Weekly Market Pulse: Well, That Was A Surprise

Last week when I wrote this weekly piece, the S&P 500 futures were down 80 points as Russia appeared poised to attack Ukraine, which they ultimately did last week. Today I sit here to write again and the futures are once again down, this time around 100 points. What’s interesting is that the level this evening is well above last Thursday’s low. I said last week that I didn’t expect Putin to go the full-scale war route and I was obviously wrong about that. I also said though that taking Kyiv and holding it would be a very expensive proposition and I doubted the Russians could pull it off. That, at least so far, is proving correct. That and what the market considered some weak sanctions on Russia produced a higher close for US stocks last week. Call it a relief rally or an oversold bounce or whatever you want but, Ukraine notwithstanding, the environment for investors didn’t change much last week and neither did stocks, bonds, or commodities. Gold, the traditional safe haven, was actually down on the week and the dollar was up a mere 0.62%.

Will that change this week? Europe and the US did up the ante on sanctions over the weekend, so…maybe. Everything with sanctions so far has sounded tough until you read the details but this round over the weekend appeared to have more bite. How much more? I have no idea. Some Russian banks will be cut off from SWIFT which isn’t what most people think it is but probably makes some difference. The central bank sanctions appear more significant (from the WSJ):

The U.S., Europe, and Canada pledged Saturday to prevent the Bank of Russia from deploying its $630 billion stockpile of international reserve “in ways that undermine the impact of our sanctions,” they said in a joint statement Saturday. The move directly targets the war chest that President Vladimir Putin has built up in recent years to help insulate Russia’s economy from outside pressures.

Of course, no one knows exactly what “in ways that undermine the impact of our sanctions” means but the combination of the two measures did create lines at every ATM in Russia so certainly Russian citizens think it means something. I daresay that finding dollars or Euros in Russia right now, outside an oligarch's safe, is pretty near impossible. The impact outside of Russia is hard to judge right now, but the dollar index is up less than 0.5% in Asian trading. The Russian central bank held roughly $630 billion in reserves with other central banks, the BIS, the IMF, and private banks. They have been building up these reserves for years – one can’t help but think for exactly this situation – to support the ruble if necessary. Now those reserves are essentially off the table. How much will the Ruble fall? Early indications are a lot based on some news reports but it hardly matters to anyone outside Russia.

As an investor, I think it is important to concentrate on the economic impact, which is hard enough, rather than get caught up in the long-term geopolitical consequences. I, like most everyone else I’m sure, have been impressed with the Ukrainian's ability to hold the Russians at bay over the first week of this assault. Almost all the “experts” I’ve seen on the news shows over the weekend seem quite certain that Russia will prevail in the end if for no other reason than sheer numbers. Maybe. Probably, I guess. But the fact is that I have no idea how this will turn out. There are reports today that the two sides have agreed to talks near the Belarusian border but that seems rather doomed since neither side seems interested in quitting the field just yet. So, unless someone in the Kremlin decides to end this – end Putin – this is going to go on for some undetermined period of time. But what if Putin is deposed? Or the Russian army is sent home with its tail between its legs? What’s the impact of the large increase in defense spending announced by the Germans? Will Finland and Sweden join NATO? I can’t answer any of those questions and I have no idea what the impact on our portfolios would be. And anyone who tells you they do is either lying to themselves or you or both.

So, that being the case, I try to think about the impact on the global economy which involves more than a little guesswork. The Russian economy is roughly $1.5 trillion annually or about 1.7% of global GDP which, of course. seems a small number. If the Russian economy disappears we’d miss their natural resources but not much else. And I don’t think we’d have to do without their oil and gas because it is their main asset (along with other natural resources such as industrial metals); they’ll have to sell it somehow and I think Iran proves that they’ll find a way. Iran is under sanctions but is estimated to export about 2.3 million barrels of oil a day, through middlemen, to China mostly. They take a haircut on the price but the oil gets into the market.

