Weekly Market Commentary: Counterintuitive

Where there is no hope it is incumbent on us to invent it.

Albert Camus

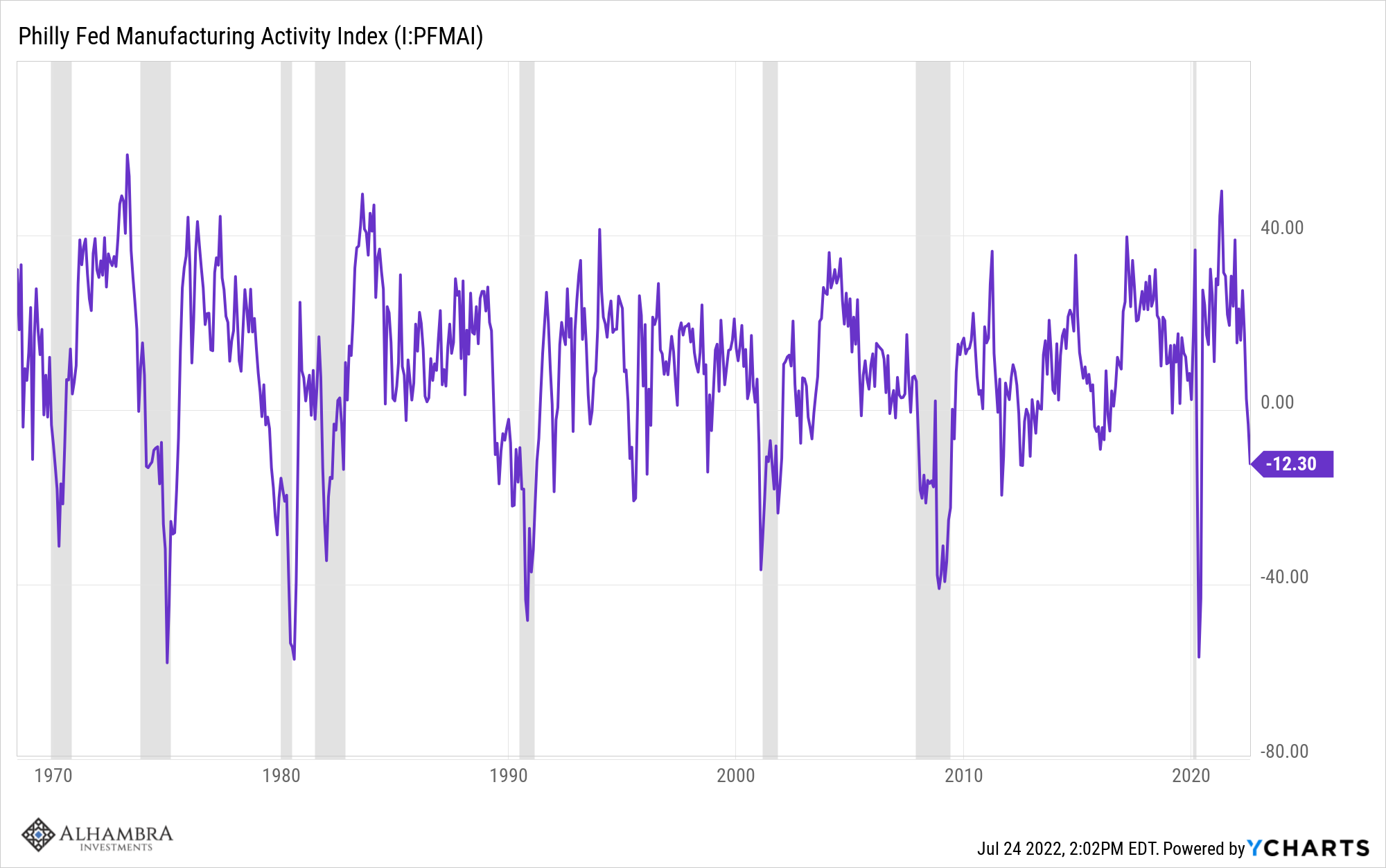

The economic data released last week was almost uniformly bad. We started the week with the NAHB Housing Index, a measure of builder sentiment, which fell from 67 to 55, much less than expected. Next up was more news on the housing market with starts and permits both down in June. The bad news on housing continued with another drop in mortgage applications and existing home sales. Thursday saw the Philly Fed manufacturing index fall for the second straight month to -12.3 with other details like new orders also negative. Jobless claims rose to 251K, up over 50% from the low set in March. Leading economic indicators were down for the 4th straight month. Last but not least in a week of bad economic news was the flash S&P PMI that showed the composite down to 47.5 and services down to 47. So, naturally, stocks were up 2.5% on the week. Wait…what?

