Weekly Economic Pulse: A Goldilocks Rate Cut

Image Source: Pexels

The Federal Reserve cut their target for the federal funds rate by 25 basis points last week due to concerns about labor market weakness. Job creation has certainly been weak the last 3 or 4 months but that is largely due to the uncertainty created by the Trump administration’shaphazard implementation of their economic program. Well, not entirely. It is also due to the economic program itself, if you include immigration in that category and I certainly do. Contrary to the administration’s claims, immigration is a net positive for the economy and there is no evidence that immigrants take jobs from American citizens. There may be reasons to limit immigration but economic growth is not one of them. Growth is a function of workforce growth and productivity growth. The Trump economic bet has always been that they can get enough of the latter to offset their stifling of the former. Unfortunately, kicking immigrants out is quick and investing to raise productivity is not. So, the economy has slowed and the Fed, like everyone else, sees this in the economic data, especially the employment data.

The quandary facing the Fed is that we don’t know how much these policy changes will reduce growth and for how long. We also don’t know their impact on prices. Targeted tariffs, such as those used by Trump in his first term, cause relative price changes but the impact of universal tariffs is more difficult to predict, especially when combined with reduced immigration. If the Fed cuts rates due to concerns about growth they could actually create the inflation they fear. If lower immigration has reduced the economy’s capacity for growth – and it certainly has – and the Fed tries to maintain the pre-tariff rate of NGDP growth, it seems likely that the result will be higher inflation. Trying to maintain the same level of growth when the economy’s potential has been reduced would likely result in labor shortages, higher wages, and higher inflation.

Did the Fed do enough last week to avoid recession? Did they do too much so that we’ll get another burst of inflation? Based on the market reaction so far, it seems they got it just about right. Long-term nominal and real interest rates are up modestly since the cut, indicating a small rise in growth expectations. The 10-year Treasury yield is up about 12 basis points and the 10-year TIPS yield is up about the same; inflation expectations are unchanged since the cut. The economy has been growing a little below the long-term trend this year and the market seems to indicate that the Fed’s move will keep it that way.

Environment

(Click on image to enlarge)

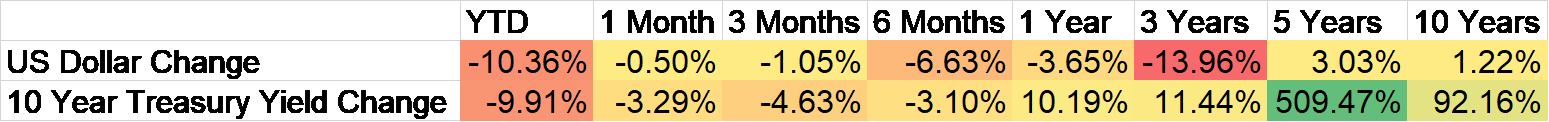

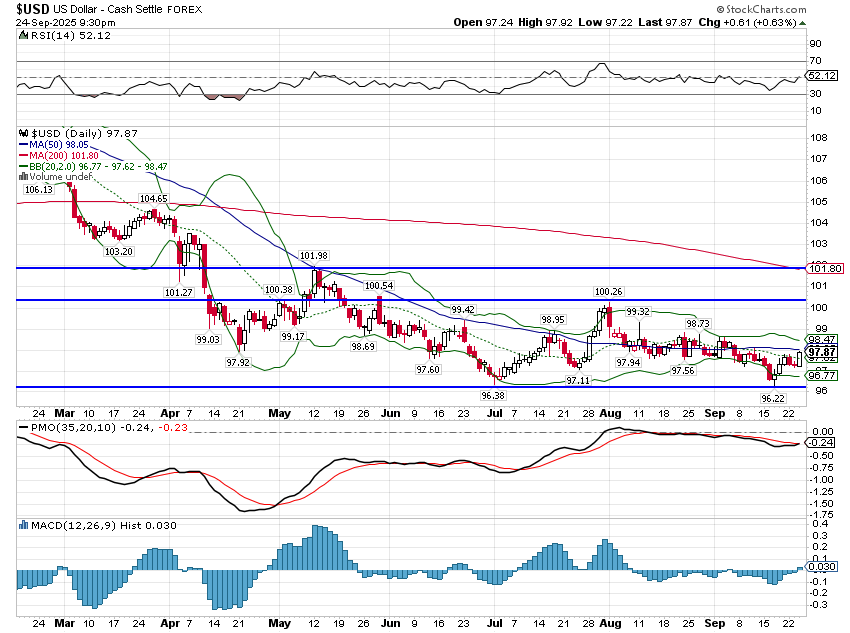

The dollar and interest rates remain in short and intermediate-term downtrends but we may be setting up for a bounce in both. The dollar’s descent has stalled, essentially unchanged since mid-June. We made a new closing low last week but there was no follow through after the rate cut. Given current market positioning and sentiment, a bounce in the buck seems likely. We had an upside probe in late July but it failed quickly. Will this one face the same fate? I don’t know but with basically everyone negative on the dollar, a quick, strong rally seems more likely than not.

