US Inflation: Fiscal Policy Incompatible With Monetary Policy

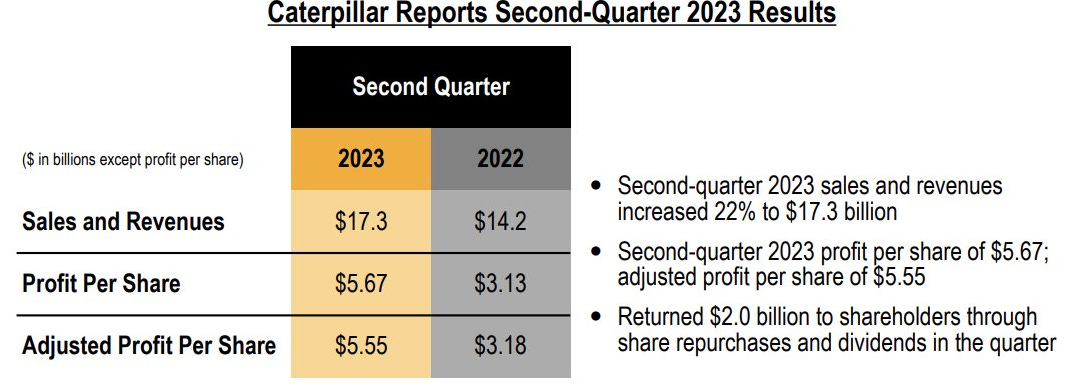

Caterpillar's latest figures still do not confirm that the US is entering a recession. Revenues are up 22%. The company's CEO explains: "The increase was primarily due to higher sales volume and favorable price realization. Our results reflect continued healthy demand as we achieved double-digit top-line growth and record adjusted profit per share while generating strong ME&T free cash flow."

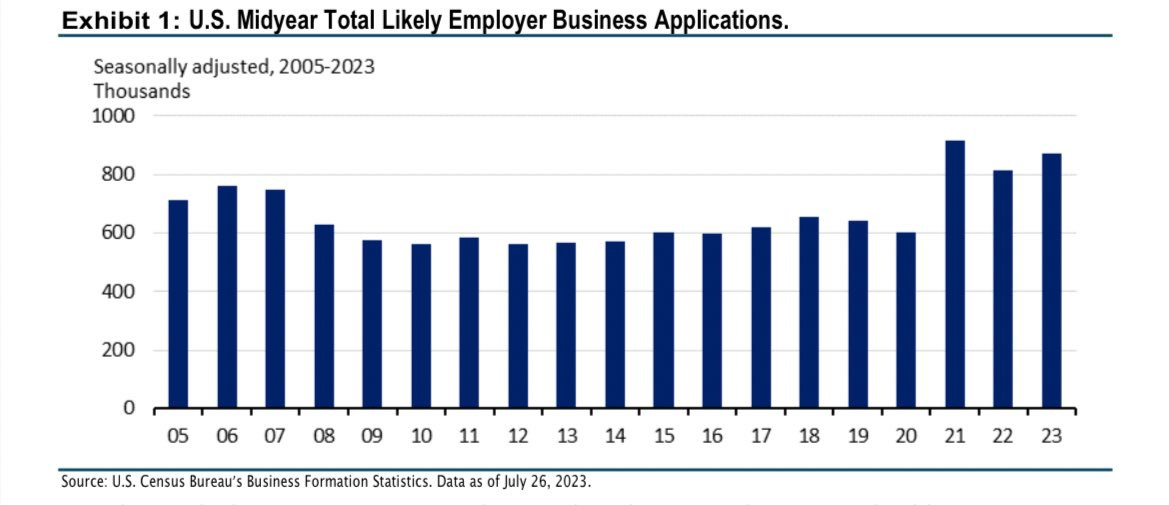

For its part, Bank of America explains that despite fears of a US recession, "the entrepreneurial spirit of the US remains robust and vibrant."

(Click on image to enlarge)

The pace of business applications in the first six months of the year remains at a historically high level.

Better-than-expected retail sales figures for July confirm that the US is still not in recession.

