Weekly Market Pulse: Stability Is Good

(Click on image to enlarge)

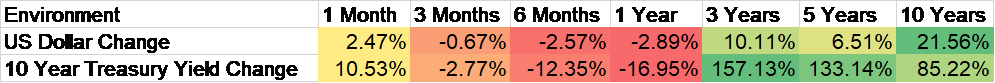

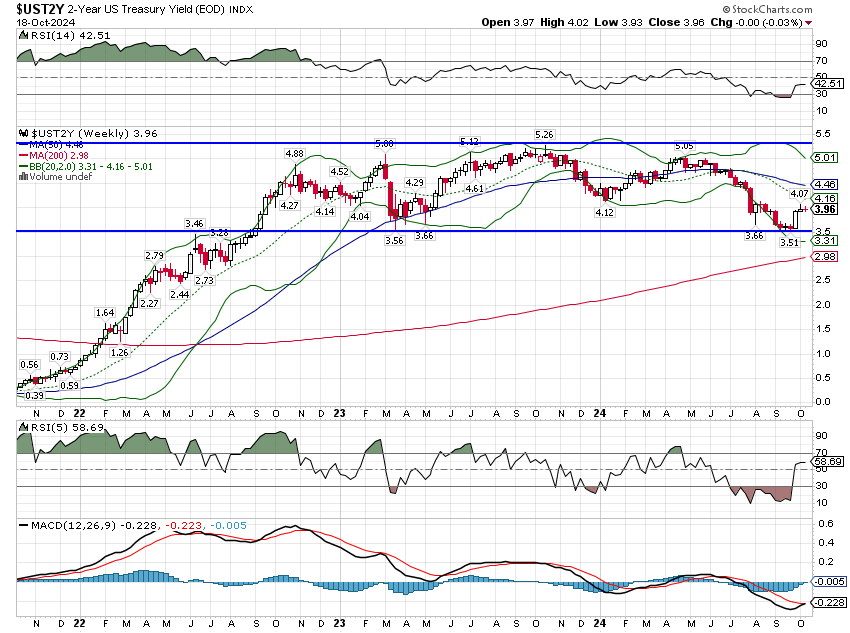

The dollar rallied last week as US economic data showed continued strength, indicating perhaps a slower pace of Fed rate cuts, and the ECB accelerated their program, matching the Fed’s own 50 basis point cut from September and indicating that more is likely to come. Still the dollar is down over the last 3,6 and 12 months so last week’s rise didn’t change the big picture. Over the trailing 2 years the buck is down nearly 8.5% but since December of 2016 it is flat (+0.43%).

While we often talk of uptrends and downtrends, the best outcome for the economy and markets is actually stability and that – with some short term deviations – is exactly what we’ve had for quite some time. Rather than hope the dollar will start to trend in your expected or preferred direction, maybe it is best to enjoy the stability while it lasts. I have spoken many times over the last few years that my expectation is for the dollar to eventually weaken but I haven’t made anything more than token tactical moves in that direction because the only downtrends have been short-lived and quickly reversed. In a stable dollar environment, there is no thumb on the performance scale and individual investment fundamentals dominate.

(Click on image to enlarge)

