GM Shares Surge 7% After Surpassing Q4 Estimates, Raising Guidance, Planning $6B Stock Buyback

Image Source: Pixabay

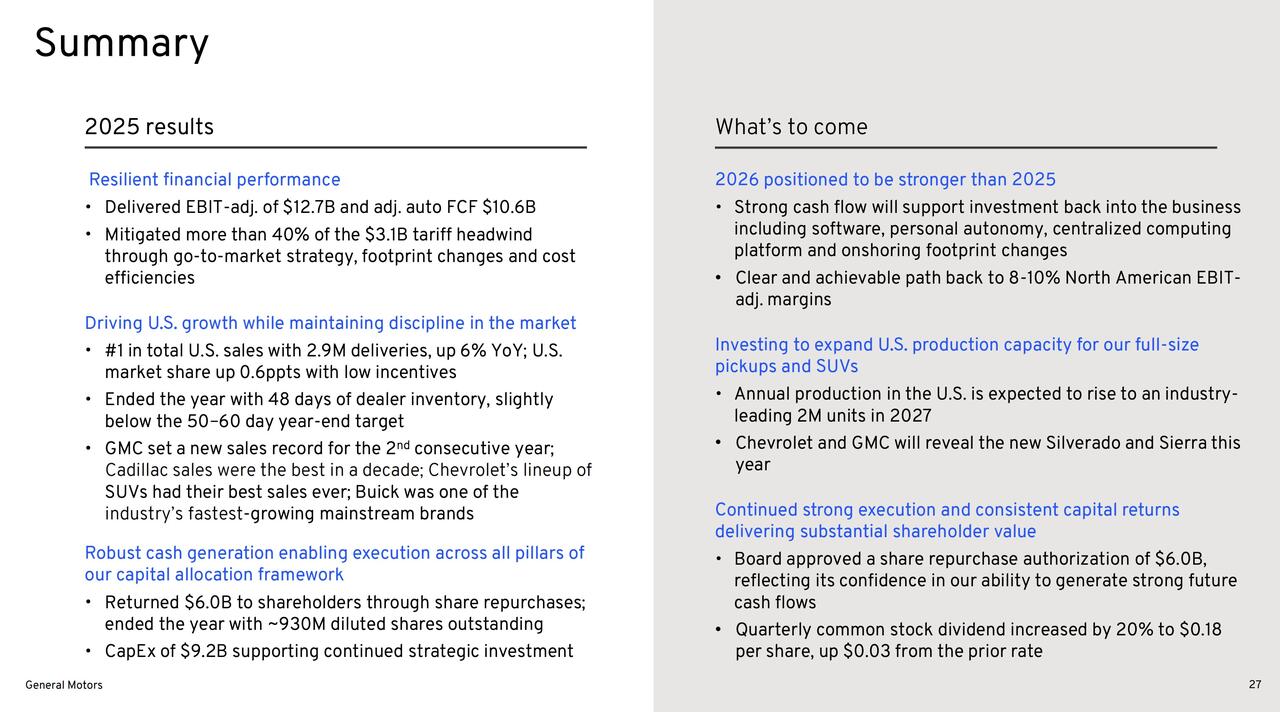

General Motors (GM) exceeded Wall Street’s fourth-quarter earnings expectations and forecast another year of “strong financial performance” in 2026. While revenue fell slightly short, the company announced a 20% dividend increase and a new $6 billion stock buyback program, according to CNBC and GM.