I’ve said this so many times by now people are getting sick of hearing it but here goes again. The market is not the economy and the economy is not the market. They can and do – often – move in opposite directions. The correlation between current economic activity and stock market returns is negative. Yes, negative. Slightly negative but negative nonetheless. If you are looking at the economic data to figure out the market, you’re doing this backwards. Economic data represents the past, markets represent the future.

Economic data is also subject to interpretation and most of the above, while negative, is not dire. The NAHB survey is over 50 which is the dividing line between optimism and pessimism. It is falling rapidly so that isn’t good obviously but recessions usually pull this down to 30 or less although that isn’t always true. There have also been a number of readings below 50 that were not associated with recession. And, as I’ve said before, the adjustment in the housing market is a necessary thing. Prices rising at 20%+ per year isn’t healthy either. Housing starts and permits were down but both are still in uptrends. Existing home sales are just down to the level that prevailed from 2013 to 2020. The Philly Fed survey is indeed low but it’s been here many times in the past outside of recession. And again, a slowing in the goods side of the economy is necessary and expected.

(Click on images to enlarge)

I’d be cherry-picking if I didn’t point out that new orders did fall to a level we’ve never seen outside recession. I’d just add that we haven’t been in this situation before, coming out of a pandemic that featured a surge in goods purchases. I certainly don’t find a drop in manufacturing new orders to be outside the scope of what I’ve been expecting.

Jobless claims are up 50% from the low but that low was an all-time one adjusted for population. There is an obvious uptrend in claims since those spring lows but whether that is positive or negative I think depends on where you sit. In the last NFIB survey of small businesses, 50% reported job openings that couldn’t be filled. For them, an uptick in jobless claims may be the best news they’ve gotten this year.

The two reports that worried me the most from last week were the LEI and the S&P PMI survey. The LEI has dropped for 4 straight months and is close to turning negative year-over-year which has been a reliable indicator of recession in the past. We aren’t there yet but it is dangerously close. The flash S&P PMI was worrisome because of the services component. A pullback in the goods side of the economy is expected and I think healthy, but a drop in services activity is not. The services side of the economy is considerably larger than the goods side and if it really is contracting at that rate, a recession is probably coming fairly soon. There are only two thin reeds for the optimist to hold onto with this report. First is that it is the flash and not the final report which we’ll get on August 1 and 3rd. The second is that it is the S&P PMI (the old Markit survey) which I have mostly ignored over the years because it isn’t as reliable as the ISM surveys. But make no mistake, if this report is accurate we are almost certainly headed for recession.

Having said all that, I don’t think those caveats to the reports are why stocks and other risk assets were up last week. I also don’t think it is because the stock market is just looking past this weakness to future economic strength. One factor was undoubtedly that Russia turned the Nordstream natural gas pipeline back on after maintenance, avoiding, at least for now, a huge shock to the European economy. That and a 50 basis point rate hike by the ECB was almost surely why the dollar was down 1.2% last week and European stocks outperformed their US counterparts. The other factor is the Fed. We’re at a point where bad economic news is good risk asset news because it means the Fed maybe doesn’t have to be as aggressive. I have a lot of problems with that kind of thinking but what matters to markets is what the majority believes not what Joe – or you – believes.

We have an FOMC meeting next week and a couple of weeks ago markets were moving on the fear the Fed would actually hike by a full 1% due to some hot inflation data. Now, after a string of weak economic reports, the market is wondering if they’ll even go the 75 basis points they’ve been prepping the market to expect. Again, I have problems with the logic behind that thinking, mainly that economic growth is tied directly to inflation. A rapidly growing economy doesn’t have to be inflationary and a slowing one certainly doesn’t ensure that inflation will fall. Inflation is a monetary phenomenon but that doesn’t mean the Fed controls it. Money is a creature of the banks and just FYI, unless they shut the vaults in the first three weeks of July, bank lending is still rising at a pretty healthy rate. Expectations of slowing growth and moderating inflation could both be wrong and have nothing to do with the Fed.

