Pairs In Focus - Sunday, May 18

Image Source: Unsplash

DAX

(Click on image to enlarge)

The German index initially tried to take off to the upside on Monday, as it gapped higher, but it then turned around and filled the gap. That being said, the EUR23,500 mark looks like a significant support level as the index has previously bounced rather nicely from that point.

The market has recently broken above significant resistance, and it’s likely that the space will continue to see buyers on each and every dip. I suspect at this point that the DAX could go looking towards the EUR25,000 level above.

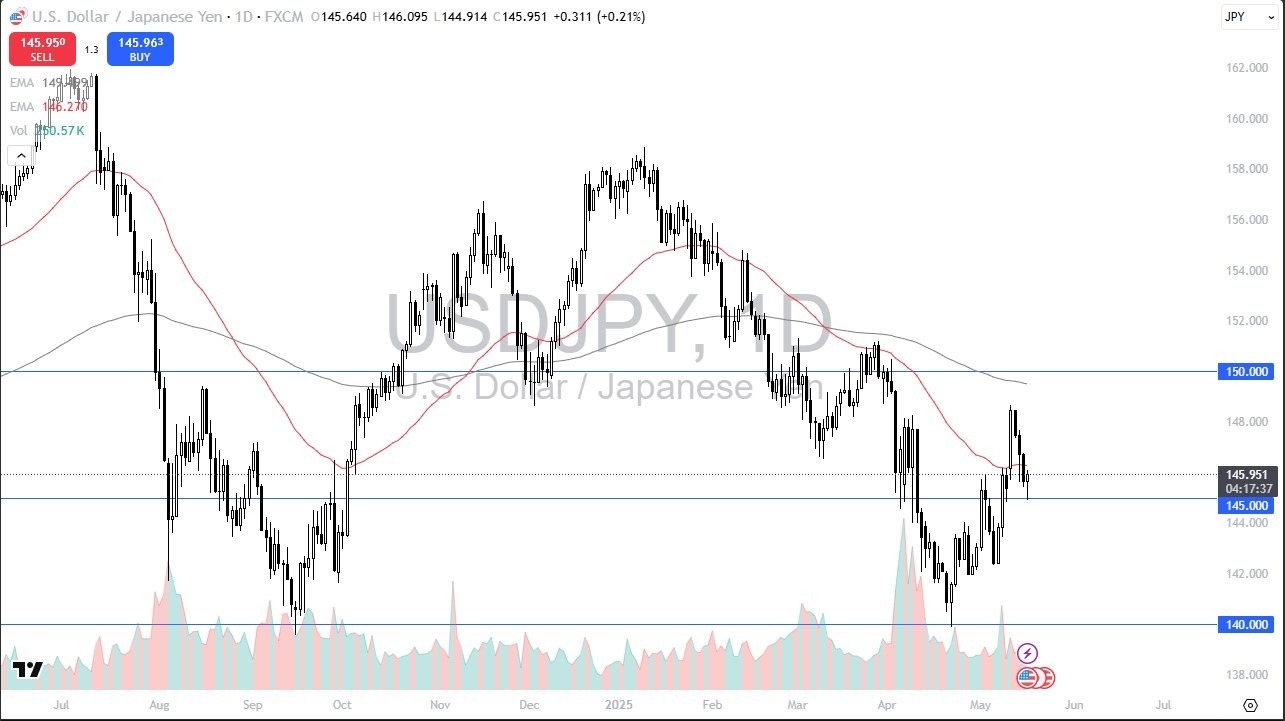

USD/JPY

(Click on image to enlarge)

The US dollar initially fell during the week against the Japanese yen, but the JPY145 level eventually offered support.

This is a market that will likely continue to see a lot of volatility. However, there are a lot of buyers underneath that could continue to come into the space and choose the US dollar due to the interest rate differential, as the Bank of Japan has no real chance of tightening anytime soon. Meanwhile, bonds have been selling off in the United States, driving yields higher.

