The All-Weather Approach

Genaro Sarvin/Pexels

The Benefit of not being Long-Only

In a previous post (Top Names Update), I mentioned that our security selection system still picks bearish ETFs sometimes after the addition of our new factor in June:

Although the new factor kept us out of TECS on June 24th and June 30th, it hasn’t kept us out of bearish ETFs entirely. On July 21st, for example, it put us in a similar ETF to TECS, the Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS).

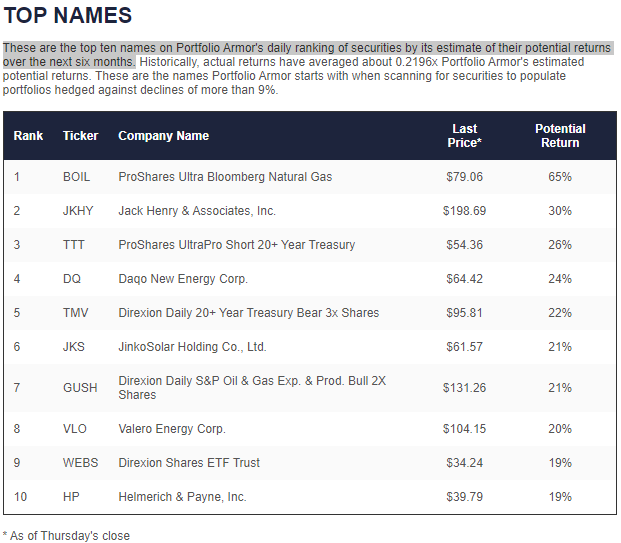

Image via Portfolio Armor on 7/21/2022

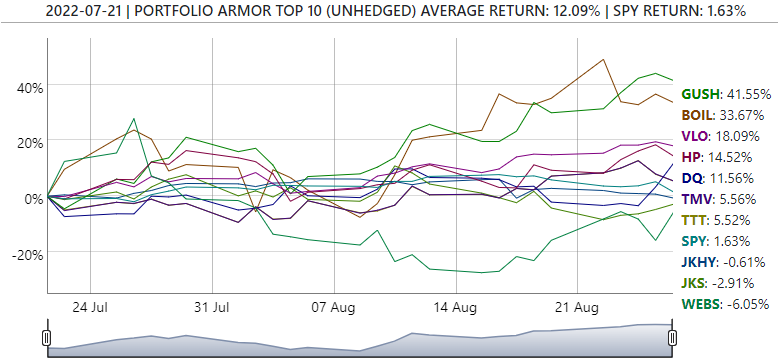

WEBS was up 11% on Friday, as the market sold off, but it’s still the worst performer in the July 21st top names cohort so far.

But it’s down ~6% so far, not ~30% like TECS in the “plain” top ten above. An example of a better entry in a volatile name.

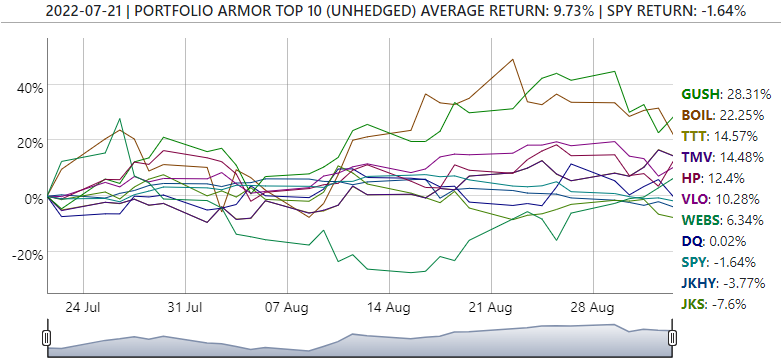

Here’s an update on the performance of that top names cohort as of Friday, September 2nd.

Our top ten names from July 21st were up 9.73%, on average, while the market-tracking SPDR S&P 500 Trust ETF (SPY) was down 1.64%. All three bearish ETFs in this top ten contributed to the outperformance: the ProShares UltraPro Short 20+ Year Treasury (TTT), the Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV), and Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS).

More By This Author:

Questioning Zoltan's Claims

Nord Stream 2 And The Ukraine War

Who Is Shelling The Zaporizhzhia Nuclear Power Plant?

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more