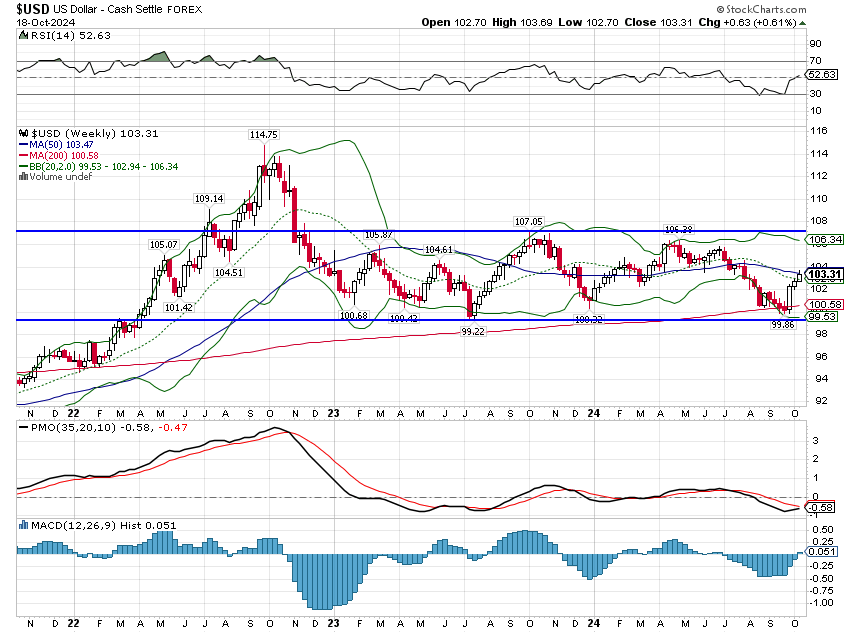

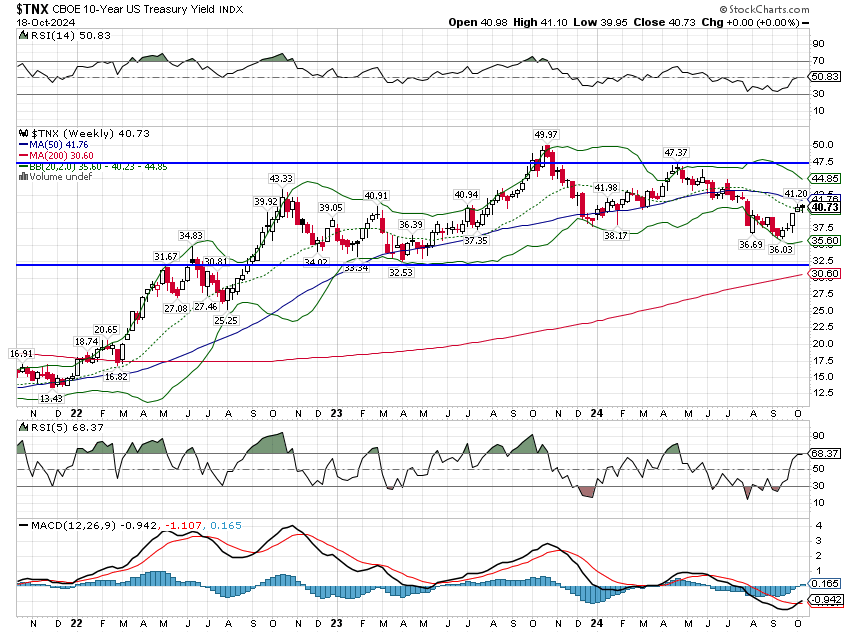

Interest rates took the week off with both the 10 year and 2 year Treasury yields unchanged on the week. Stability in the dollar isn’t just happenstance or luck; it comes from stability in the real economy, reflected by the stability in rates.

(Click on image to enlarge)

(Click on image to enlarge)