Gold

(Click on image to enlarge)

Gold experienced a tough week, but it looks set to close just below the crucial $3200 level. That level is a large, round, psychologically significant figure, and an area that many will be paying close attention to.

After all, it has previously served as support and resistance multiple times, and we are in the middle of a massive rally overall. With this being the case, I suspect that if the price can recapture the $3200 level, then it would be possible to see the yellow metal start reaching upward yet again.

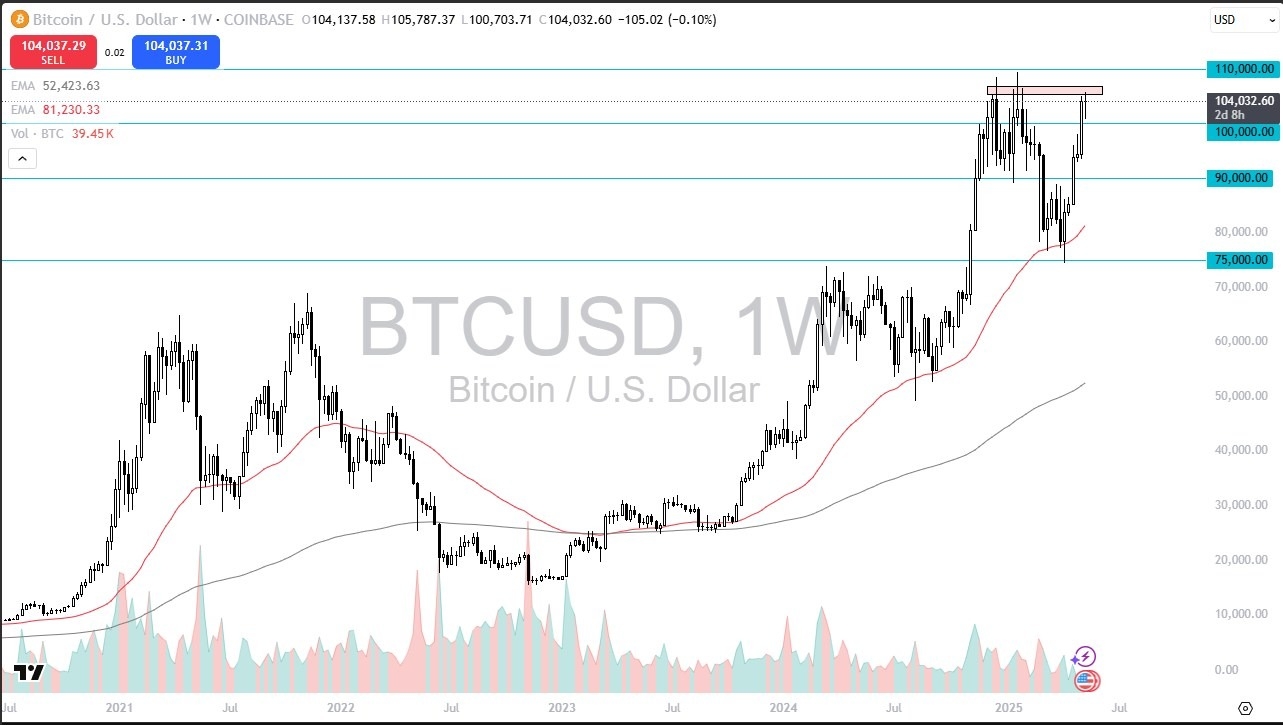

Bitcoin

(Click on image to enlarge)

Bitcoin witnessed a pretty choppy week, but it ultimately ended up settling on a fairly unchanged turn of events. This is a market that will likely continue to find buyers on dips, and therefore I suspect it is probably only a matter of time before we see it break out above the crucial $106,000 level, perhaps with the potential to break above the $110,000 level.

The $100,000 level underneath is likely to be massive support, as Bitcoin has continued to perform fairly well. At this point, it needs to digest some of the massive gains it's seen.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 exploded to the upside yet again, as buyers continued to flood into the marketplace. The 21,000 level will likely end up being support, right along with the 20,000 level.

