Which Matters More: The Inversion, Or The Ebbing Of The Inversion?

Like many of you, I have been somewhat obsessed with the ongoing 2-10 inversion. For those of you who are not familiar with that term, it refers to the situation we’ve been seeing where 2-year yields exceed 10-year yields. It is relatively unusual for that situation to occur, and it typically precedes recessions, hence many investors’ preoccupation with this market oddity. It is not an idle concern, especially because recent move movements may indicate further trouble to come.

It is typical for longer-term rates to exceed shorter-term rates. The economic term for that is called liquidity preference. In general, people prefer owning shorter-term fixed income assets to longer-term counterparts. Remember, a key factor in bond investing is whether you will receive all your promised payments in a timely manner. The longer the time to maturity, the higher the potential likelihood that something can go wrong to disrupt the present value of those payments. As a result, bond investors are usually willing to pay more for shorter-term notes, and of course, higher bond prices result in lower yields.

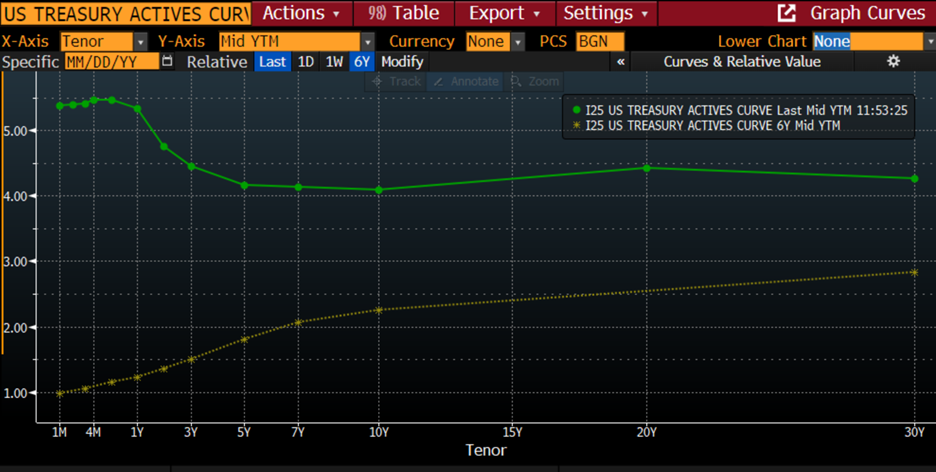

When one plots out all the various yields and maturities of government debt, it is called the yield curve. The yield curve is normally upward sloping at we read from right to left. Note the differences in the graph below, where the yellow line (the yield curve from 6 years ago today) has a normal upward slope, while the green line (today’s curve) has a downward slope from 6 months to 10 years, with 10-year yields about 70 basis points below 2-year yields:

US Treasury Yield Curves, Today (green), 6 Years Ago (yellow)

(Click on image to enlarge)

Source: Bloomberg

You should also notice that the current curve sits completely above its older counterpart. That shows how much higher current rates are than levels to which we had become accustomed.

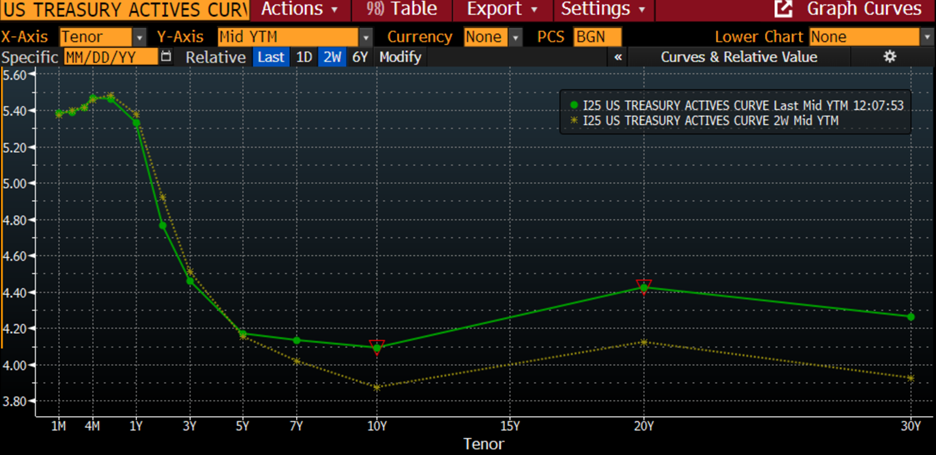

When we compare today’s curve with that of just two weeks ago, we see how much longer-term rates have moved, even as short-term rates are relatively unchanged:

US Treasury Yield Curves, Today (green), 2 Weeks Ago (yellow)

(Click on image to enlarge)

Source: Bloomberg

The inversion has shrunk from lows of about -1%, a level not seen since the early 1980’s to the current -0.7% almost strictly because longer-term rates rose. The bond market term is “bear steepener”, meaning the curve has steepened (or in this case, less inverted) because of rising rates at the long end rather than the short end.

In theory, this should be a welcome development. If steep inversions usually portend recession, then shallower inversions should indicate that recession fears are abating. We have seen several analysts at major banks pare back their probabilities of recession, which fits that rubric.

Except, history shows that shrinking inversions occur before the onset of recessions. In the graph below, we show the 2-10 spread on a monthly basis over the past 30 years. The onset of recessions are marked with vertical red lines and the ends are marked with vertical green lines. We used the National Bureau of Economic Research’s (NBER) definition for the timing of recessions.

2-Year / 10-Year Yield Spread, 30-Year Monthly Data, with Red/Green lines at the Beginning/End of NBER-defined Recessions, and 0% level highlighted (yellow)

(Click on image to enlarge)

Source: Bloomberg

When we look at the above chart, we see that recessions began after the 2-10 inversion had resolved. At present, we are far from seeing the yield curve return to its normal shape. But if we believe that 2-10 inversions are an excellent early warning system for recessions, a return to normalcy for the yield curve may actually be the more important recession signal.

More By This Author:

It’s Better When Growth Stocks, Um, Grow…

Options Market Expectations For Apple, Amazon, And Payrolls

Beware The Ides Of August?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more