged ETFs can be extremely volatile, but here's a way to use that volatility to your advantage. This was the optimal collar, as of Wednesday's close, to hedge 500 shares of BOIL against a greater-than-25% drop by mid-December, while not capping your possible upside at less than 44% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

Note that the net cost of this collar was negative, meaning you would have collected a net credit of $19,200, or nearly 31% of position value when opening it. So your maximum upside here would be a gain of nearly 75% by December (30.9% + the 44% upside cap), and your maximum drawdown would be a decline of 25%.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more