Any short-term pullbacks to occur in this space could serve as buying opportunities as the index continues to reach toward the 22,000 level above, which was a major all-time high. This climb would be the goal of many bullish traders out there, and with this kind of momentum lately, it’s hard to argue that they won’t be able to do it.

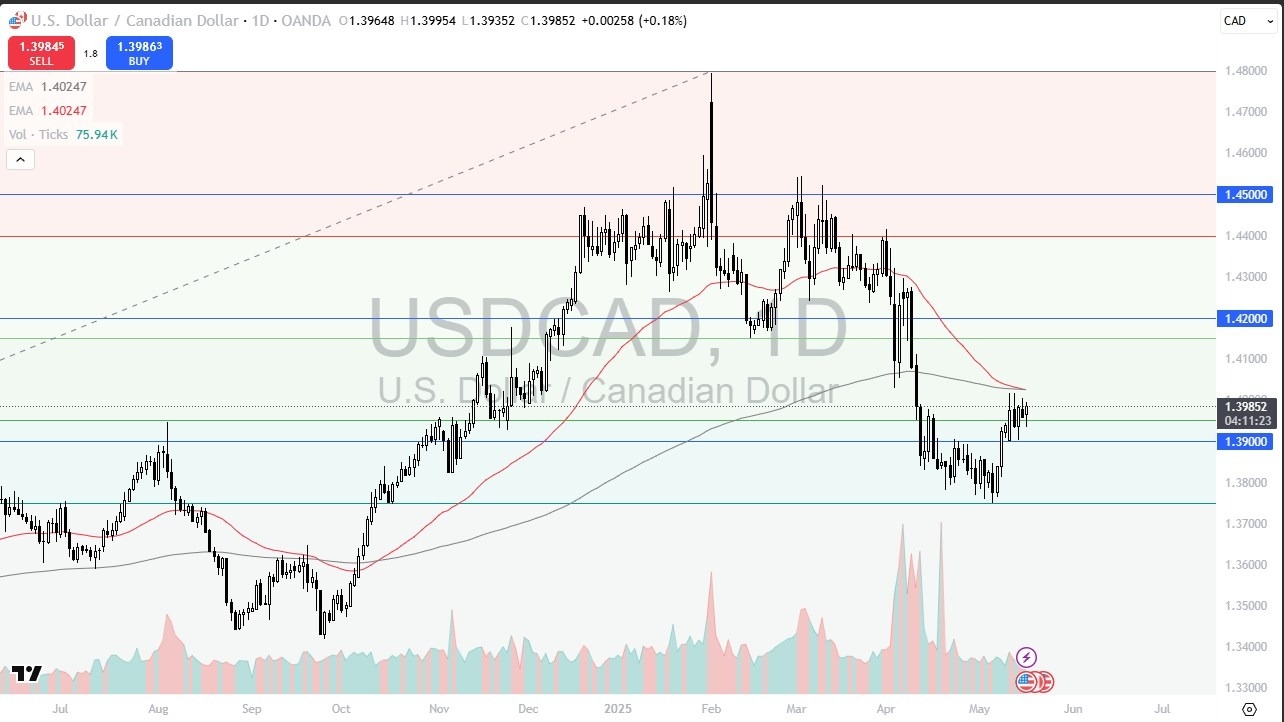

USD/CAD

(Click on image to enlarge)

The US dollar initially pulled back against the Canadian dollar during the week, before it then turned around to show signs of support.

The market has continued to see a lot of upward momentum, and at this point in time the US dollar has continued to strengthen against many other currencies. Therefore, the Canadian dollar probably won’t be any different, especially as the United States and Canada still do not have a trade deal worked out. Ultimately, short-term pullbacks and a break above the 200-week EMA would both represent more momentum going to the upside.

GBP/USD

(Click on image to enlarge)

The British pound moved all over the place during the week, before essentially settling for a neutral candlestick. That being said, we have seen 3 shooting stars in a row on the weekly chart at the 1.34 level, which is an area that has previously offered significant resistance. Because of this, I’m still looking to the downside, and I think short-term rallies could open up the opportunity to sell the British pound.

