25 Or 50?

The big question of the week is 25 or 50? No, we’re not talking about the age of Leonardo DiCaprio’s next girlfriend (obviously 25). We don’t have time to think about about girlfriends (or boyfriends) because we’re too busy thinking about Federal Reserve policy and whether they’ll go 25bps or 50bps at the next FOMC meeting.

As I’ve noted in the past I think they should have cut in July and I think they actually regret having not cut in July so there’s a pretty reasonable argument that they should cut 50bps just to make up for the mistake. That’s what I would do if I were Supreme Leader of the Fed and I’d frame it very specifically as a catch-up rather than an emergency, but I don’t think they’ll do that. I think they’ll go 25 bps. Let me explain why.

1) 50 bps could cause some concern. Yes, they could cut 50 bps and frame it like I did above where the Fed comes out and clearly says “we are cutting 50 bps due to the elongated meeting schedule and to catch up on recent economic slowness, however, we are NOT, we repeat, NOT cutting due to an emergency or extenuating circumstances.” This wouldn’t go over well. It’s basically admitting that they made a mistake in July and that they’re now behind the curve. Which they are, but they can’t admit that without potentially causing some unnecessary worries. So I don’t think they can do this because pessimistic animal spirits could make investors believe that the Fed knows something evil lurks under the hood.

2) The economy is strong. Enough. There’s no doubt that the labor market is softening. It has been for over a year and I’ve explained in detail how the underlying data told that story despite what the headline story said. But even the headline data is softening materially. That said, it’s not softening so much that the Fed needs to panic. Last week’s payroll report showed all the consistent under-the-hood weakness in temporary employment, long-term employment, etc, but the headline was at 140K – not great, but not terrible. Hourly earnings were 4.1%, which is still high by historical standards. And broader economic data is still consistent with an expanding economy. So this isn’t a panicky environment, but it is one in which a 5.25% policy rate now looks excessively tight. So starting to ease the rate down makes a lot of sense.

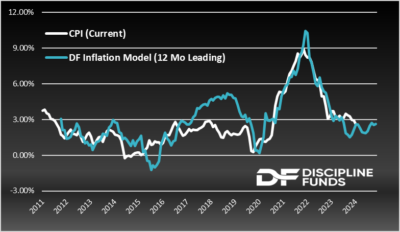

3) Inflation is still a little bit sticky. Wednesday’s CPI came in at 2.5% on the headline, well down from last month’s 2.9% and way off the highs of 9%. Disinflation has clearly won now. I’ve argued for 2 years now that disinflation was embedded and that the second wave of inflation was an overblown concern. I don’t want to toot my own horn (even a blind squirrel something, something1), but our inflation model has been pretty damn good over the entirety of the Covid inflation surge. Inflation’s been stickier than I expected at points, (mainly because shelter’s been stickier than expected) but directionally, the model has been pretty bang on. And right now it’s still pointing to subdued inflation. That said, there’s enough stickiness remaining in the core readings that a slower pace of cuts makes sense.

So here’s the big conclusion. The Fed is right to start a rate cut cycle. They haven’t defeated inflation yet, but they’re damn close and you don’t want to wait until there’s an emergency to have to cut. To use the analogy I hate, you don’t start landing the plane when you’re at the airport. You start easing it down well in advance. At the same time, inflation is still high enough and sticky enough in certain areas that moving slowly makes sense. There’s no emergency on the horizon and so emergency 50 bps cuts aren’t necessary at this time. So I’d expect 25 bps at the next meeting and a high probability that this is the start of a march towards something below 4% in the coming year so I hope you locked in those high rates or extended durations earlier this year when we said it was time to do so.

1- I’ve always wondered if that’s true. Do blind squirrels actually find nuts? I doubt it. My guess is a coyote would find them first. Something worth exploring for someone more knowledgeable in this area.

More By This Author:

Yes, You Can Eat Risk Adjusted ReturnsThree Things – Happy (Almost) Weekend

Three Things – Weekend Reading: Friday, Aug 16

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more