The 12 Charts To Watch In 2022 - Q4 Update

As we head into the final stretch of the year and even start to think about 2023, it's time to review and update what I thought would be the 12 Charts to Watch in 2022.

The point of this post is to update the thinking and reflect on initial thoughts from the start of the year. A lot of things have changed since then, and a lot of things about this year have been quite unusual, but some things remain the same: e.g. you can still make well-informed judgments on the risk vs return outlook by using good charts within a sound framework.

In the original article, I shared what I thought would be the 12 most important charts to watch for multi-asset investors in the year ahead (and beyond). In this article, I have updated those 12 charts and provided some updated comments on the outlook -- given the dramatic shifts seen during the year so far.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I'm thinking now vs what I said back then]

1. Fed Behind The Curve: Depending on who you ask, arguably the Fed remains behind the curve, but it is fast closing the gap. Just as I write the Fed has hiked another 75bps taking total hikes to 300bps. This is the most rapid pace of tightening in recent years, and will only become more accentuated as we head into year-end with the Fed scheduled (dot plot) to deliver as much as a further 100bps from here. As for the chart, looking back to my comment below from the start of the year, this chart worked very well. Sometimes it is just that simple.

"Based only on this chart we could make an assertion that the Fed has fallen behind the curve. Against that there is the argument that other factors are important too, not to mention the point that the Fed basically decided to position itself behind the curve to try and prevent the mistake of tightening too soon. With the composite measure of inflation expectations at 40-year highs, it’s fair to suggest that the Fed may have some catching up to do as it kicks off the transition away from easing."

2. Fed Catch-Up Risk: Fed Catch-Up Reality. As the Fed looks to catch up with inflation, and potentially even overshoot to guard against the risk of inflation expectations anchoring at a new higher plateau, the risks to markets are real. We are still early in the process of tightening financial conditions and mounting headwinds, as recession probability rises, the probability of stress and collateral damage rises by the day. This is not the time to be a hero.

"Naturally the Fed now faces another risk – i.e. the risk of being dragged into a game of catch-up in the context of a very complacent market that has arguably come to expect permanent easing... “the Fed has my back”. Just remember, the old saying of ‘don’t fight the Fed’ means don’t fight against the tides, and the tides are starting to change."

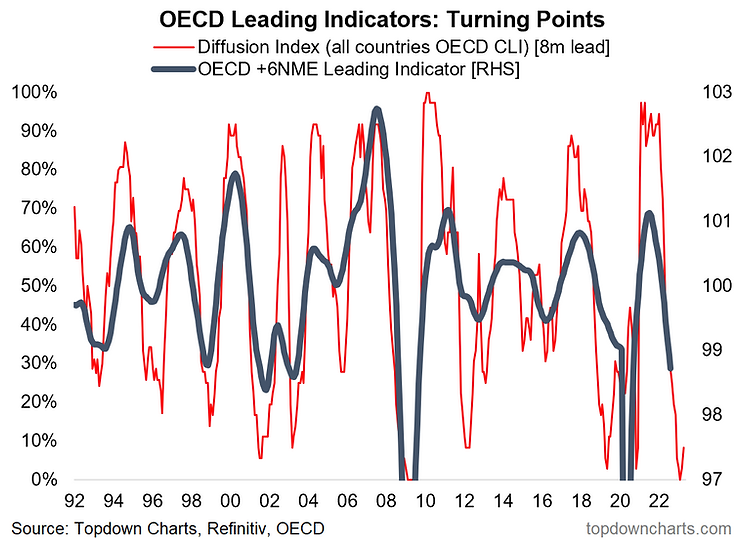

3. Growth Scare 2022: As mentioned a couple of months ago in a presentation on recession risks, we have a long list of leading indicators that are pointing to a global recession -- scheduled to become clearly evident in Q4 and intensify into 2023. The chart below is one of those many examples mapping out the pathway into recession.

"But then again, maybe the Fed won’t even get a chance to get a rate hike out the door if the chart below proves anywhere near accurate. This and a few other leading indicators are pointing to a possible growth scare in 2022. Maybe it will be one-and-done for the Fed? Or maybe any such growth scare only serves to extend the economic expansion further by triggering renewed stimulus. Certainly a risk and a key chart to keep on the radar."

4. Corporate Capex: I've had to tone back the cyclical outlook for corporate capex, just simply based on tighter financing conditions, lower earnings growth, and uncertainty on the outlook. There are pockets where we should expect to see an uplift e.g. commodities, logistics, and certain elements of manufacturing. But in line with global recession risks, expect capex growth to weaken next year.

