Weekly Market Pulse: Who’s The Boss?

I told you last week that there were strange things going on in the labor market but I had no idea how much of an understatement that really was. Much of last week’s economic focus was on the inflation report but I think the JOLTS report may turn out to be more significant. Inflation was indeed pretty hot year over year but that wasn’t unexpected. It wasn’t all about base effects either as our Jeff Snider pointed out. The bond market reaction to the CPI report was not as expected though and that gives us reason to believe that, for once, the Fed is going to get something right. This “inflation” is probably of the transitory variety, mostly a consequence of the supply shock nature of the last recession. There are still things to worry about on the inflation front but sustaining current inflation rates is probably going to require an assist from the dollar. Inflation is, after all, a measure of purchasing power, i.e. the value of the dollar. In the last weak dollar period from 2002 to 2008, the annual rate of inflation exceeded the Fed’s 2% target for 5 consecutive years (2003-2008). By contrast, the generally strong dollar of the last decade kept CPI inflation under the Fed’s target almost the entire time. And the dollar, at least so far, is not cooperating with the big inflation narrative. The dollar is still near the bottom of its 6-year range but it refuses to fall any further.

Maybe it will eventually but in the short term, the dollar looks poised to resume the gentle uptrend it started at the beginning of the year. Global yields continue to favor the dollar and investors are taking advantage which should push the dollar up and inflation down.

And so, with CPI printing at 5% year over year what did bond yields do? Fell of course. What else would you expect from this strange market? But, as I’ve pointed out before, these are small moves and the trend for rates is, for now, still up:

The 10 year Treasury yield fell 10 basis points on the week and the yield is back to where it was in early March. I think a lot of what is going on here is nothing more than a consolidation of the gains from earlier this year. I don’t think this economic cycle is even close to over but the pace of change is not what the market was looking for. The COVID recovery is going to be a bumpy one with all kinds of twists and turns no one could have predicted.

The drop in nominal yields last week was not, however, matched by TIPS yields so the result was a drop in inflation expectations. We may have already seen the high:

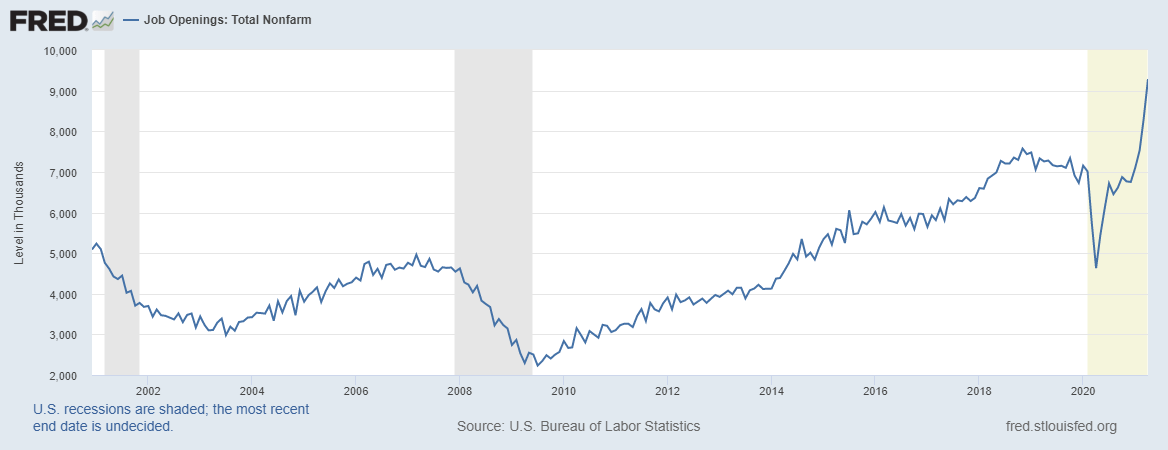

Which brings us to that JOLTS report from last week. Job openings is the metric that usually gets the most attention in this report and the change in April was huge, up nearly 1,000,000 jobs from March to an all-time record. There are apparently plenty of jobs out there if some qualified person would just step up. And that may be part of the problem – not enough qualified applicants – but I think there is more going on here than the normal lament of a “skills mismatch”. There is also the matter of wages and there is at least anecdotal evidence that offering better pay will get you plenty of qualified applicants. There is also the small problem of very generous unemployment benefits that is keeping some portion of workers at home posting stupid tik tok videos.

