Business Cycle Indicators – Industrial, Manufacturing Production, Retail Sales

Image Source: Pexels

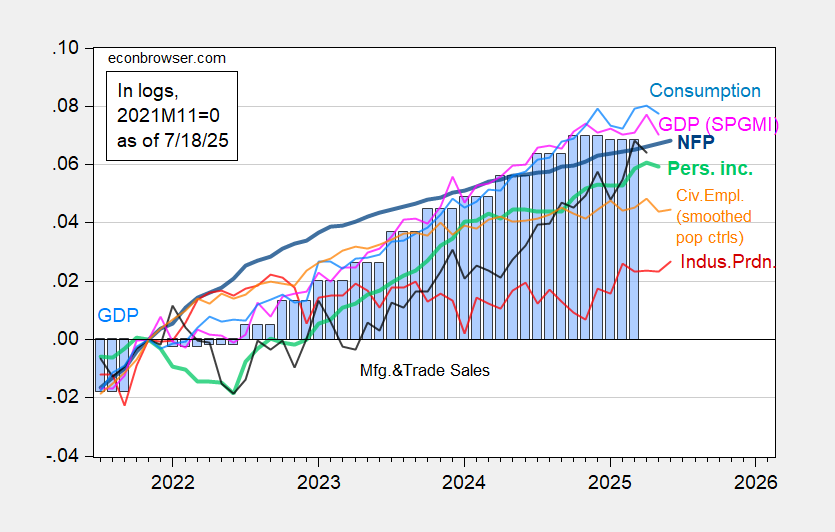

Up for all three, although production essentially flat since February, and real retail sales down since March. Indicators followed by the NBER’s BCDC in Figure 1:

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), civilian employment using smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/2/2025 release), and author’s calculations.

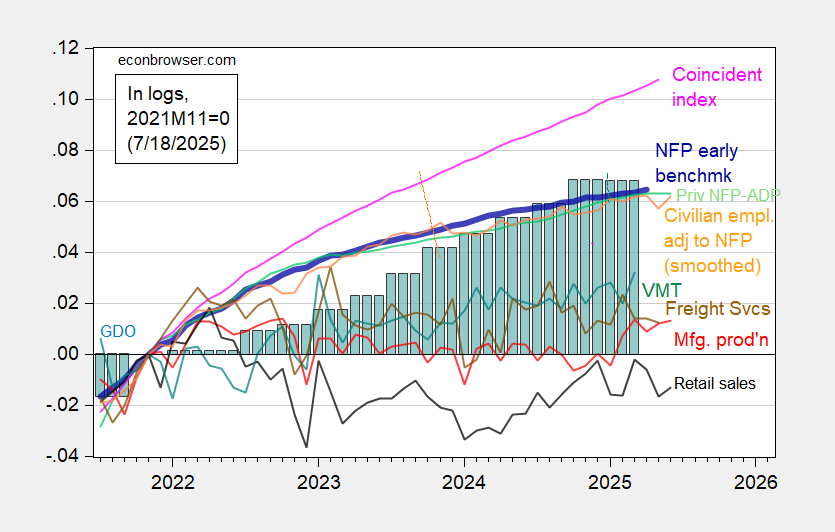

Alternative business cycle indicators:

Figure 2: Preliminary Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, with smoothed population controls (orange), manufacturing production (red), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2025Q1 third release, and author’s calculations.

More By This Author:

WSJ July Survey: 2025 Q4/Q4 Growth At 1%Policy Uncertainty *Before* 30% Tariffs On EU, Mexico … And Rosie O’Donnell

Dispersion In GDP Nowcasts