Ugly 30Y Auction Tails For First Time Since November, Lowest Foreign Demand Of 2024

Image Source: Pixabay

After two consecutive ugly auctions (and in the case of yesterday's 10Y reopening, very ugly), moments ago the Treasury completed the week's coupon issuance when, on the day when the BLS published a doctored PPI report to boost market sentiment, it sold $22 billion in 30Y paper in what was yet another ugly auction.

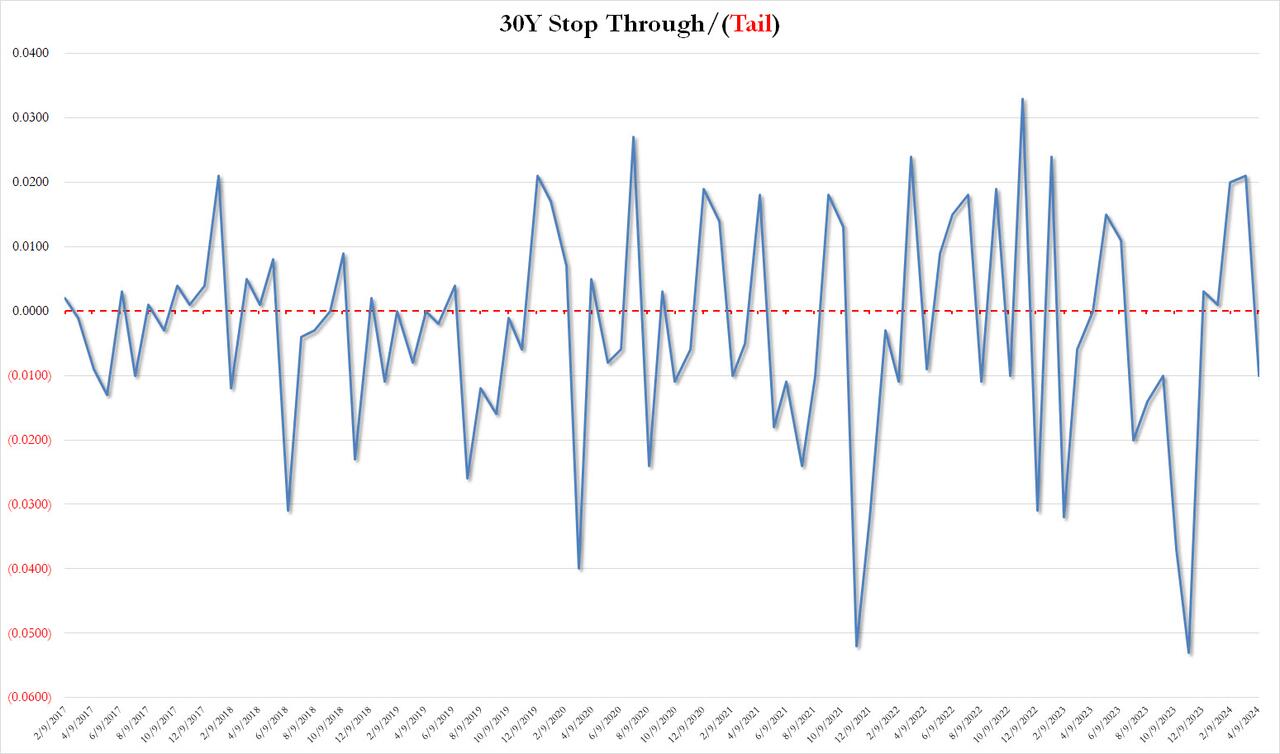

The high yield on today's sale stopped at 4.671%, higher than last month's 4.331% by 34 bps and also tailing the When Issued 4.661% by 1 basis point, the first tail for the 30Y tenor since last November.

