Yields Hit Session High After 5Y Auction Tails

Image Source: Pixabay

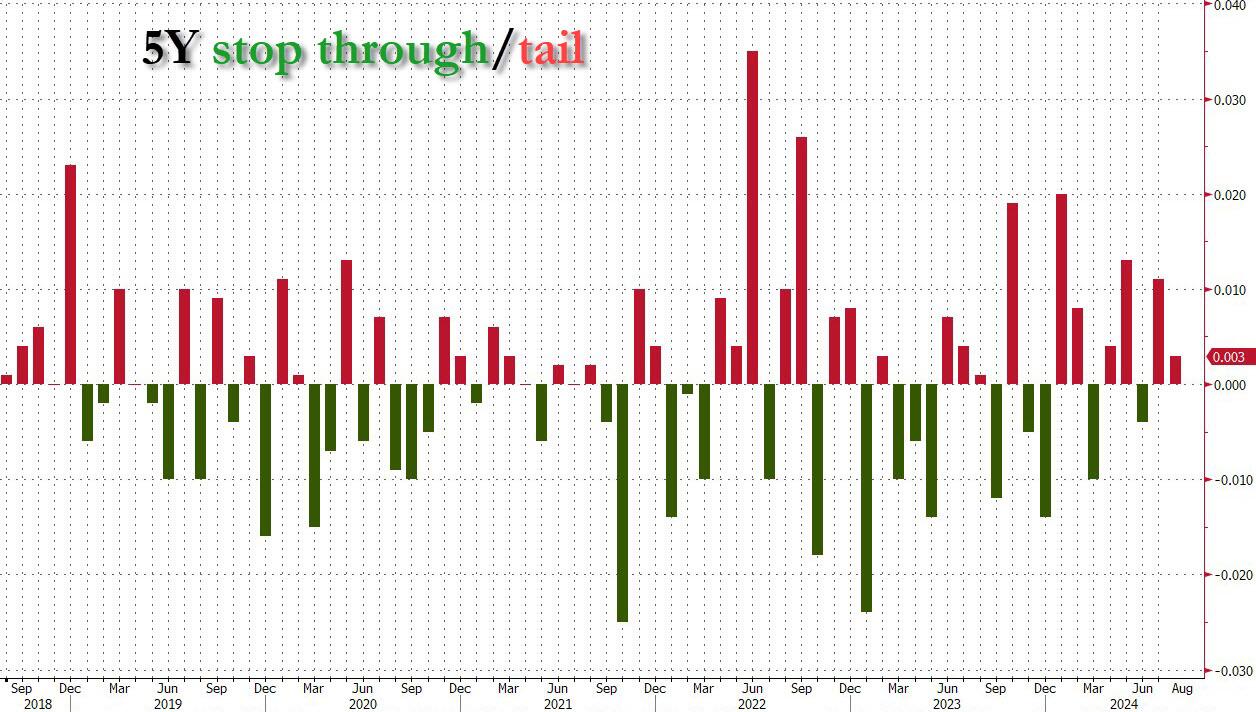

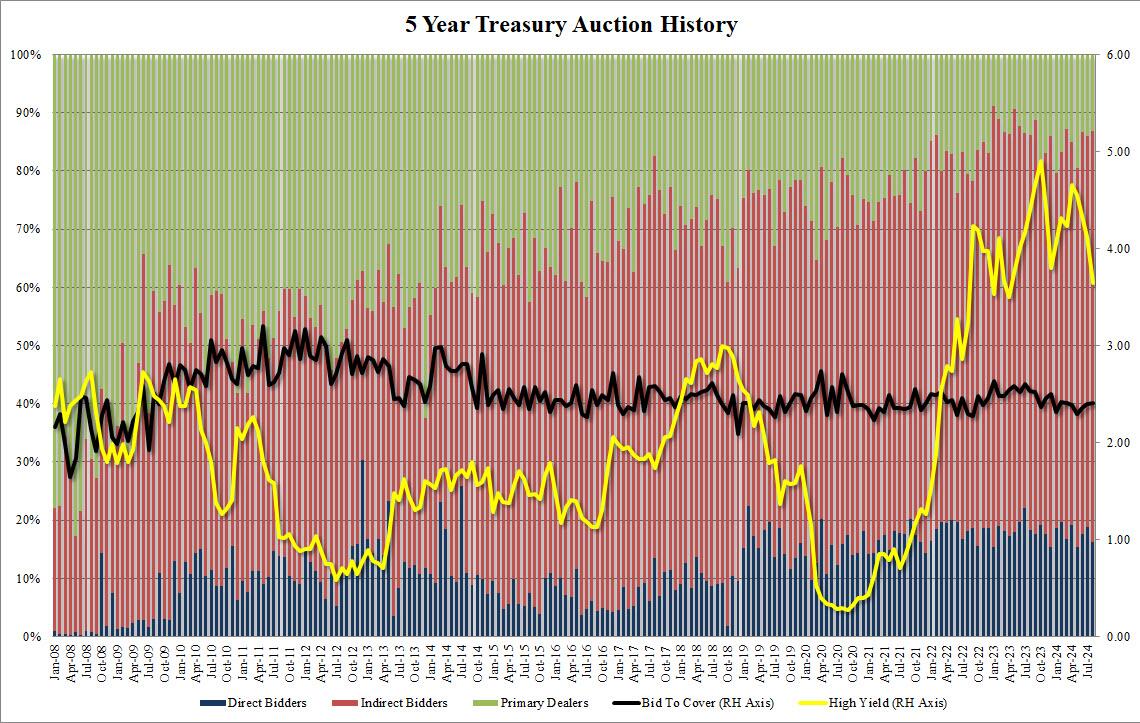

After yesterday's solid 2Y auction, moments ago the US Treasury sold $70BN in 5 year notes, in an auction which saw yields tumble 46.8bps, to 3.642% - the lowest since April 2024 - from 4.110%. However, unlike yesterday's stopping through 2Y auction, today's sale tailed the When Issued 3.642% by 0.3bps, which was the 4th tail in the past 5 auctions.

The bid to cover of 2.41 was effectively unchanged from last month's 2.40% and just above the six-auction average of 2.38%.

The internals were stronger, with Indirects awarded 70.5%, the highest since March, and up from 67.25% in July. And with Directs taking 16.3%, or the least since May and below the recent average of 17.9%, Dealers were left holding 13.2%, down from 14.0% last quarter and also below the recent average of 15.2%.

Overall, this was a mediocre, tailing auction if one looks at the superficial metrics, yet a quick look deeper reveals more solid demand than yesterday's stopping through 2Y. Of course, nobody ever accused the market of digging deeper in anything, ever, and so yields are pushing out to session highs with 10Y rising above 3.84% for the first time today.

More By This Author:

Warren Buffett Continues Dumping BofA SharesGold Hits New Record High, Bitcoin Battered As NVDA Earnings Loom

Solid 2Y Treasury Auction Prices At Lowest Yield In Two Years

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more