(Click on image to enlarge)

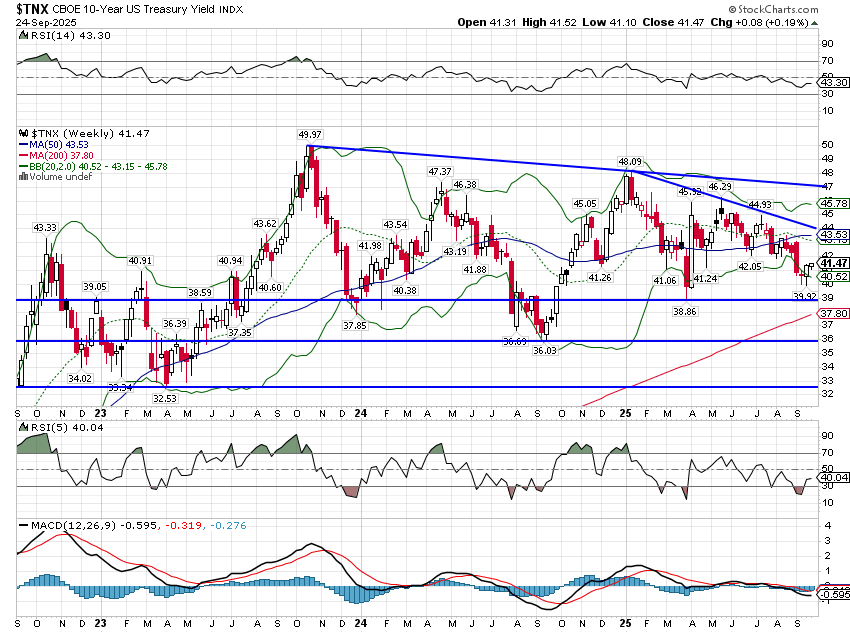

A rally in the dollar would probably coincide with a rise in US interest rates but I don’t think this is like last year’s September rate cut which pushed rates up 120 basis points over the last quarter of the year. The economy is facing more headwinds now and I think investors will need convincing before they bet on a return to trend or above trend growth.

(Click on image to enlarge)

