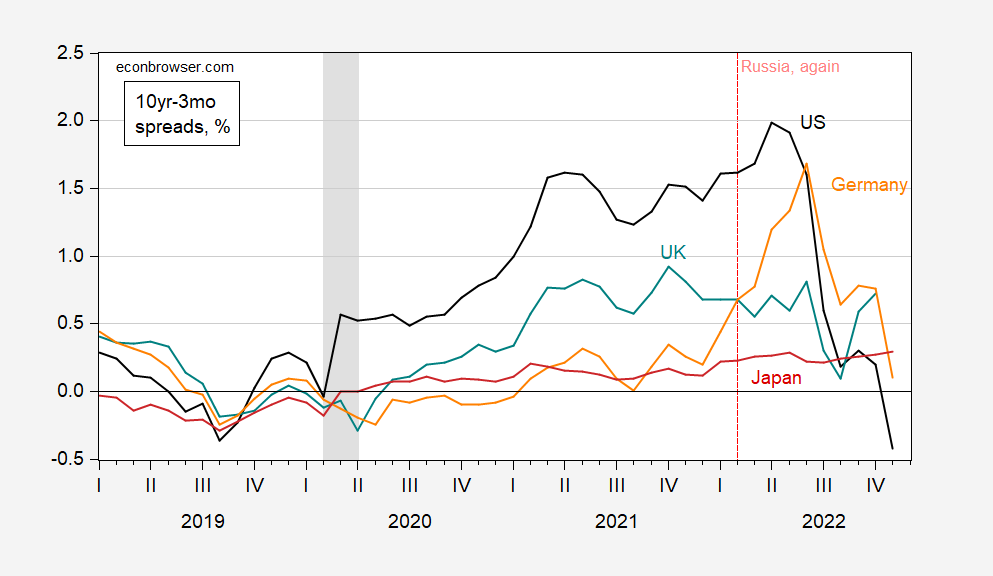

Term Spreads Around The World, As Of December 6, 2022

Here is a snapshot of four key term spreads through November (an examination prompted by a Deutsche Bank missive title “The Looming Recession” which dropped into my inbox today).

(Click on image to enlarge)

Figure 1: Ten year government bond yields minus three month rates for US (black), UK (tea), Germany (orange), and Japan (red), %. Three month rates are government bond yields for US, interbank rates for others. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, OECD Main Economic Indicators, updated with Tradingeconomics.com, NBER, and author’s calculations.

Note that US and German (proxy for euro area) spreads are declining; UK spread rebounded in October, but I don’t have (comparable) November data. Japan’s spreads continue to trend sideways. Side note: These spreads inverted before the 2020 recession, suggesting that even if Covid had not struck, a recession may very well have occurred. In any case, more curves are inverting, although at different parts of the curve.

