The Fed's Quarter Pounder With Doubt

Image source: Pixabay

For over a year, the financial markets lived on fantasies of interest rate cuts – now Jerome Powell has actually taken the plunge. The FOMC lowered the key interest rate range by 0.25 percentage points to 4.00–4.25%.

The decision was almost unanimous. Only the “new guy,” Stephen Miran, pushed for a half-percent cut. This is no coincidence: Miran is considered Donald Trump's favorite and, if all goes according to plan, will succeed Jerome Powell in May 2026. In our Thoughts 95, we already took a detailed look at him and his involvement in the “Mar-a-Lago concept.”

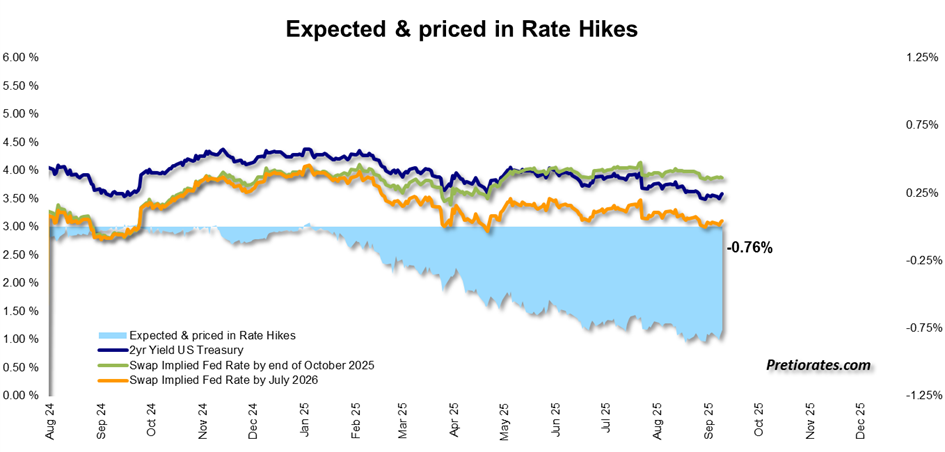

Powell himself has indicated that there could be up to two further quarter-point cuts this year. The financial markets are already ahead of the game, pricing in a total of 0.75% by next summer. Anyone looking to invest in US bonds now is therefore unlikely to see particularly impressive returns.

(Click on image to enlarge)

Whether yesterday's interest rate cut was wise remains to be seen. The Fed relies primarily on “hard facts” when making decisions – in other words, data that always looks to the past. Leading indicators that provide clues about the future course of the economy, on the other hand, play hardly any role.

But inflation is proving stubborn. The ISM Services PMI correlates very strongly with the consumer price index. And it even points to a possible acceleration in inflation. And cutting interest rates while prices are rising? That is extremely dangerous. After all, higher interest rates are almost the only effective means of curbing inflation.

(Click on image to enlarge)

The FOMC cited the recent weakness in the US labor market as its main argument. Disappointing job growth in particular weighed on sentiment. The inverse unemployment rate had long correlated closely with consumer confidence—until the pandemic turned everything upside down. Since then, consumer sentiment has been at rock bottom, and it is clear that consumers are no longer the driving force behind the US economy. Instead, the government's expansionary monetary policy has been keeping the economic engine running for five years.

(Click on image to enlarge)

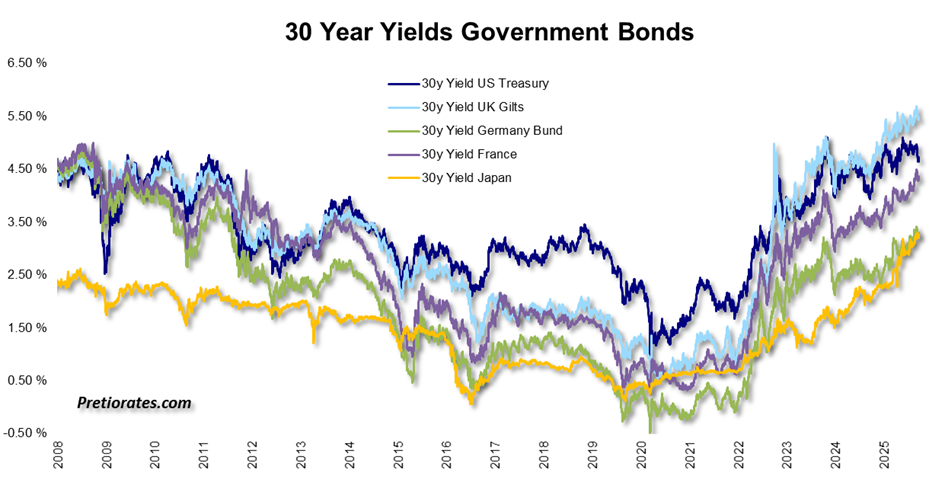

No wonder, then, that the financial markets recently reacted euphorically to falling interest rates. In the short term, this has a stimulating effect. But rising yields on 30-year US government bonds cloud the picture: they are a warning sign that government debt is likely to be at the top of the agenda soon – not only in the US, but also in Europe and Japan.

(Click on image to enlarge)

Incidentally, the short-term market pendulum also suggests that yields are likely to rise again in the coming weeks. “Buy the rumor, sell the fact” could once again prove true.

(Click on image to enlarge)

Bottom line: The markets are now fully focused on US labor market data. The figures for September are due on October 3 – and weak data would be interpreted by the financial markets as meaning that the Fed will move to further easing. We consider the likelihood of this providing further tailwinds for equities and bonds to be rather limited. Much has already been priced in. In contrast, the outlook for precious metals remains positive. Because one thing is clear: the issue of government debt is inexorably looming. And this issue would also be bullish for gold and other precious metals.

More By This Author:

It’s A Matter Of Trust...In Autumn When The Leaves Fall...

Decoding The Nonsense: Trying To Find Logic In Trump’s Puzzle

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more