However, the Fed is still today somewhat captured by Phillips Curve thinking and so they will likely see a slowing in economic data as a positive for future inflation. I don’t know what they’ll do at the meeting this week other than raise rates but the important information will be in the post-meeting press conference. Futures markets have been bringing forward the date of peak short-term rates for the last few months, from 3rd quarter 2023 a few months ago to now December of this year or Q1 of 2023 (depending on the market). I’ve said before and will repeat again, the Fed is a follower on rates, not a leader. If that proves true again – and I think it will – then this press conference seems a likely time for Powell to announce a slowing in the pace of rate hikes. I think that is what the market was anticipating last week but that could be my own bias; I can’t actually know what millions of traders and investors were thinking.

We will get a slew of new economic data next week and maybe a clearer picture of the current state of the economy. I don’t expect any big positive surprises for the most recent data but the least important report of the week may be one that could surprise people. The 2nd quarter GDP report will be released the day after the FOMC meeting and it is widely expected to be negative for the second quarter in a row, which some think is proof of recession (even though that isn’t what the NBER recession dating committee says). The 1st quarter negative was driven by inventories and trade but mostly trade which shaved 3.2% off GDP. Well, this quarter it is likely to add to GDP as the trade deficit shrunk considerably in the 2nd quarter. If trade for June is estimated at about the same level as May (the actual figures aren’t out yet), then trade should add about 1.5% to 2nd quarter GDP. Whether that will be enough to offset enough of the negatives to produce a positive surprise I don’t know but it certainly seems possible. In reality, it doesn’t mean much anyway – the second quarter is over – but a positive report may impact sentiment which has been extraordinarily negative.

More than anything economic, it is sentiment that has led to this month’s rebound in stocks. Most of the negative sentiment can be seen in positioning data. Futures market positioning has moved to extremes in several markets. Large speculators are the most short the S&P 500 since June of 2020 and the Russell 2000 since…well, as far back as I have data. They are also long the dollar index at levels near past peaks. A more dovish Fed would probably correct some of that. We also see the NAAIM (National Association of Active Investment Managers) coming off a recent low in equity exposure of less than 20, another reading associated with past bottoms. I’m sure you saw or heard about the Bank of America fund manager survey:

The Full Capitulation: July BofA Fund Manager Survey (FMS) shows dire level of investor pessimism…expectations for global growth & profits all-time lows, cash levels

highest since “9/11”, equity allocation lowest since Lehman, BofA Bull & Bear Indicator remains “max bearish”

That survey also showed the % saying recession is likely is the highest since March of 2009 and April of 2020. The % who expect global profits to improve is lower than 2008. Say what you will about the current outlook but I have a hard time seeing it as more dire than late 2008 right after the failure of Lehman.

Investing is often a counterintuitive exercise and it is most counterintuitive – and hardest – at turning points. I know I’ve quoted Howard Marks before but I’ll do it again. In one of his most famous market letters (It’s Not Easy), he says:

Remember, your goal in investing isn’t to earn average returns; you want to do better than average. Thus your thinking has to be better than that of others – both more powerful and at a higher level. Since others may be smart, well informed and highly computerized, you must find an edge they don’t have. You must think of something they haven’t thought of, see things they miss, or bring insight they don’t possess. You have to react differently and behave differently. In short, being right may be a necessary condition for investment success, but it won’t be sufficient. You must be more right than others…which by definition means your thinking has to be different…

For your performance to diverge from the norm, your expectations – and thus your portfolio – have to diverge from the norm, and you have to be more right than the consensus. Different and better; that’s a pretty good description of second level thinking.

One example he gives of the difference between first and second level thinking is this:

First level thinking says, “The outlook calls for slowing growth and rising inflation. Let’s dump our stocks.” Second level thinking says, “The outlook stinks but everyone else is selling in panic. Buy!”

Like I said, counterintuitive.