"This chart hints at perhaps one of the most important themes I’ve been talking about over the past year – the prospect of a possible multi-pronged, multi-year investment boom. The chart below highlights the typical cycle leads and lags in terms of capex growth, and with easier funding conditions, booming corporate earnings, and a rebounding economy it’s likely that we see a generalized uplift in capital expenditure.

But as I’ve been highlighting in the reports there are a few particular sectors that are likely to see a surge in investment in response to surging prices – for example, the global shipping sector, and commodity producers. Both of which have seen capex languish for the past decade, and both of which have seen an effective windfall from the pandemic (i.e. surging shipping rates and commodity prices)."

5. Capacity Utilization: Tight labor markets are one of the key stories this year, and a key reason why there has been a lot of upward pressure on *nominal* wage growth. Unfortunately, with the supply shock (and lingering elements of demand shock) pushing living costs through the roof, I would say many people are experiencing downward pressure on *real* (inflation-adjusted) wage growth. The other key point from this chart is that with tight labor market capacity, there is real underlying pressure on inflation, so it's not just some commodity shock.

"Another key impetus to resurgent capex is tightening of capacity e.g. measures of labor market capacity utilization are close to pre-pandemic levels. This will put upward pressure on pricing and present an incentive or signal to firms to lift investment.

But it also speaks to the inflation theme. While some of the short-term upward pressures on inflation are likely to pass (e.g. backlogs, base effects, the initial bounce-back), should we see further and sustained tightening of capacity utilization it will put upward pressure on the more core or underlying inflation pulse."

6. Government (and Green) Capex: We've seen some further incremental movement on this, e.g. ~400b in the "Inflation Reduction Act" towards green/environment/climate-related initiatives. Globally post-pandemic recovery fiscal programs are also engaged in infrastructure and climate-related investment. So this remains an important background theme but probably is still undercooked in terms of what's needed, especially regarding enabling sustainable growth and achieving the lofty climate goals.

"To really drive it home, the capex/investment theme is not just about corporations responding to economic forces, it’s also about governments responding to the pandemic as well as social/political forces.

Specifically in terms of recovery/rebuilding fiscal programs which in many countries have been targeted at infrastructure. But also climate-related infrastructure and investment – something that is definitely part of fiscal packages, but also part of shifting investor preferences. We’ve observed a clear trend of rising financial investment into clean energy sectors being followed by an uplift in real investment. So altogether it’s quite interesting."

7. US Absolute vs Relative Valuations: Moving on to markets, despite all this mixed but mostly murky macro, US equities are still not cheap. Absolute valuations have come down a lot and are no longer expensive, but not cheap either, and nothing like the generational buying opportunity of 2020. Relative to bonds, equities are not particularly compelling either, this is because much of this year has seen both stocks and bonds bleeding. To really get excited about equities you'd need to see a much more meaningful reset in PE ratios and a drop in bond yields to make them look attractive in relative terms.

"Should all this talk of capex and investment booms come to pass, we’d likely start to see upward pressure on bond yields, and that will put a squeeze on the US equity risk premium.

The chart below is one of my favorites for thinking about US equity valuations. It points out what most of us already know: US equities are expensive in absolute terms …i.e. the PE ratio is really very high. But if we factor in low bond yields then maybe it’s not so bad. At present, the chart says absolute valuations are wildly expensive, but relative valuations are ok (for now). That will change if/when bond yields rise – and in that sense, it also goes to highlight the interest rate sensitivity of the market if we accept the statement that equities only offer reasonable value in a low yield environment."

8. US Asset Class Valuations: Looking at valuations across asset classes, this one is actually kind of shocking. We know the story for equities, but what may come as a surprise is property: US housing market valuations are the highest ever, even higher than the subprime credit bubble. Interestingly, elsewhere on this chart commodities went from slightly expensive to now neutral, and bonds are best with slightly cheap valuations. We must always note the cautionary that cheap can get cheaper, but bonds are certainly looking a lot better vs their own history and relative to the rest.

"To complicate matters slightly, my valuation metrics show bonds expensive vs history as well – so: “equities look reasonable vs expensive bonds??”. To make matters worse, property prices are also sailing into rarefied air. Commodities on the other hand, while not cheap, at least look reasonable by comparison and could benefit from increased capex."

9. US vs Global Equity Valuations: Globally, again the US equity situation is hammered home -- the US is no longer expensive, but not yet cheap either, and actually very richly priced relative to the rest of the world. I would say the most interesting thing in this chart is developed markets ex-US: yes they have their issues, but at this point, the valuation picture looks fairly compelling. Meanwhile, you might argue EM needs to cheapen up a bit to make up for the lingering macro risks.