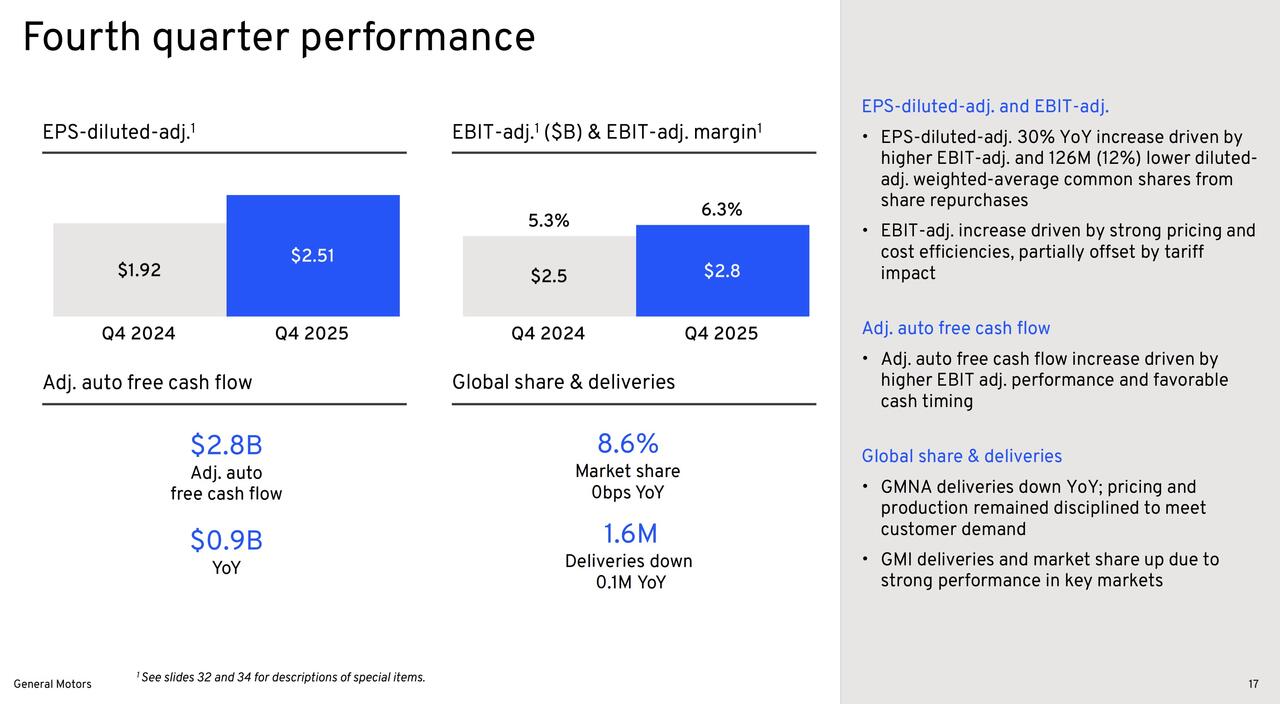

GM reported adjusted earnings per share of $2.51, beating estimates of $2.20, though revenue of $45.29 billion missed expectations.

Shares rose about 7% in early trading.

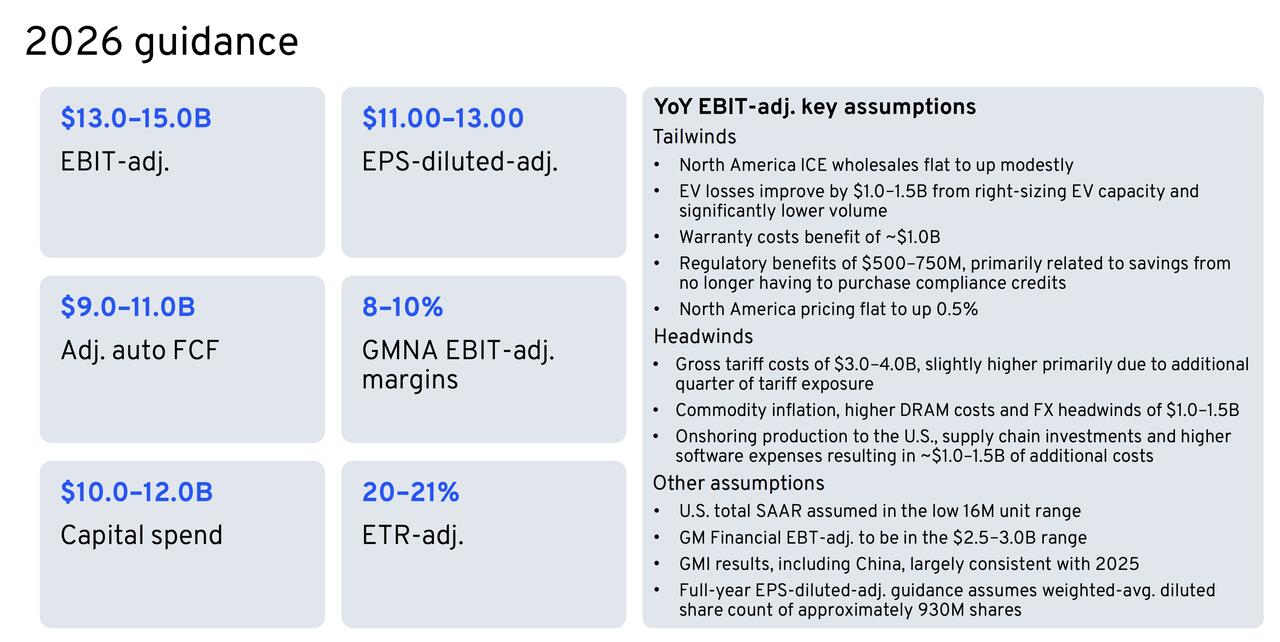

For 2026, GM projects net income of $10.3 billion to $11.7 billion, adjusted EBIT of $13 billion to $15 billion, and earnings per share between $11 and $13. These forecasts reflect continued investment of $10 billion to $12 billion as the company reevaluates its shift toward electric vehicles.

CEO Mary Barra said GM expects North American profit margins of 8% to 10% this year, up from 6.8% in 2025. She added that GM remains “in a strong position to return capital to shareholders.”

In 2025, GM posted net income of $2.7 billion and adjusted EBIT of $12.7 billion, both down sharply from 2024. Revenue fell 1.3% to $185.02 billion.

The company reported a fourth-quarter net loss of $3.3 billion, driven largely by more than $7.2 billion in special charges tied to EV cutbacks, legal issues, restructuring in China, and the shutdown of Cruise.