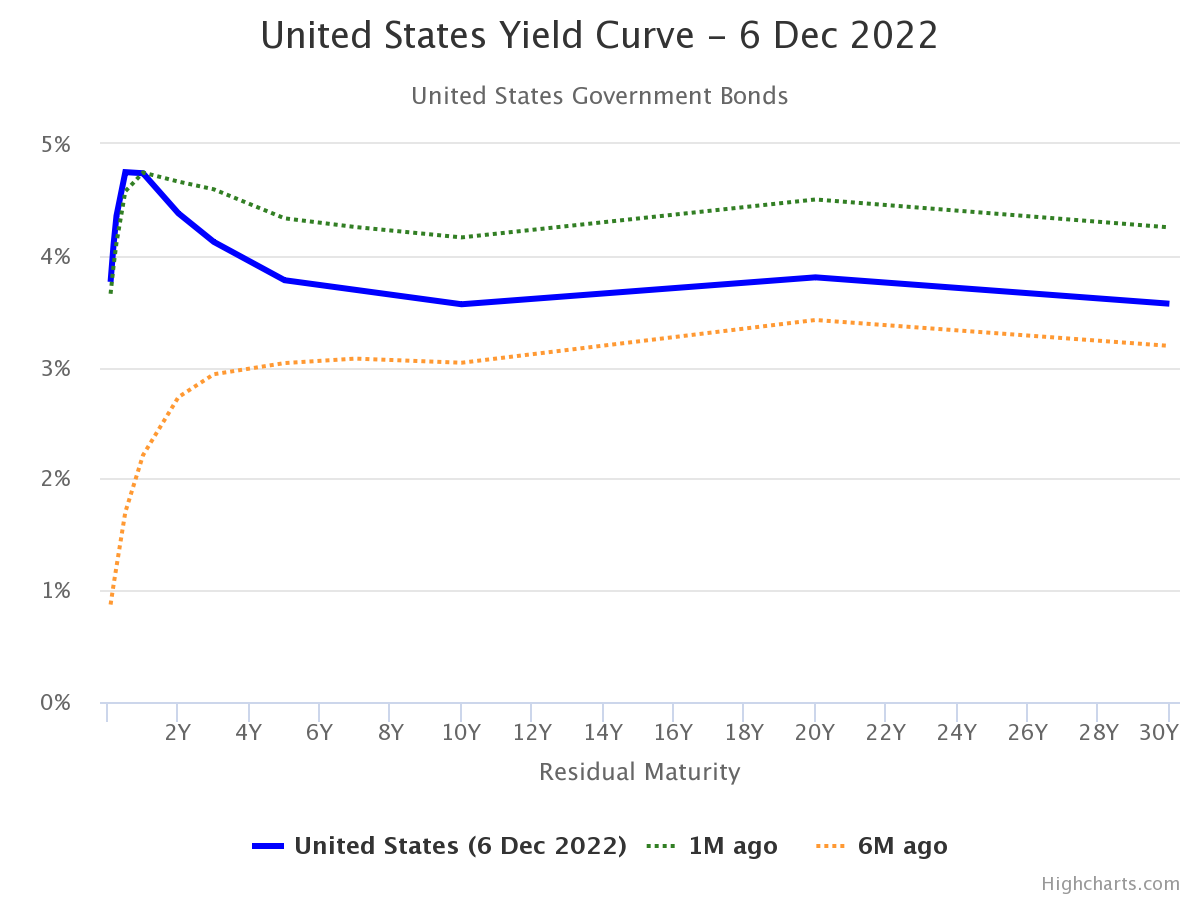

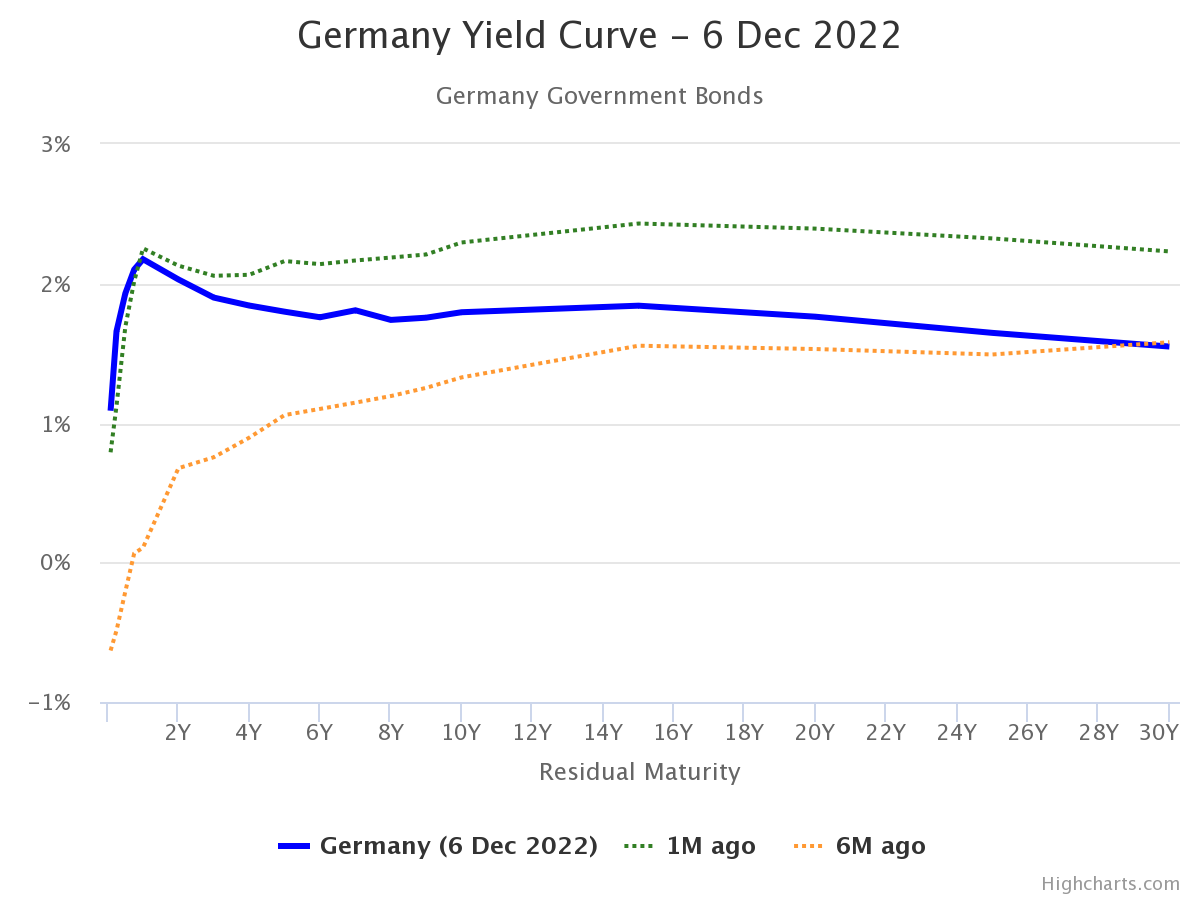