The Russian economy is just slightly smaller than Italy ($1.9 trillion) but if Italy fell into the Med it would have a much greater impact because they owe the world $2.8 trillion. The impact on the owners of that debt – banks and the ECB mostly – would be severe. Russia, on the other hand, has less than $500 billion in external debt which you might note is less than the reserves the West just basically confiscated. I’m not saying those reserves would compensate any holders of Russian debt (there are sovereign immunity issues probably) but if Russia defaults it is certainly manageable. This is not a re-run of the late 90s.

If there is a quick resolution to the conflict, and oil and gas keep flowing, the impact on the global economy is probably minimal. If oil and gas flow is disrupted in a longer conflict, Europe’s economy slows but probably avoids recession if it doesn’t go on too long. A worse case would be if Russia completely cut off the supply of gas to Europe for an extended period. That would probably cause, at least, a European recession and maybe a global one. There is any number of factors that might come into play depending on whether oil and gas flow out of Russia are disrupted. Other countries might make up the loss of crude production – most likely the Saudis – but I wouldn’t expect it to be the US. Other countries can make up for the loss of other natural resources such as platinum, palladium, and other industrial metals that come out of Russia but prices would likely rise. Any number of countries could well benefit from a disruption to Russian mining. Supplying Europe with natural gas at a price they can afford is the hardest nut to crack.

The longer the conflict goes on, the more severe the economic consequences but in the end, the global economy will adjust to the outcome. I do not want to minimize the impact because I have no idea how long this will go on or what a desperate Putin could or would do if the war continues to drag out. But in the end, the world will adjust as it always has.

What does any of this mean for markets? There are a lot of moving parts to that question and I don’t know if there is any way to determine the reaction in advance. Any material slowing in US growth could put the Fed on hold which the market may take as a positive for risk assets. But that would likely depend on how severe the slowdown becomes; we’ve already slowed from the best pace of the recovery. The economic data we have now – which predates the invasion obviously – is okay but certainly not great. My base case for the US economy is that we will settle at a growth rate that is somewhat less than what prevailed prior to COVID. The simple idea is this: we grew at a 2.2% annual pace in the decade prior to COVID. During COVID we reduced immigration and did nothing – yet – to improve productivity and added a lot of debt. To me, that adds up to slower growth than the previous 2.2% rate. The fall back to that slower rate of growth will be jagged – some quarters better and some worse – but logically I think that’s where we’re headed. The wild cards are the labor force participation rate which certainly has room to improve (62.2% in the US vs 74.3% for Europe by the way) and productivity growth which is dependent on investment (core capital goods orders up in January for the 11th month in a row). It is possible that both of those surprise us and we get better than expected growth but I am not willing to bet on it.

Regardless of the path, we take from here, it is important to have an investment strategy you can stick with regardless of what happens in Russia or Ukraine, or any other faraway place. A strategy is nothing more than a long-term plan – an asset allocation in investing – to achieve a long-term goal. How you implement that strategy is where tactical calls are made. If your strategic plan calls for an investment in large cap stocks, which ones you choose – value or growth, domestic or foreign – is a tactical decision. You might also make a tactical decision to deviate from your strategic allocation but those should be rare. And I’d suggest that they should almost never be based on geopolitics. If economists exist to make weathermen look good, then geopolitical strategists serve the same function for economists.

The economic environment changed only slightly last week.