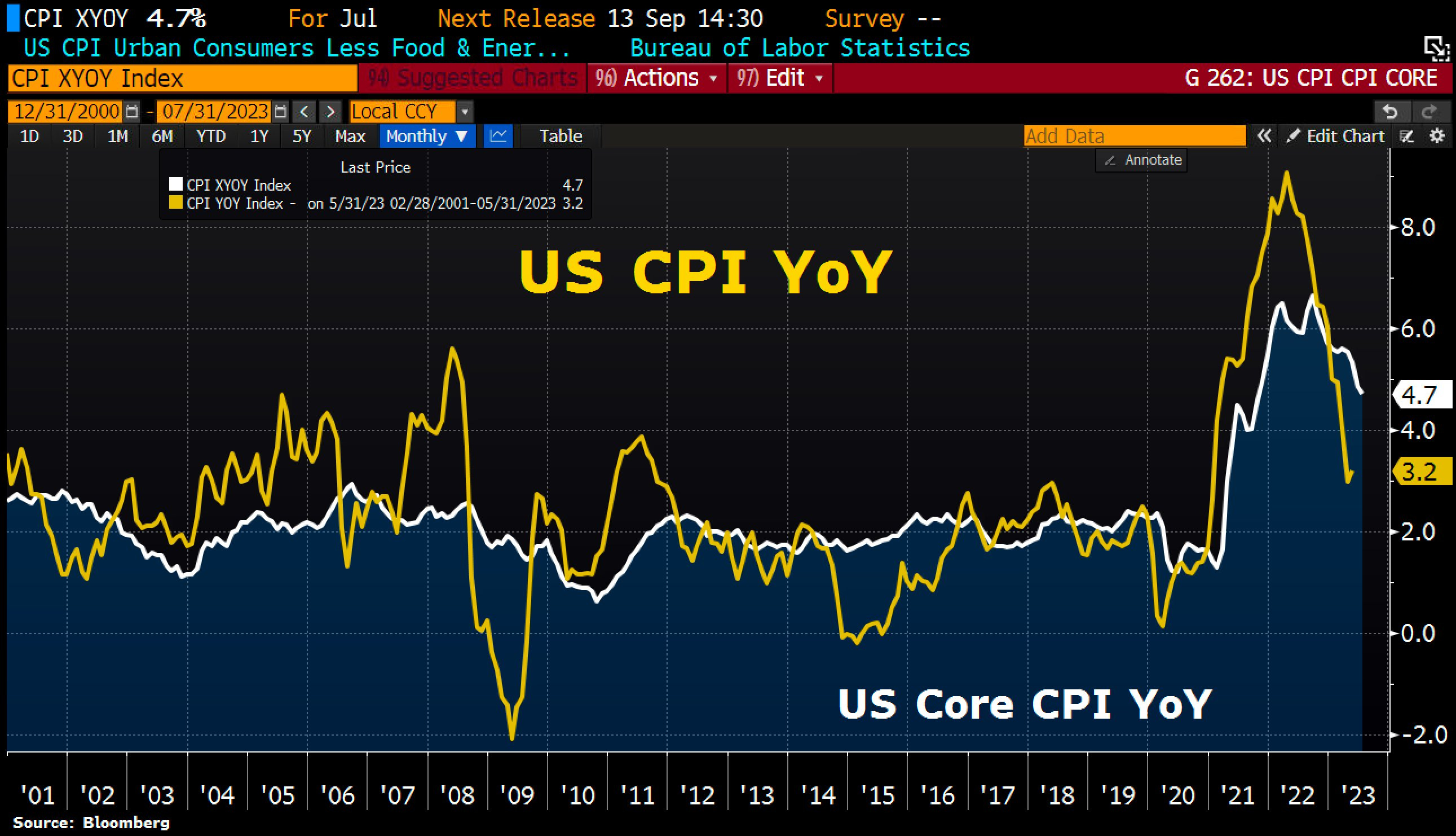

The US economy showed unexpected resilience in the final quarter, and this record activity is undoubtedly behind the upturn in inflation in the country.

The consumer price index (CPI) rose again last month.

