Three Things – Weekend Reading: Saturday, Sept. 21

Image Source: Pexels

Here is a brief look at some of the things I am thinking about this weekend.

1) Are Short-term Rates Forecasting a Recession?

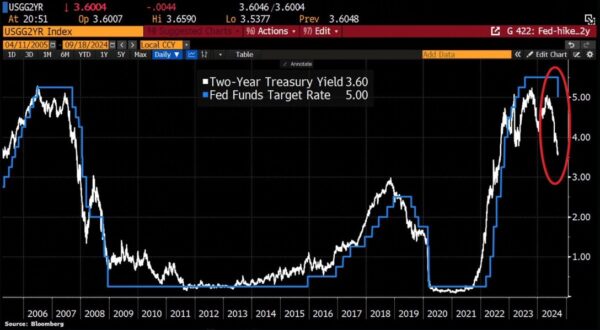

Here’s a chart that’s been floating around a lot, and I think it communicates a very common myth about how the bond market works. The chart shows the 2-year note vs. the Fed Funds Rate.

Now, if you looked at this chart throughout history, you might be inclined to think that the 2-year typically leads the FFR. And, in many cases, it looks like the 2-year is forecasting something like a recession. For instance, in 2008, the 2-year was cratering even when the FFR remained relatively elevated. So, what is really going on here?

I like to think of the government yield curve as a person walking a dog on a leash. At the handle is the FFR, and the collar is the 30-year bond. The Fed is the dog walker, and they have absolute control over the FFR because they’re the reserve monopolist. The bond market cannot set overnight rates for the Fed, but the rest of the leash is also relatively controlled by the Fed.

Even the 30-year is taking cues from where the Fed wants to go, just like the dog on a leash. Yes, the Fed lets the dog dictate some movement, but the walker has more control than it might appear. In fact, if the Fed wanted to pull that leash all the way in and grab the dog's neck, they absolutely could. This is called yield curve control, and the Fed could absolutely set the entire curve if they really wanted to.

I’ve regularly argued that one reason QE isn’t that effective is because the Fed doesn’t do this. Instead, QE is a quantity tool where they set the quantity of reserves and let the price float. If, on the other hand, the Fed implemented QE by setting the price of a 10-year note, they’d be able to more directly influence the economy via QE.

As it pertains to the 2-year, the Fed is much more influential than it might appear. I like to think of the 2-year note as the bond market’s best guess about where the FFR will average over the next two years. For instance, the current 2-year note yield of 3.6% is very close to the average of the current FFR (4.8%) and the Fed’s two-year projection of the FFR (3%). So, the Fed is letting the dog take the leash to where they’ve projected.

In other words, it might look like the 2-year is leading the FFR, but the 2-year is just going to where the Fed has said it should go. So, think of it like this – the Fed has 100% control of the FFR, 80% control of the 2-year, and something like 50% control of the 30-year.

The further out you go on the leash, the more the Fed lets the dog wander and send signals back to the Fed -- but don’t mistake this for the dog walker lacking any control, and certainly don’t mistake it for the dog leading the walker. It’s not that simple.

2) Nobody Knows Nothing – Bond Edition

Here’s an incredible chart of the value of global bonds reaching a new all-time high. Remember back in 2022 when nearly everyone was saying 60/40 is dead because the 40% bond piece is dead? It’s amazing how these narratives repeat themselves like clockwork.

When rates were at 0%, investors convinced themselves that rates would never rise. Then, as soon as the Fed starts raising rates, bond prices fall, and all we heard was that interest rates (and inflation) would spiral higher out of control. We were told that a 60/40 portfolio was dead at the exact moment when it was looking more attractive than ever.

Year-to-date, the bond aggregate index is up 4.77% with a standard deviation of just 5.6%. Any time you’re getting a return that is close to the standard deviation, you know you’re getting a pretty good risk-adjusted return.

And the good news is that this period of strong performance is unlikely to end any time soon because the Fed is clearly beginning a rate cut cycle, inflation is showing no signs of a resurgence, and the yield on something like the aggregate bond index is still a very attractive 4%. So, don’t let people scare you out of bonds these days. This is not the time to be scared about bonds.

Of course, it does depend on how you take bond market risk. If you’re buying high yield bonds (which are stocks in costume) or super long duration bonds, then you’re taking a very different kind of risk than something like a 5-year T-Note or an aggregate bond index.

As I often note, a lot of this just depends on your duration profile -- and I am a big advocate of matching assets with specific liabilities depending on a specific financial plan. But, on average, the bond market hasn’t looked this attractive in a long time.

3) We Don’t Build Anything Anymore (Not)

Every few months, I see an online meme about how we don’t build anything anymore. The meme usually shows an old Medieval church or something. The general narrative is that we used to make buildings of marble, carved into beautifully designed structures, and now we just build these drab boxes and shove people into them. I don’t get this mentality. When I built my house, I was consistently mind-blown by how advanced the materials are versus the stuff we removed.

For instance, I ripped off thousands of square feet of old wood siding and replaced it with fiber cement board that weighs 75 pounds per sheet. The exterior of my home is noncombustible, waterproof, and virtually bulletproof. And that’s not even a good example.

Modern architects build structures that are thousands of feet tall made out of glass. The buildings are mind-blowing in their complexity, beauty, and sheer magnificence. Or what about something like the International Space Station? We built a structure the size of a football field made out of ceramics, Kevlar, and aluminum alloy, slammed a bunch of solar panels on it, installed plumbing and a water recovery system, and now it just floats around the Earth for people to go live on.

Do you realize how unbelievable that is? We don’t just build amazing stuff these days, I’d argue humans are building the most amazing stuff we’ve ever built.

Anyhow, I have this macro theory that modern humans are increasingly bored and nostalgic for old times. We increasingly lack purpose, which makes us feel virtually nihilistic, which leads to a lack of accountability and a degree of apathy about the fact that it’s never been a better time to be a human being.

P.S. Doctor Peter Attia got me obsessed with building core and leg strength, as he claims it’s an essential aspect of longevity. Last week, I jokingly wrote that if the Fed goes for 25 bps, you need to have a leg day, and if the Fed goes 50 bps, you once again need exercise your legs. Lo and behold, the next day, we get a video of Fed Governor Christopher Waller doing exactly that. It’s going to be hard to criticize the Fed if they keep this up.

More By This Author:

Three Things – The Fed Goes 50!!!!!

25 Or 50?

Yes, You Can Eat Risk Adjusted Returns

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more