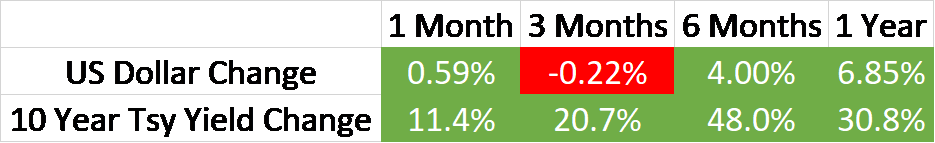

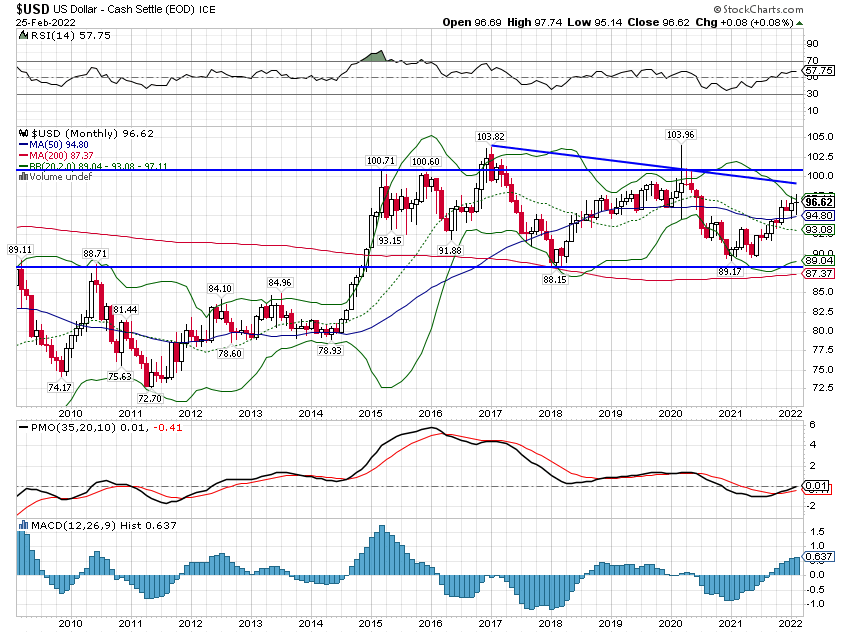

The dollar rose slightly last week but it is still in the same range it has been in for years, near the top of that range:

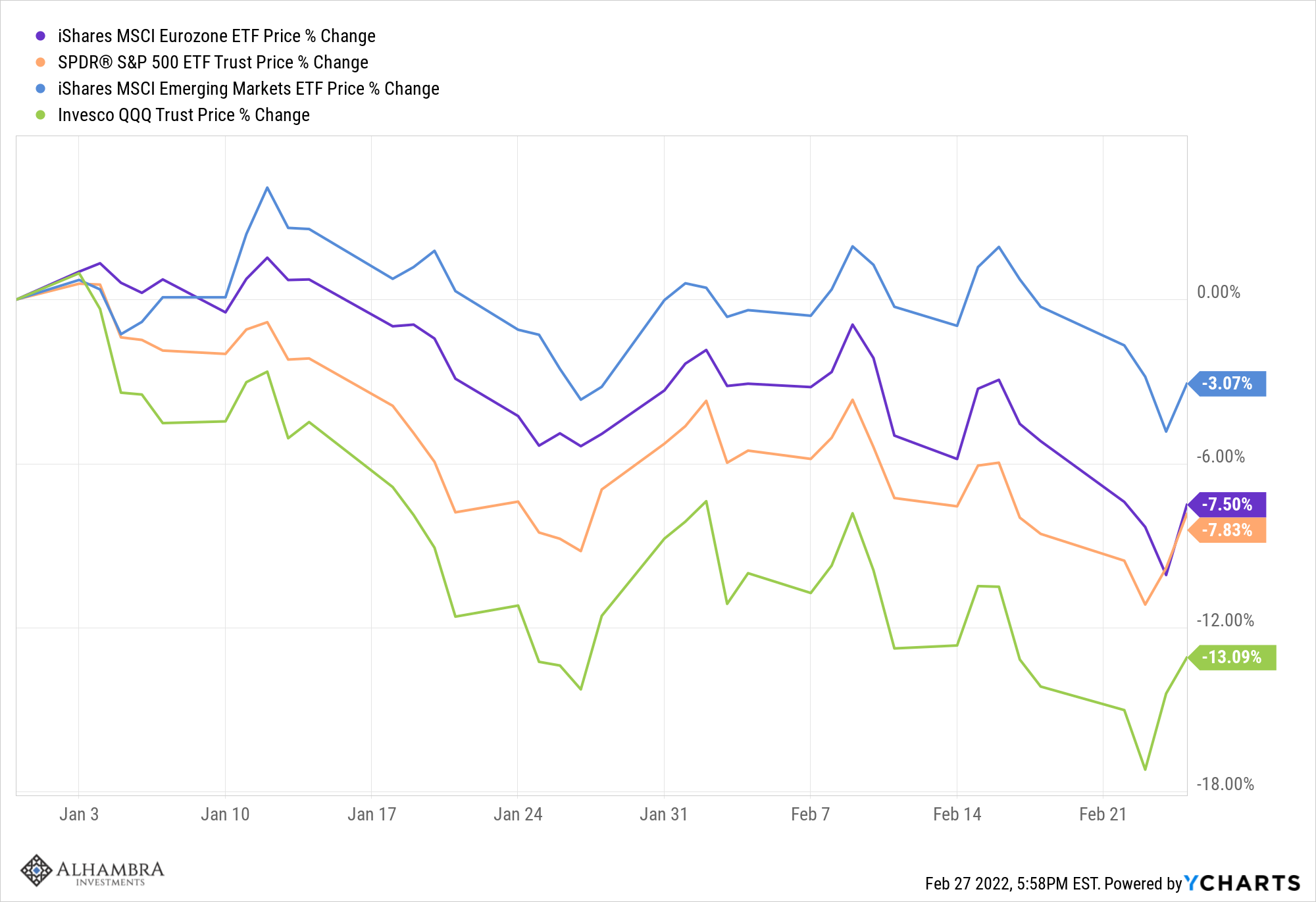

Europe and EM stocks had a tough go last week but EM still leads the pack YTD with Europe in second.