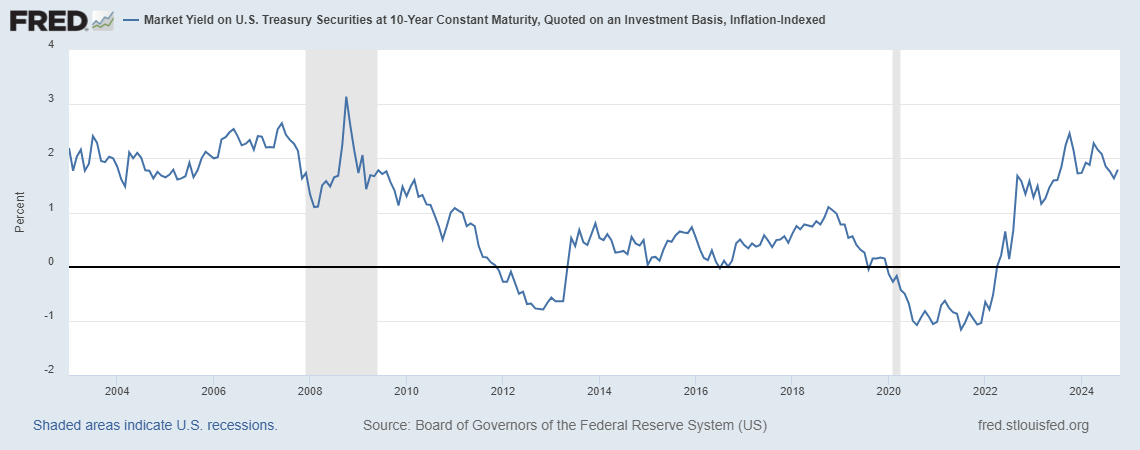

10 year TIPS rates – real rates – rose slightly last week and inflation expectations fell slightly. Real rates have also been stable, ending last year just 5 basis points less than the current level. The peak, in the 4th quarter last year, when real growth peaked, was almost 2.5% while today is 1.77%. Even after falling from the highs, today’s levels are higher than most of the period from 2010 to 2020 and more consistent with the levels that prevailed prior to the financial crisis of 2008.

What that means is that current real growth is better than during the post financial crisis period. The statistics say it’s better and the markets say it’s better which is certainly good enough for me. There are plenty of economic pundits and politicians who want you to believe otherwise; I’d suggest you consider their motives. Markets anticipate so if the economy starts to have problems it will show up in markets and right now there is no indication of it. Until they do, it’s probably best to tune out the negative vibes.

(Click on image to enlarge)

Markets

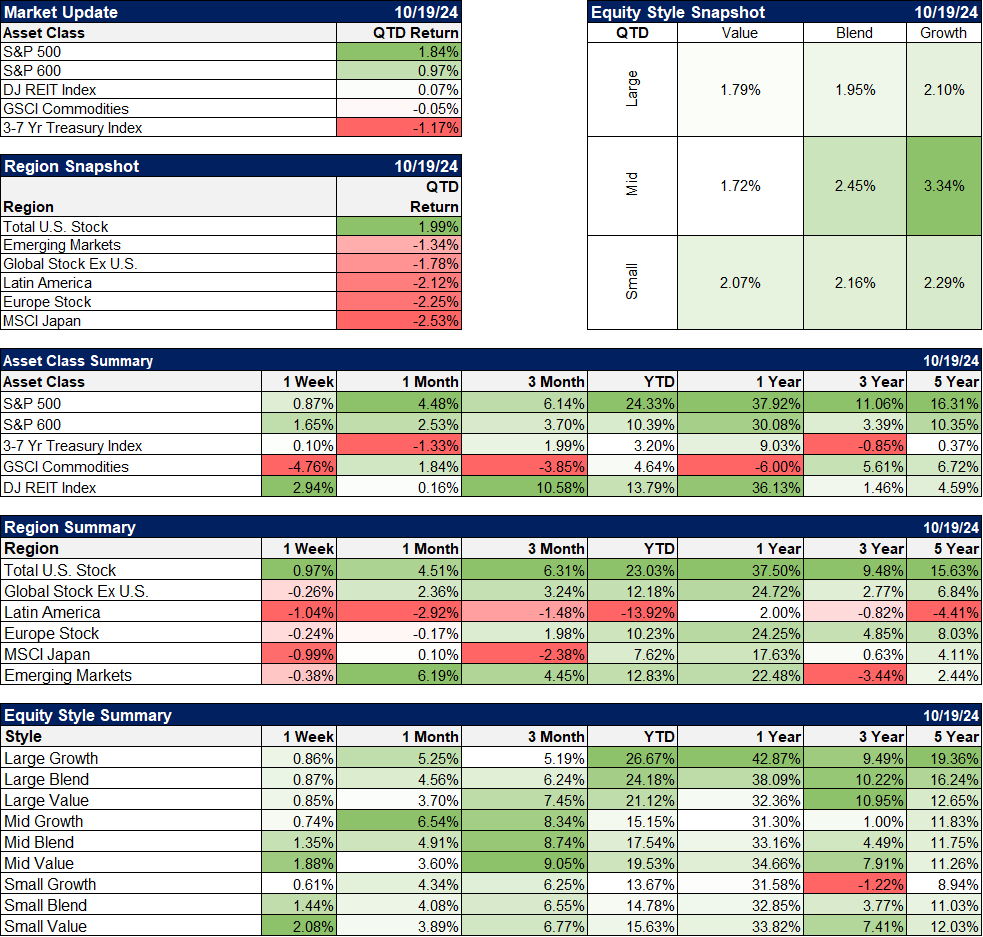

Markets last week returned to the themes of last quarter with small caps, REITs, value and bonds all out-performing. Commodities also performed poorly as crude oil dropped 9%. Copper fell 2.4%, presumably on Chinese stimulus disappointment, although platinum and palladium both rose. Gold was up 2%, continuing its winning ways. Non-US markets were down on the week but not all that significantly considering the rise in the dollar.