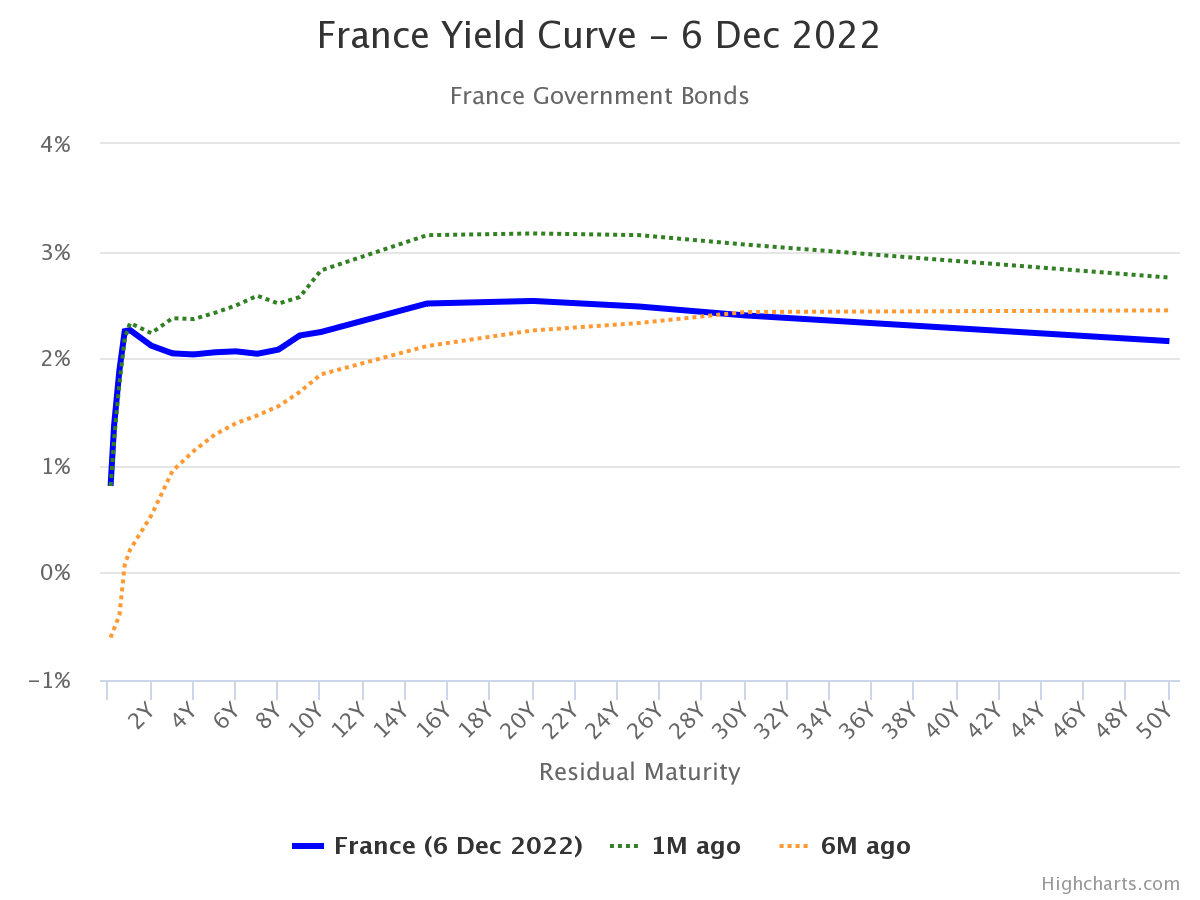

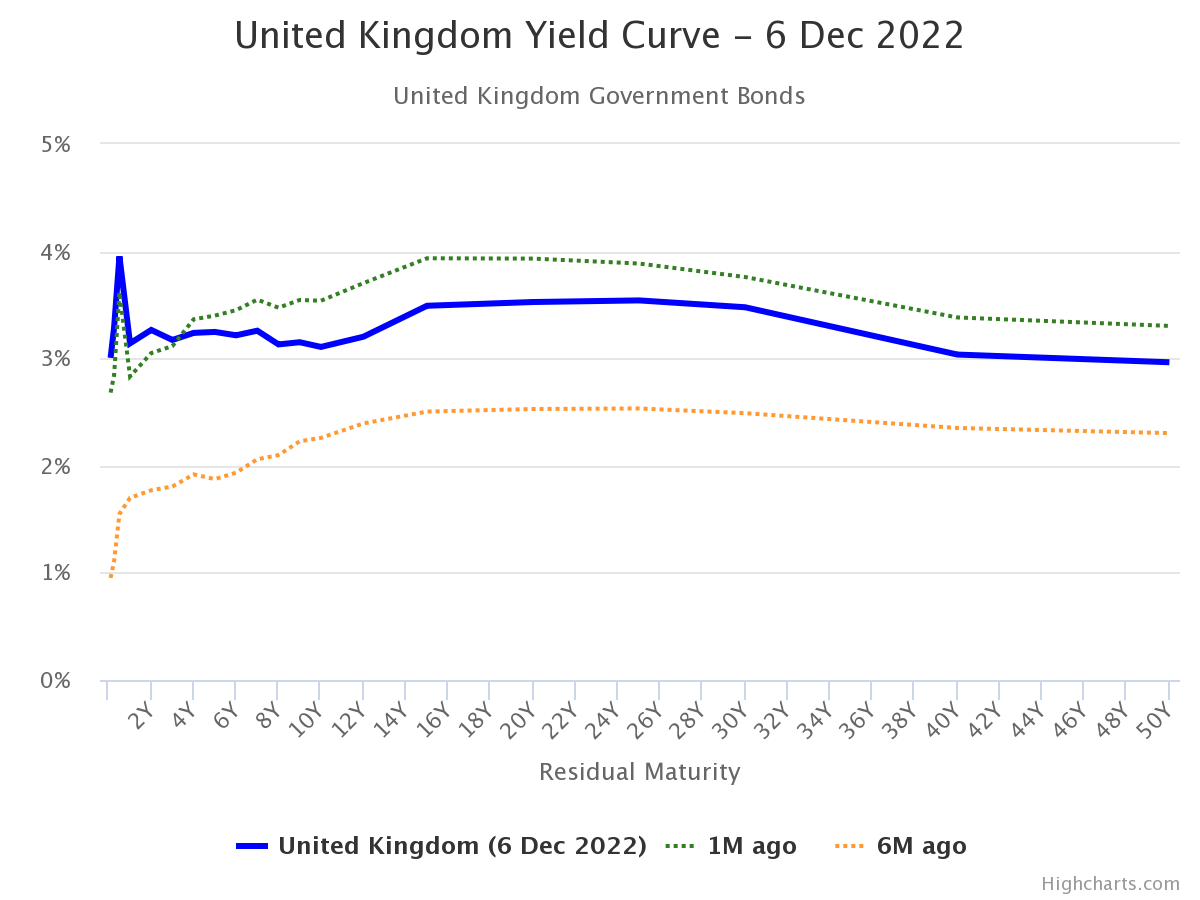