"Another chart that makes US equities look expensive by comparison is when you look at PE10 (or really just about any other valuation metric) for the US vs the rest of global equities. It is true that Emerging Markets and Developed Markets excluding the US have seen a decent rebound in valuations since the March 2020 lows, but there is a clear and compelling relative value case here."

10. Global Equity Super Sectors: After a very strong first part of the year, both "old cyclicals" and "defensives" gave background against the tech super sector. But perhaps most interesting on this chart is how defensive sectors look to be gearing up for a breakout. They never gave back much ground after the initial surge, have been tracking a tight trading range, and could easily break out as monetary headwinds intensify.

"The most logical pushback on the previous chart is to note that we could have said something similar for much of the past 5-10 years. So, the question is then what will it take for this gap to close?

One avenue for a turn in the relative performance of global vs the US is the path of the “super sectors”. A big part of the US outperforming the rest of the world has been the high hurdle set by tech and tech-related companies. Global ex-US has a big skew to “old cyclicals”.

In that respect, the most important technical clues to a rotation in performance between the US and the global will be the chart below. Specifically look for an upturn in the blue line to get a jump on a ‘virtuous turn’ in the US vs global relative performance (and value vs growth for that matter, also smalls vs large – it’s a fairly sprawling issue in equities!)."

11. Low-Quality Credit – Low-Risk Premium: This is another intriguing chart, around the turn of the year, the credit risk premium for the lowest quality cohort was tracked at expensive levels (very low-risk premium). That has changed now, as recession risks require a more suitable credit risk premium. But it's not a buy signal for credit just yet. We'd need to see much more of a cushion against default risk given the substantial tightening of financial conditions and the risk of recession.

"The valuation conundrum is not just the domain of equities – credit also is looking increasingly expensive. The chart that hammers the point home to me is this composite view of where the lower-quality credits are trading relative to the higher-quality credits. Basically, we see a lower and lower risk premium for lower-quality credit.

By itself, this may not be an issue, particularly if the economic and monetary backdrop is supportive of credit conditions. But if credit conditions deteriorate, things could turn sharply here – and indeed, we may see early clues of any impending stress in this indicator itself. So very much one to keep checking in on."

12. China Property Downturn: Perhaps one of the most surprising things on the monetary policy front this year has been the relative lack of policy response in China to the property market downturn and multiple macro downdrafts (e.g. covid lockdowns). The PBOC has made some incremental steps to ease monetary policy, but as yet it remains somewhat piecemeal, and clear policy divergence is one obstacle (aggressive Fed hikes vs a slightly dovish PBOC have put upward pressure on USDCNY -- presenting a risk of a more disorderly devaluation). In the meantime, China's property downturn = downside risk for metals, downside risk to inflation in China, and still overall raises the odds of eventual monetary easing by the PBOC.

"I always say in my many years of covering China macro, if I could only choose one indicator it would be property prices, and perhaps if I were to pick only one chart it might be the one below.

My composite leading indicator for Chinese property prices (money supply, interest rates, funding) is pointing to an extension of the current downturn deeper and well into 2022. This is of critical importance in so far as the economic pulse and commodity demand is concerned, but also – for the policy outlook: the lower that black line goes, the greater the probability of monetary stimulus (and you know what that means!)."

Summary and Key Takeaways:

-The Fed has pivoted aggressively and fully into catch-up (and overshoot?) mode as inflation expectations remain elevated and risk anchoring higher; expect a likely further string of rate hikes and progression on balance sheet normalization (at least until growth risks elbow out inflation risks -- and it's going to need to be *obvious* to make the Fed pause let alone pivot).

-The global pivot from stimulus to stimulus removal and outright tightening poses risks to just about every asset class, as we have clearly already seen this year. No changes here.

-In terms of the growth outlook, downside risks dominate over any upside risks, and virtually all signs point south for the global economy this year and into the next.

-"Growth Scare" thesis has pivoted to outright global recession (high)probability.

-An initial shift in valuations has removed some previous excesses and even revealed some opportunities. That said, the property is likely the next shoe to drop given ever-loftier valuations.

--one pocket of emerging value is in bonds, both treasuries, and global ex-US.

-All in all, a defensive skew and eye on risk management remain the prudent path.

Overall: Headed into Q4 and indeed into 2023 it's still hard roads ahead as we're clearly in the middle of a global equity bear market, and impending global recession. Valuation resets remain a work in progress, but there are clear emerging opportunities for active asset allocators as some things change while others remain the same...

More By This Author:

Chart Of The Week - Pricing Pressures Peaked (Piqued?)

Chart Of The Week - Global Equity Risk Premium

Chart Of The Week - Silver ETF (Out)Flows