A Bullish Trend In Gold Driven By Financial Market Risks

Image Source: Pixabay

The financial markets are currently facing a multitude of challenges, including US bank failures, concerns about inflation, and a potential recession on the horizon. These factors have led to a strong bullish trend in the gold market, as investors seek a safe haven to protect their assets. This article presents the various factors contributing to the attractiveness of gold as an investment and the price outlook based on the price action analysis. Following the failure of Silicon Valley Bank, a chain reaction of US bank failures has introduced significant risk into the financial markets. This uncertainty has prompted investors to turn to gold as a safe haven asset. The demand for gold has surged, causing a bullish trend in the market. Gold has long been considered a reliable store of value during times of economic turmoil, offering protection from market volatility.

Strong Job Numbers and Inflation Concerns

The strong job numbers reported last Friday suggest a growing job market, which could lead to an increased likelihood of inflation. This may impact the Federal Reserve’s stance on interest rates, potentially causing them to maintain their current trajectory of rising rates in order to curb inflation. While higher interest rates can diminish the appeal of gold, the prevailing market instability and inflationary fears may still keep investors interested in this safe haven asset.

(Click on image to enlarge)

Total Nonfarm

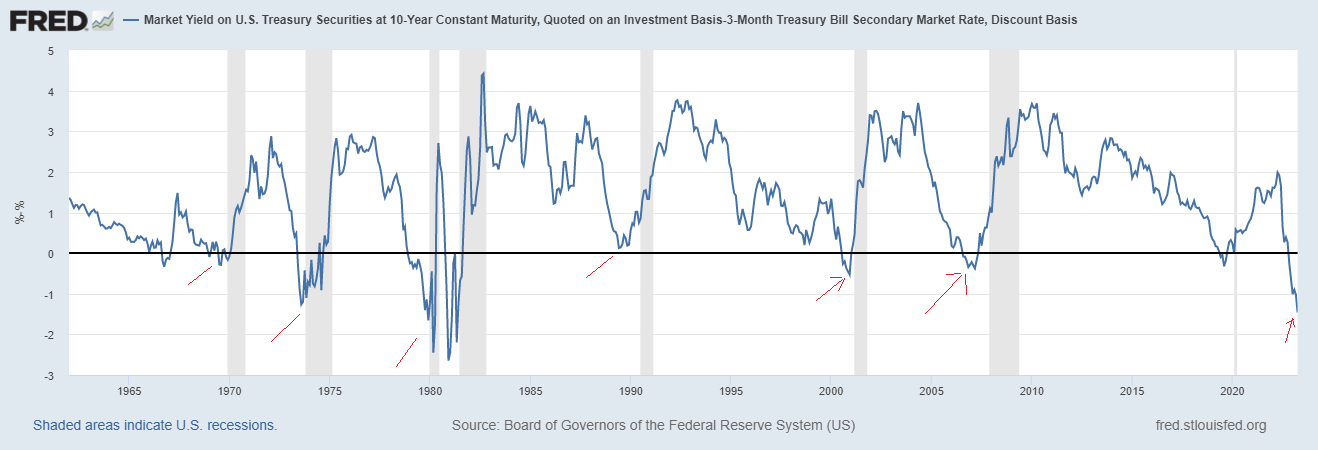

The inverted yield curve, a key indicator of economic health, has declined below zero and reached record levels. This development suggests that a recession may be imminent in 2023. Recessions typically boost demand for safe-haven assets like gold, as investors seek to preserve their wealth amidst economic downturns.

(Click on image to enlarge)

Treasury Yield Curve

The Buy Zones in Gold Market

The weekly chart illustrated below demonstrates a reversal at the resistance line during the last week, indicating that a short-term correction may be due in the market. However, this correction is perceived as a prime buying opportunity. The chart also highlights that the previous correction from the highs was substantial, but since the gold market established a new low below the inflection point of $1680, it is likely that the market will break through the $2075 region and experience further price increases.

(Click on image to enlarge)

Weekly Gold Chart

A closer look at the market’s correction can be observed in the daily chart presented below, which depicts a rising channel. The 1920-1950 region appears to be a crucial support level within the rising channel, making it a significant buying area for traders seeking exposure to the gold market.

(Click on image to enlarge)

Gold Daily Chart

Although the recent jobs report may exert short-term pressure on the gold market, the long-term outlook remains bullish. Any short-term market corrections are likely to be viewed as buying opportunities for investors, with the ongoing financial instability and looming recession continuing to drive interest in gold as a safe haven asset.

Bottom Line

In light of the current market conditions characterized by bank failures, inflation concerns, and the possibility of a 2023 recession, gold presents an attractive investment option for those seeking a safe haven. Despite any short-term pressures, the long-term outlook for gold remains positive. Investors may wish to consider the potential benefits of incorporating gold into their portfolios as a means to hedge against market volatility and safeguard their wealth in uncertain times. The recent correction in the gold market within the channel looks to be a buying opportunity.

More By This Author:

Silver: A Safe Haven Amidst Looming Recession

Gold Emerges A Strong Buying Opportunity

Microsoft Constructs Bullish Momentum

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more