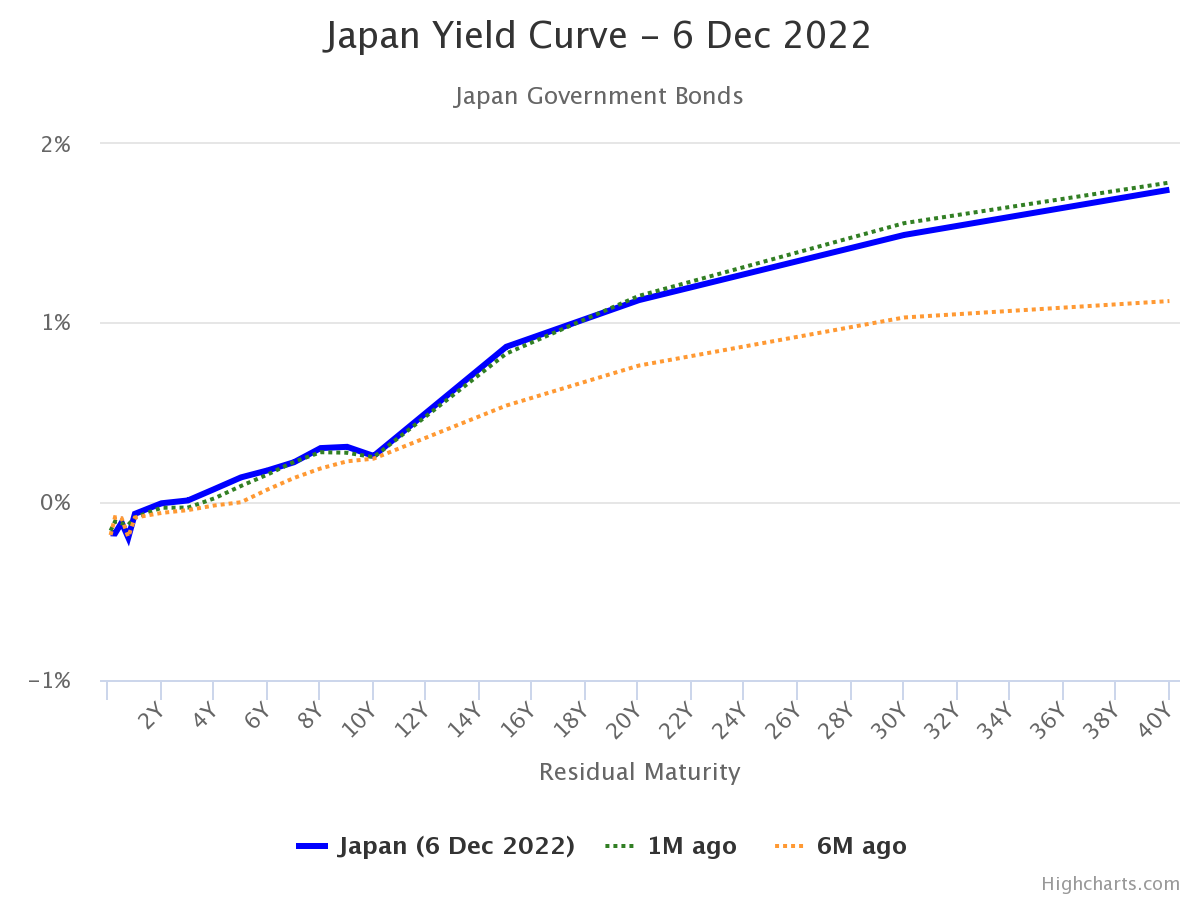

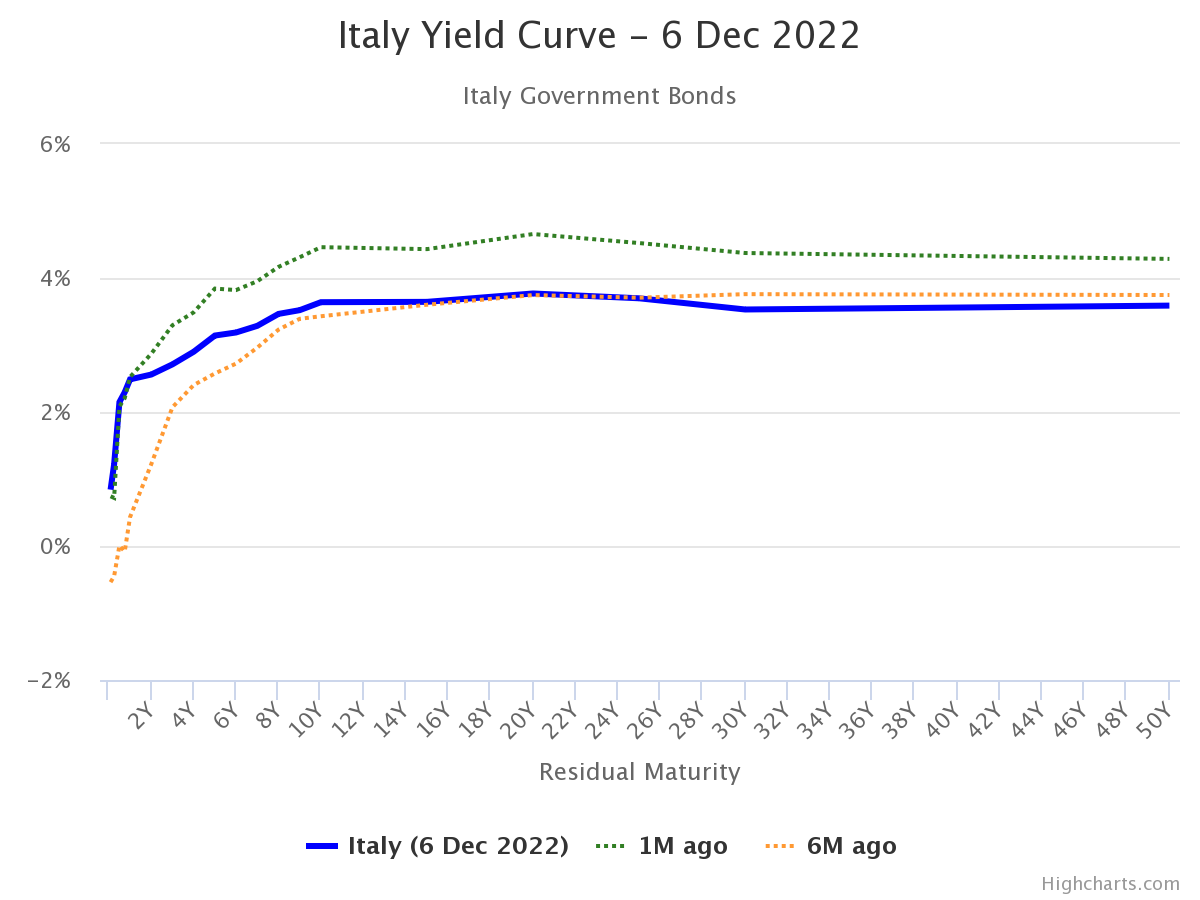

