“Tale Of Two Cities” Stock Market (And Sentiment Results)

What’s Behind The Rise in Bond Yields?

On Wednesday, I joined the great Stuart Varney on Fox Business to discuss Bond Yields, Election, Fed, Outlook, Boeing, Misconceptions about the “Trump Trade”, and a lot more. Thanks to Stuart, Preston Mizell and Christian Dagger for having me on.

Overnight Update: The Union for Boeing workers (IMA) rejected the 35% pay raise and bonuses. Expect Boeing to announce another round of layoffs in the next two days and raise $10B+ of capital to starve out (wait out) the Union.

Facts: Union Head earns over $330k/year. 33,000 Boeing Strikers are getting paid $250 per week to strike (with no salaries – many of which are normally six-figures). This is costing the Union $8,250,000 per week. The union started with $300M of total assets. It has been depleted for 5 weeks ($8,250,000 x 5 = $41,250,000). This implies the IMA has less than $260,000,000 left. The problem is there are 530,000 members of the IMA Union. So Boeing workers only represent 6% of this Union’s members and they have already depleted 13% of the total assets in 5 weeks. If you were the other ~500,000 non-Boeing members who had contributed dues for years, how comfortable would you be to see your reserves dwindling into the abyss?

Meanwhile, the strike is costing Boeing $1B/month. They can raise $10B in a minute and wait them out for 10 months or if they raise $20B debt/equity wait them out for over a year and a half. BTW, for everyone worried about dilution, if they raised $20B of ALL equity tomorrow it would only take the share count back to 2014 levels. They have repurchased Billions of stock over the last decade.

Meanwhile, The Union cannot go raise money in the public markets at the drop of a hat. They rely on contributions from WORKING union members. The Union will cease to exist in 31.5 weeks (just over a half a year) as 6% of the union members (from Boeing) will have burned through 100% of the cash.

In addition to the Union being unable to compete with Boeing on the “waiting game” due to their inability to raise $10B in the public markets overnight, the workers who are not receiving salaries and getting paid $250/week by the union are running desperately behind on their mortgages, car payments and other bills.

Many who have now rejected a 35% pay raise + bonuses will find themselves with 100% pay loss as the next round of 17,000 cuts is imminent.

What’s going on with Alibaba?

Thanks to Doug Krizner and Juan Torres for having me on Bloomberg DayBreak Asia on Sunday to talk Stock Market Outlook, Asia, Election, Fed, China, Alibaba and a lot more:

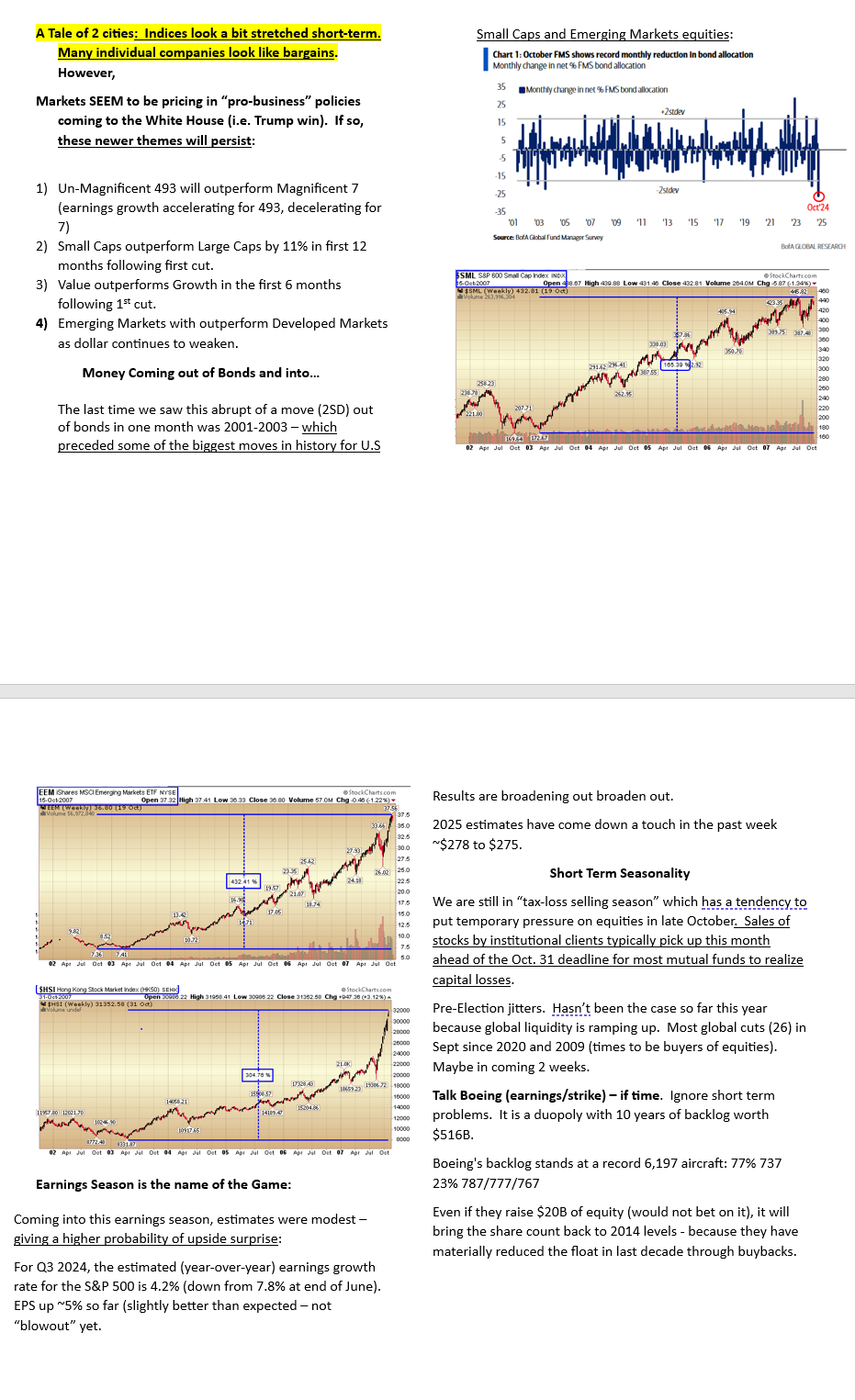

Tale of Two Cities!

