The New Normal Will Include A Much Higher Equity Risk Premium

The foundation of modern-day portfolio analysis is the ‘equity risk premium’ (ERP). In its simplest form, ERP measures the difference between the annual return of a stock index and the safest bond yield, namely sovereign debt. ERP. Given the safety of government debt, the premium is positive meaning that stock returns are higher than bond yields. Clearly, there is a lot at stake regarding the outlook for equities exceeding the future rates of risk-free assets. The ERP is a fundamental measure used in all of asset pricing. It is a key measure of investor tolerance and an important determinant of the cost of capital for corporations, whether to raise new equity or new debt.

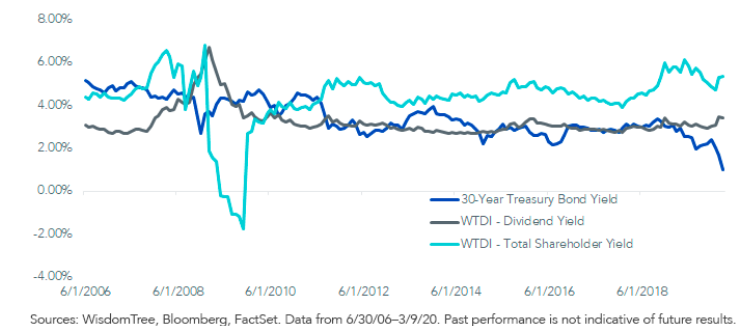

The accompanying chart compares shareholder returns--- dividends plus capital gains—with the yield on the US long bond. Post-2008, equities generated considerable returns over bonds, as capital gains, more than dividends, accounted for the stellar stock market performance. No wonder investors skewed their portfolios ever more in favour of equities--- the alternative was simply unattractive. Even the plain vanilla dividend stocks offered favourable returns compared to the long bond. Moreover, as the long bond yield fell dramatically in 2018-19, stocks continue to march ever higher and thus the spread over bond yields continue to widen further.

(Click on image to enlarge)

Stock Returns Compared to 30-year Bond Yields.

Was the economy so strong that it allowed stock prices to expand so much. Or, did equity prices take off because Treasury yields are unusually low? Most economists would find the latter a more compelling explanation. After all, the economic expansion post -2008 was one of the weakest on record. Although unemployment fell to record lows, that decline was attributed to an aging labour force and numerous changes in the composition of the work force. Hence, expected dividends and earnings growth played a relatively smaller role in the decline of ERP. The ERP had the benefit of the Fed as a backstop despite weak growth.

As the COVID-19 virus swept throughout the world, the equity markets fell at rates never before experienced. Immediately, the S&P companies withdrew previous earnings guidance, hinted at dividend suspensions or cuts and announced the cancellation of share buybacks. Share buybacks, of particular note, have probably been the single most important factor in pushing up stock prices---- keeping the ESP as low as 4% in many instances. All the factors that went into keeping the ERP relatively low suddenly disappeared. Worse still, companies, in good conscience, could not provide any forward guidance to investors who were in some state of shock as they watched the value of their stock portfolios plunge daily. At the same time, the yield on risk-free asset class also fell in response to an unprecedent series of rate cuts and the expansion of Fed bond buying programs to include Treasuries, IG and high-yield corporates and municipal bonds. However, the earnings/price side of the equation drove down the equity premium.

The tail event of COVID-19 will most likely lead investors to discount heavily future earnings. Investors will need the ESP to expand to reflect increased risks to earnings. Equities will come to represent a set of greater risks than that experienced over the last couple of decades. The damage to the world economies will be proof to be unprecedented with depression-like job losses and idle productive capacity. Economic growth rates have been permanently dropped lower and this will profoundly alter corporations’ risk profiles. Investors are coming to appreciate that the lower interest rates and the intervention by central banks into the credit market signal the precarious nature of the economy. Moreover, this weakness will extend beyond the time when the coronavirus ceases to be the public health threat of today. Risk-taking has entered an entirely new, unknown, phase.