China Is A Paper Tiger - It's Time To Fully Implement Globanomics

Mao Zedong first introduced his idea of “paper tigers” in an August 1946 interview with American journalist Anna Louise Strong, when discussing atomic bombs and the United States. Ten-years later In an interview with Strong, Mao used the phrase "paper tiger" again to describe American imperialism. He said, “In appearance, the U.S. is very powerful but in reality, it is nothing to be afraid of; it is a paper tiger. Outwardly a tiger, it is made of paper, unable to withstand the wind and the rain.”

Well, I think it is time to let you in on one of the best-kept secrets in the business world. China is a “Paper Tiger” when it comes to the world of business.

We are one country away from implementing Globanomics world-wide. And now that the United States is throwing its charlatan, America-first President out of office, it is time we subdue the tiger with the backing of our supportive and well-earned allies.

Now do not get me wrong. China is not necessarily a bad tiger. It just needs to be tamed a bit. Nothing is more important for the long-term betterment of the world where freedom, equality, and an individual’s right to pursue happiness should be a birthright guarantee.

Ah, Jim, what have you been smoking? China is hardly a paper tiger. Look at the data. China just recently surpassed the United States in terms of GDP and I do not think the United States will ever catch them again. How in the world could you say they are a paper tiger?

I say GDP does not mean jack as an isolated term. You need to consider the population, too. The Gross Purchasing Power (GPP) per capita of the United States is more than three times that of China’s GPP/capita. According to the latest CIA World Factbook, the GPP/capita of the United States is $59,500 compared to $16,700 for China, whose GPP/capita figure comes in just below that of the Dominican Republic. That essentially says that every individual in the United States has more than three times the purchasing power of an individual from China. The same holds true in perspective for the rest of the Free World, too.

Yes, but. . .

Let me stop you before you put your foot in your mouth.

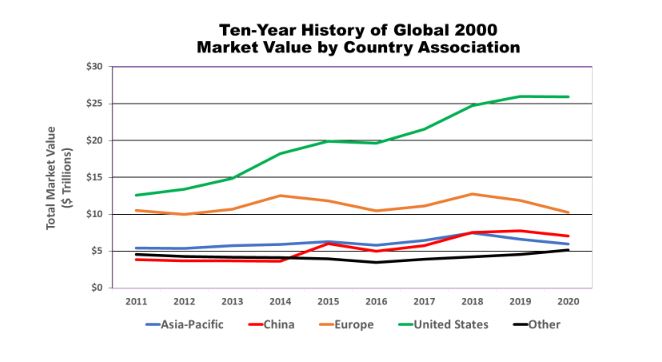

Have you looked at the statistics relating to the Global 2000 lately—the largest 2000 public companies traded in the world? I have and the statistics are telling. Let me show you what I discovered by looking at the last ten-year history of data based upon the companies identified in the Forbes Global 2000 from 2011 to 2020. The following graph shows you the total market value by year summed by a country’s association (e.g., France-Europe, Japan-Asia Pacific, Hong-Kong-China, etc.).

Whoa! You must be kidding me. First of all, I did not realize how much the United States dominated the marketplace in the world of business. Secondly, I see that China’s share of the business marketplace is growing, but I would have expected it to be much greater than what you are showing. I am even a little surprised that Europe’s market value is greater than that of China.

That’s good! I think you are beginning to understand the “paper tiger” symbolism a bit better. In fact, if you take Hong-Kong’s contribution away from China, the market value of China's Global 2000 businesses is almost the same as that of the combination of Japan, South Korea, Taiwan, and Australia. And those four countries have less than one-fifth the population of China.

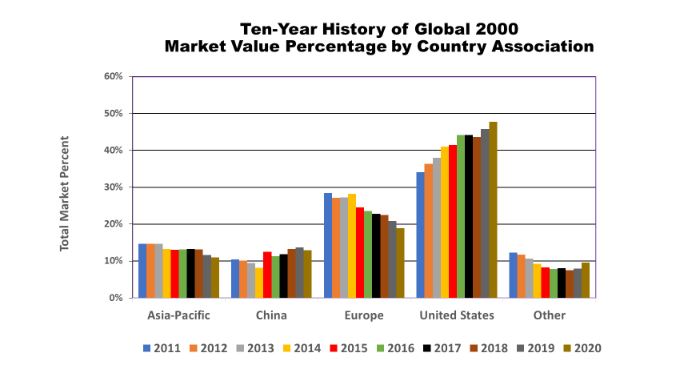

Now let me show you the above data from a different perspective with the following exhibit. Meow.

Now, what does the above graph tell you? It tells me a lot and I say now is the time for the United States to stand up and to take a leadership role in the implementation of Globanomics with the aid of its allies. As the above exhibit shows, the United States is a dominant force in the business world and the Free World together overwhelms China in terms of free enterprise.

And this same dominance holds true across every business sector (i.e., consumer discretionary, consumer staples, energy, financials, health care, industrials, information technology, materials, telecommunications, and utilities). But I will save that for my next Talkmarkets article.

But Jim, what about China's growing military presence and strength?

Don't even begin to take me there. You will only dig yourself into a bigger hole. Military strength, science, education, existing infrastructure--the Free World still dominates.

Anyway, there is no need for military strength in the way that you imply. Military war, cold or otherwise, is antitheoretical within Globanomics. In fact, as Globanomics professes, military war should be passe. Instead of military wars, the next world wars should be fought against world hunger, poverty, disease control, prejudicial hatred, and the misuse of global resources.

There is no better time than now to fully implement Globanomics. And now is the time for the Free World to invite China to join its Globanomic coalition. In that invitation, however, the Free World should demand two things from China so it can show its own commitment to Globanomics:

(1) free Hong Kong to its previous state (allowing China to keep it under its umbrella); and

(2) help the Free World denuke North Korea.

What we seek with Globanomics is a better, more loving future for all of Human Kind and Human Kind’s planet, Earth. It is still early in the new millennium, but it is not too early to start using Globanomics to lead the way.

Disclosure: No positions.

Agreed.