BTC/USD Forecast: Bitcoin Continues To Attempt To Build Upward Momentum

Image Source: Unsplash

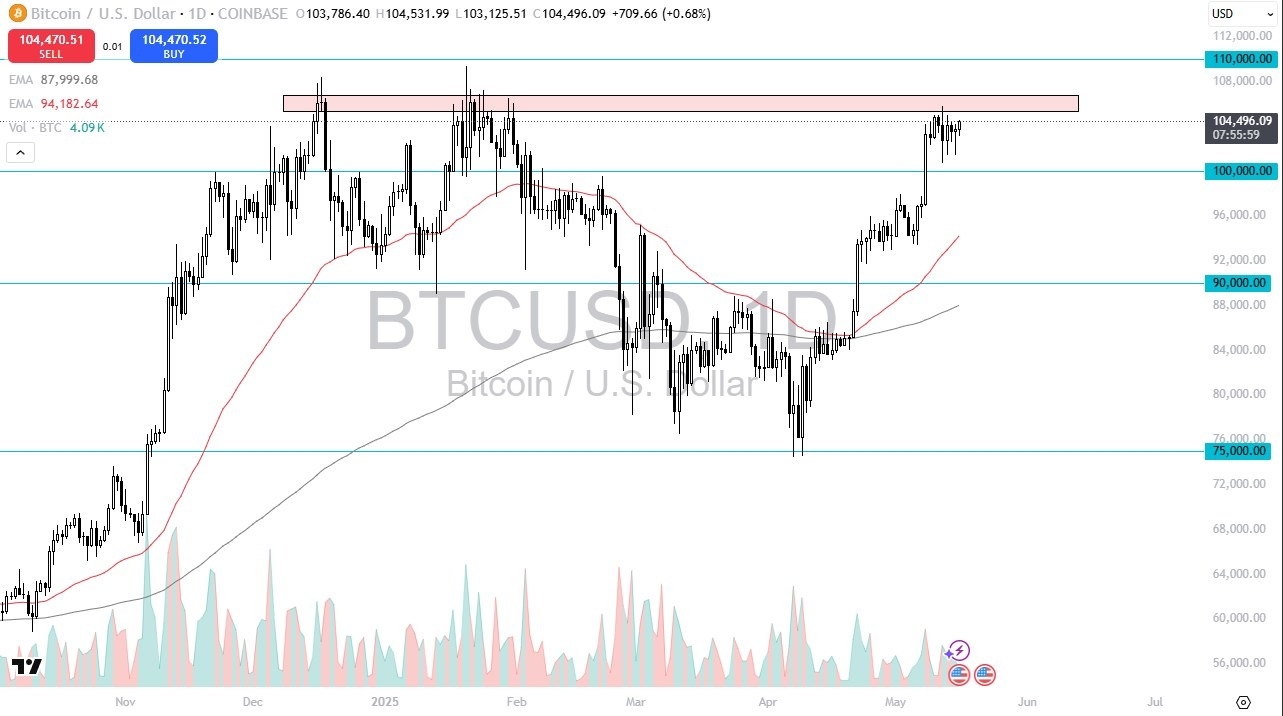

- Bitcoin has shown itself to be somewhat positive in the early hours of Friday as market participants continue to look at the $106,000 level as a bit of a barrier.

- With that being the case, the market is likely to be noisy, but I do think it is probably only a matter of time before we break above the $106,000 level.

- If and when we do, then I'm looking for this market to go looking to the $110,000 level.

This of course would be a very bullish turn of events, and the $110,000 level is a place that is extraordinarily difficult to get above based on the double top that we had formed back at the beginning of the year, but if we can and I think eventually we probably try to Bitcoin will then enter the next leg higher and at that point in time we could be looking at a move to the $135,000 level before it's all said and done, based on a measured move of the pullback and extension that doesn't mean that we get there quickly nor does it mean that we have to be a grind higher either. You just don't know how that plays out.

(Click on image to enlarge)

The Target?

You know where the measure of move suggests we should go but the timeframe you just don't have any way to calculate short term pullbacks at this point in time continue to attract buyers and it looks like the $100,000 level remains a significant support level and the fact that we are not really pulling back significantly does suggest that traders will continue to look at these dips as value breaking below $100,000 opens up the 50 day EMA as a potential support level but there's nothing in the price action that suggests this is a real threat.

More By This Author:

Pairs In Focus - Sunday, May 18

Natural Gas Weekly Forecast: Natural Gas Falls On Friday

GBP/USD Forecast: Struggles At Resistance

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more