For those of you still waiting for value to start outperforming please note the five year return of small cap value below which is now beating small cap growth. Mid cap value is only slightly behind MC growth over the 5 year period. Yes, large cap growth is still leading over value but I just checked and if you want to buy value – which is a lot cheaper than growth across all market caps – there is no rule that says you have to wait for large cap to flip as well.

I would also point out that REITs, while drastically underperforming over the 3 and 5 year time frames, has done quite well over the last year, nearly as well as the S&P 500. It is too early to call that a trend but it is certainly encouraging.

(Click on image to enlarge)

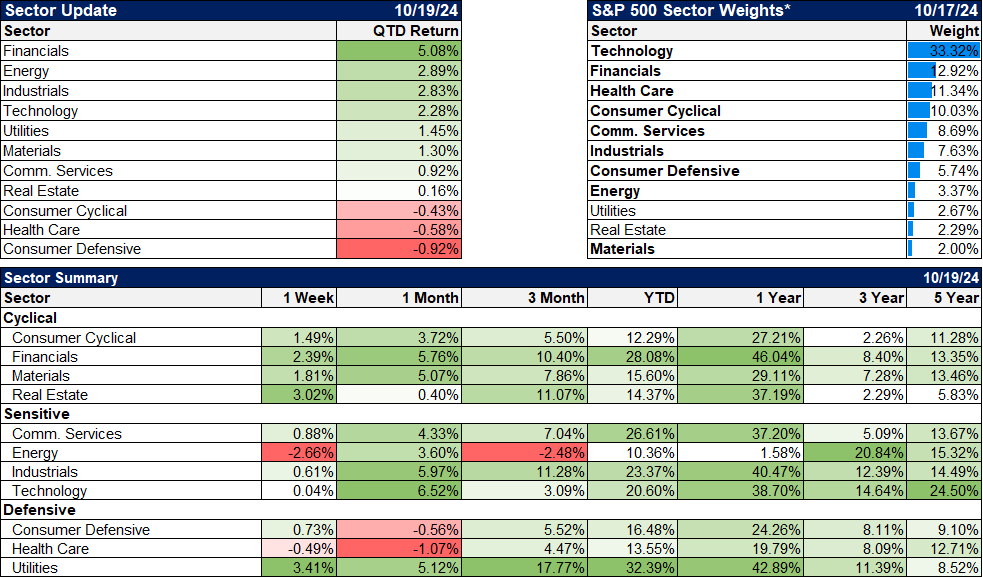

Sectors

Financials have led the way QTD and I find it amusing that so many seem to believe that lower rates are going to hurt this sector. Back when the yield curve inverted a couple of years ago, there were a plethora of articles about why that was so bad for financials. Obviously, these pundits opined, an inverted yield curve is negative for financials. Banks make money on the spread between short and long term rates and so when short term rates are higher than long term they can’t make any money and stop lending. That’s why an inverted yield curve is a precursor to recession they said.

So, now it’s two years later, there has been no recession and these same “analysts” are saying, well falling interest rates are negative for bank/financials earnings. They seem to have forgotten completely about the yield curve, which is now positive and getting steeper. If an inverted curve was negative for financials earnings shouldn’t a steepening and not inverted yield curve be positive? Apparently not for the perpetually bearish.

Here’s the truth. Lending is not correlated with the shape of the yield curve or the level of interest rates. And bank lending into the private economy isn’t actually all that correlated with economic growth either. This is the 21st century economy; check your assumptions at the door please.