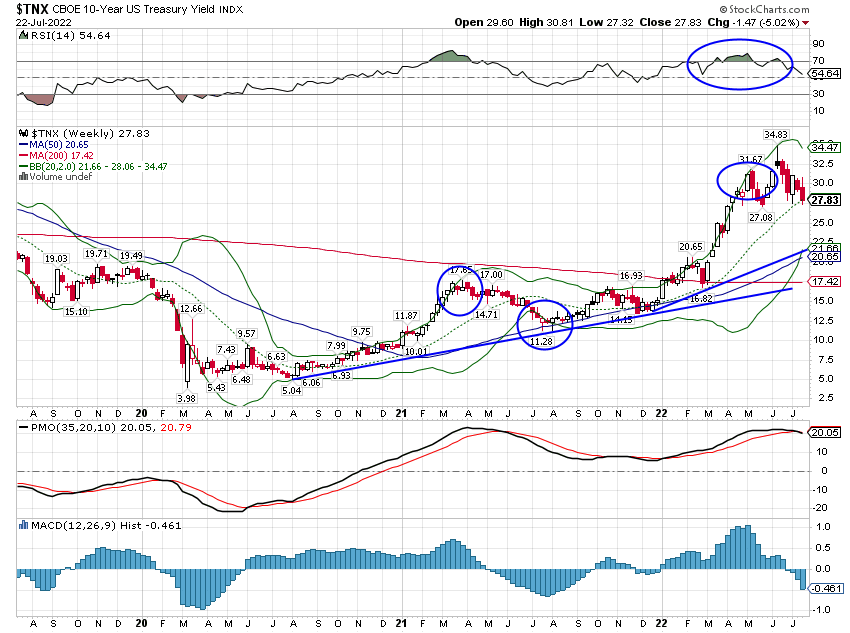

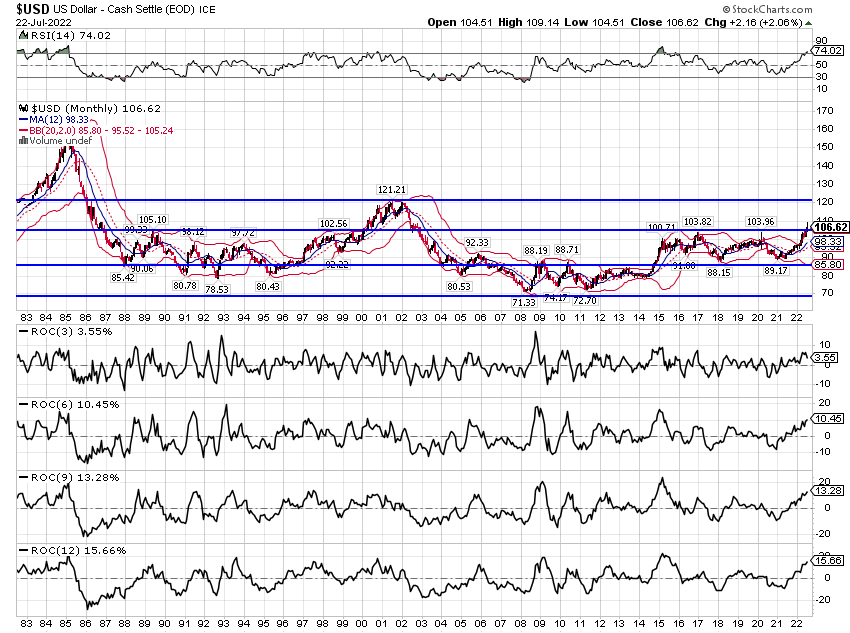

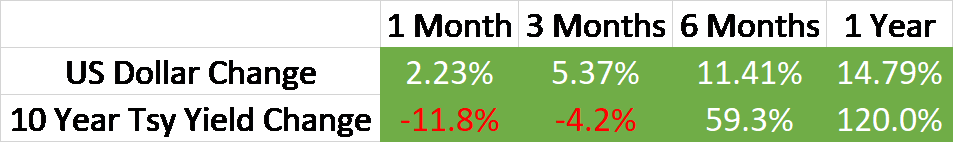

The one and three-month change in the 10-year Treasury yield is now negative and I think it is likely that the short-term trend has some room to run. The intermediate-term trend though is still up:

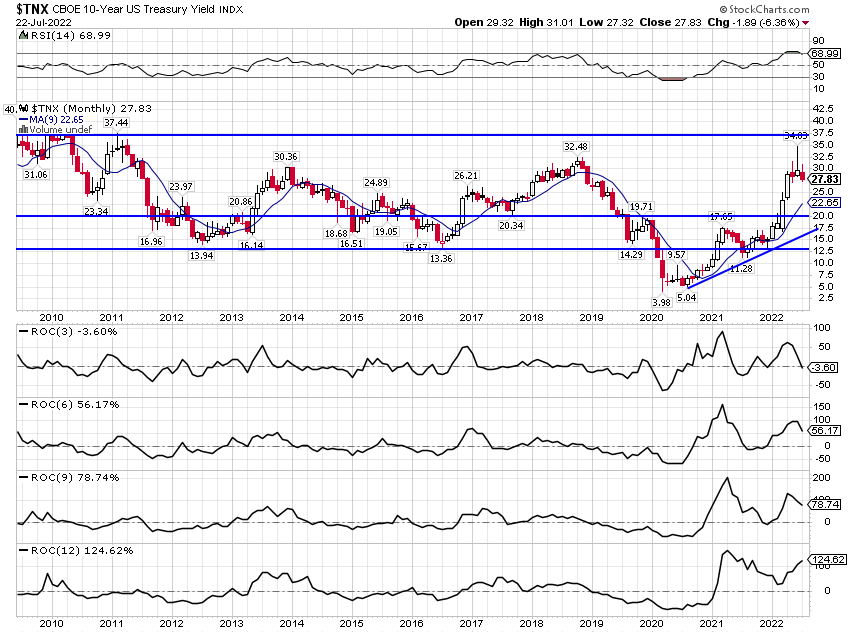

The long-term trend going back a dozen years or so is pretty obvious; there isn’t one.

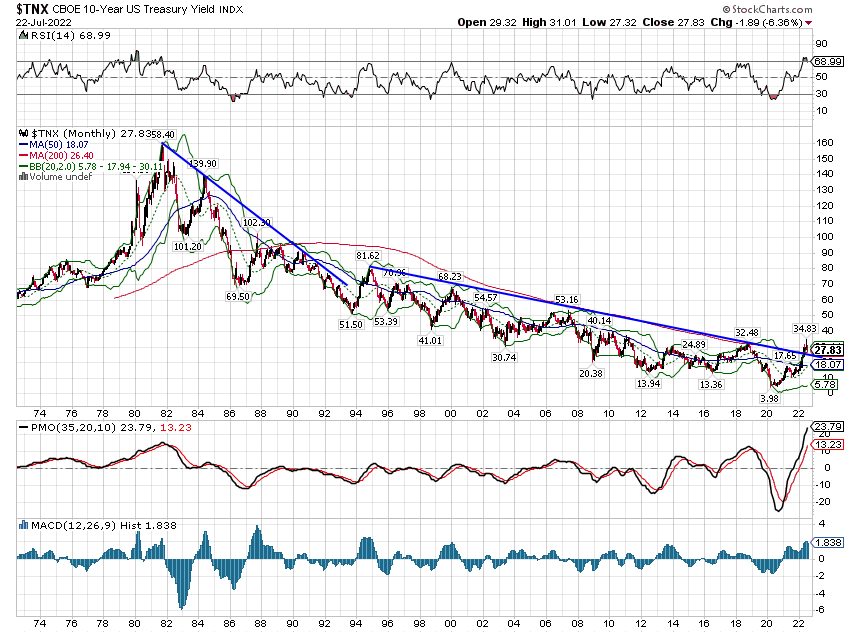

And the really, really long-term downtrend appears to have been broken.

Perspective matters.

The dollar was down last week but the short and intermediate-term trends are still up. The really, really long-term trend here will surprise some but dollar stability has been more the rule than the exception over the last few decades:

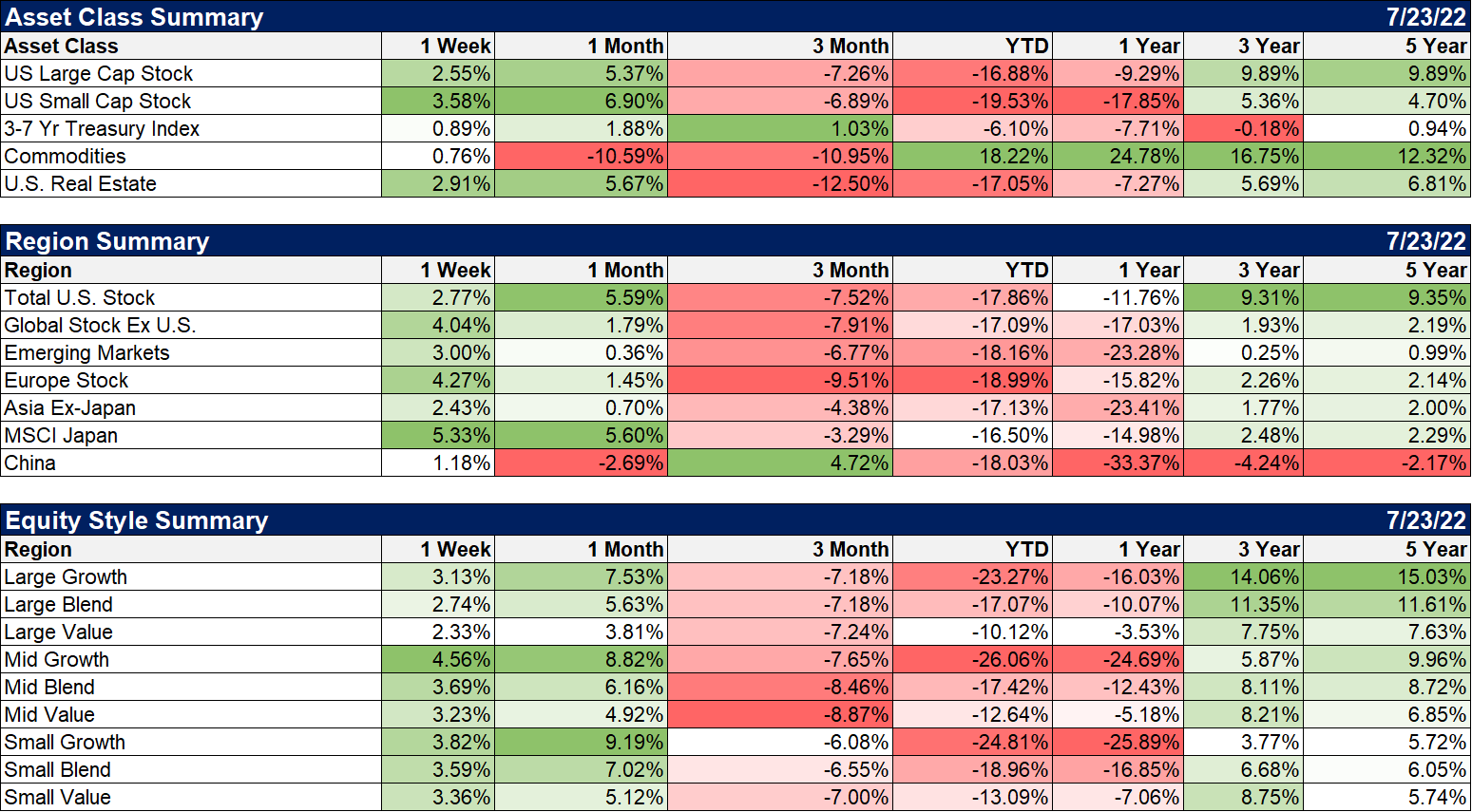

We’ve had a lot of weeks this year when there was no place to hide. What do you call it when everything goes up? I don’t know but that’s where we were last week.

Growth stocks outperformed modestly last week but value still has a large lead YTD.

Non-US stocks led last week with the positive pipeline news in Europe. I do not expect that to continue only because Putin seems intent on wreaking as much havoc as he can and turning it on and off does more damage than just turning it off for good. It also preserves hope in Europe and keeps them buying Russian gas. If he just turns it off Europe will finally be forced to find alternatives and they’ll never go back to buying Putin’s gas.

