US Dollar May Stay In A Correction After The US CPI Inflation Report

Image Source: Pixabay

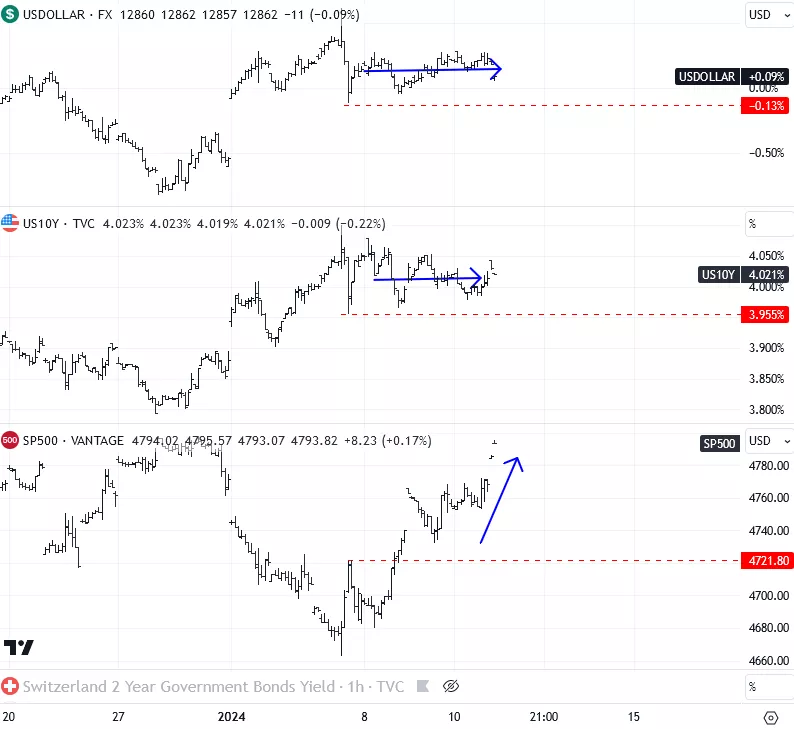

It's going to be an important day for the FX markets which have been sideways for the whole week now as traders are waiting on important US inflation data, which will be interesting to see after strong jobs data last Friday, which signaled that maybe there was too much speculation for FED cuts. So if today's inflation comes strong, above 3.2% (expectations are 3.2 from 3.1), then I think USD will rally as we will have another indication and FED is definitely not going to cut rates. BTW inflation target of 2% is still far away. Data below 3.2, let's say around 3%, will likely keep the dollar sideways or even bearish with the dollar index dropping towards 101-101.40.

Now, from an Elliott wave perspective, we are seeing ongoing recovery after that five waves up, so more upside can be seen after wave B. Also, it's worth mentioning that higher stocks from the last few days are not confirmed by the US dollar and US yields when comparing all three of them.

More By This Author:

GBP/AUD Steps In A Temporary Corrective Recovery

BTCUSD Is Pointing Higher After A Correction

EUR/JPY Slows Down For A Higher Degree Correction

For more analysis visit us at www.wavetraders.com and make sure to follow us on Twitter (https://twitter.com/GregaHorvatFX)