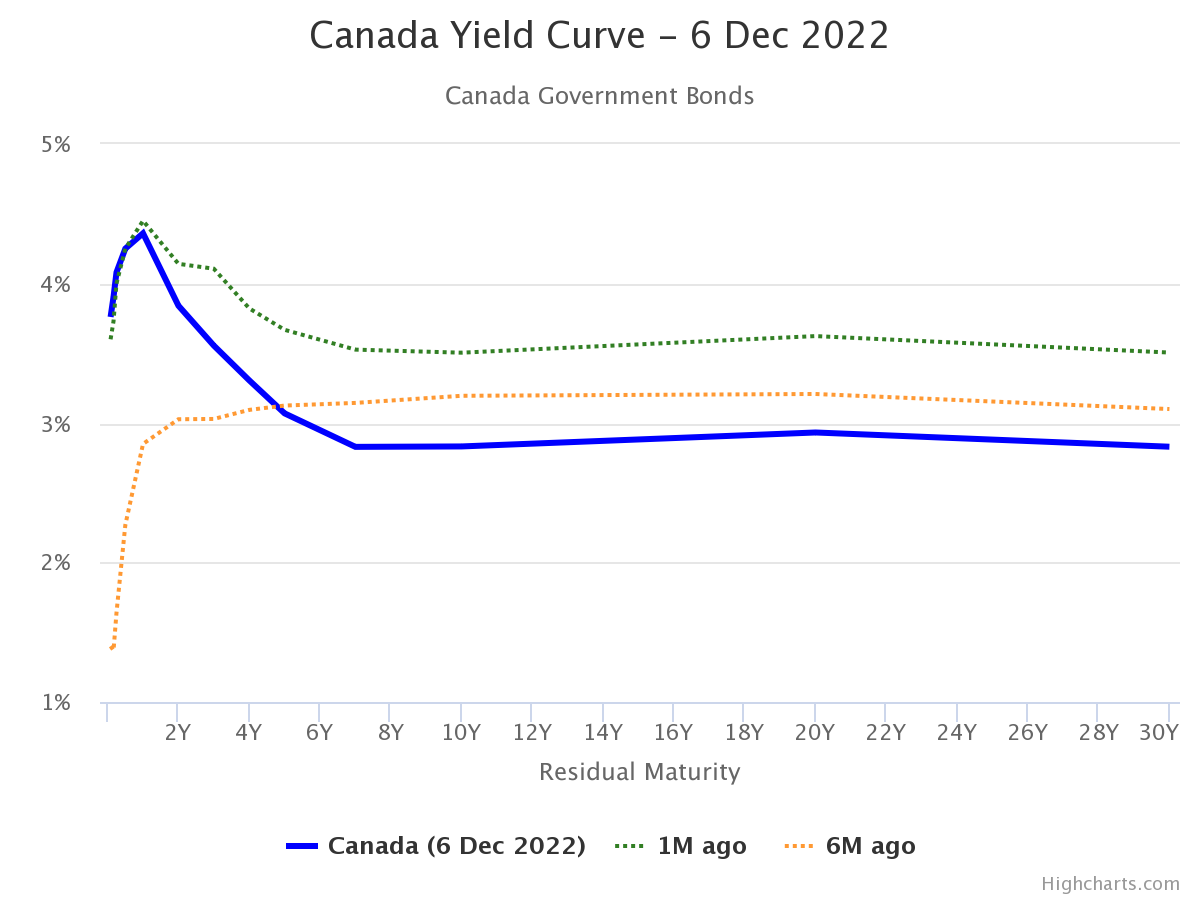

Here are yield curves for G-7 countries, as well as other large economies, recorded on December 6th, by worldgovernmentbonds.com.

(Click on image to enlarge)

