The Push And Pull Of Momentum

“Davidson” submits:

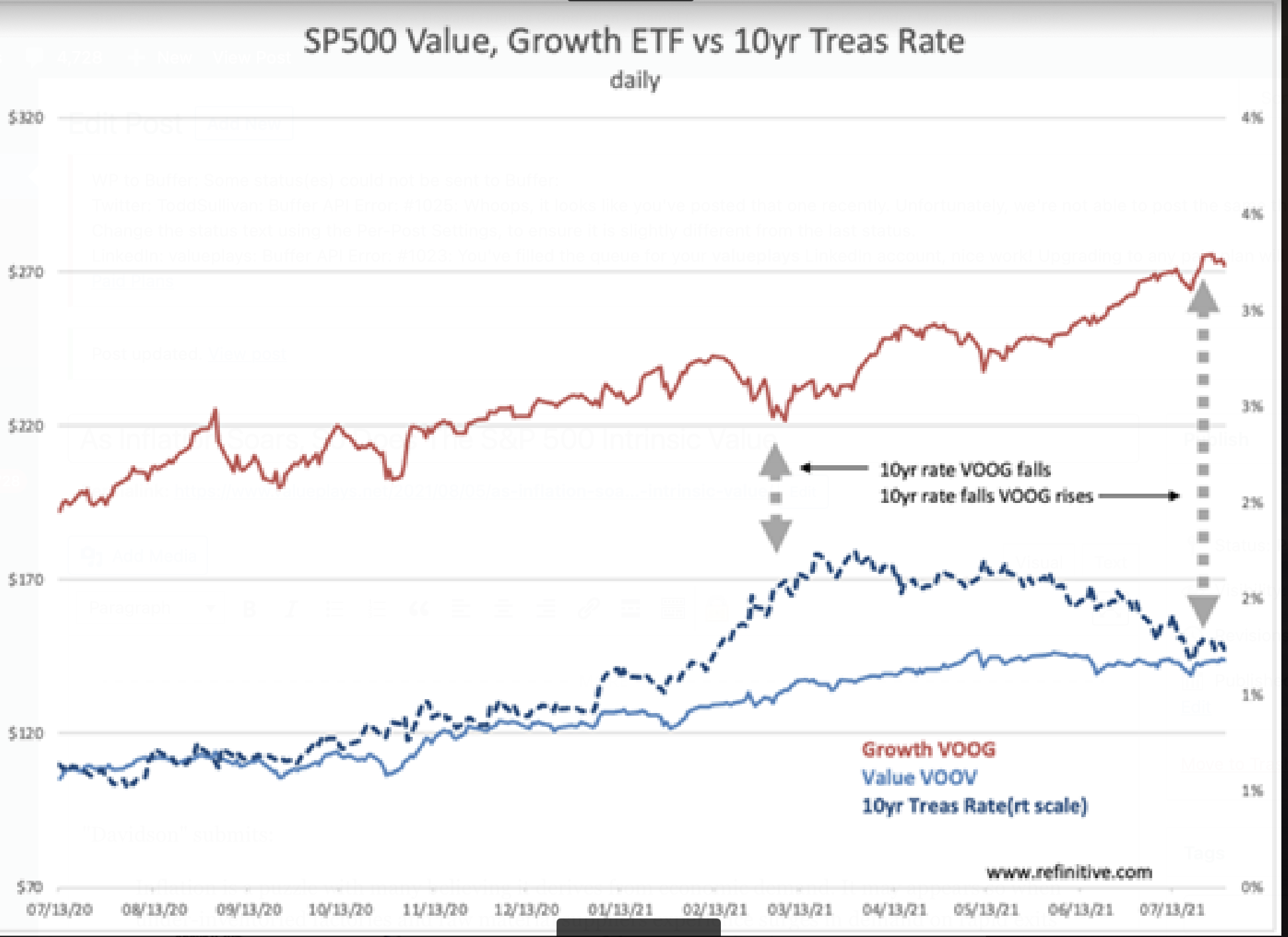

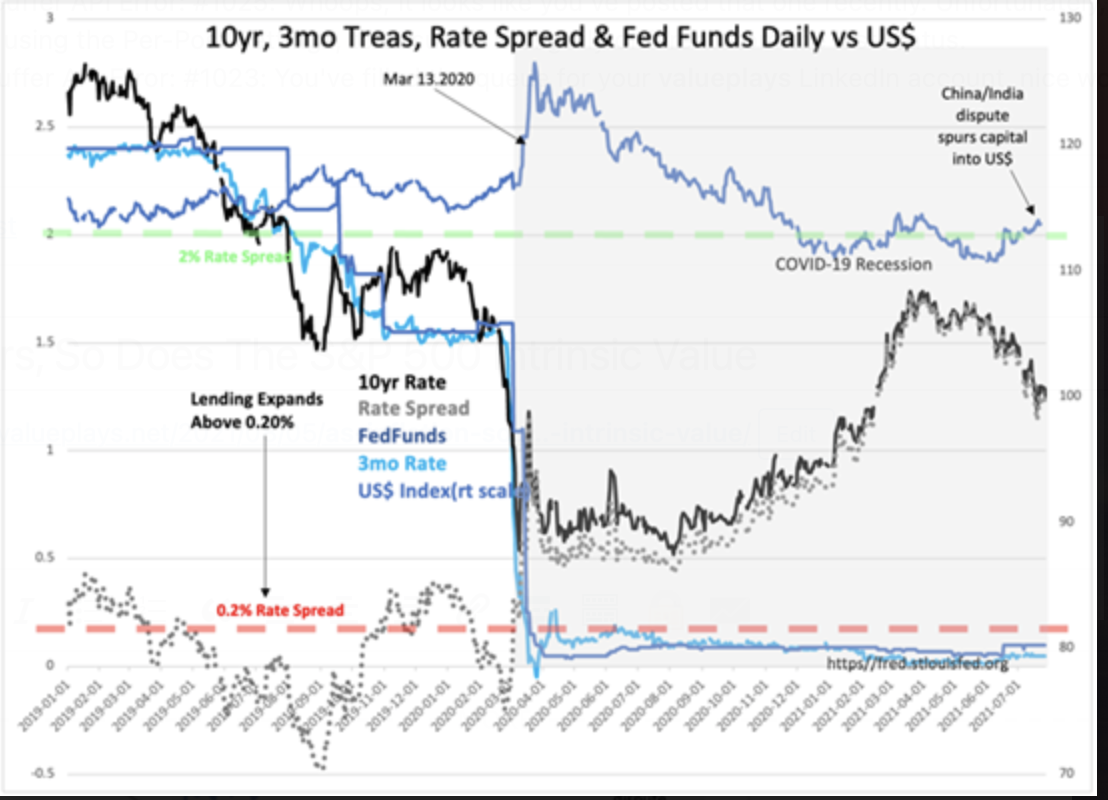

Markets are always a composite of investor perceptions. The short-term shifts come from Momentum investors/short-term traders using price trends as a guide to forecasting the direction of the next expected direction. The 10yr Treasury rate is part of this mix factored into computer-driven trading algorithms. The first chart is daily prices from Nov 2019 of the SP500 Value, Growth ETF vs 10yr Treas Rate. It shows such a relationship. Higher rates suggested economic reopening and capital shifted out of VOOG (SP500 Growth issues) March 2021 towards VOOV (SP500 Value issues). Momentum investors moved out of FAANG-type stay-at-home favored stocks as rates rose with the belief that inflation-sensitive industrial issues would do better as the economy reopened post-COVID. Then the media shifted its focus to the ‘Delta Variant’ with intense coverage even though the data does not support the concerns expressed and capital shifted back to VOOG coupled with a fall in the 10yr rate. The second chart, also daily, of the 10yr, 3mo Treasury, Rate Spread & Fed Funds Daily vs US$ covers a longer period from Jan 2019 and shows the relationship rates have with the US$. Periods of global uncertainty correlate with capital shifts into the US$ as shown with the sharp rise in the US$ with COVID and in recent days there was a US$ rise with concern over the China/India border dispute leading to war. This appears to have settled into a standoff as in the best interests of all.

(Click on image to enlarge)

US media with its focus on Momentum Investor commentary did not mention the troop build-up on the Chinese/Indian border to over 200,000 troops. With a standoff in place, the troops remain and they are building infrastructure for a long term presence. In my experience we should see an easing near term in the US$ and a turn higher in 10yr rates as inflation and economic reopening recover their importance. Economic indicators which forecast the long-term direction of markets remain solidly expansionary. The economy continues to reopen post-COVID with earnings and revenue growth surprises for VOOV issues while VOOG issues are in the early stages of not meeting very high expectations.

The media makes it appear that investing is all tech and nothing else and that the timing decisions are either ‘on’ or ‘off’. Both perceptions are far from reality. Tech companies cannot survive unless there is a base of thriving economic activity on which to operate. The media focus on the 5%-10% of issues to the detriment of the 90% which makes tech possible is where the opportunity lays for investors in my experience. Many companies, which typically generated strong margins and earnings in prior market cycles and were priced at 3-4x Revenue, are today priced 1x Revenue or less with significant economic expansion ahead of them. It is these companies that are represented by the VOOV ETF that has the greatest opportunity for investors.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more