(Click on image to enlarge)

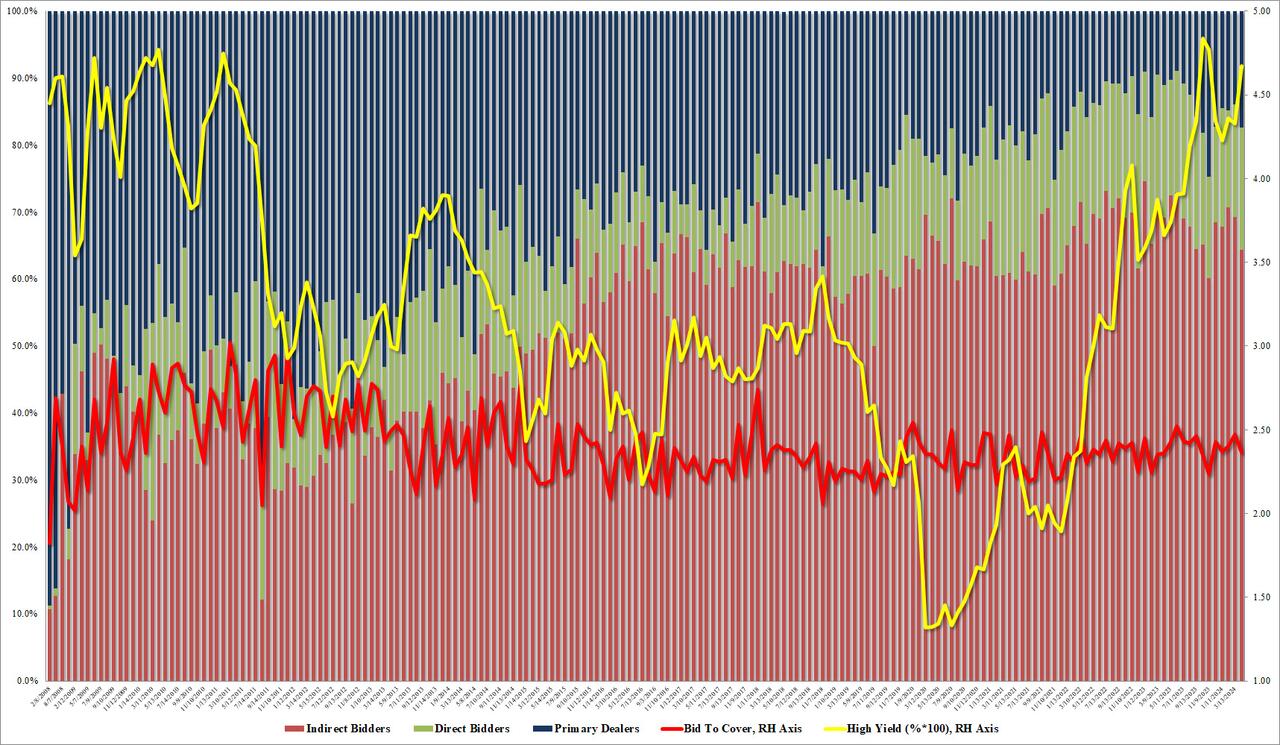

The bid to cover dropped from 2.472 in March to 2.367, the lowest since November, and obviously below the 6-auction average of 2.37.

The internals were ago ugly as Indirects slid to 64.4% from 69.3%, which was the lowest since November. And with Directs awarded 18.3%, up from 16.8% last month, Dealers were left holding 17.3%, the most since November.

(Click on image to enlarge)

And even though the auction was ugly top to bottom, what is surprising is that so shellshocked was the market by the recent inflation data and yesterday's catastrophic 10Y auction, that yields actually dipped despite the auction effectively disappointing on every vertical, with 10Y yields dropping a bp to 4.56% from 4.57%.

More By This Author:

Producer Prices Rose At Fastest Pace In A Year In March

Goldman Is "Taking Profits On Tech & Moving To Other Sectors"

Pump-Prices Surge To 6-Month Highs Ahead Of CPI, Crude Inventories See Another Build

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more