The Bubble Is Back… And It’s Bursting Will Only Be That Much Worse

The financial system is back in bubble mode.

Everywhere you look, there are major signs of froth.

1) Investors poured $1.5 billion into stocks per day in January.

2) Meme stocks and insolvent garbage tech plays are exploding higher by 20%, 30% even 100%+ in days.

3) Financial conditions are now LOOSER than they were before the Fed started raising rates in March of 2022.

4) The c-r-y-p-t-o pumpers are back… promoting their scams as the “answers” to everyone’s problems.

Put simply, it’s as if the Fed never even attempted to deflate the bubble of 2021-2022. If it weren’t for the fact Treasuries now yield 5%, you’d be hard pressed to find any signs that the Fed has accomplished anything of note.

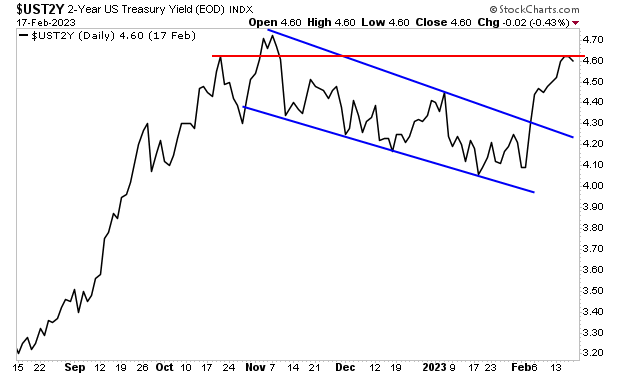

Speaking of Treasury yields, the yield on the 2-Year U.S. Treasury has broken out of its downtrend. It is now probing its former highs. If it breaks here… GOOD NIGHT.

The Fed is going to have to get a LOT more aggressive to reduce this level of froth and asset price inflation from the financial system. Put simply, the Fed will need to tighten things until something MAJOR breaks.

This opens the door to a SEVERE recession later this year. And that will mean stocks crashing to lows that no one anticipates.

More By This Author:

Investors Are About To Pay The Price For The Fed’s Failures…

Here’s Your Roadmap For the Market’s Next Money Making Move

I Guarantee Most Portfolios Aren’t Ready For This