If it can break above the 1.35 level, then that would be a major breakout that could spark a move much higher. In that scenario, I would anticipate that the US dollar would probably be struggling against most currencies, not just the British pound.

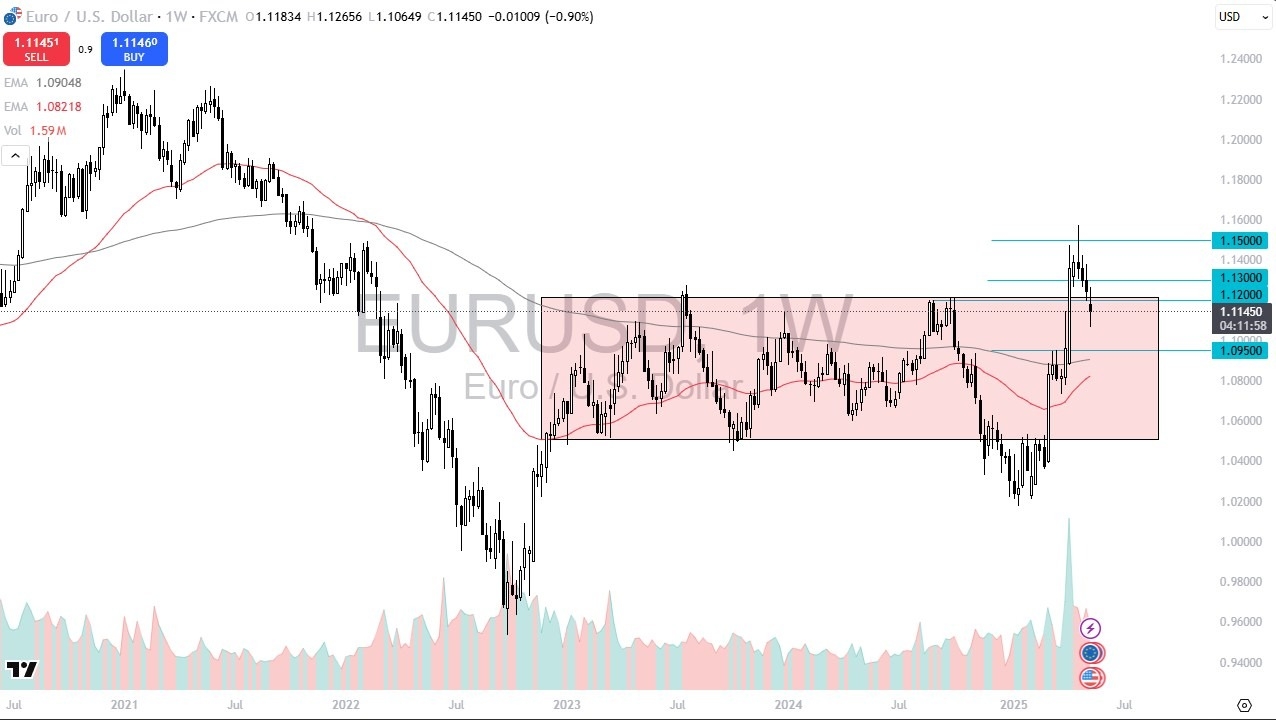

EUR/USD

(Click on image to enlarge)

The euro was very negative during the week, as it gapped lower, filled that gap, and then plunged once again before it bounced. It ended up selling off quite nicely, and it looks as though the euro could continue to go lower.

The euro reentered the previous consolidation area, with the 1.12 level offering a bit of resistance during the previous couple of years, and now that we have seen it jump back into that rectangle, I think it could start dropping to the 1.0950 level. A break above the 1.13 level would open up the possibility of a retest of the 1.15 handle.

More By This Author:

Natural Gas Weekly Forecast: Natural Gas Falls On FridayGBP/USD Forecast: Struggles At Resistance

BTC/USD Forecast: Bitcoin Holds Above $100K

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more