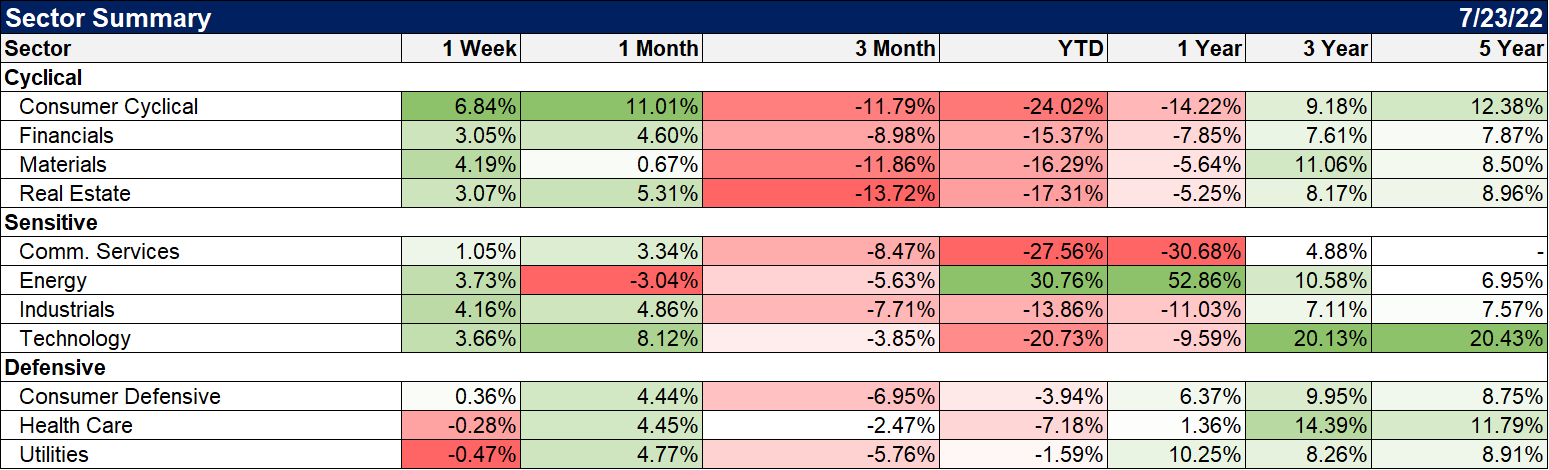

The best performing sectors were economically sensitive ones which also would seem to point to optimism about the pace of future rate hikes. Defensive stocks were mostly down on the week.

BTW, I still expect crude oil to have an 80 handle before this correction is done but earnings in the energy patch have been great. We’re getting close to a buy point I think.

Earnings season is underway. It is very early but with 21% of S&P 500 companies reporting so far, 68% have reported earnings better than expected and 65% have reported revenue better than expected. Both of those figures are below the 5-year average (77% for earnings and 69% for revenue). And the margin of the beats (+3.6%) are also less than the 1, 5, and 10-year average. The most interesting fact about earnings so far though is this (from Factset):

To date, the market is rewarding positive earnings surprises and negative earnings surprises more than average. Companies that have reported positive earnings surprises for Q2 2022 have seen an average price increase of +2.2% two days before the earnings release through two days after the earnings release. This percentage increase is above the 5-year average price increase of +0.8% during this same window for companies reporting positive earnings surprises.

Companies that have reported negative earnings surprises for Q2 2022 have seen an average price increase of +2.0% two days before the earnings release through two days after the earnings. This percentage increase is well above the 5-year average price decrease of -2.4% during this same window for companies reporting negative earnings surprises.

That is what happens when sentiment gets too negative.

