It’s Better When Growth Stocks, Um, Grow…

Image Source: Pixabay

This morning held the possibility to bring a major market event. Earnings from Apple (AAPL) and Amazon (AMZN) after yesterday’s close and the release of July Payrolls data before the open all had the potential to move markets dramatically. As it turns out, AMZN’s post-earnings rise and AAPL’s decline largely balance out, while the payrolls report had a mix of positives and negatives.

In theory, this should make for a quiet summer Friday. Certainly, there are no major fireworks, at least by midday, but there are several storylines that should continue to be played out over the course of the coming weeks.

AAPL is the latest in a line of high-flying companies that reported EPS above analyst consensus but nonetheless sank after its earnings report. AMZN, on the other hand, reacted similar to Meta Platforms (META) when it jumped last week after beating on a wide range of metrics. We noted yesterday:

There is a reasonable likelihood that the market could react similarly to MSFT, TSLA, NFLX, etc., where EPS beat estimates, but traders focused on other items. Handset sales for AAPL and cloud computing for AMZN are but two possibilities.

In the case of AAPL, it wasn’t just handset sales – it was sales overall. Last quarter was the third straight when its revenues fell. Worse yet, they guided that next quarter could bring something similar. While it is possible to grow earnings even if sales fall in a given quarter, that is not a feat that can be repeated indefinitely. Coming into earnings, we showed that AAPL’s P/E was 32.6 and its estimated P/E was 32.06. That implied very modest expectations for earnings growth over the coming year. Yet its PEG ratio was 2.47. Taken as a whole, the market was willing to pay a significant premium for a company with solid earnings and cash flows, but not a lot of immediate growth. Even after today’s 3% selloff, those numbers have only shrunk modestly.

Contrast that with AMZN. Sales rose and margins improved in both its retail and cloud computing (AWS) businesses. We showed that AMZN’s price was already incorporating the potential for serious growth, with a trailing P/E of 138.43 and an estimated P/E of 80.86. After today’s 10% bounce, those numbers have improved to 97.97 and 75.23. It is likely that the estimated P/E will improve further as analysts upgrade their earnings expectations for the coming quarters. AMZN had a high hurdle to clear and was rewarded for doing so.

When we look back at the results for earnings season so far, we see the usual majority of companies beating EPS expectations. Quite frankly, that’s not news. It is typical for that to occur, and I’ve frequently posited that US CEOs are as skillful at managing their analysts’ expectations as they are their businesses. It is quite possible that investors have begun to recognize that simply beating a consensus estimate is no longer sufficient – especially when investors are paying premia for growth that can be hard to come by.

Moving on to the July Payrolls report, there was something for everyone to either like or dislike. The headline Nonfarm Payrolls report showed job gains of 187,000, which was below the 200,000 median estimate of economists. We also saw a -49,000 cumulative adjustment to the prior two months’ reports. For those who see a cooling but not catastrophic labor market as a precursor to both a more accommodative Federal Reserve and a soft landing for the economy, this was welcome news.

But other data painted a more difficult picture. The unemployment rate fell to 3.5% when it was expected to be unchanged from last month’s 3.6%. It was not the result of people leaving the labor force since the participation rate remained at 62.6%. Meanwhile, average hourly earnings rose 0.4% on a month-over-month basis. That matched last month’s 0.4% and was above the 0.3% estimate. On an annualized basis, that is a hefty 4.8%. Many economists prefer to annualize the last three months' data, which instead annualizes to 4.4%, which is indeed the year-over-year change.

In other words, wage inflation is not improving. That’s fine for workers, but not for a central bank that is committed to fighting inflation. The bump in wages may not prove to be enough to justify a Fed rate hike, but there is also no reason for them to change their rhetoric about the potential for higher rates, nor is there a reason for them to back off their program of quantitative tightening.

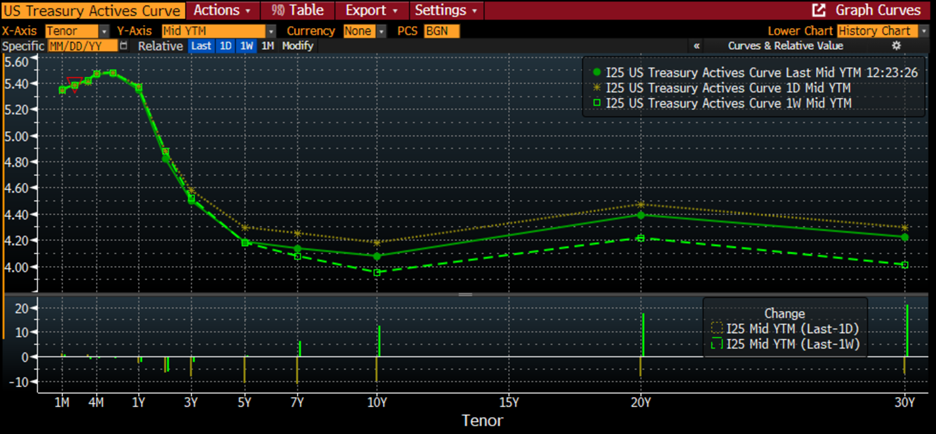

Taken together, the bond market reacted positively to the labor reports. Yields are lower across the curve. Yet they are simply off yesterday’s highs and not back to last week’s levels. We have a relief rally in stocks and bonds, but as of midday, we have not come close to recouping this week’s damage.

US Treasury Yield Curve, Today (green line, middle), Yesterday (orange, top), Last Week (green dashes, bottom)

(Click on image to enlarge)

Source: Bloomberg

More By This Author:

Options Market Expectations For Apple, Amazon, And Payrolls

Beware The Ides Of August?

Two Out Of Three Is Really Good

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more