The Rise In Japanese Bonds Is Starting To Pressure The Global Bond Market

Image Source: Pixabay

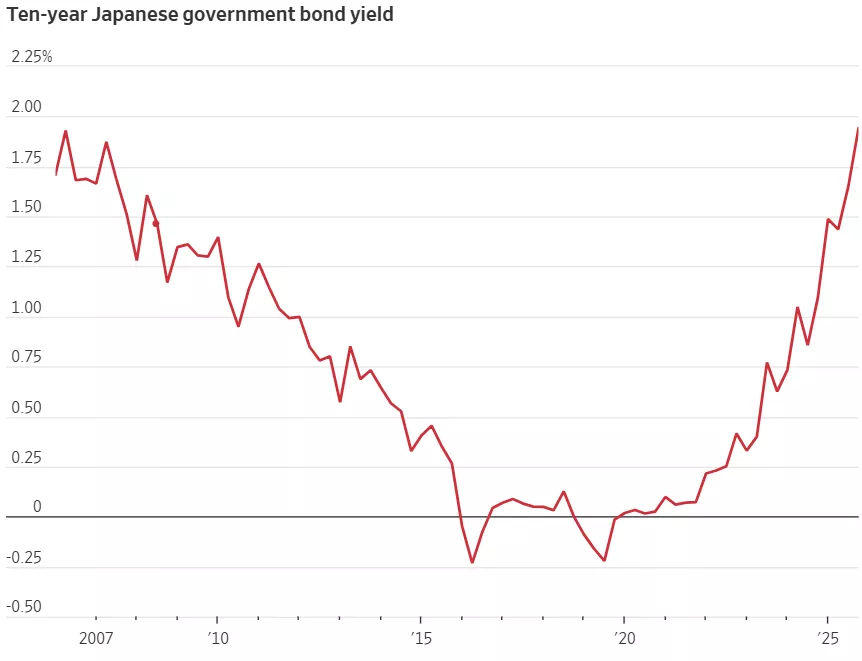

Japanese bond yields have been on an upward march , reaching highs not seen in more than a decade. Japan has long had the lowest interest rates among the advanced economies for several decades. Known for its ultra-loose monetary policy, featuring yield curve control (YCC) which pegged the 10-year rate near zero, the Bank of Japan ( BoJ) has stepped aside and let market forces set long term rates. Other related policy rate changes have signalled the most significant shift in Japanese monetary policy in over two decades.

What lies behindthese dramatic developments?

The BoJ abolished its Yield Curve Control (YCC).The 10-year government-bond yield just hit 1.9%, the highest since 2007. The YCC was a deliberate policy to suppress long term rates near 0% and now the BoJ is allowing the marketplace to set long rates.

The Ending of Negative Real Rates. The BoJ raised its policy rate from 0% to 0.1%, seemingly a small move, but the first hike in 17 years.The Bank of Japan (BoJ) has hinted that a December rate hike is in the works, citing a great deal of uncertainty about what rate would result in economic stability . Wage increases andinflation have both moved up, after decades of deflation. Accordingly, the market participants have started to stake out speculative positions . However,investors never take a shine to such policy uncertainty, especially given that Japan has had such a firm handle on its rate structure for more than a decade .

Government Spending Growth. Japan is notorious for having thehighest ratio of debt-to-GDP among developed countries, exceeding 200%. While BoJ has long been the main buyer of government bonds, there is concern that more bonds need to be issued to fund deficits, ultimately adding to higher yields.

Globally, we can expect a shift within the bond markets. Japanese institutions will likely sell some foreign bond holdings and repatriate funds. This prospect will result in some downward price on bonds and higher yields overseas. For many years, investors engaged in the “ carried trade” which involved borrowing the yen at near zero cost and purchasing assetsoutside Japan. That trade is at risk to be unwound in which caseoverseas assets are sold off and the yen appreciates.In sum, the rise in Japanese yield will pressure bonds globally and arise in interest rates across the spectrum.

More By This Author:

Why The Silence On Canada-U.S. Tariffs Negotiations?Post Iranian War The Israeli Economy Soars

The Long Awaited Canadian Budget In Perspective