I Guarantee Most Portfolios Aren’t Ready For This

As I have been warning for weeks… inflation is resurging.

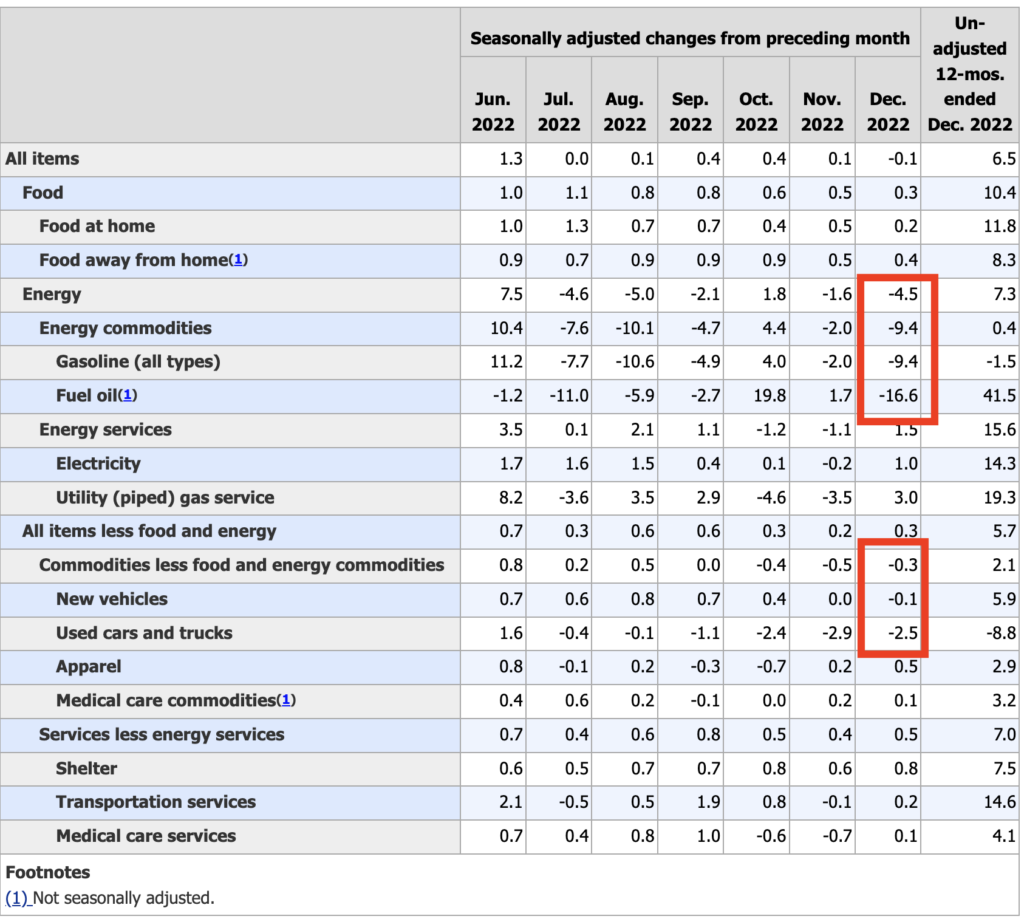

The only portion of the inflation data that declined last year was energy (well that and used car prices). The reason energy declined was because A) China was in lockdown and B) the Biden administration dumped 250 million barrels of oil on the market.

If you don’t believe me about this inflationary claim, you can take a look at December’s inflation data for yourself. Everything remains positive except energy and vehicles.

Obviously, for anyone paying attention, this raises a major concern..

What happens to inflation when china re-opens its economy and the Biden administration stops dumping oil?

The answer is simple: inflation comes roaring back.

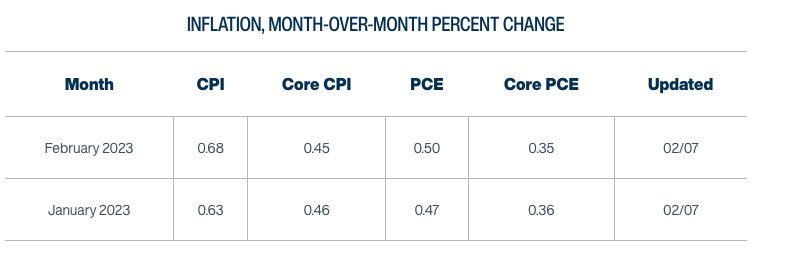

The Cleveland Fed runs an inflation tracker called Inflation Nowcasting. In December, this data point was at -0.1%. It then jumped to 0.53% in mid-January, before ending the month at 0.63%. Today it’s at 0.68%. This represents a .78% swing in inflation in the span of six weeks. And it confirms that inflation is once again rising in the financial system.

Bear in mind, this is happening AFTER the Fed already raises rates from 0.25% to 4.75% while also draining $500 billion from its balance sheet.

So imagine what happens now that the Fed is SLOWING the pace of its rate hikes…

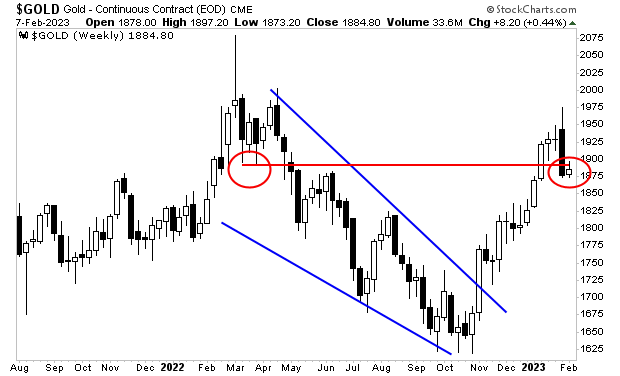

Gold has already figured it out: the precious metal has broken out of its downtrend and is right back to the levels at which it traded in March 2022 (when the Fed still had rates at 0.25%)!

This is the #1 threat to investors’ portfolios today… that inflation has come roaring back.

More By This Author:

Forget the Forecasts, This Chart Proves Inflation Won’t Disappear Anytime SoonThe Fed’s Worst Nightmare (A Wage Spiral) Has Officially Arrived

The Next Major Threat to Your Portfolio Just Arrived