Ugly 5Y Auction Tails Amid Faltering Demand

Image Source: Pixabay

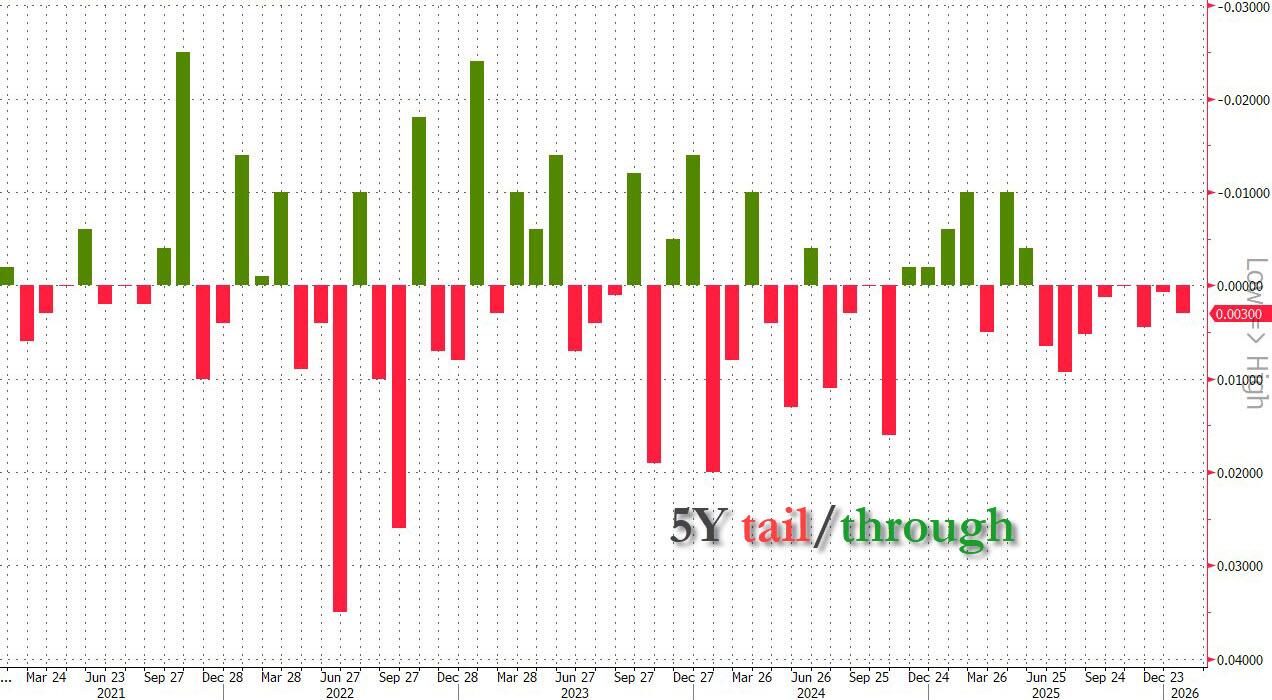

If yesterday's 2Y auction was stellar, today's 5Y sale was the opposite.

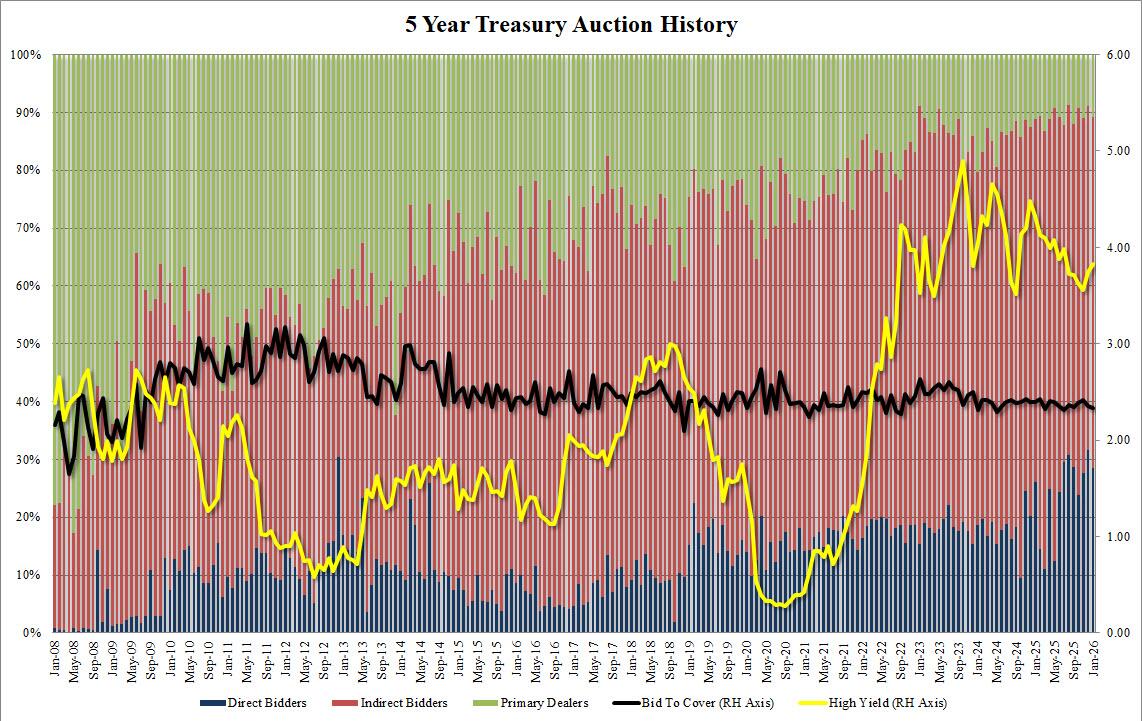

Just after 1pm, the US completed the sale of $70BN in 5Y paper at a high yield of 3.823%, up from 3.747% one month ago and the highest since July. It also tailed the When Issued 3.820% by 0.3bps, the 7th tail in the last 8 auctions.

The bid to cover of 2.34 was essentially unchanged from last month's 2.35 and just below the six auction average of 2.36.

The internals were also on the soft side: Indirects were awarded 60.7%, up from 59.5% but below the recent average of 61.0%; and with Directs right in line with expectations (28.5% vs 28.7% recent average), Dealers were left with 10.8%, up modestly from 8.8% last month and also just above the recent average of 10.4%.

Overall, this was an ugly auction, yet the market reception was just modestly chilly at best, with 10Y yields barely moving after the break. After all, the market has the Fed to worry about tomorrow, a far biggest catalyst.

More By This Author:

GM Shares Surge 7% After Surpassing Q4 Estimates, Raising Guidance, Planning $6B Stock Buyback

US Home Prices Surged In November As Mortgage Rates Tumble

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%