The objective of returning to the 2020 level is receding, especially as the CORE CPI remains high:

(Click on image to enlarge)

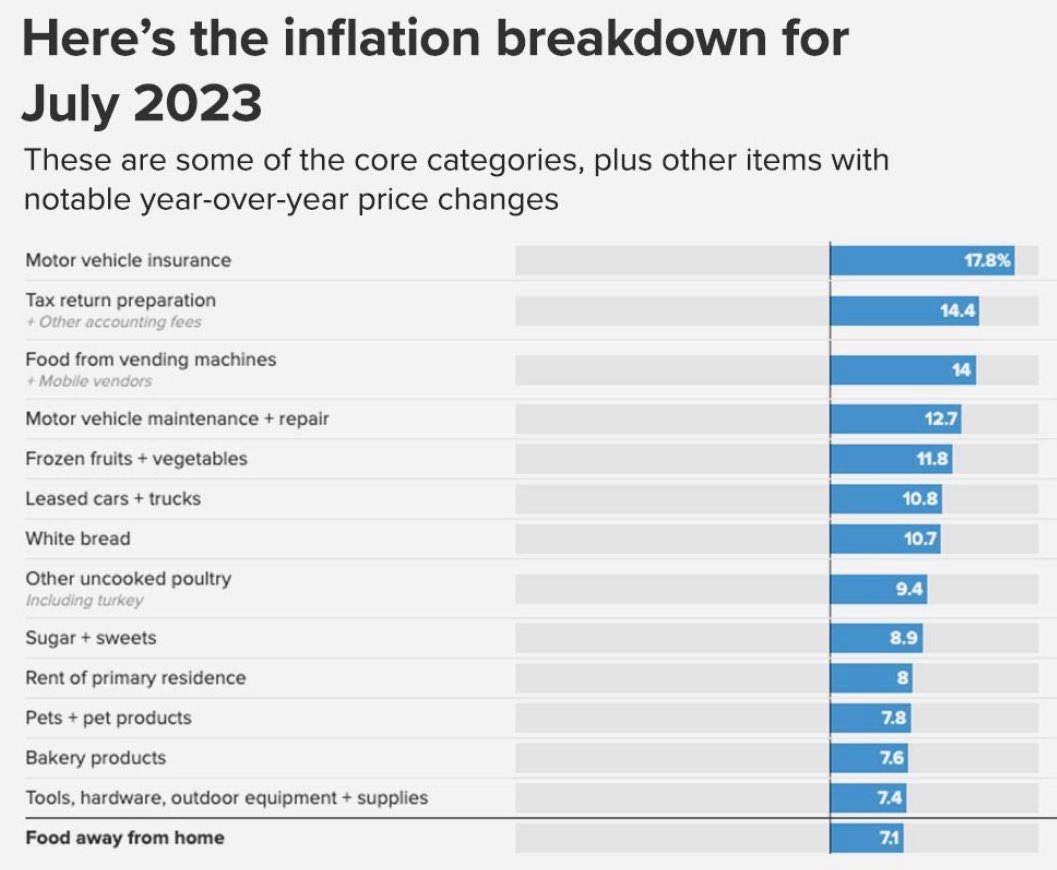

Inflation affects most major consumer spending items, such as housing and food:

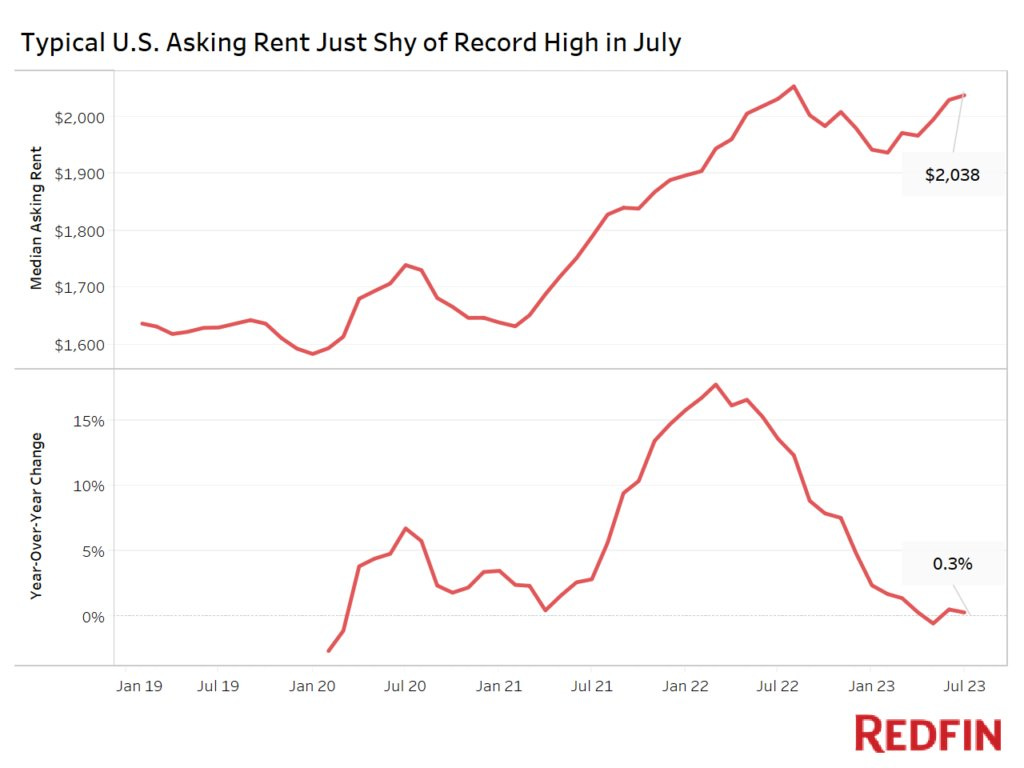

Rents are rising again, to record levels:

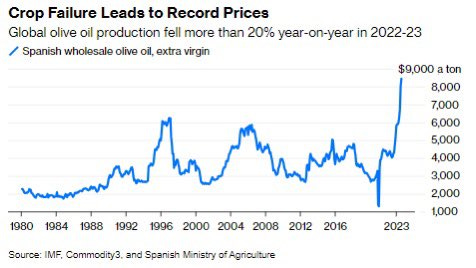

Some agricultural markets are on a spectacular upswing, boosted by the unpredictable weather this summer.

Olive oil prices are at an all-time high due to a drop in production in many Mediterranean countries:

Orange juice prices also hit an all-time high after devastating storms in Florida:

US consumption is supported by the use of credit.

The economy is also spurred by Joe Biden's stimulus plan.

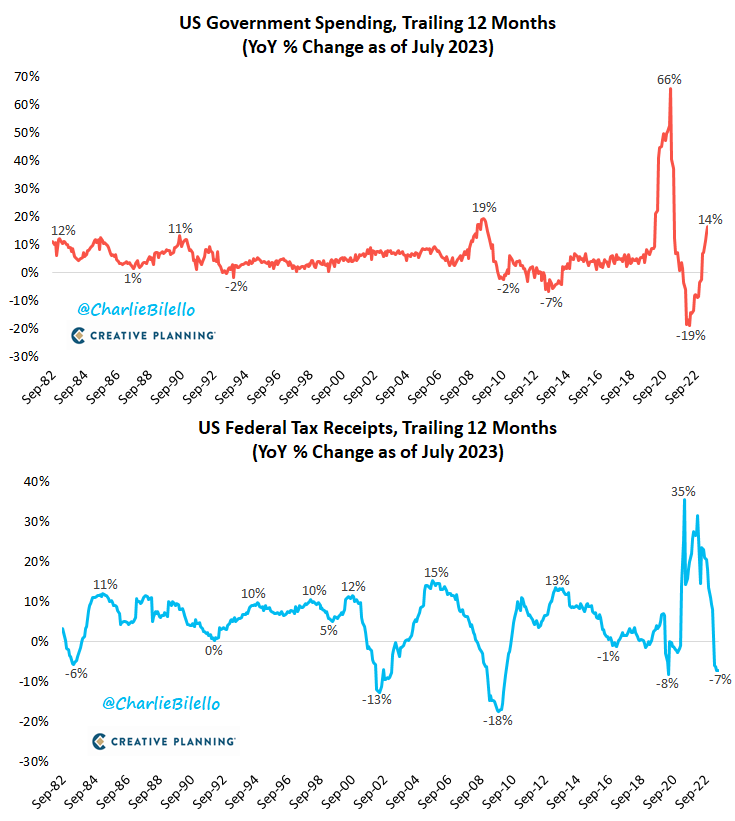

The recovery in public spending was largely underestimated by those who predicted a more significant fall in inflation:

(Click on image to enlarge)

This upturn in public spending comes at a time when Treasury revenues are in sharp decline.

