Subpar 7Y Auction Tails As Direct Bidders Tumble To Lowest Since March 2020

In the week's final coupon auction, moments ago the US Treasury sold $44 billion in 7Y paper in what was at best a subpar auction.

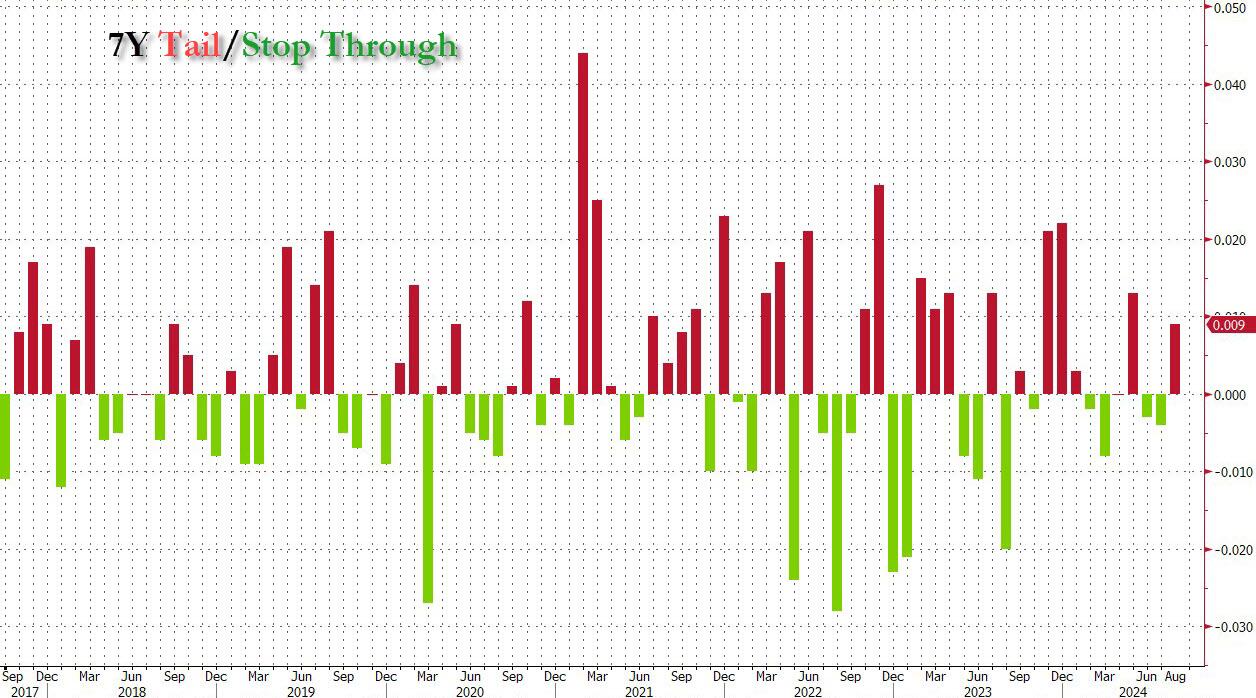

Stopping at a high yield of 3.770%, this was the lowest yield on the tenor since April 2023 and was a whopping 39bps tighter than last month's 7Y auction. More importantly, the auction tailed the When Issued 3.761% by 0.9bps, the first tail since May.

(Click on image to enlarge)

The bid to cover also dropped from the July auction, dropping to 2.50% from 2.637% last month and below the 2.55% six-auction average.

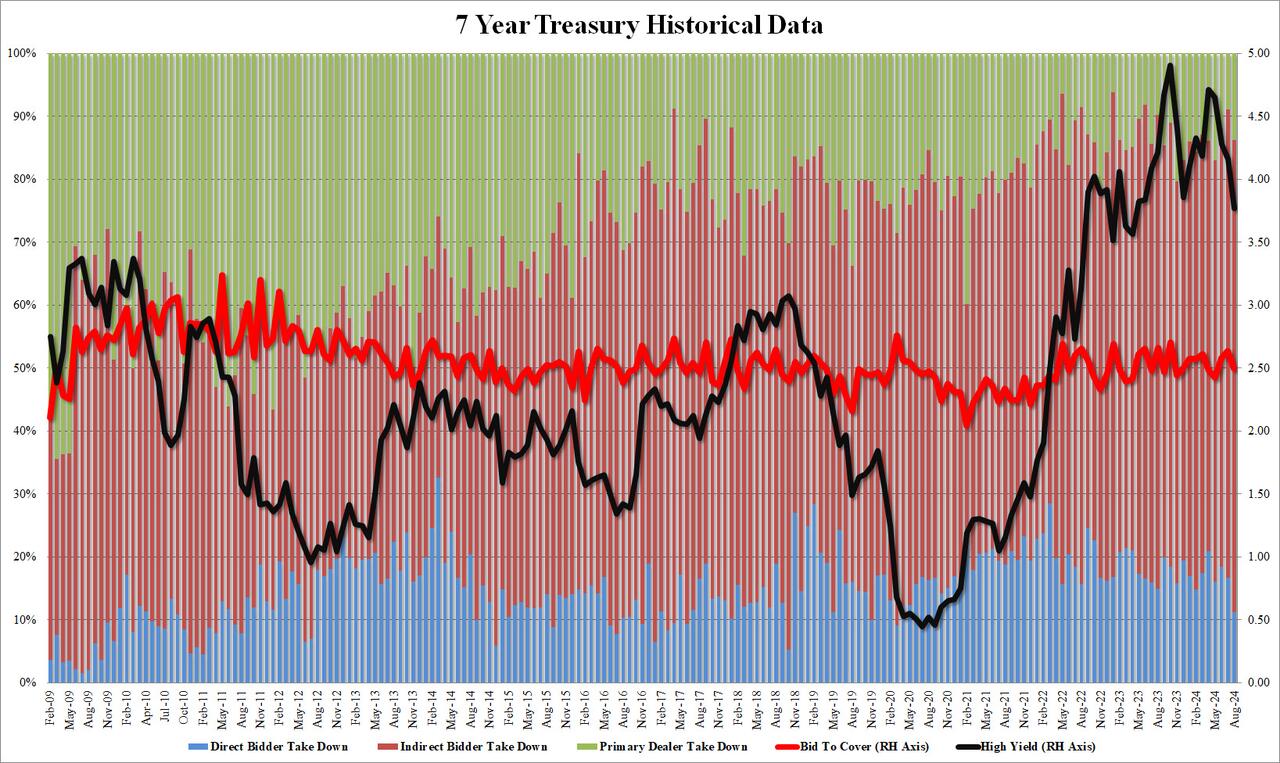

The internals were more impressive, with Indirects taking down 75.1%, above last month's 74.4%, and also above the recent average of 69.22%. But while Indirects rose, the Direct takedown tumbled to just 11.2% from 16.8% last month, and the lowest since March 2020. That means that Dealers were left with 13.7%, up from 8.9% last month and in line with the recent average of 13.4%.

(Click on image to enlarge)

Overall, this was a subpar auction, and the weakest of this week's coupon trio. And yet, with yields already snapping higher after today's stronger than expected GDP and initial claims data, there was little movement in the secondary market, with the 10Y barely budging on news of the auction's pricing, with the benchmark paper trading at 3.87% since this morning.

(Click on image to enlarge)

More By This Author:

Yields Hit Session High After 5Y Auction Tails

Warren Buffett Continues Dumping BofA Shares

Gold Hits New Record High, Bitcoin Battered As NVDA Earnings Loom

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more