But the rest of the JOLTS report offers another explanation that doesn’t involve accusing a large swath of Americans of laziness. The quits rate had a big jump too from 1.6% a year ago to 2.7% this year. Those are the numbers most of the news stories cited but that overstates the issue. People were not quitting jobs last April for pretty obvious reasons. The quits rate in February 2020 was 2.2% so the change to this year is about 22% which is still a stunning number if not quite as dramatic as the headlines. A high quits rate is seen as a sign of confidence. Workers don’t generally quit a job without having another one lined up or at least believing they can get one pretty easily.

But a lot of these people quitting their jobs do not appear to be just job-hopping because the hires numbers was the outlier in this report. Hires were up but nothing like openings or quits.

So what are these quitters doing? Increasingly they are starting businesses. There has been a huge jump in business formation, a trend that started last June. There were nearly 500,000 new businesses formed in April so we know what at least some of those quitting their jobs were doing.

The Census Department also tracks what it calls high propensity business applications which are for corporate entities that indicate they are hiring employees. Those numbers have also jumped so all of these new businesses are not one man or woman shops.

A lot has changed over the last year and most of it doesn’t show up in the economic statistics yet. My wife, who knows way more about economics than most economists, says we won’t know the full COVID impact for a decade and I think she’s being conservative. A lot of people are reassessing their previous way of life, pondering their professional (and personal in many cases) relationships and how work affects their quality of life. A lot of two-income couples became one-income couples last year – and discovered the second income may have come at a very high cost. One of the consequences of the repeated rounds of “stimulus” payments last year was a big rise in personal savings which now appears to be fueling this new business boom. Some of this is undoubtedly just people shifting from employee to contractor, probably so they can continue working from home. But some of it is also genuine entrepreneurship, new businesses doing new things or old things in new ways. People had a lot of time to think over the last year and surely some had some great ideas that they are now taking from drawing board to action. That is not a bad thing no matter how or why it happened. Secular stagnation was about more than just a low growth rate; it was about a lack of dynamism in the economy. Maybe, in some weird unintended way, we are about to get our mojo back. If we are that is good news obviously, but with all these new businesses we’d be foolish to expect the change to be quick or smooth. Most new businesses don’t survive, much less thrive and there is a steep learning curve. Believe me, I know. Even for those who stuck with their old employers or at least their old profession, things are different now, businesses and industries changing in ways we didn’t expect. Supply chains are shifting and companies are learning how to be more adaptive, more antifragile to use Taleb’s phrase. I think that decade my wife says it will take to know the full impact of COVID is going to be very interesting.

The other reports released last week were generally as expected. Exports rose a bit but remain well below previous peaks. Imports were down a little in April but are well above the previous peak. Nothing surprising about either one. Wholesale inventory to sales ratios were generally unchanged at low levels. At some point, I would expect to see those ratios rise some but so far businesses remain cautious. Consumer sentiment continues to rise. Expectations and current conditions both rose while inflation expectations fell.

We get retail sales this week along with another read on inflation, this time at the producer level. This report often gets short shrift compared to the CPI but it now be more the more important one for investors. If businesses can’t pass through higher input prices, it will come out of somewhere else – profit margins or some form of cost-cutting. High stock prices and falling margins are probably not on good terms. We’ll also get housing starts and permits which have been quite volatile of late.

A turn higher for the dollar would generally be negative for commodities and the asset class is quite overbought in any case. Futures market positioning is overly bullish based on history with most of the specs long, particularly in the ag space and the softs. We have recently reduced our general commodity exposure as the market continues to adjust to a slower rate of recovery and moderating inflation expectations. The indexes are back to where they were prior to COVID and while there are some supply issues with specific commodities (lumber), I don’t think there is a lot of reason for the indexes to continue to climb at recent rates. The supply side of the economy will catch up eventually and probably sooner than commodity bulls currently believe. With no defined trend for the dollar, commodities should be considered trading assets.

