Treasury Sells A Record $44BN In 3Y Notes To Solid Buyside Demand

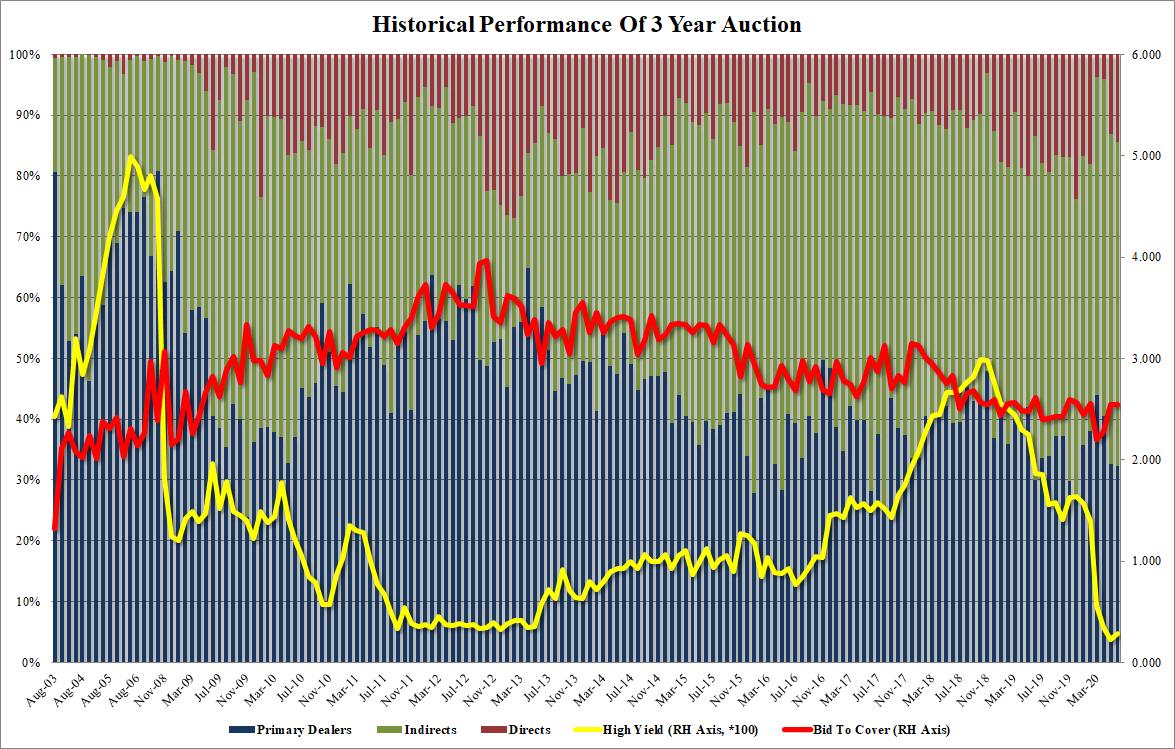

After last month's 3Y Treasury auction priced at an all-time low yield, moments ago today's sale of three-year paper stopped at 0.280%, higher than last month's record of 0.23% - and also 0.3bps through the When Issued 0.283%. And while the yield ticked up modestly, so did the auction size, which rose from $42BN last month to a new all-time high of $44BN, as the Treasury rushes to fund the trillions in fiscal deficits that the US will incur in the coming years.

(Click on image to enlarge)

Despite the record auction size, demand was solid: bid to cover was virtually unchanged from last month at 2.55, and above the six auction average of 2.43; total bids were $112.6BN, sharply higher than the $101.6BN in bids tendered for the previous 6 auctions.

The internals were also impressive, with Indirects taking down 53.3%, down slightly from 54.4% last month but also above the 6-auction average of 50.4. Directs rose again, taking down 14.5%, the highest since February's 18.1% (above the average of 13.2), leaving Dealers 32.2% of the auction (slightly below the 36.3% average), which they will seek to promptly sell back to the Fed.

(Click on image to enlarge)

Overall, a solid auction, even if this was largely to be expected as the near-end now trades as if Yield Curve Control has already been launched.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

That is good news given we are minting more and more greenbacks every day.

Good news. But also expected, yes?

Sadly yes, the Republicans have given up fiscal conservatism and are now as bad or worse than the Democrats. The strong demand is caused by the US dollar safe haven buying by foreign governments and individuals, so that is somewhat expected in a time of crisis as well.

We will see how it does if Trump decides to launch a bigger trade dispute with China to lock in his weak economy into the election. His pull out of Germany looks more like fulfilling a promise to Putin than it looks like a move to make America great again. It obviously makes the US weaker and less nimble.

Yes, quite upsetting.