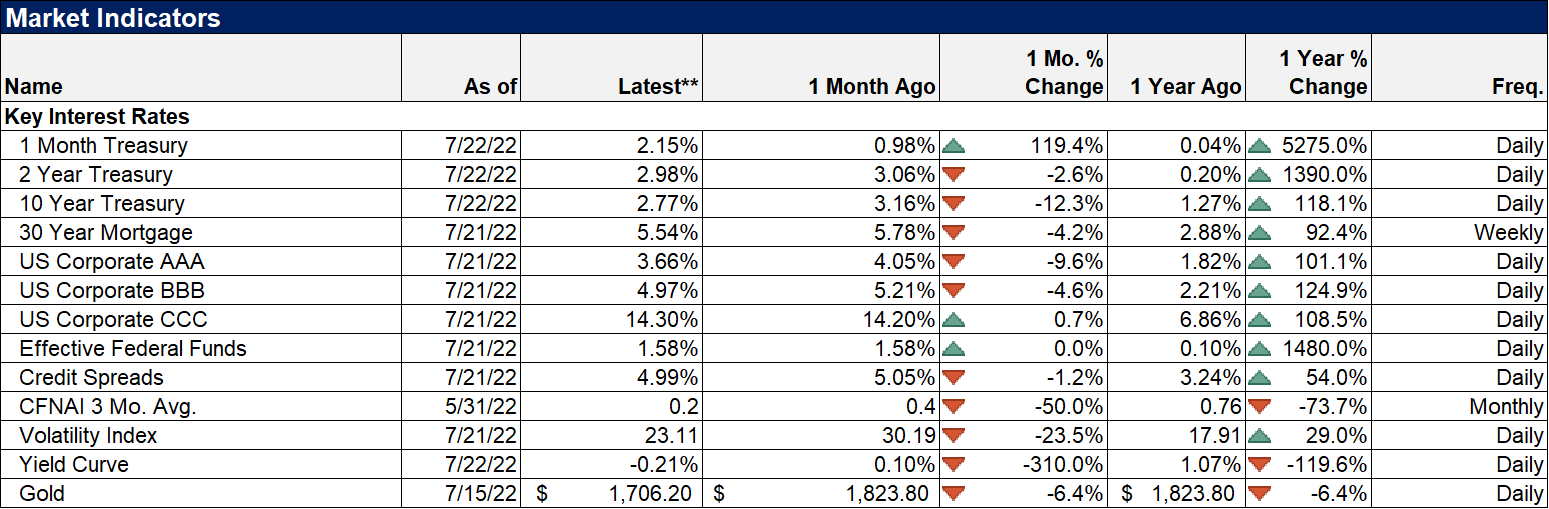

The most interesting movement in these indicators is credit spreads which fell below 5% last week after running up to nearly 6%. Second most interesting is the VIX which continues to trend lower despite everybody and his brother looking for a 40 reading to sound the all clear. Joe’s market maxim #1: The market will always act to frustrate the maximum number of people.

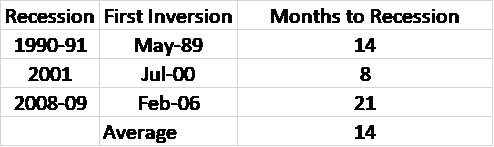

The economic data continues to trend negative but markets have – mostly – stopped responding negatively to negative news. I say mostly because the bond market did react somewhat negatively last week. Bonds rallied on bad economic news just as one would expect. The yield curves shifted down but more importantly, the 10-year/3-month spread narrowed to just 28 basis points. The yield curve inversion is moving to the shorter part of the curve now. That is not unusual, just the way this normally progresses in a business cycle; the longer maturities invert first and as you get closer to recession, the shorter maturities invert. But the inversion is the warning, not the recession signal. In the last three recessions, the curve steepened and turned positive before the onset of recession because short-term rates start to fall as the economy weakens further. Short-term and long-term rates will generally fall together before recession but short-term falls faster, steepening the curve. In the last three recessions, the average time between inversion of the 10-year/3-month curve and the onset of recession is 14 months:

I have called this an unusual economy and market and I stand by that. I don’t know if the yield curve will work exactly as it has in the past. I don’t know if widespread knowledge of it is affecting its shape today or in the future. I will, however, take yield curve inversion seriously and assume it means what it has always meant. But I will not – and have not in the past – tried to anticipate an inversion. They happen when they happen and we adjust. But we aren’t there yet.

I ran across the Camus quote at the beginning of this post recently and it made me think about what it takes to be a contrarian, a true investor in the mold of Howard Marks. I’ve never been much of a Camus fan because I find him depressing; this quote is not, I think, positive. He is saying that even when things are dire when there is no hope, humans will just invent some to make themselves feel better. But that isn’t what being a contrarian is about. It isn’t enough to just buck the consensus; the consensus can be right for long periods of time. You have to wait until the consensus has become conventional wisdom when the future is considered obvious and everyone has already placed their bets on the sure thing. Another Camus quote says it well:

Always go too far, because that’s where you’ll find the truth.

What position is too far today?

More By This Author:

Weekly Market Pulse: Counterintuitive

Weekly Market Pulse: There Is No Certainty In Investing

Weekly Market Pulse: A Most Unusual Economy

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more