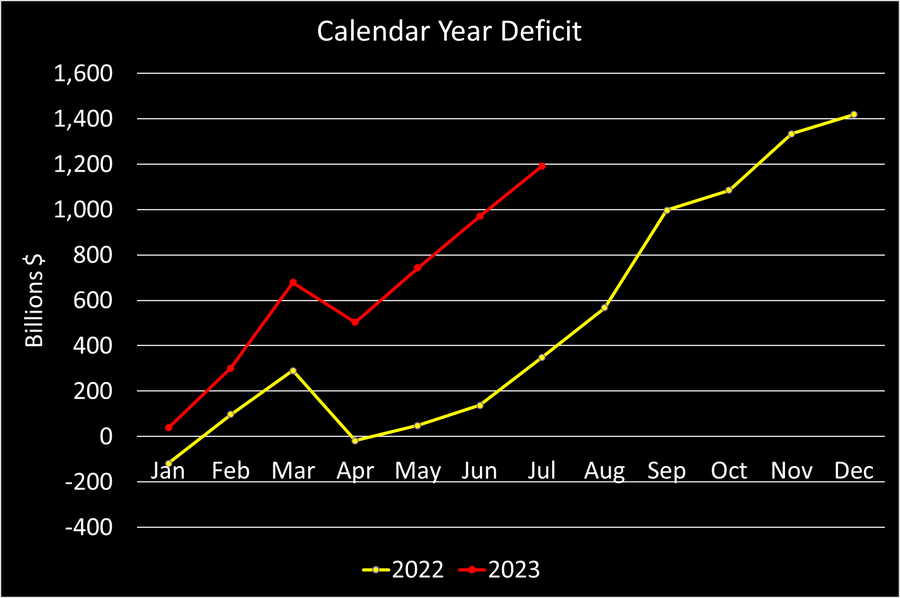

The US federal deficit is widening at an historic pace.

In the first seven months of 2023 alone, the deficit reached $1.2 trillion, an increase of 242% compared with 2022:

The Treasury is spending without limit to support the economy and avoid a recession, without worrying about the impact on inflation.

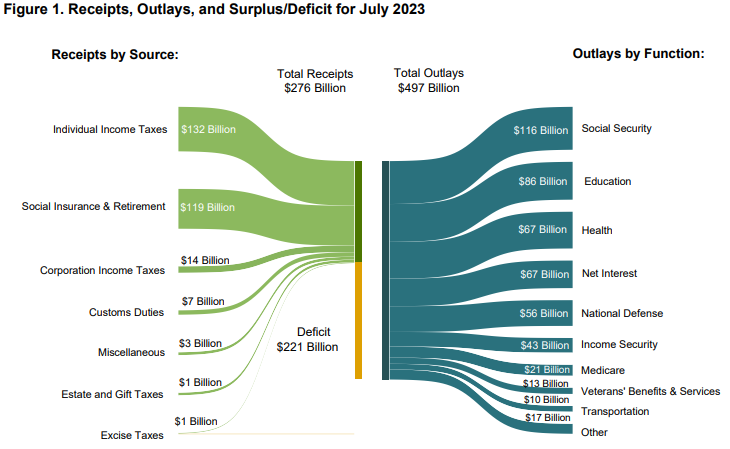

As of July, the government's coffers were $221 billion short of the gigantic gap between receipts and outlays:

(Click on image to enlarge)

US fiscal policy is incompatible with current monetary policy, whose primary objective is to bring down inflation.

This incompatibility between fiscal and monetary policy is also the reason for gold's resilience, despite the recent explosion in interest rates and the dollar's rise against the yen:

(Click on image to enlarge)

The yen has returned to its October 2022 lows, at a time when gold was reaching $1,600.

US interest rates are back to their highs:

(Click on image to enlarge)

Despite the yen's weakness and rising interest rates, the gold price is holding steady at around $1,900:

(Click on image to enlarge)

More By This Author:

The Dollar Falls, Gold Rises

Oil & Copper Point the Way for Higher Inflation (And Gold Price)

Return Of Stress On Liquidity And In The Banking Sector

Disclosure: GoldBroker.com, all rights reserved.