Barra said GM’s smaller Detroit headquarters is expected to save “hundreds of millions of dollars” each year.

The report says that the new buyback and dividend increase to 18 cents per share continue GM’s effort to reduce shares outstanding, which fell to 904 million at the end of 2025.

North America remained GM’s strongest region, though profits declined 28.1% to $10.45 billion. International operations improved, while losses in China narrowed.

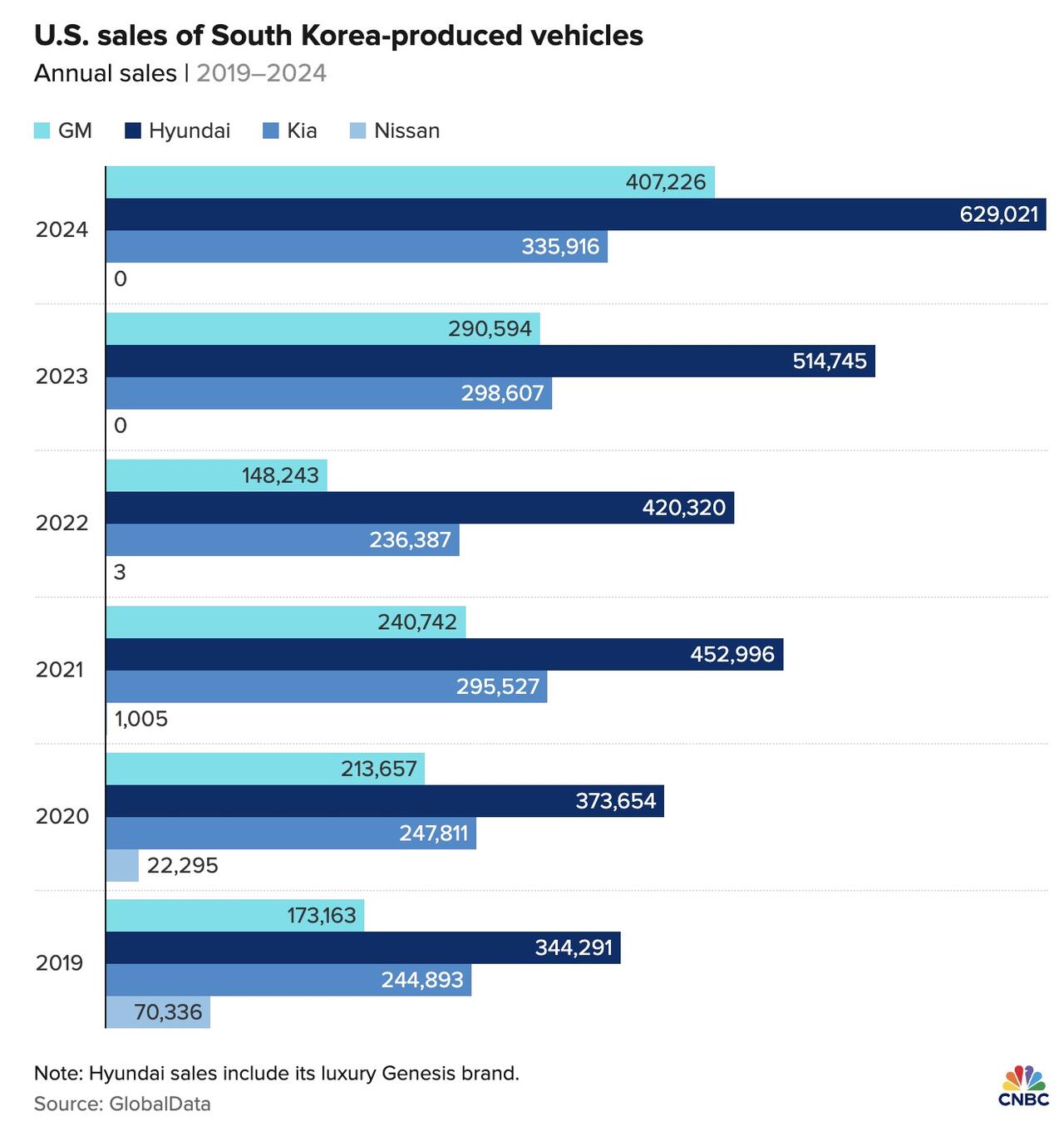

CFO Paul Jacobson said U.S. tariffs cost GM $3.1 billion in 2025. Barra said the company is “hopeful” the U.S. and South Korea will finalize a trade deal with a 15% tariff, warning that higher tariffs could hurt costs.

“We’re really encouraging the countries to get the trade deal done,” Barra said.

GM continues to rely on South Korea for entry-level vehicles such as the Chevrolet Trax and Buick Envista, making trade policy a key issue for its future performance.

More By This Author:

US Home Prices Surged In November As Mortgage Rates TumbleWinter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Booz Allen Shares Hammered After Treasury Cancels Consulting Contracts