There are some potentially interesting exceptions and copper may be one. Managed money accounts (hedge funds, CTAs) were quick to take profits on what were large longs in copper a few months ago. With most of the longs cleared out, a resumption of the uptrend is more likely. There are obviously some geopolitical reasons to question the reliability of copper supply too with Castillo clinging to a narrow lead over Fujimori in the Peruvian election. Castillo has threatened to nationalize the mines although he may already be moderating that position. There has been a decided political shift left in Chile too. Colombia may be next to flirt with some variant of socialism as Latin American seems to be going through one of its periodic spasms of populism. We may even get a rerun of Lula in Brazil now that his conviction has been overturned. Everything is cyclical in Latin America.

I am also watching the copper to gold ratio for a clue about future rate moves. I don’t know how much more nominal rates will fall but my guess is not a lot without some impetus. Absent a further slowdown in growth, rates should still have some upside. If the yield curve reaches the levels it did in the last three recessions, I’d expect to see rates top out a little north of 2%, maybe 2.5% at the high. Of course, the yield curve has been flattening as rates have been falling recently so it could have already peaked. If it has this may be a very short business cycle. We should be hoping the copper/gold ratio turns higher soon.

We also took some profits in our REIT allocation. We didn’t change the allocation target as we did with commodities but sold down to the target. After a big run-up the allocation had gotten too large (roughly 20% for a moderate account). We may be early on this one but we had to make an adjustment for risk purposes. The rate of ascent on many markets over the last year is not if it needs to be said, sustainable and I think it makes sense to start anticipating a moderation. We have raised a decent amount of cash recently (about 12% for a moderate account) as momentum has reached some extremes. Selling at overbought extremes is just as hard as buying at oversold extremes but it is at those extremes that alpha is made.

There is still upside in REITs vs the S&P 500 but remember outperformance doesn’t mean positive returns. REITs could outperform by falling less in a correction.

We have been building up some cash in our portfolios recently but that has more to do with momentum than the macro-economic outlook. Stocks are expensive and we are underweight (versus our model) both large and small-cap. We continue to emphasize value over growth although it is not held with a lot of conviction. We also have some international value exposure and we continue to hold a long-term strategic position in Japan. We continue to like REITs and still have a full allocation after taking some profits. We are underweight general commodities but have a full allocation to gold as we await some direction from the dollar. We extended duration in our bond portfolio ever so slightly over the last few months but are still fairly short. We are positioned fairly cautiously right now but as always that is subject to change at a moment’s notice.

Small caps and REITs were the stars last week. Growth outperformed value for the week but value is still way ahead for the year. Europe continues to lead non-US markets.

The one sector that stands out right now in my opinion is healthcare which had a very good week. We are long the biotech ETF in our portfolios and hold several pharma stocks in our individual stock portfolio. Biogen was a big winner for us last week but Roche Holdings also made new highs for us. Bristol Myers has had a run of good news on its pipeline recently as well. Healthcare as a whole seems very reasonably priced and it is one of the few industries that continues to invest and innovate.

Economies are hard to predict because human behavior is hard to predict. And when we talk about economics that is really what we are talking about – human behavior. Who would have thought a year ago that new business applications were about to take off? I know I didn’t. But here we are with a different economy than the one we had a year ago (thank goodness) and one that is different than almost anyone expected. All the while, markets have functioned well and been more accurate about the future than any Wall St. or Federal Reserve economist. Interest rates have confounded so many recently because they couldn’t imagine that rates would fall in the midst of a big inflation scare. But bonds rallied and low and behold we get a consumer sentiment survey that says exactly what the bond market has been telling us – inflation expectations have moderated. Growth expectations have moderated some too and while the S&P did hit a nominal new high last week, other stock indexes have stalled for the last several months (NASDAQ and Russell 2000).

We seem to be at some kind of transition point right now between re-opening euphoria and the more subdued reality of a global economy still trying to recover from a pandemic. I am optimistic about the long term but I am not panglossian. The big rise in new business applications is a big positive in my opinion but it will take time to have an impact on the economy. Secular stagnation didn’t happen overnight and neither will our emergence from it. And that assumes that our government doesn’t do something stupid to slow things down further, an always dubious proposition. If you doubt that I give you nearly a decade of QE whose impact, when reckoned years from now, will likely be judged as negative. Now with Congress and the President only arguing about how big the spending blowout will be I fully expect the fiscal equivalent of QE.

I don’t know what will cause markets to correct or when but I know that overbought markets don’t stay that way anymore than oversold ones. So I’m comfortable being a little more conservative right now and waiting for better opportunities. We’ve had a great run over the last year but it’s time to dial it back a little.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more