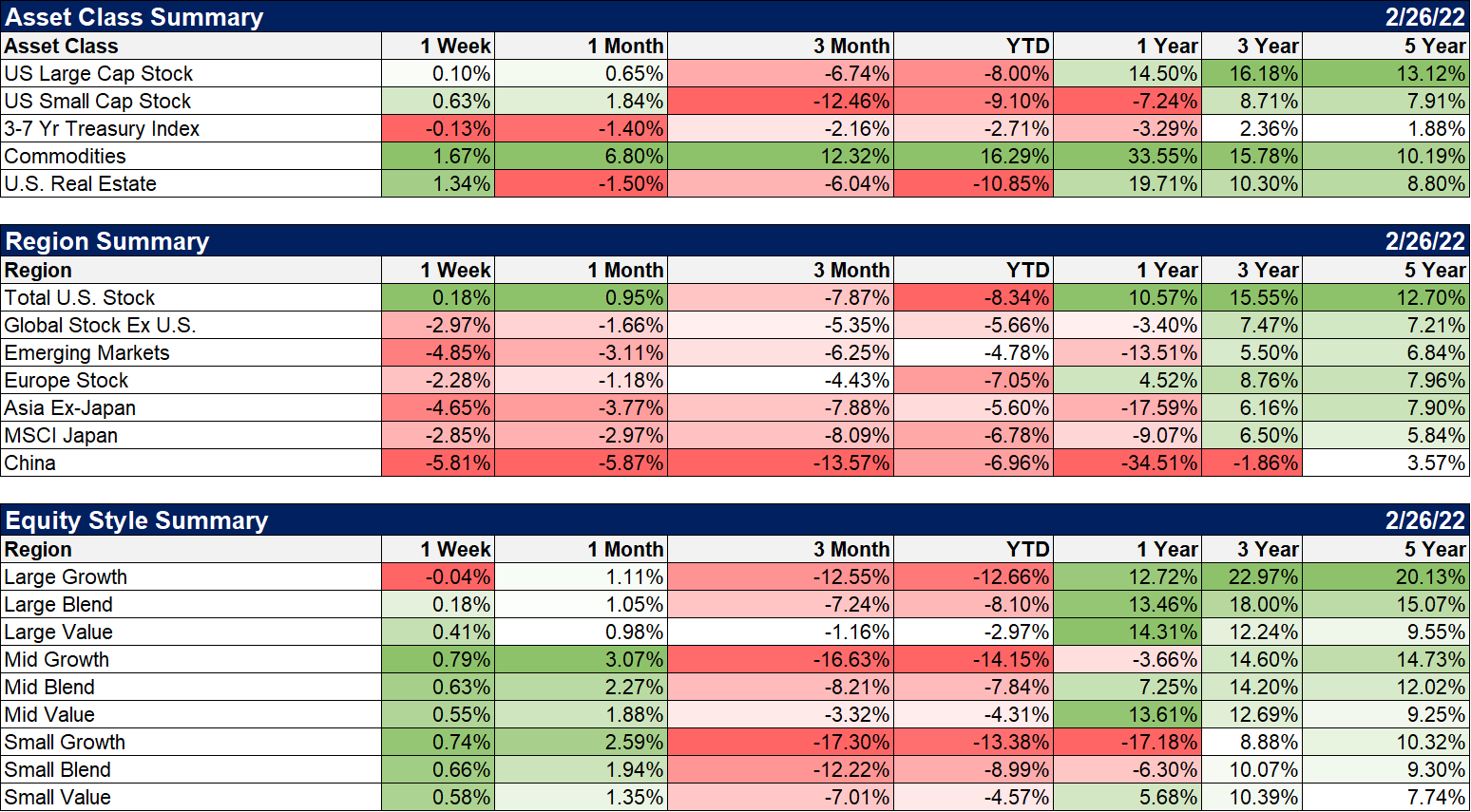

Stocks, commodities, and real estate were all higher last week while bonds were down slightly. Foreign markets were down with China the worst performer. One area that continues to buck that trend is Latin America, which was up again last week. Would Latin America benefit from a disruption of Russia’s mining industry?

Large cap value outperformed last week but in small and mid caps, growth nosed out value.

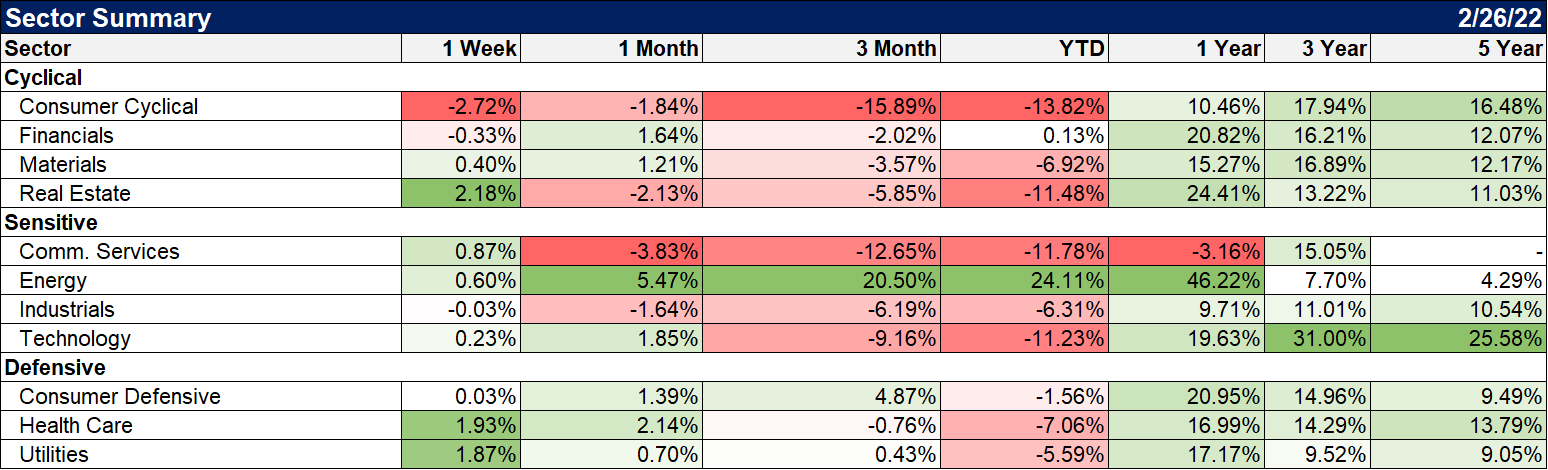

(Click on image to enlarge)

It was mostly defensive sectors leading last week with cyclical leading the laggards.