(Click on image to enlarge)

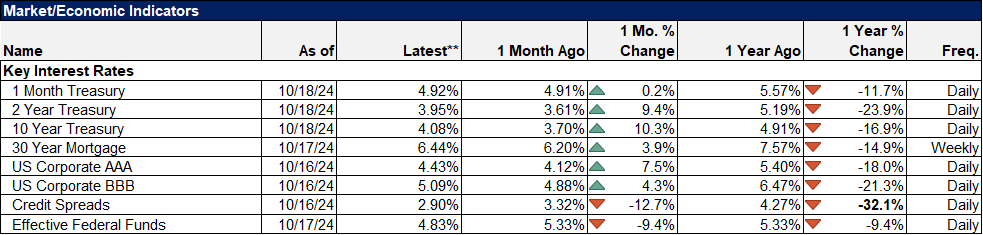

Market/Economic Indicators

Credit spreads are now the narrowest since December of 2006. I only have data back to 1997 readily available but since then spreads were only narrower for 8 months in 1997 and 6 months in 2006/7. Investors are stretching for yield and basically ignoring risk today but this does not mean we are close to a top in this bull market. After hitting these levels in February of 1997, stocks continued to climb for almost 3 years before peaking in March of 2000. After hitting current levels in December of 2006, stocks continued to climb for another 11 months before peaking in October of 2007 and the S&P 500 was within 10% of the high until May of 2008.

In both cases spreads continued to narrow for several months after falling to these levels and more than doubled from their lows to over 5% before stocks peaked. Outside of some kind of sudden shock, spreads will widen before stocks peak and start to fall. But make no mistake, the sentiment right now is very bullish and we will get a reversal at some point.

(Click on image to enlarge)

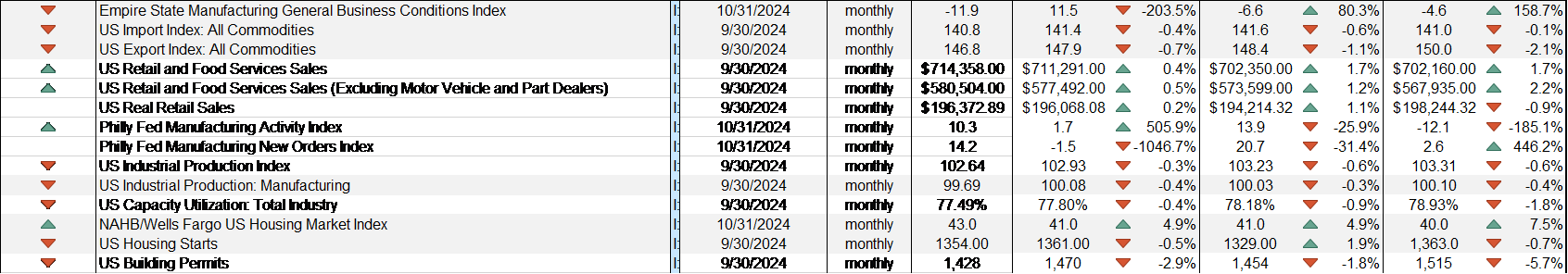

The economic data last week was mixed with a slightly positive tilt. The Empire State manufacturing survey fell back into negative territory but the Philly Fed improved and has now been positive 8 of the last 9 months. Retail sales were better than expected and are up 1.7% over the last 3 months. Retail sales ex-autos and gas were especially strong, up 0.7% month to month (August to September). However, real retail sales (adjusted for inflation) are -0.9% year over year.

Import and exports prices both fell on the month. The drop in import prices was almost entirely due to lower fuel prices.

Industrial production was down 0.3% in September but that’s actually not bad considering the Boeing strike and two hurricanes.

The housing market index improved slightly but is still below the +/- dividing line of 50. Housing starts and building permits fell back a bit which isn’t particularly surprising given the recent rise in mortgage rates and the two hurricanes.

Jobless claims actually fell which I find very surprising after the surge in the wake of Helene. Maybe we’ll see a similar surge from Milton next week.

The economy appears to have ended Q3 in healthy enough shape but there are still some signs of slowing. We’ll see how quickly hurricane recovery takes to get started but I think a Q4 slowdown should be expected.

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: Questions

Weekly Market Pulse: The Impact Of AI

Weekly Market Pulse: Did The Fed Just Make A Mistake?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more