Business Cycle Indicators - Mid-October

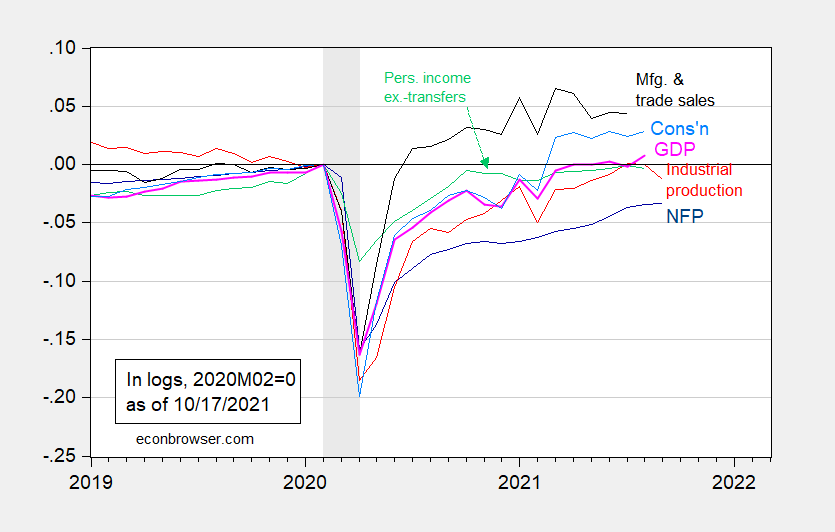

Here is a graph of some key indicators followed by the NBER Business Cycle Dating Committee, including industrial production, which missed expectations (actual -1.3% vs. +0.2% Bloomberg consensus, m/m not annualized):

Figure 1: Nonfarm payroll employment from August release (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/1/2021 release), NBER, and author’s calculations.

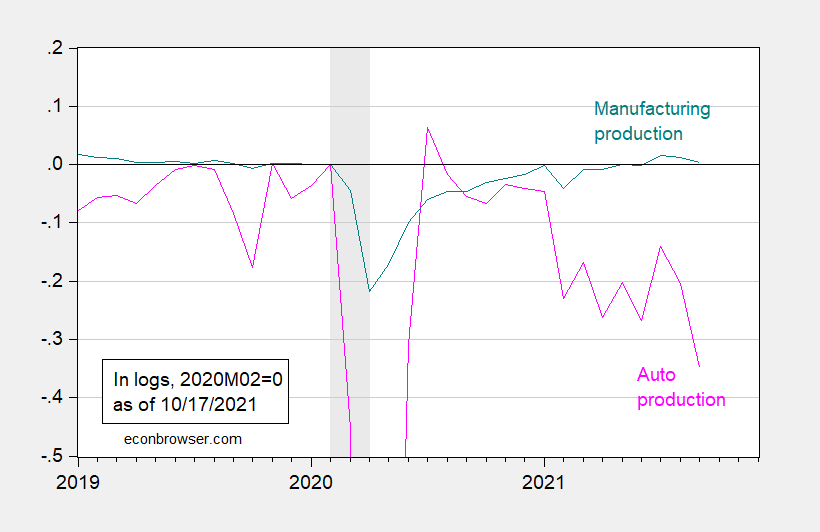

Industrial production was hit partly by the after-effects of Hurricane Ida, and also (in manufacturing) by the reductions in auto production.

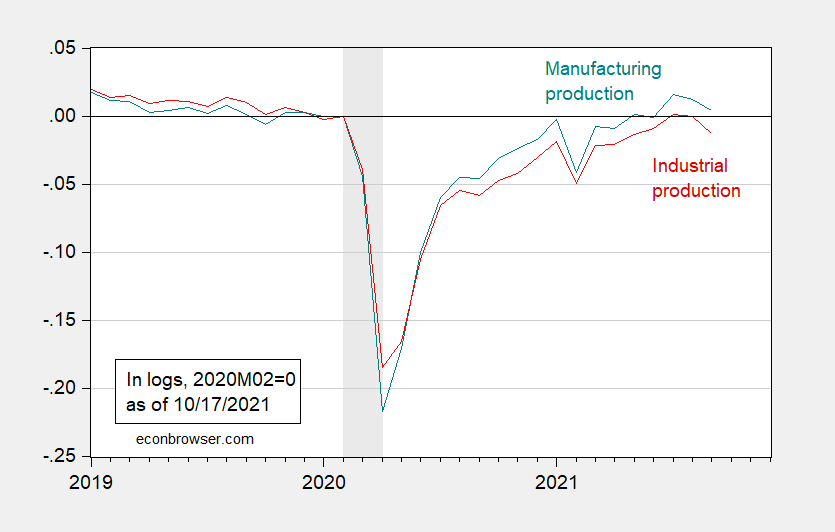

Figure 2: Industrial production (red), and manufacturing production (teal), both in logs, 2020M02=0. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

Manufacturing also missed expectations, at -0.7% vs. +0.1% m/m not annualized. That’s two consecutive months of declines for both industrial and manufacturing production.

Figure 3: Manufacturing production (teal), and auto and light duty vehicle production (pink), both in logs, 2020M02=0. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

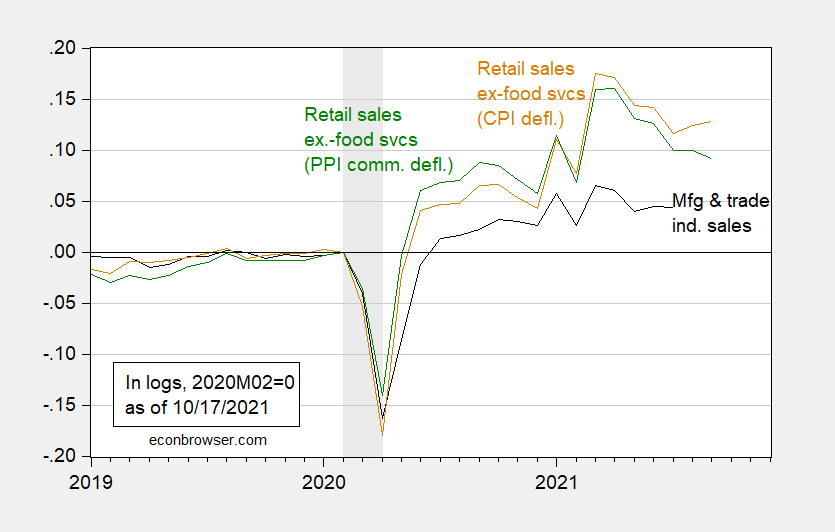

We are lagging on measures of real manufacturing and trade industry sales (last observation is July). It might be tempting to infer August numbers from some related series, e.g., retail sales ex.-food services.

Figure 4: Manufacturing and trade industries sales (black), retail sales ex.-food deflated by CPI-all (tan), deflated by PPI-finished goods (green), all in logs, 2020M02=0. NBER defined recession dates shaded gray. Source: BEA, BLS via FRED, NBER, and author’s calculations.

Clearly, the linkage between manufacturing and trade sales and retail sales is loose, so it’s not clear what one can say about the former series.

Summing up, the recovery has clearly slowed down in September.

Disclosure: None.