The Bull Market Has Broadened Out

For most of the year, all we heard about was that 7 or 8 stocks were the only ones going up while 493 languished. That’s not exactly true, but you get the picture. Additionally, I consistently pushed back that if you know the market was being dominated by a handful of stocks, no one was preventing you from owning some. Bears didn’t like that argument.

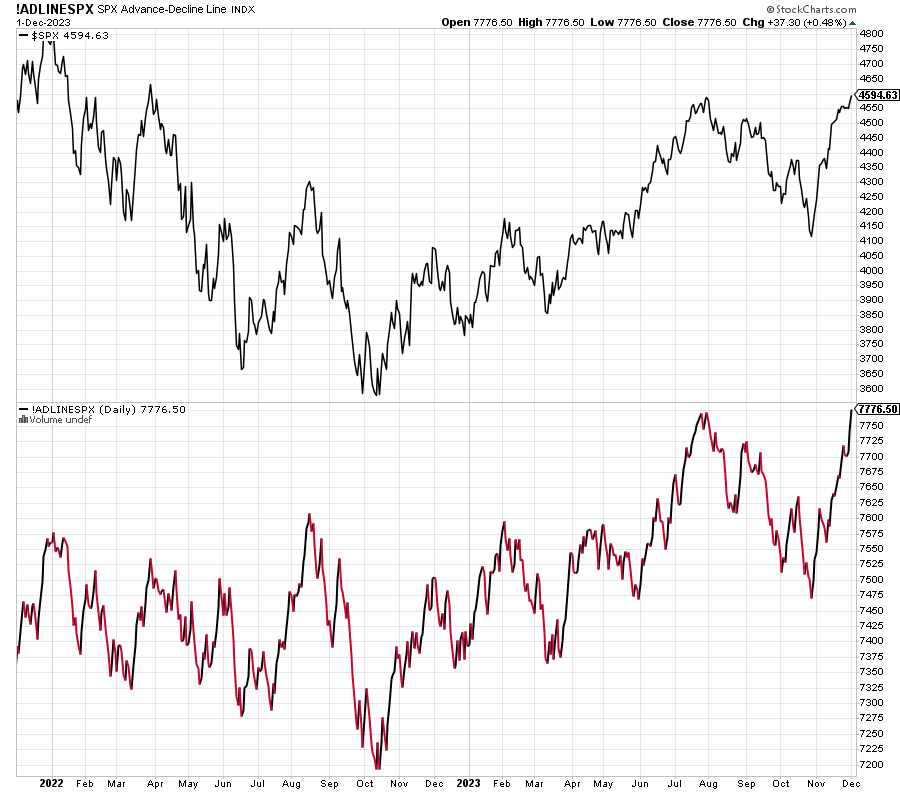

In the upper chart below you will see the S&P 500. The lower chart in red shows the number of stocks going up and down each day on a cumulative basis. Don’t look now but the Advance/Decline Line for the S&P 500 is making all-time highs. But Paul, how can that be if only 7 or 8 stocks are making money?

Well my friends, that’s because the bull market has totally broadened out, especially since the current rally began in late October. Just another indicator for the bears to disavow.

(Click on image to enlarge)

But Paul, the Russell 2000 Index of small cap companies is making historic lows against the S&P 500 and it has been a disaster all year. And that’s a bear market. Well friends, since the October bottom, the small caps have caught fire. And look at the monster day they had on Friday after already seeing a huge rally.

Let me say this, small cap underperformance isn’t going to be fixed by one rally or over one month. It is going to take time and perhaps some more frustration. However, it is entirely possible that small caps can contribute by either not making anymore new lows or outperforming the other indices. The bull market can live on with the Russell being less bad.

(Click on image to enlarge)

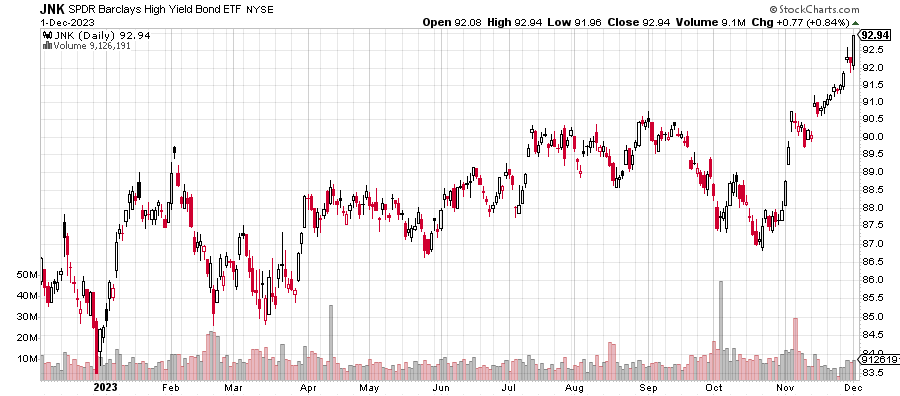

But Paul, junk bonds are in big trouble. After all, everyone knows they have to refinance at significantly higher rates over the coming year or two. Well friends, that is true. But if you know that and I know that, I would venture to guess that the market knows that as well. Let’s look at one high yield bond ETF below, JNK. No matter how any bear slices it, no one with a straight face can argue that the chart below is bearish. It shows a lot of comfort with risk in the bond space.

(Click on image to enlarge)

The charts above all support the bull market continuing over the intermediate-term. They say nothing about the short-term. Stocks enter a mild seasonally weak period with most things overbought. The bears have an opportunity for a mild 1-3% pullback over the next two weeks. That’s about all I see, worst case, on the downside without some exogenous event.

On Friday we bought more SOXL, QQQ, and levered NDX. We sold some ERX and DXHYX.

More By This Author:

Bulls Surprising Even Me

Stocks Look Full As Gold Breaks Out & Bears Scream About Small Caps

Some Weakness Possible – Volatility At New Lows

Please see HC's full disclosure here.