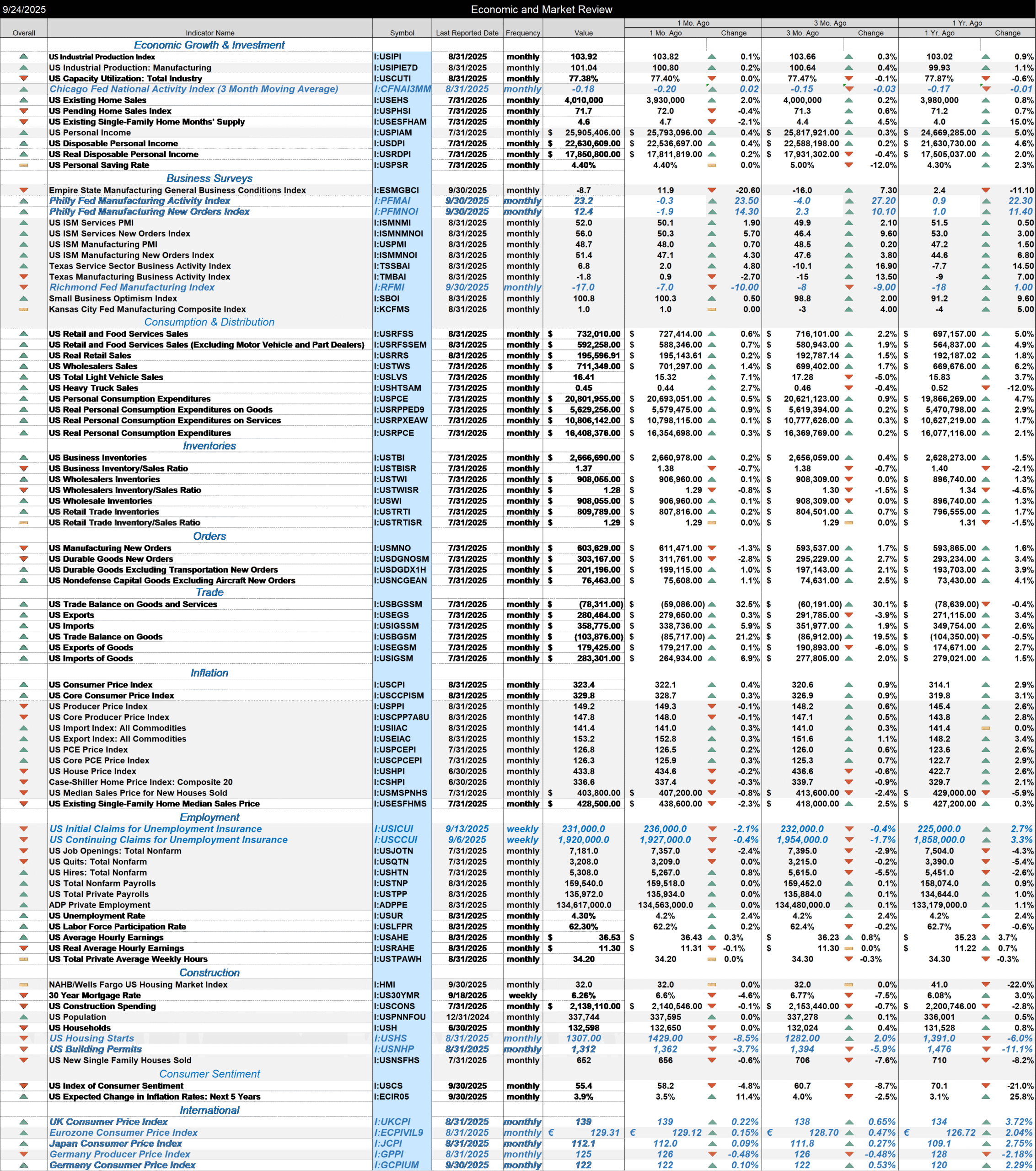

Economy/Market Indicators

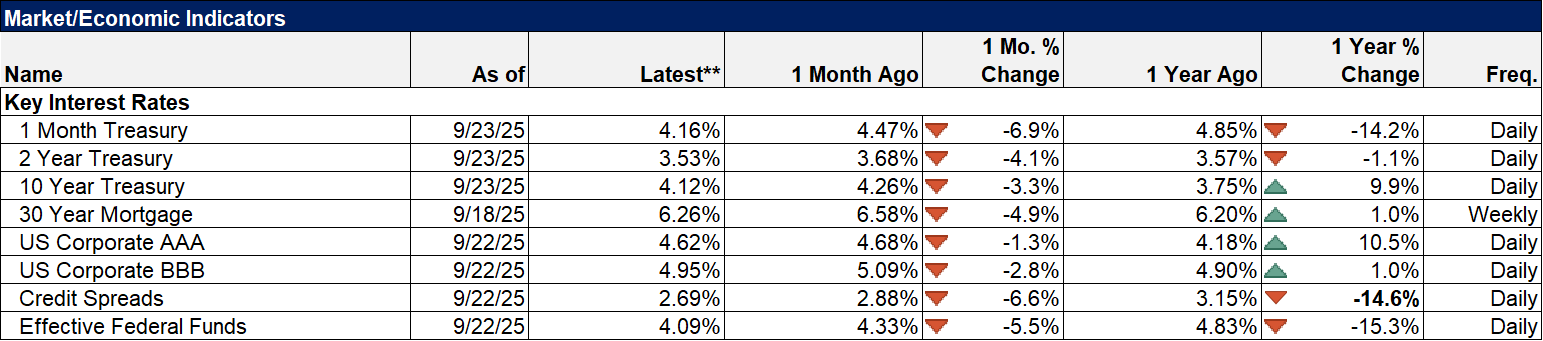

The spike in credit spreads we saw after the reciprocal tariff announcement in early April has been almost entirely erased. The low for this cycle was 2.59% so we’re just 10 basis points away. If the market gets worried about recession, widening spreads will likely be our first warning sign.

(Click on image to enlarge)

Economy/Economic Data

- The Chicago Fed National Activity index improved from -0.28 to -0.12. The 3 month average improved from -0.20 to -0.18. All the sub-indexes (production & income, sales/orders/inventories, employment and personal consumption/housing) are right around the zero level indicating trend growth. We use the 3 month average to smooth out the month to month movements and a reading of -0.18 means growth slightly below trend. In fewer words – nothing has changed.

- The Philly Fed manufacturing survey, unlike last week’s Empire State version, rose strongly. Why Philly is rising and NY isn’t I don’t know.

- The Richmond Fed survey looked more like the NY version last week, dropping from -7 to -17

- Jobless claims fell back to 231k after last week’s Texas weirdness. Companies may not be hiring much but they aren’t firing many either.

- Housing starts and permits were down hard and improvement will only come with an improvement in sales; inventories are getting a little high.

- The inflation data from Europe was generally pretty good, although UK is still quite high at 3.7% year over year. However, the rate of change is slowing and the MPC (UK equivalent of the FOMC) voted to hold rates steady.

(Click on image to enlarge)

More By This Author:

The Economic Hippocratic Oath

Weekly Market Pulse: Nuance Is Subtle

Weekly Market Pulse: The Slowdown Continues

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more