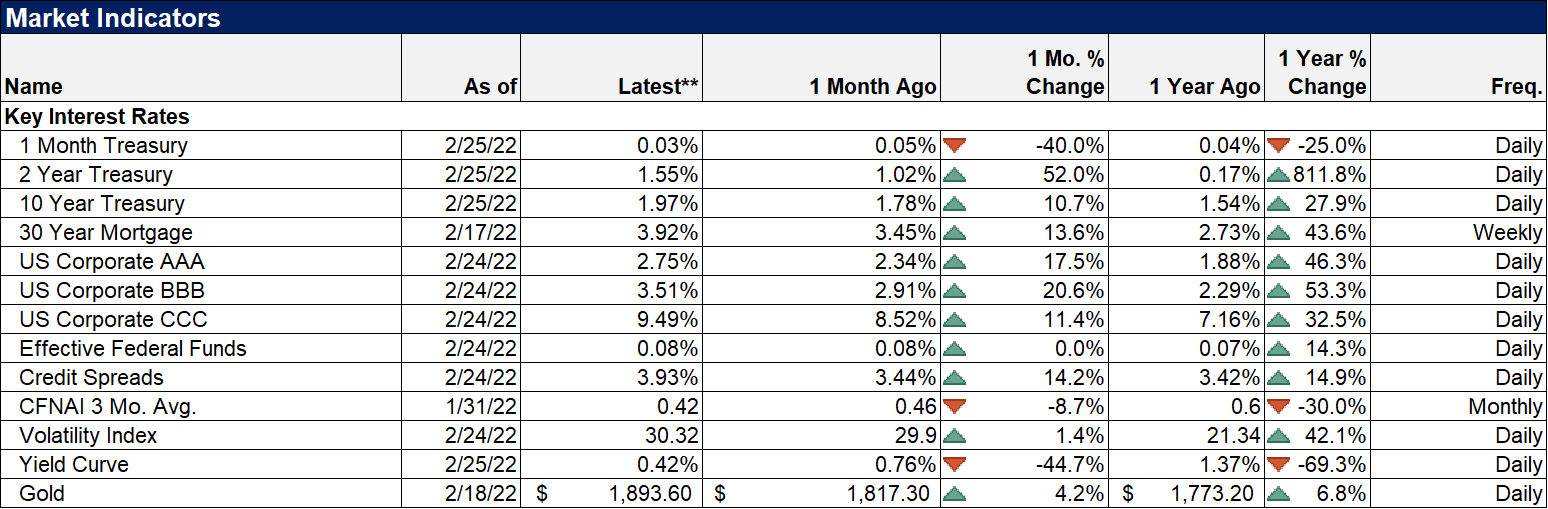

(Click on image to enlarge)

The CFNAI, a broad indicator of economic growth, was released last week. December was revised modestly negative to modestly positive and January was better than expected at 0.69. The 3-month average fell slightly to 0.42 which corresponds to growth slightly above trend.

(Click on image to enlarge)

A widely diversified portfolio essentially broke even last week as positives from US stocks, real estate, and commodities were offset by losses in bonds and foreign stocks. Considering that the week included the invasion of one sovereign European nation by another, I’d say that isn’t a bad result. It would have been nice to avoid foreign stocks altogether but considering the neutral nature of the dollar right now (which could certainly change if things go really sideways in Ukraine), that’s a hard call to make. I think too that if you have some foreign exposure, as we do, it is hard to sell right now despite the Ukraine situation because it could be resolved in a surprising fashion. If we wake up tomorrow with a new Russian President – not that I’m advocating anything, mind you – I think European stocks might react favorably. Geopolitics is…tricky.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more