This is what I had intended to talk about on Varney & Co. As always, we remain flexible to the topics of the day:

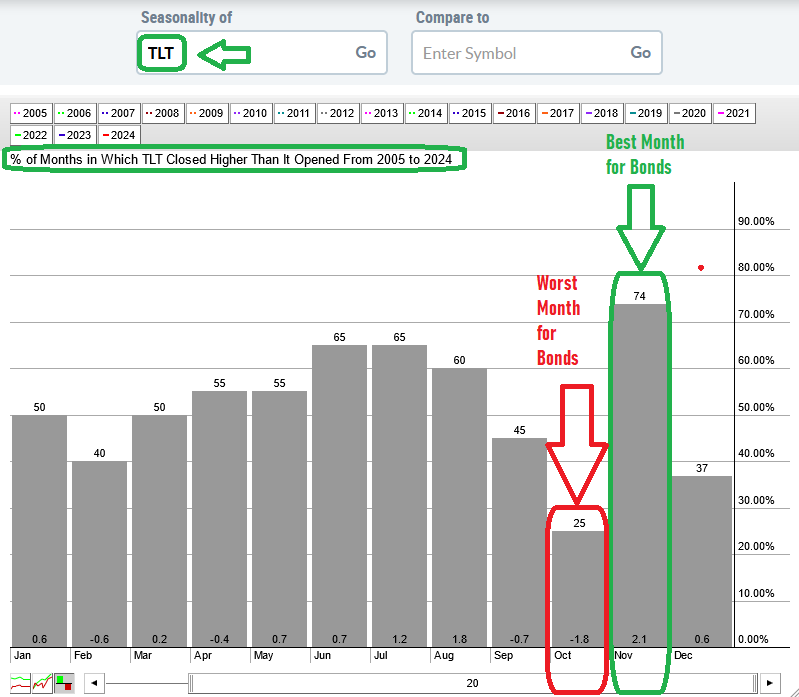

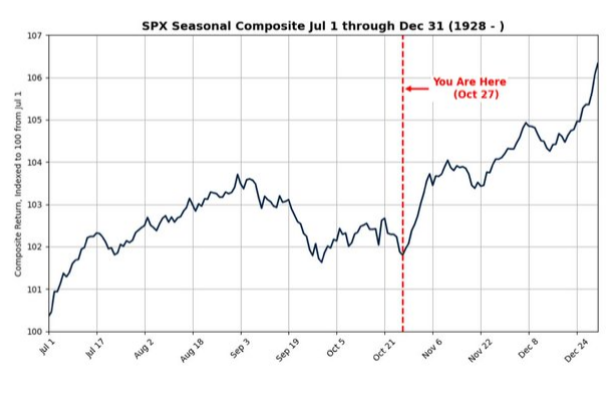

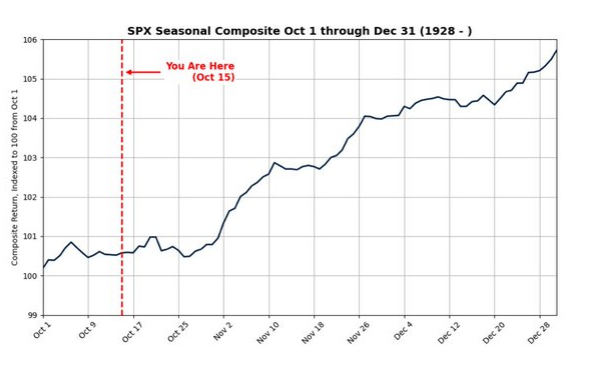

Seasonality

Here?

or Here?

Source: Carson Group – Ryan Detrick

General Market:

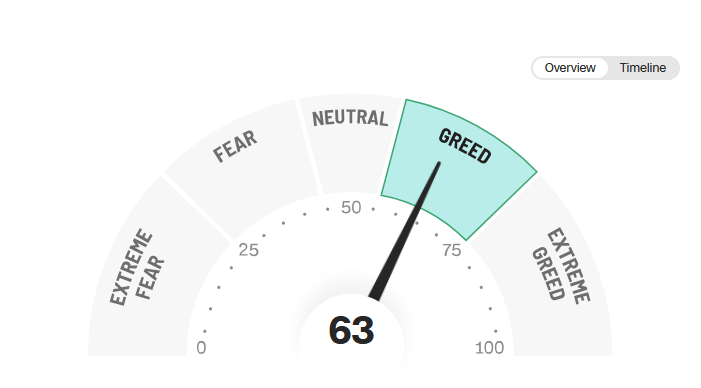

The CNN “Fear and Greed” dropped from 70 last week to 63 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 81.86% this week from 90.26% equity exposure last week.

More By This Author:

Liquidity + Complacency Stock Market (And Sentiment Results)…

Fake Out Or Breakout? Stock Market (And Sentiment Results)

“Sell Rosh Hashanah, Buy Yom Kippur?” Stock Market (and Sentiment Results)…