Silver: A Safe Haven Amidst Looming Recession

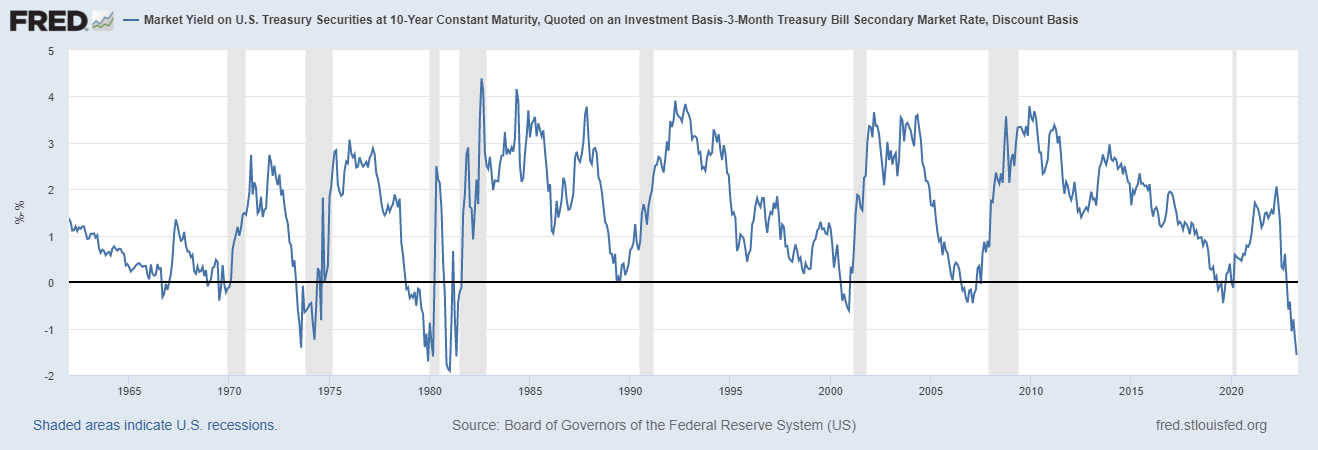

As the global economy teeters on the edge of a recession, savvy investors are turning their attention to the silver market in search of potential gains. Inflation has finally begun to abate after the Federal Reserve increased interest rates to 4.65%, a move that has led to an unprecedented inversion of the Treasury Yield curve below zero. This negative inversion, a phenomenon not seen in the past 40 years, serves as a stark warning that a recession is fast approaching. As illustrated in the chart below, the Treasury yield curve has historically picked up before each recession, further solidifying this hypothesis. Silver remains a safe haven amidst the looming recession.

(Click on image to enlarge)

Treasury yield curve

In addition to the worrisome Treasury Yield curve, the Conference Board Economic Index has dipped below -5%, sending further warning signals that a downturn is imminent. With these red flags in mind, investors are advised to capitalize on the current bullish silver market as a potential hedge against the looming recession. As silver has traditionally served as a safe haven during times of economic uncertainty, now may be the perfect opportunity to execute buy signals in the silver market and benefit from its recent rebound.

(Click on image to enlarge)

CB Economic Index

Analyzing Significant Levels in the Silver Market

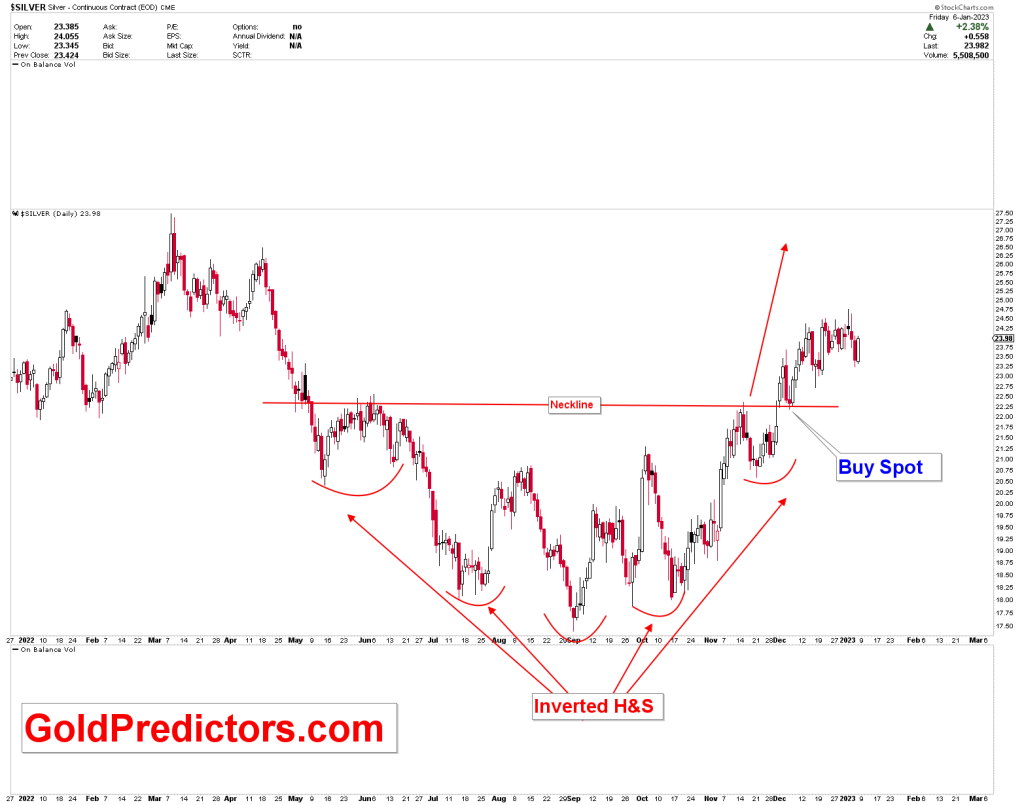

In a previous update on the silver market, we forecasted that silver prices would reach $26 based on the emergence of an inverted head and shoulders pattern. As illustrated in the chart below, an optimal entry point in the silver market was identified between $19 and $22. Investors who seized this opportunity saw prices surge toward the anticipated $26 mark. The inverted head and shoulders pattern, supported by a triple bottom observed on weekly charts, suggests a robust bullish formation and indicates that prices may continue to rise from the current level.

(Click on image to enlarge)

Daily Silver Chart

The weekly chart also displays a notable long-term bullish price pattern originating from the inverted head and shoulders formed during the Covid-19 recession. This historical pattern carries bullish implications for the silver market, with prices expected to trend higher. The upcoming 2023 recession could further propel this bullish run, potentially driving silver prices toward $50.

(Click on image to enlarge)

Silver Weekly Chart

Understanding Key Levels in the Silver Market

To gain insight into the key levels of the silver market, the chart below highlights the Fibonacci retracement levels derived from the 2022 bottom to the 2021 peak. The recent bounce from long-term support levels of $19-$20 broke through the 38.2% retracement mark. Any correction back to this level, approximately $23.20, will be interpreted as a strong buy signal for traders. As a result, market participants can capitalize on the next pullback to enter the silver market, anticipating the subsequent upward movement. In summary, the silver market has already established its footing and is poised to continue its ascent from current levels. In conclusion, silver continues to stand as a reliable and secure investment option, offering a sense of stability and protection in the face of the impending economic recession.

(Click on image to enlarge)

Silver Weekly Chart

More By This Author:

Gold Emerges A Strong Buying Opportunity

Microsoft Constructs Bullish Momentum

Gold: A Recession Warning

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more