Treasuries Slide After Ugly, Tailing 20Y Auction

After last week's dismal 30Y auction, which we said "bombed" due to a surprising lack of investor demand and significantly repriced the bond market sending yields sharply higher, bond traders were cautiously looking forward to the results from today's 20Y auction, the 4th since the tenor was relaunched in May. And just like last week, it wasn't pretty.

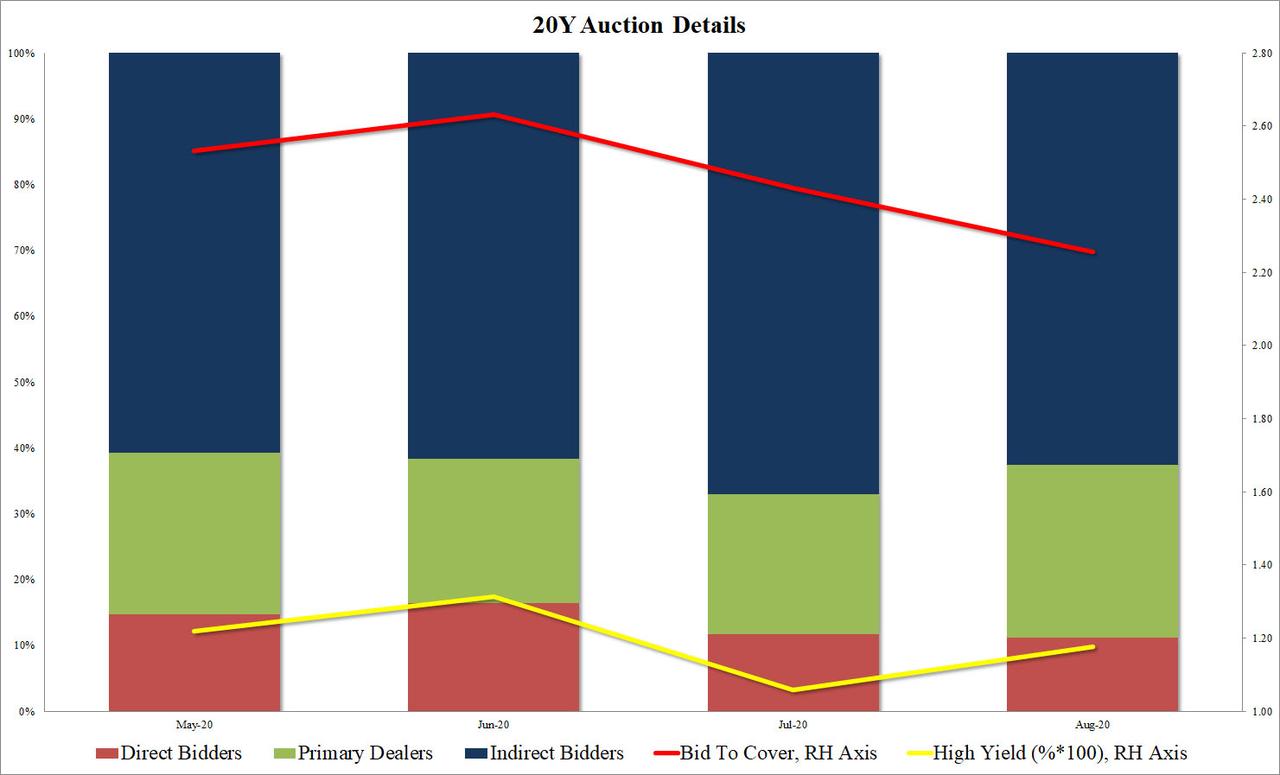

The sale of $25BN in 20Y bonds priced at a high yield of 1.185%, well above July's 1.06%, and tailing the When Issued 1.176% by 0.9bps.

The bid to cover was just as ugly, sliding to 2.26 from 2.43 last month and the lowest of all 20Y auction since the May resumption.

Lastly, the internals were also ugly, with the Indirect takedown sliding to just 62.6%, well below last month's 67.0% if better than the foreign demand in May and June. And with Directs ending up with 11.2% of the auction, Dealers were left with 26.2%- the highest allottment so far.

(Click on image to enlarge)

Bottom line: while not as ugly as last week's disappointing 30Y, today's 20Y left a lot to be desired, and the yield quickly spiked to session highs across the long-end of the curve, even if it has since regained much of the losses. That said, the 10Y is now back to where it was before last week's 30Y auction so bond investors appear willing to forgive and forget, for now.

(Click on image to enlarge)

It's not surprising with Presidential elections looming and the current administration blowing money like small business money on big business and trying to write Executive orders that reallocate money to be spend on other things without Congressional approval. With such powers Presidents will be able to blow future money in ways no one dreamed possible (like take money from the military and spend it on construction, oops Trump already tried doing it for the border wall. Like spending hallmarked money on social programs, Trump is already attempting to do that, like undermining State sovereignty and forcing States to spend their money, Trump again). This needs to be stopped. If he can't get Congress to make a deal he is SOL just like Constitutionally he should be, especially if its his own party for not submitting their proposal in the Senate months after the House submitted theirs.

Yes rates will rise, and there is no one to blame than the Presidents own antics in an election year.