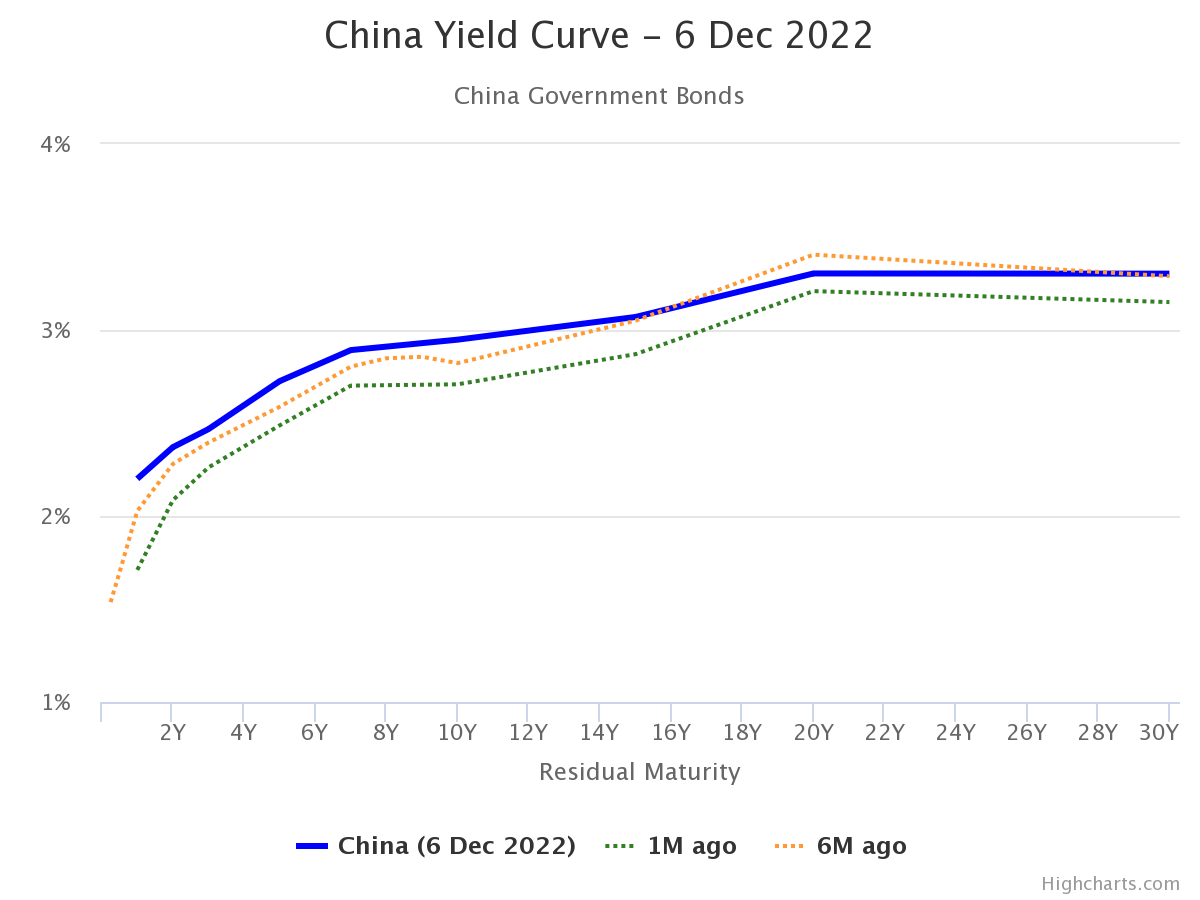

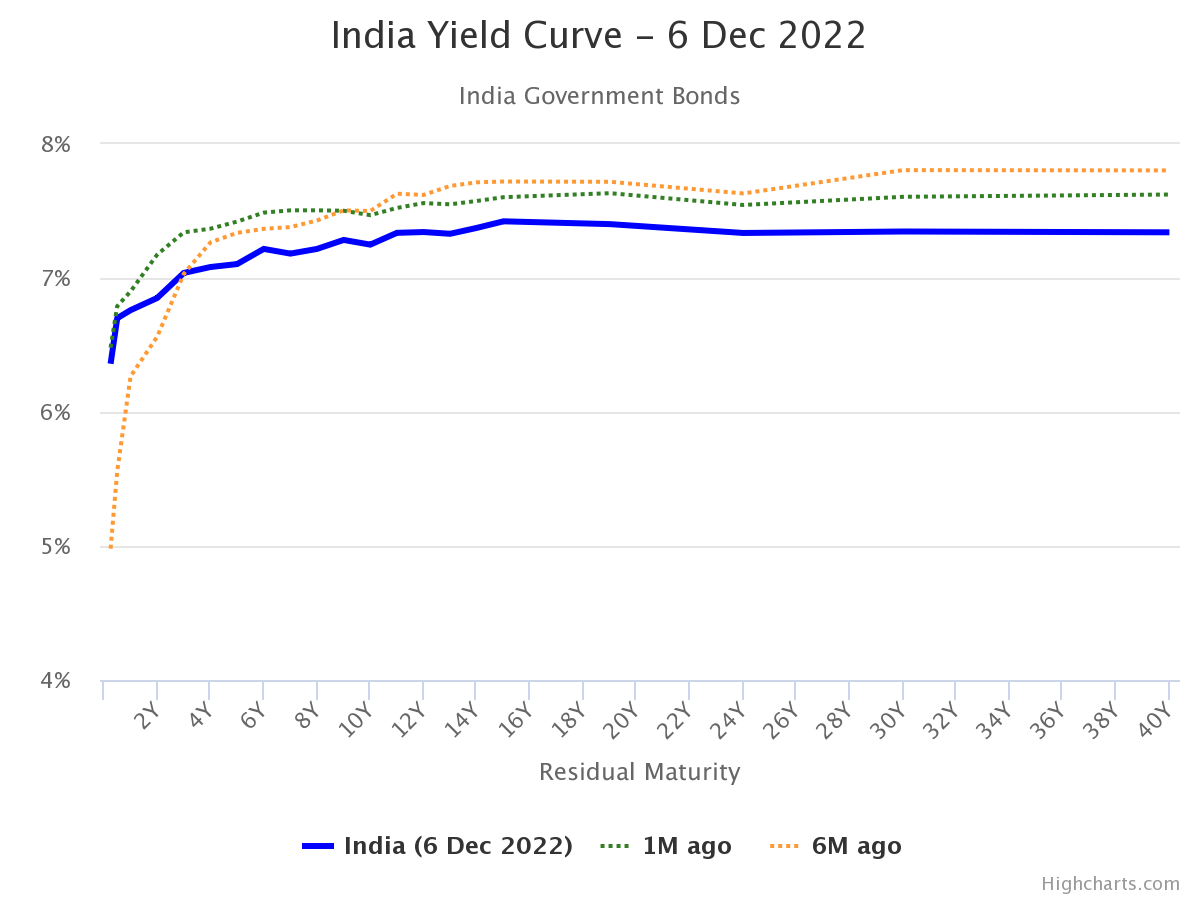

Two other large economies not included in the G-7:

(Click on image to enlarge)

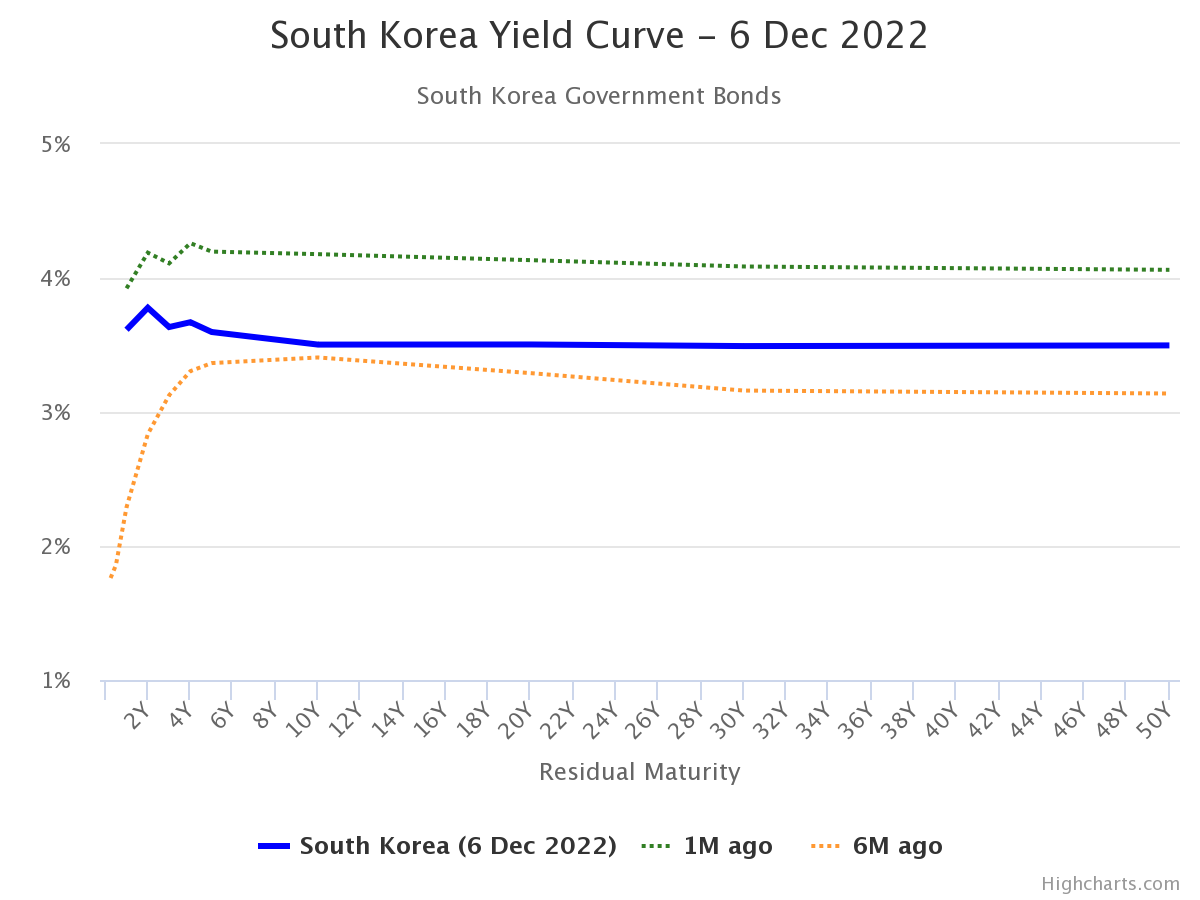

And one other large economy, Korea.

(Click on image to enlarge)

Chinn and Kucko (2015) found that the 10yr-3mo yield curve predicted recessions in the US, France, Germany, and (if including 3-month yield) Japan.

Some additional studies (including on China) recounted here.

More By This Author:

Real Wages During And Post-PandemicIs The Establishment Series Overestimating NFP Employment?

Employment Release And Business Cycle Indicators - Friday, Dec. 2